Lien For Mobile Home In Orange

Category:

State:

Multi-State

County:

Orange

Control #:

US-00432

Format:

Word;

Rich Text

Instant download

Description

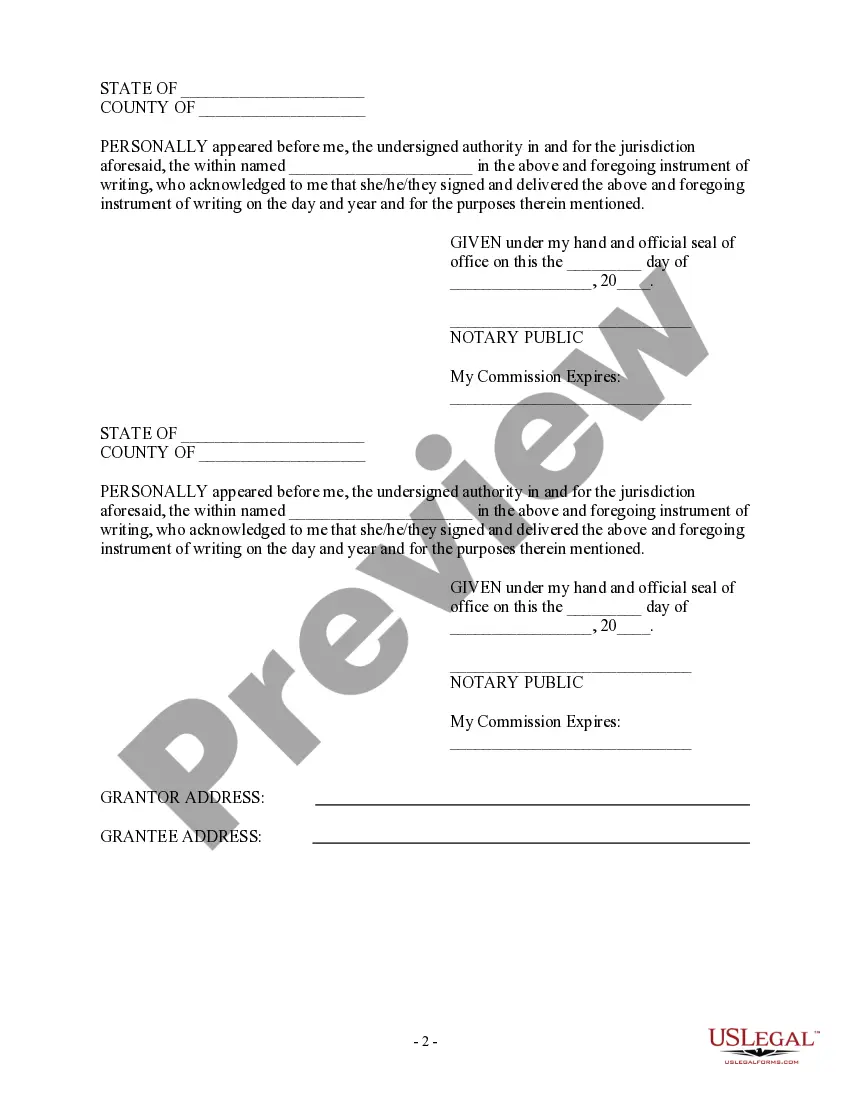

The Lien for Mobile Home in Orange form is a crucial legal document designed for transferring ownership of a mobile home while acknowledging any existing liens. This form includes sections for the sale price, seller and buyer information, and a declaration regarding any existing liens on the mobile home. Users must clearly fill out the serial number of the mobile home and provide details of any liens, affirming whether these will be assumed by the buyer. The document includes a notary section to ensure legal validation. This form is particularly useful for attorneys, partners, and associates involved in real estate transactions, as well as paralegals and legal assistants responsible for drafting and reviewing sales agreements. It streamlines the process of documenting the sale while protecting the interests of both parties involved. Clear instructions for filling out the form make it accessible for owners unfamiliar with legal documentation, ensuring compliance with local regulations while facilitating smooth transactions.

Free preview