State Tax On Estate In Clark

Category:

State:

Multi-State

County:

Clark

Control #:

US-0042LTR

Format:

Word;

Rich Text

Instant download

Description

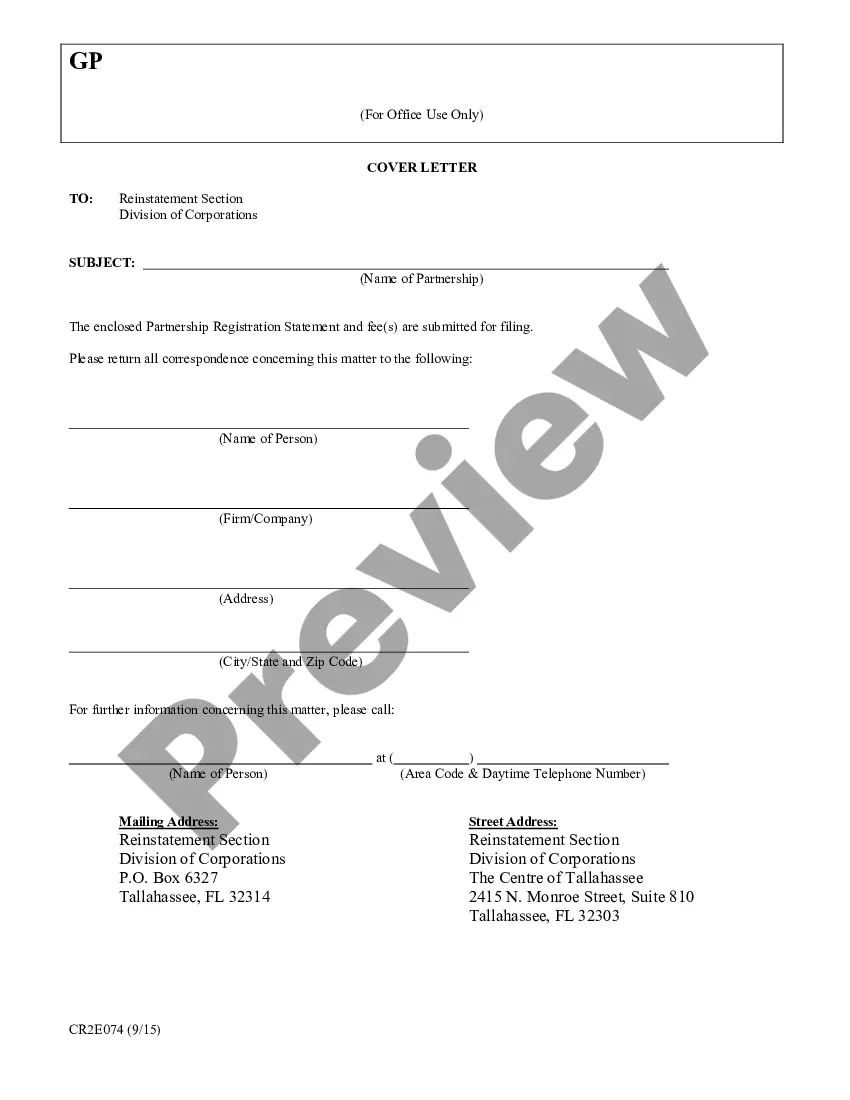

The State tax on estate in Clark document is essential for individuals engaged in estate administration, particularly within the jurisdiction of Clark. This form serves as a model letter to request information regarding vehicles owned by a deceased individual, which is vital for accurately assessing the estate's assets and liabilities. Key features of the form include the introductory section that identifies the administrator and the deceased, as well as specific requests for vehicle titles and related transfer history. The form is designed for adaptation based on individual circumstances, ensuring flexibility for various cases. Filling this form involves entering relevant names, dates, and vehicle details, making it easy for users to personalize it for their needs. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form invaluable, as it streamlines the process of gathering essential asset information necessary for estate tax calculations. Moreover, the clarity and straightforward structure allow users to navigate the request process effectively, even if they have limited legal experience. Additionally, the form encourages proper documentation, which supports compliance with state tax regulations, ensuring that all relevant estate taxes are correctly assessed and paid.

Free preview