Agreement Between Partnership Withdrawal In Texas

Description

Form popularity

FAQ

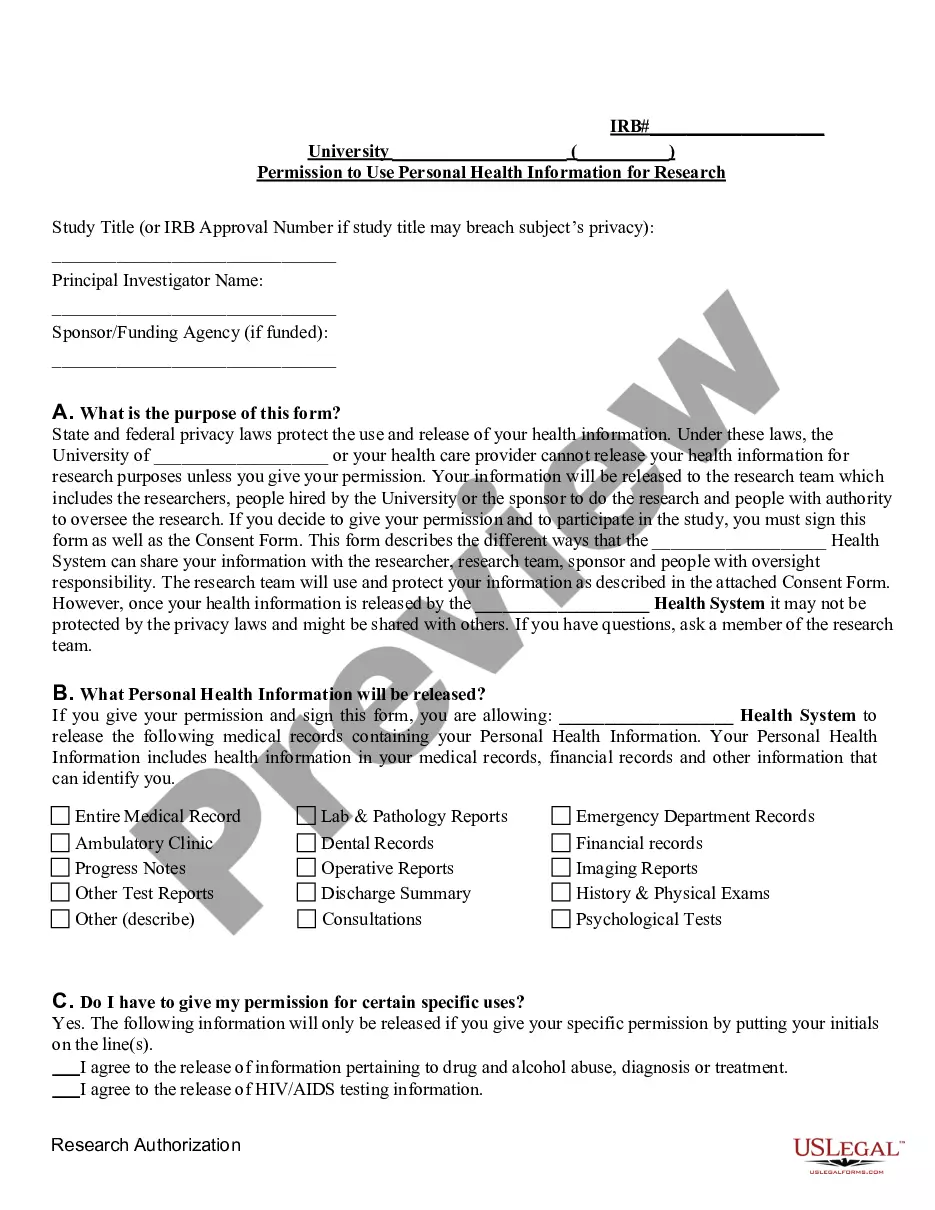

Documents Required For Change in Partners Signed Consent Letter (Format will be provided by us) Signed Resignation Letter (Format will be provided by us) PAN Card/ Aadhaar Card of upcoming Partners. Photo of upcoming Partners. Existing LLP Agreement/ Partnership Deed.

