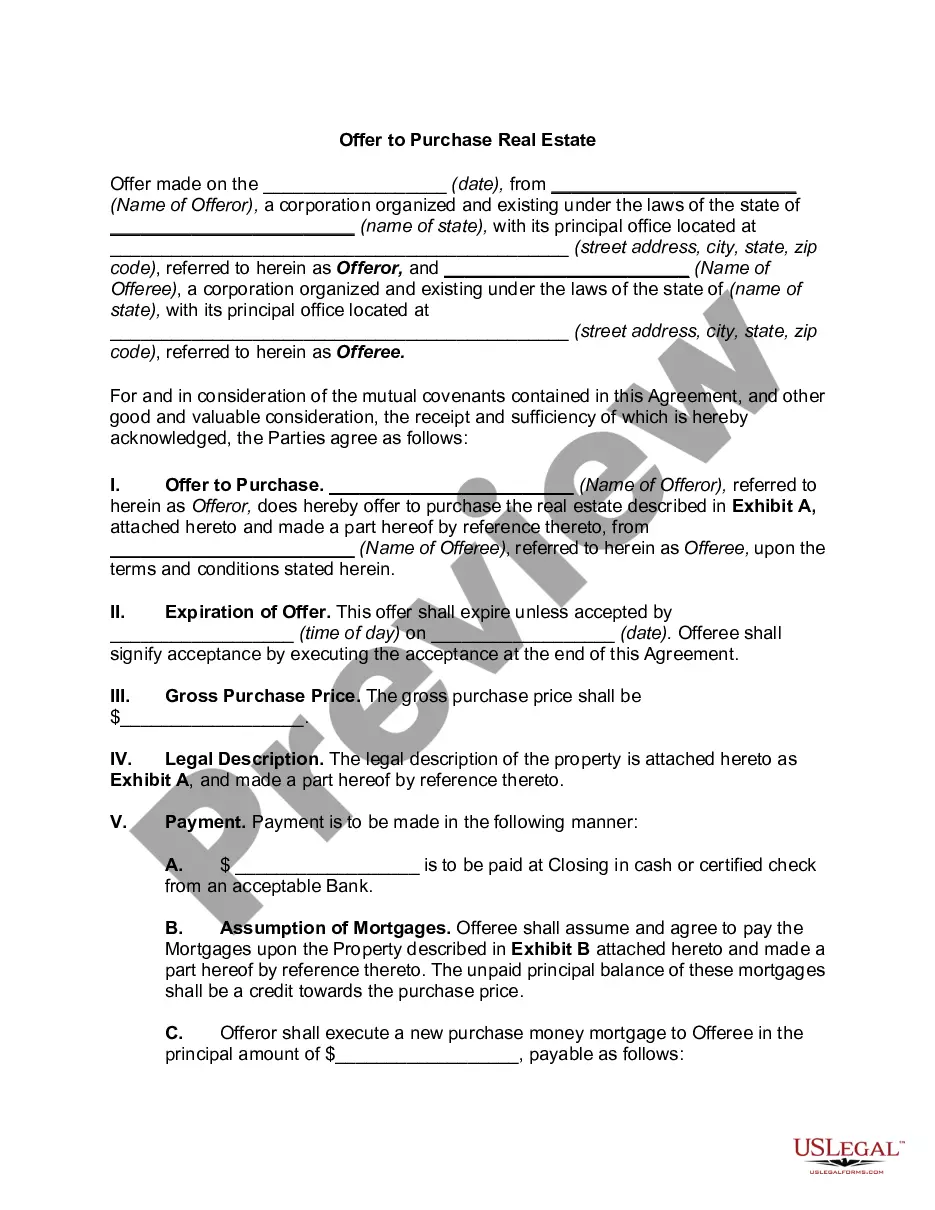

This form grants to a realtor or broker the sole and exclusive right to list and show the property on one ocassionsell the commercial property described in the agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Broker Commercial Property With No Money Down In Texas

Description

Form popularity

FAQ

A larger down payment is often required for land loans due to their higher risk. While most acquisitions require down payments of 10% or more, land loans often require 20% to 25%, except for sponsored programs for developing single-family residences.

Strategies like seller financing, HELOCs, and FHA loans reduce upfront costs. House hacking and partnerships minimize financial risks and lower down payment needs. Creative options like cross-collateralization or lease options expand property financing possibilities.

