Agreement Commercial Property With Sale With Rental Income In Collin

Description

Form popularity

FAQ

Types of leasehold estates The first type is most common: Estate for years: An agreement that permits occupancy between two specified dates, at the end of which the property must be vacated. Estate from period to period: A monthly tenancy that has no specified end date.

Many of the issues confronting industry stakeholders in the new year are interrelated. High Financing Costs. Massive Commercial Real Estate Debt. High Cap Rates. Soaring Insurance Costs. Increasingly Unaffordable Housing. Rise in Artificial Intelligence. Impact of Extreme Weather. Lingering Office Vacancies.

NNN Lease: NNN leases often attract well-established, national tenants with strong credit profiles. These tenants are typically financially stable and less likely to default on lease obligations. NN Lease: NN leases may attract tenants with a varying degree of financial strength.

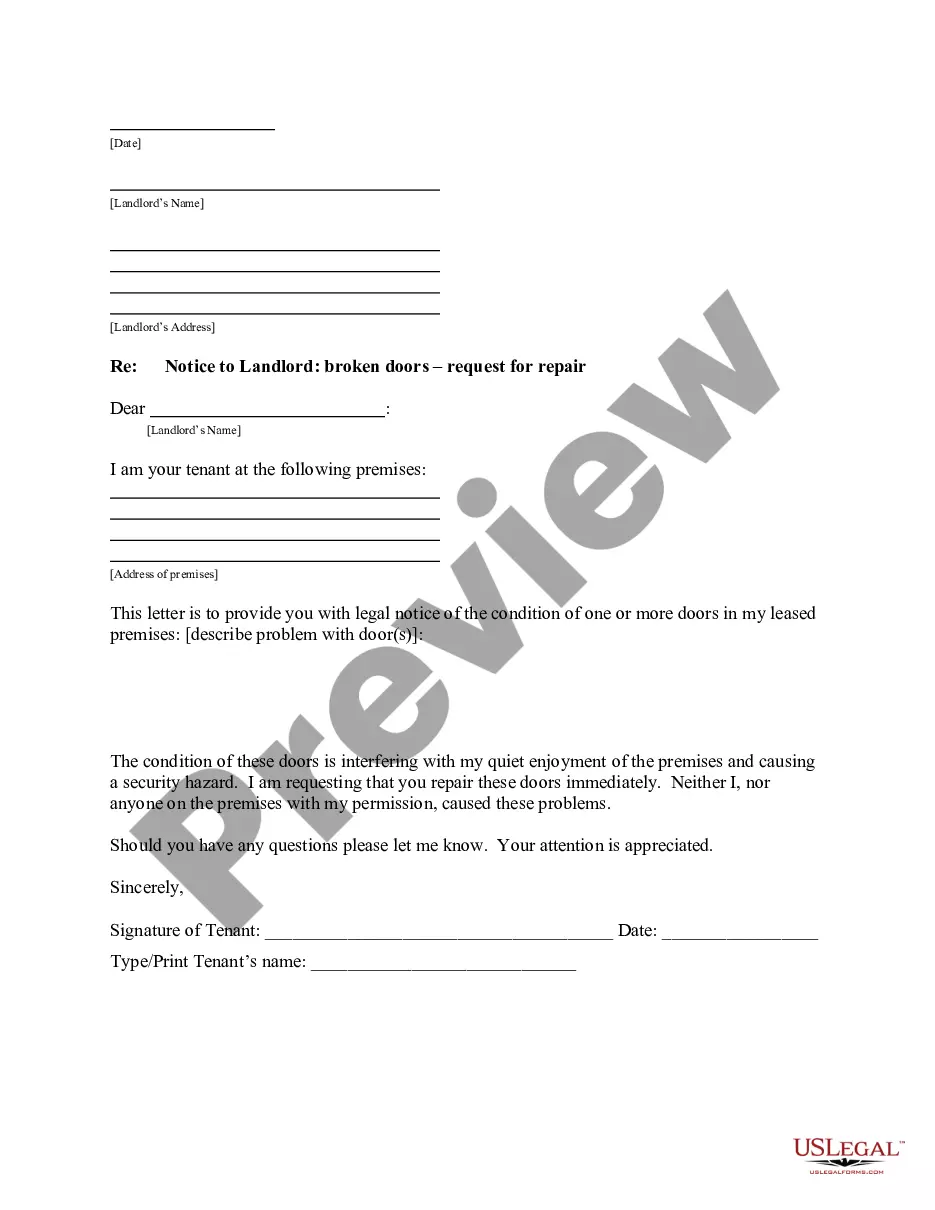

There are many reasons why a Landlord and Tenant may choose to include an “option” in a commercial lease. The most common type of option is one that gives the Tenant the right to extend the lease term, usually for additional — sometimes two or more — terms of equal length to the original term.

Gross leases are most common for commercial properties such as offices and retail space. The tenant pays a single, flat amount that includes rent, taxes, utilities, and insurance.

1. Gross Lease. Gross leases are most common for commercial properties such as offices and retail space. The tenant pays a single, flat amount that includes rent, taxes, utilities, and insurance.

No State Income Tax On Rental Income: Texas does not impose state income tax on rental income, but landlords must report this income on federal tax returns.

Key takeaways: Texas does not impose state income tax, so rental income isn't taxed at the state level. However, federal taxes still apply. Landlords must accurately report rental income on their federal tax returns, accounting for eligible deductions like mortgage interest and property repairs.

For contracts of 1-30 days, 10 percent of gross receipts, less discount and separately stated fees for insurance, fuel and damage assessments. For contracts exceeding 30 days but no longer than 180 days, 6.25 percent.

In Texas, commercial real estate tax rates are higher than the national average at 1.83% rather than 1.08%.