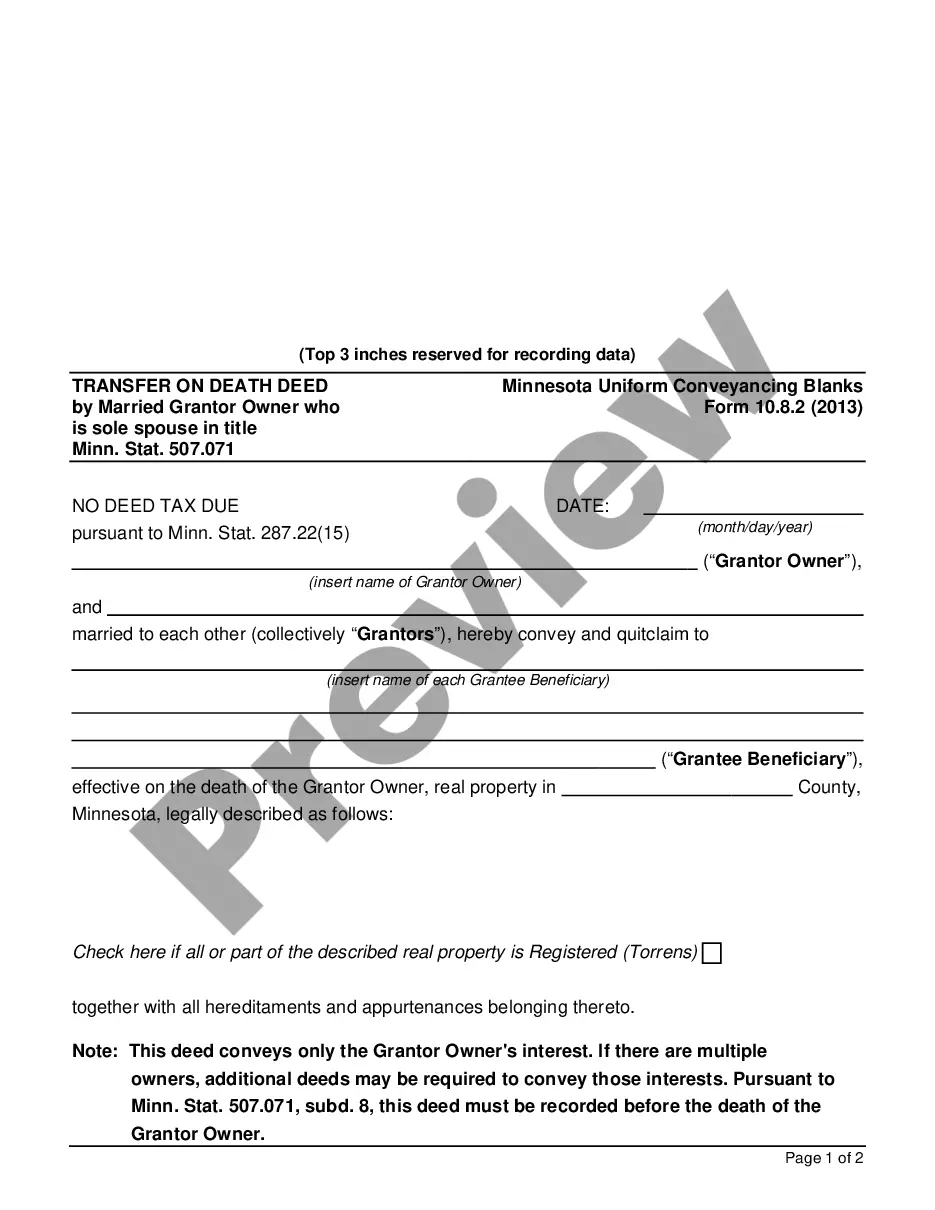

If a partner's departure triggers an end to the partnership, the partners will need to follow a dissolution procedure. In this case, the partnership will settle its debts and distribute any remaining assets to the partners—including the withdrawing partner—ing to their capital accounts.

A partner might leave (or "dissociate" from) a partnership voluntarily or involuntarily. When a partner exits the business, the partnership can either continue or dissolve (end), depending on what the partnership agreement or state law allows or requires.

If you want to get out of your business partnership, you will have to sell your shares to your partner. However, if you want to continue running the business and want your partner out of the picture, that means you will have to buy their shares.

