Stock Purchase Agreement Template With Car In Texas

Description

Form popularity

FAQ

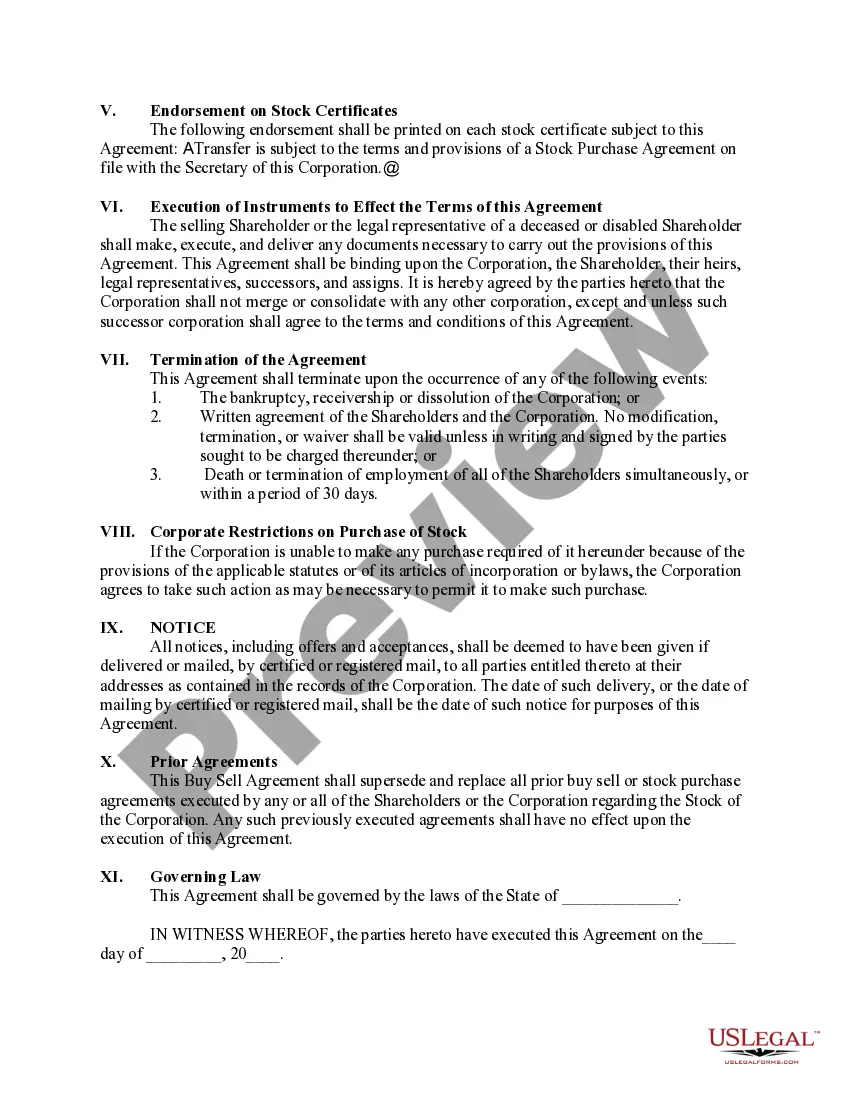

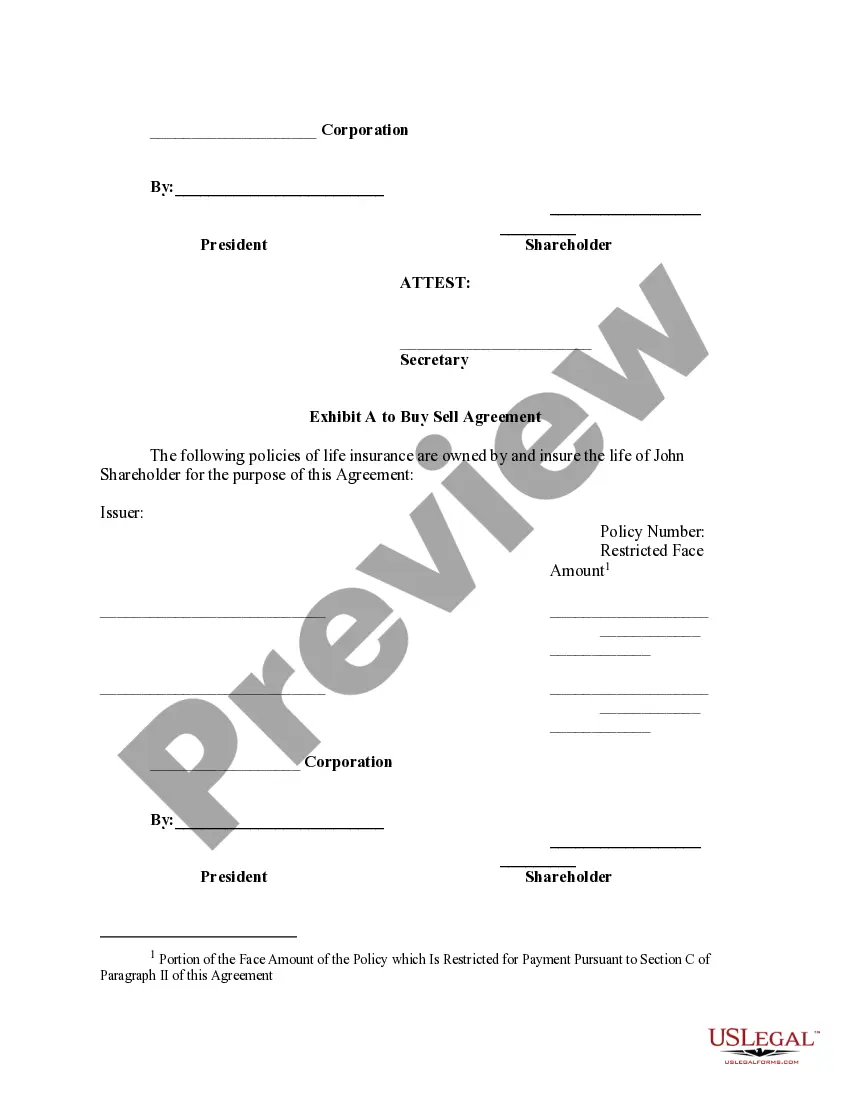

Below are four critical topics you and your lawyer should consider when drafting your company's buy-sell agreement. Identify the Parties Involved. Agree on the Trigger Events. Agree on a Valuation Method. Set Realistic Expectations and Frequently Review the Agreement Terms. About the Author.

What should be included in a buy-sell agreement? Any stakeholders, including partners or owners, and their current stake in the business' equity. Events that would trigger a buyout, such as death, disability, divorce, retirement, or bankruptcy. A recent business valuation.

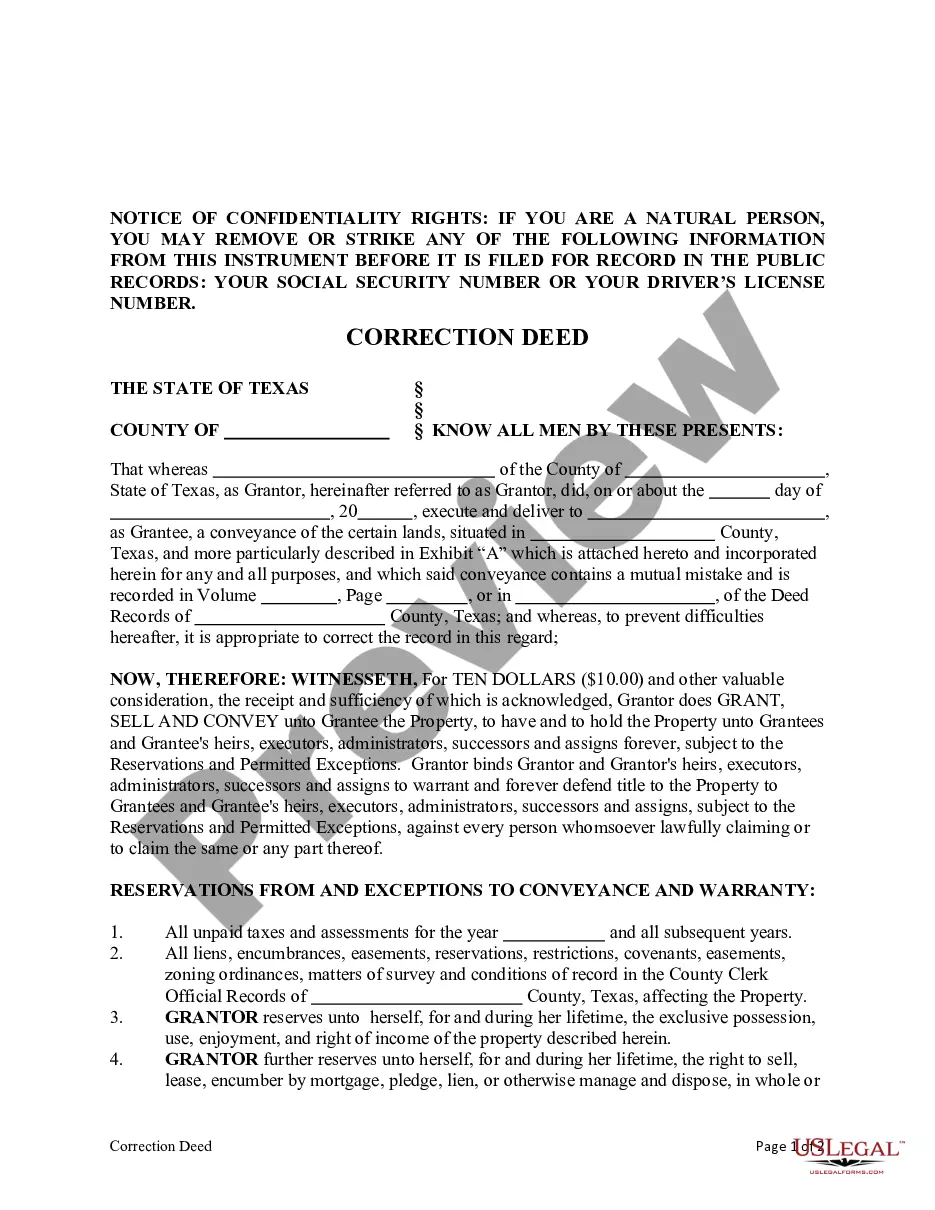

To write a simple contract, title it clearly, identify all parties and specify terms (services or payments). Include an offer, acceptance, consideration, and intent. Add a signature and date for enforceability. Written contracts reduce disputes and offer better legal security than verbal ones.

Write the contract in six steps Start with a contract template. Open with the basic information. Describe in detail what you have agreed to. Include a description of how the contract will be ended. Write into the contract which laws apply and how disputes will be resolved. Include space for signatures.

5 Ways to Begin Creating Shared Agreements Everyone participates. Cultivate a safe space to speak from the heart, but be open to feedback when your words harm others. Listen from the heart. Make sure that your intent matches your impact. Lead with empathy and self-awareness. Listen to understand, not to respond.