Federal And State Estate Taxes Are Best Described As In Virginia

Category:

State:

Multi-State

Control #:

US-0042LTR

Format:

Word;

Rich Text

Instant download

Description

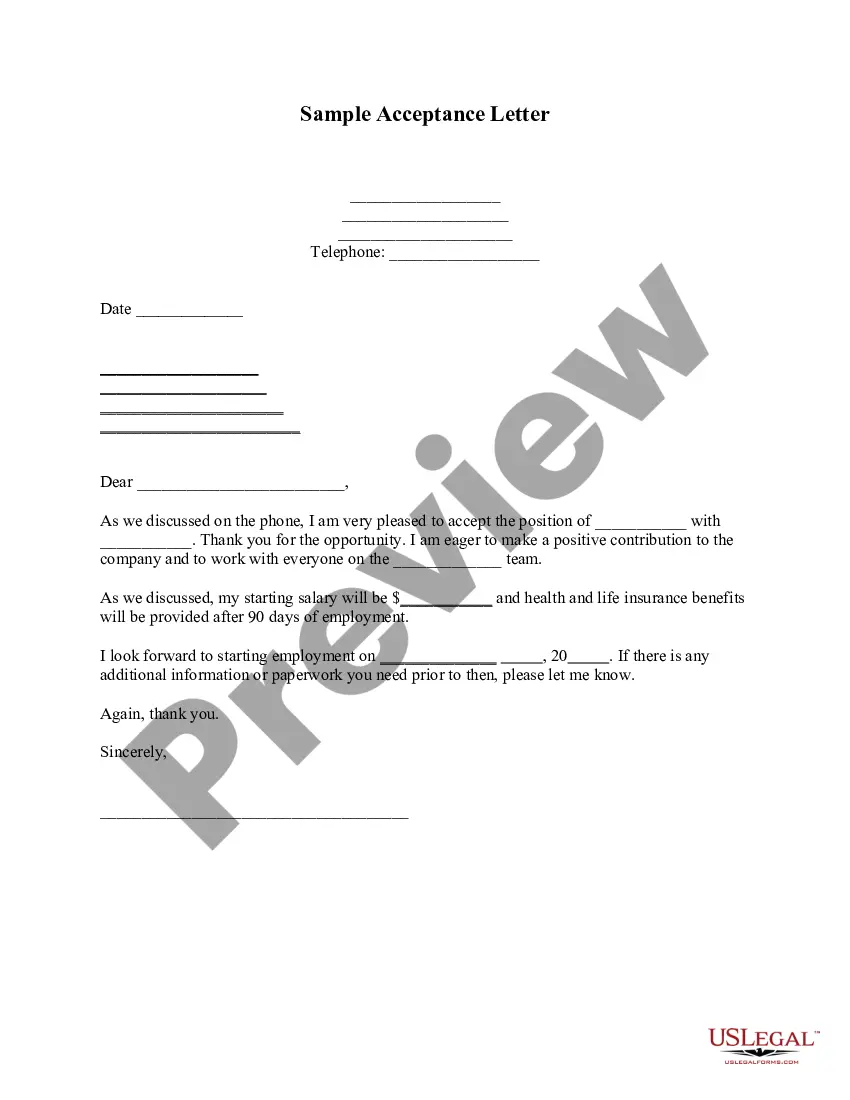

This form is a sample letter in Word format covering the subject matter of the title of the form.