In such a business, you can simply write a withdrawal from partnership letter, if you want to withdraw your partnership. This letter will serve as a notice of intimation to your other partner (s) regarding your impending exit. The notice must mention the date from which the withdrawal will be effective.

No, under Texas law, an LLC member cannot voluntarily withdraw or be expelled from an LLC. There are three primary ways a member can be removed from a Texas LLC—by complying with the operating agreement or by seeking voluntary or involuntary dissolution.

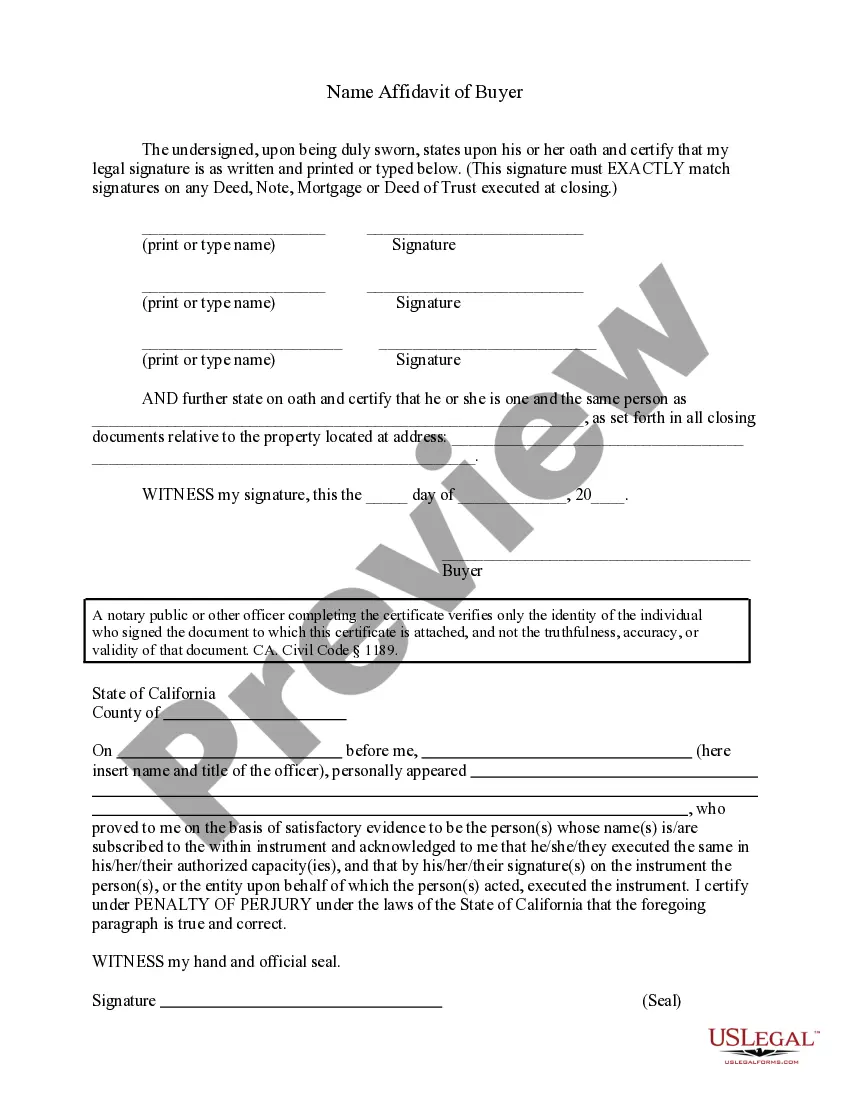

Withdrawal from a partnership is achieved by serving a written notice ending the involvement of a particular partner in the partnership for one reason or another. There are two kinds of withdrawals: Voluntary withdrawal is when a partner chooses to leave the partnership and is serving notice on the other partner(s).

Negotiating a Buyout One of the most common ways to remove a partner is through a buyout agreement, in which one partner buys the other's share of the business.

In some instances, a partner's withdrawal will lead to the end of the business as it cannot operate without that person. In others, the business continues and the remaining partners either proceed as is or look for options.

Legal Grounds for Removing a Partner Breach of the Partnership Agreement. If one business partner violates the terms of the agreement, such as engaging in fraud, negligence, or breach of fiduciary duties, the other partner may have grounds to remove them. Misconduct or Wrongdoing. Inability to Perform Duties.