Lien For Mobile Home In Maryland

Category:

State:

Multi-State

Control #:

US-00432

Format:

Word;

Rich Text

Instant download

Description

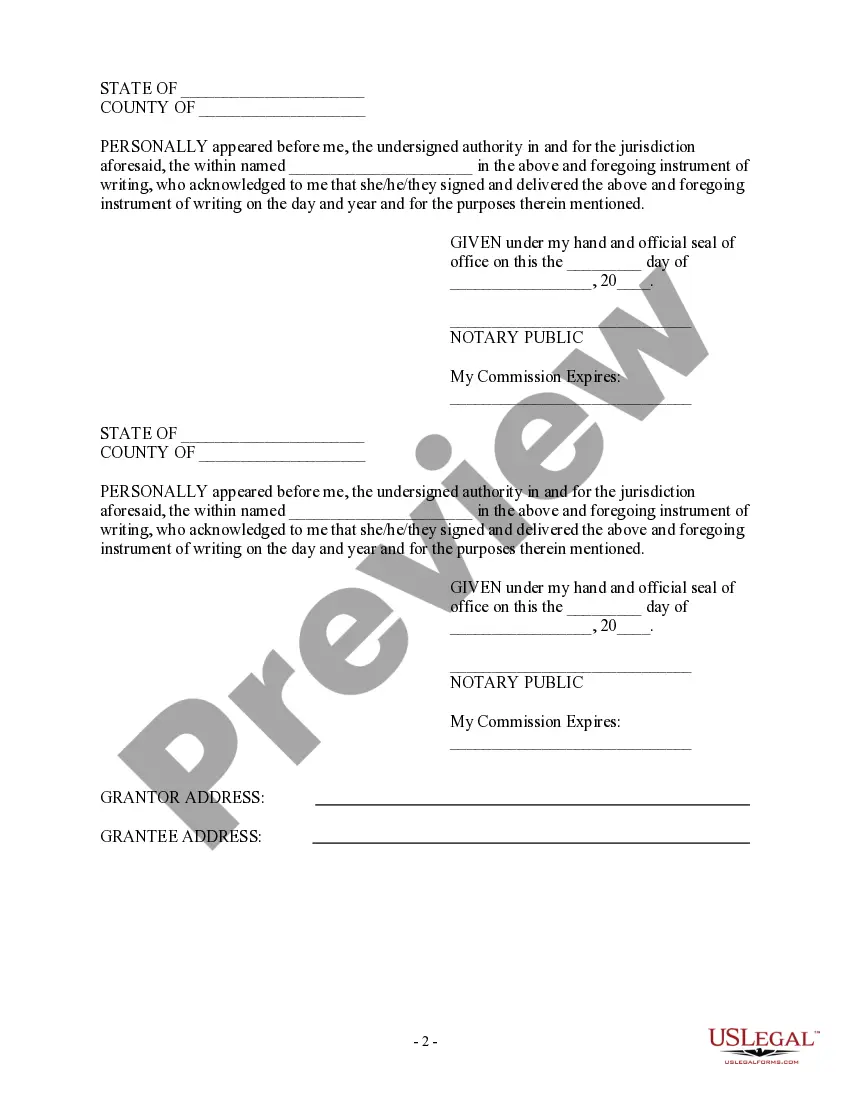

This form is a Bill of Sale for a mobile home. The form also provides a section for the seller to list any and all liens against the mobile home. The form must be signed in the presence of a notary public.

Free preview