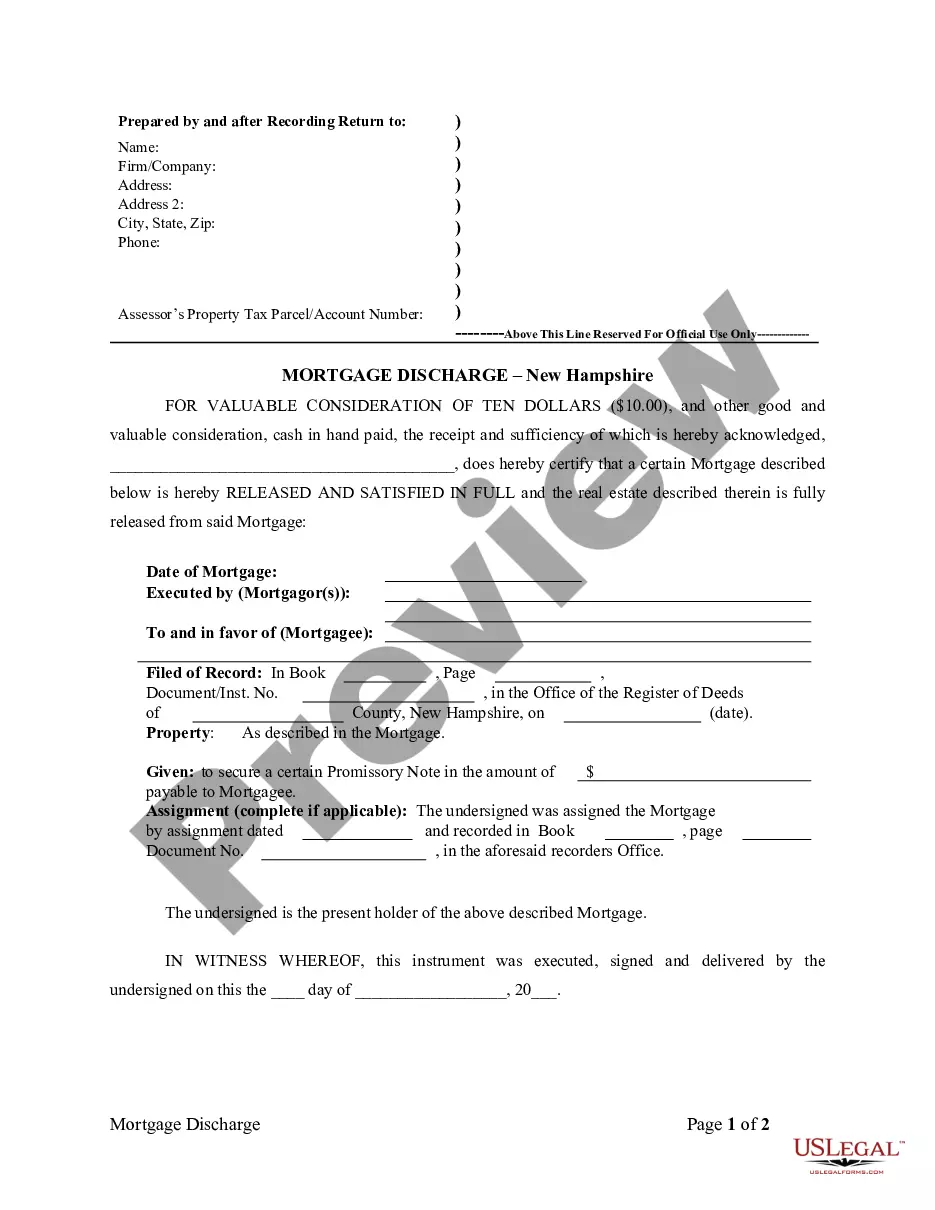

This is a generic form for the sale of residential real estate. Please check your state=s law regarding the sale of residential real estate to insure that no deletions or additions need to be made to the form. This form has a contingency that the Buyers= mortgage loan be approved. A possible cap is placed on the amount of closing costs that the Sellers will have to pay. Buyers represent that they have inspected and examined the property and all improvements and accept the property in its "as is" and present condition.

Closing Property Title For Sale In Travis

Description

Form popularity

FAQ

Physical Address Changes within the City of Austin or Travis County can be requested by phone at 512-974-2797, online service form or email at addressing@austintexas. A change of address may be initiated by a property owner or the Address Management Services office.

In Texas, tax lien sales occur through public auctions, which are typically held monthly by the county sheriff's office. Interested investors must first register for the auction, often requiring a refundable deposit.

Tax Jurisdiction2024 Tax Rate2021 Tax Rate Travis County 0.344445 0.357365 Travis County Healthcare District 0.107969 0.111814 City/Village City of Austin 0.477600 0.54100085 more rows

The Judicial Tax Sale is held the first Tuesday of each month at a.m. at the rear of the Travis County Courthouse, 1000 Guadalupe St., Austin, TX 78701. A Tax Foreclosure sale is a legal action the county takes as its final effort to collect delinquent property taxes.

Tax Jurisdiction2024 Tax Rate2021 Tax Rate Travis County 0.344445 0.357365 Travis County Healthcare District 0.107969 0.111814 City/Village City of Austin 0.477600 0.54100085 more rows

You can file your mechanics liens with the Travis County Clerk's Recording Division by postal mail, by courier, or in person. The County Clerk also accepts electronic filings of documents from an authorized eRecording submitter.

Once a deed has been recorded by the County Clerk's Office, copies of the deed may be requested if the original deed has been misplaced. Plain copies can be found by using the Official Public Records Search and selecting "Land Records". A certified copy may be purchased through request either in person or by mail.