Estate Claim Form Withholding In North Carolina

Description

Form popularity

FAQ

Process used by Probate Creditors The Executor is required to provide 90-days from the date of the first publication of the notice for the Estate Creditors to present their claims.

Federal and state laws allow for creditor attachment to an estate. A lien claim is a debt collection order that can impact the value of an estate when become effective.

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person ...

The inheritance tax was repealed for estates of decedents dying on or after January 1, 1999. Filing Requirement A North Carolina Estate Tax Return is required to be filed by the personal representative if a federal estate tax return (Form 706) is required to be filed with the Internal Revenue Service.

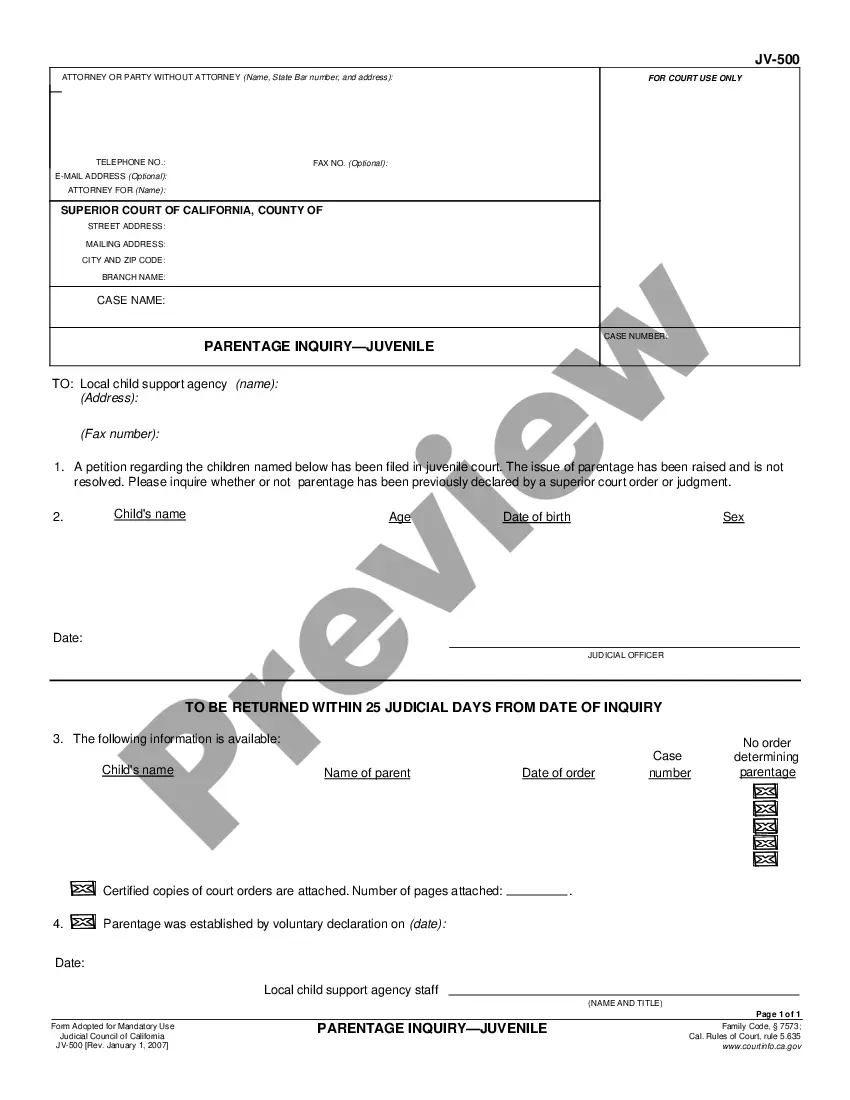

To make a claim in an estate, the creditor must go through the court system. The creditor first files a Statement of Claim in the probate matter for the decedent, or the person who died.

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person ...

General Information: In ance with state and federal Law, employees may claim “exempt” status for income tax withholding on Forms W-4 and NC-4EZ, but the exemption must be renewed each year.

Some customers are exempt from paying sales tax under North Carolina law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale.

If you are a personal representative and you are filing an income tax return for an unmarried individual or a married filing separately return for a married individual who died during the taxable year, enter the name of the decedent and your address in the “Name and Address” section of Form D-400.