Free preview

Form popularity

More info

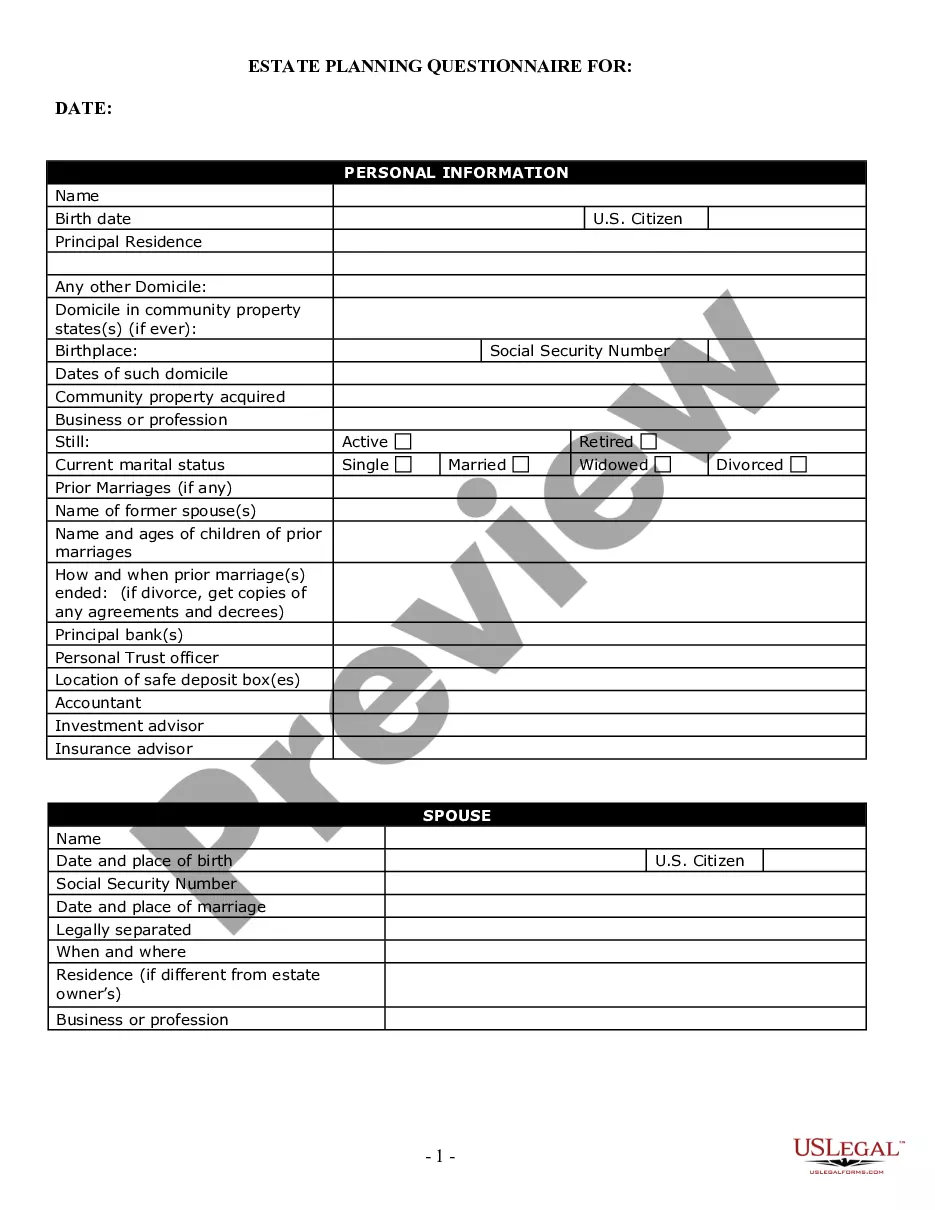

The state of Virginia does not have an estate tax but you still may be subject to the federal estate tax, depending on the size of your estate. There is no current Virginia Estate Tax.The 2006 General Assembly House Bill 5018 repealed the state Estate Tax in the Commonwealth of Virginia. The Estate Tax is a tax on your right to transfer property at your death. Virginia does not have an estate tax or inheritance tax. Virginia has a graduated income tax, with four tax brackets. Rates start at 2 percent and max out at 5.75 percent. This manual is intended to assist persons who are involved in the administration of a decedent's estate in Virginia. A Virginia estate tax return must be filed if required (generally only required if a federal estate tax return is necessary. The federal estate tax is levied on a dead person's inherited assets.