Sample Letter For Tax Penalty Waiver In Ohio

Category:

State:

Multi-State

Control #:

US-0042LTR

Format:

Word;

Rich Text

Instant download

Description

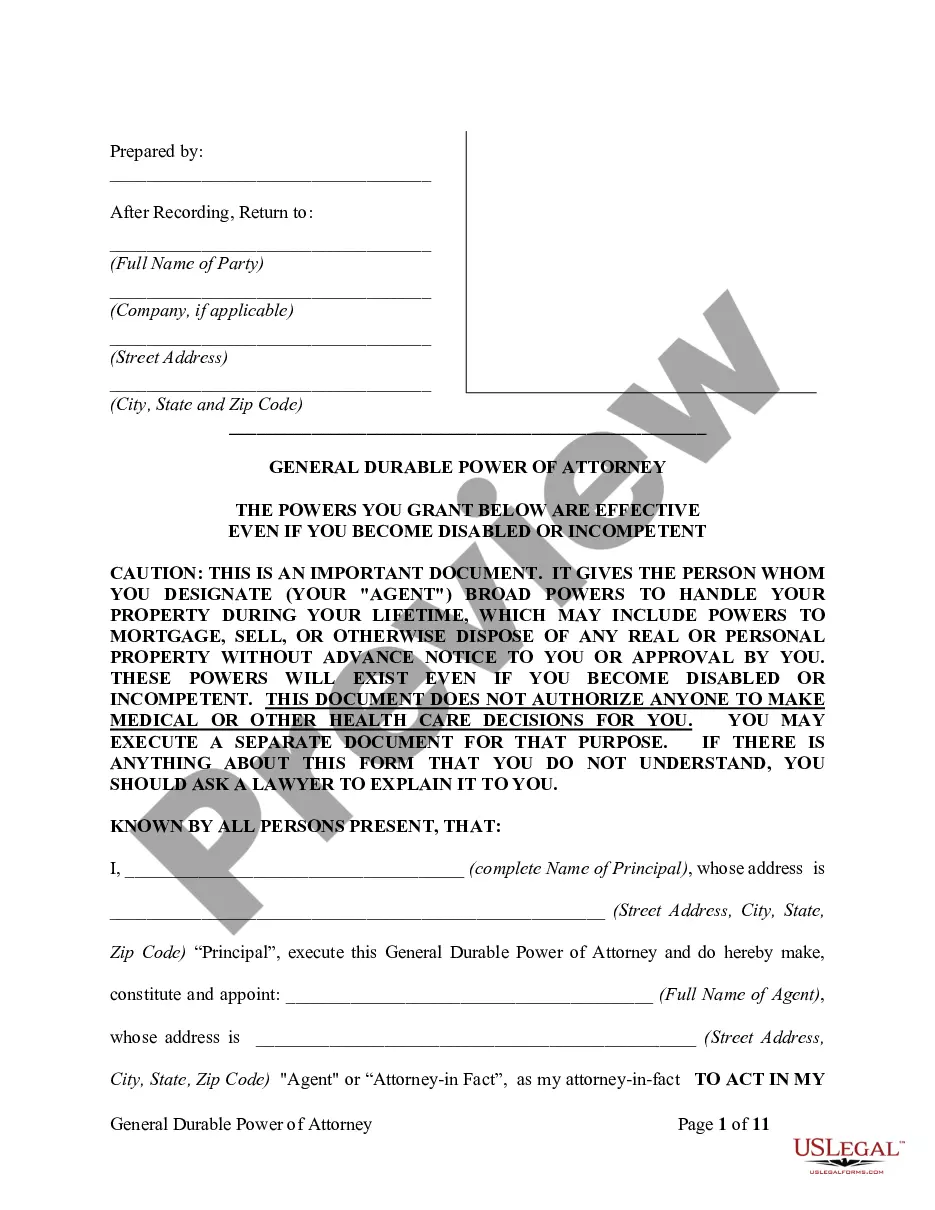

The Sample Letter for Tax Penalty Waiver in Ohio serves as a formal request to the state tax authority for waiving penalties due to specific circumstances surrounding a taxpayer's situation. This model letter includes sections for the sender's details, the recipient's information, a clear subject line, and a body that outlines the reason for the request. The letter should be customized to reflect the taxpayer's unique circumstances and any pertinent supporting documentation should be attached. It is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants who manage clients facing financial penalties from tax authorities. The form instructs users to clearly state the basis for the waiver, thereby making the case more compelling. They should maintain a professional tone while detailing the taxpayer's situation to enhance the letter's effectiveness. Upon completion, users can easily edit this letter for future cases, making it a valuable resource in legal practice related to tax issues in Ohio.

Free preview