Federal And State Estate Taxes Are Best Described As In Florida

Category:

State:

Multi-State

Control #:

US-0042LTR

Format:

Word;

Rich Text

Instant download

Description

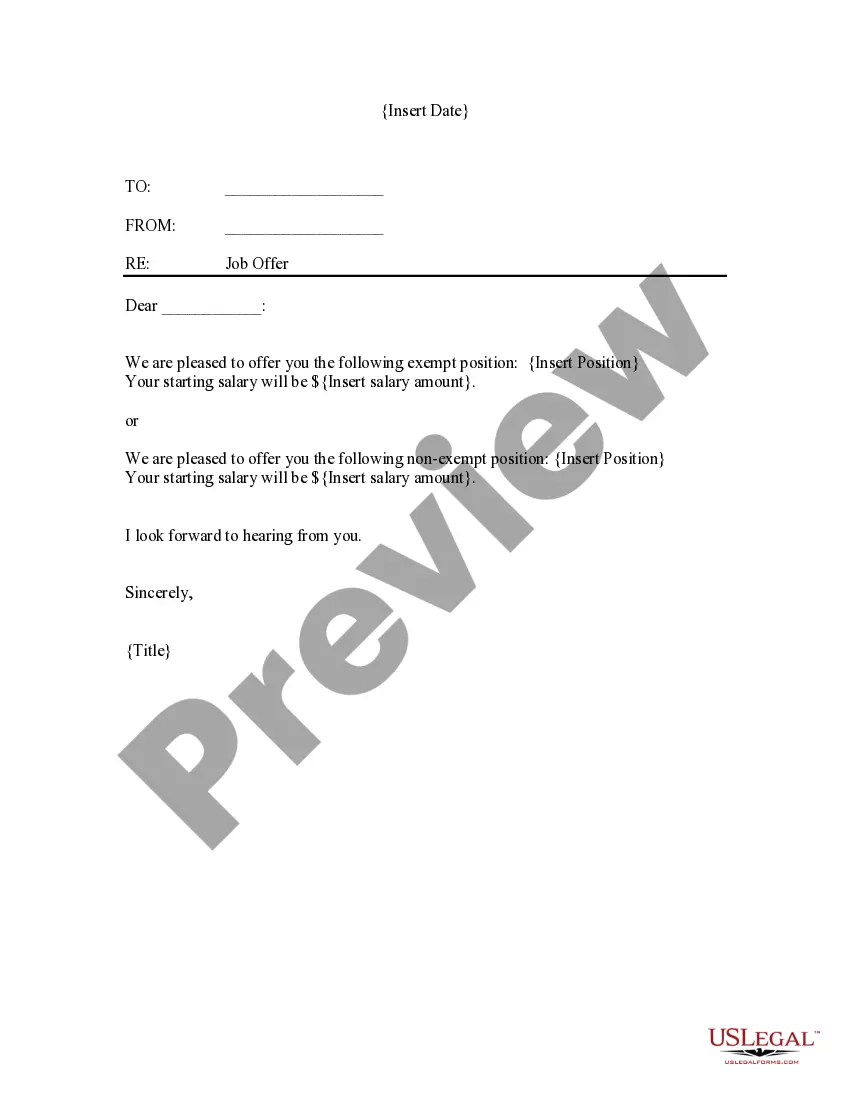

This form is a sample letter in Word format covering the subject matter of the title of the form.

Free preview

Form popularity

More info

Florida does not have an estate tax, which means that the state does not impose a tax on the transfer of assets after someone passes away. The good news is Florida does not have a separate state inheritance tax.The Florida estate tax is directly linked to the federal estate tax. Florida also doesn't have an inheritance or estate tax. In some states, you will pass away and be subject to both federal and state estate tax. However, in Florida, you will only be subject to federal estate tax. There is no estate tax in Florida, as it was repealed in 2004. Florida residents may still pay federal estate taxes, though. Florida also does not assess an estate tax, or an inheritance tax. No portion of what is willed to an individual goes to the state.