Here is a list of some of them: The minimum amount that the Certificate of Deposit can be issued in India is ₹1 lakh. The SCBs or Scheduled Commercial Banks and the All-India Financial Institutions are responsible for issuing the Certificate of Deposit. CDs cannot be issued by Cooperative Banks or Regional Rural Banks.

The minimum denomination allowed for an Indian certificate of deposit is Rs. 5 lakh. Higher value CDs can be in multiples of Rs. 5 lakh.

Most investors need to put down at least 20% on their investment property purchases. If your credit score is 680 or higher, you may be able to put down a minimum of 15%. A 20% down payment can be avoided by considering alternative financing options, such as group investing.

A down payment for investment property generally ranges from 15% to 25%. House hacking is a technique used by some real estate investors to reduce the down payment amount to as little as 3.5%. Loans backed by Fannie Mae and Freddie Mac are two options for financing an investment property.

Credit Requirements - The minimum varies but typically ranges between 660 and 680. To assess your credit risk, lenders will also check how long you've been in business.

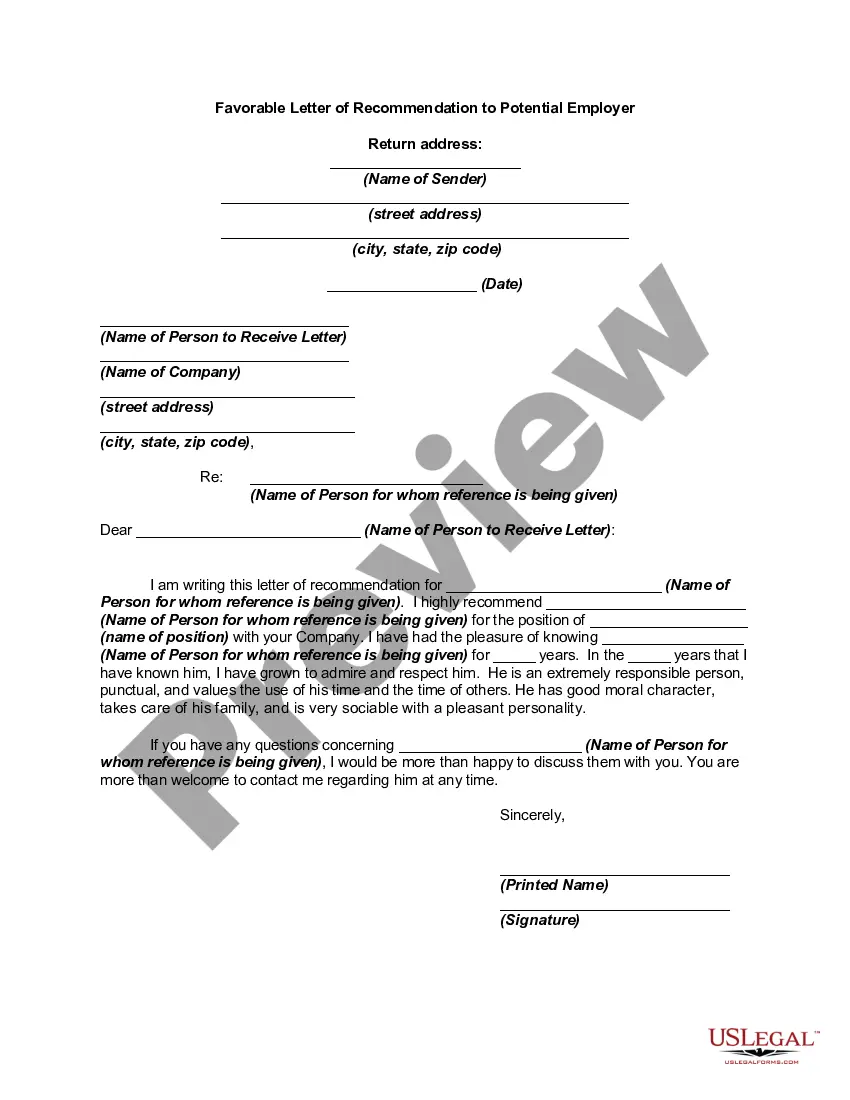

While there's no universally required credit score needed to rent an apartment, having a solid credit score can certainly help your chances of a landlord handing you a set of keys. In general, a landlord will look for a credit score that is at least “good,” which is generally in the range of 670 to 739.