Federal And State Estate Taxes Are Best Described As In Wake

Category:

State:

Multi-State

County:

Wake

Control #:

US-0042LTR

Format:

Word;

Rich Text

Instant download

Description

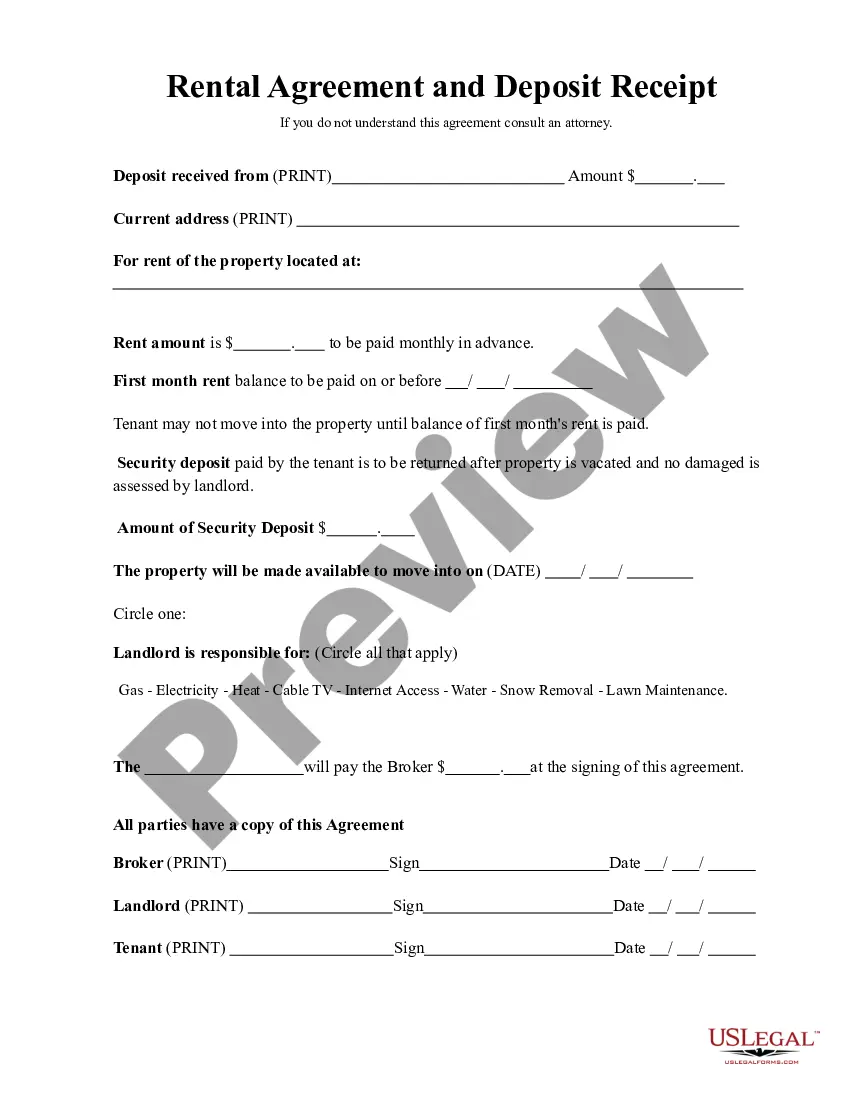

This form is a sample letter in Word format covering the subject matter of the title of the form.

Free preview

Form popularity

More info

The Estate Tax is a tax on your right to transfer property at your death. New York State's estate tax is calculated using the tax table provided on Form ET706.There are multiple versions of Form ET-706. Form 706 ensures that estate taxes are adequately assessed for larger estates, while Form 1041 helps report the estate's income during the settlement process. Find common questions and answers about estate taxes, including requirements for filing, selling inherited property and taxable gifts. Learn about different payment options available to pay your property taxes. As we've written before, the phasingout of the federal estate tax has left a complex minefield of statelevel estate taxes in its wake.