S Corporation With Passive Income In Texas

Description

Form popularity

FAQ

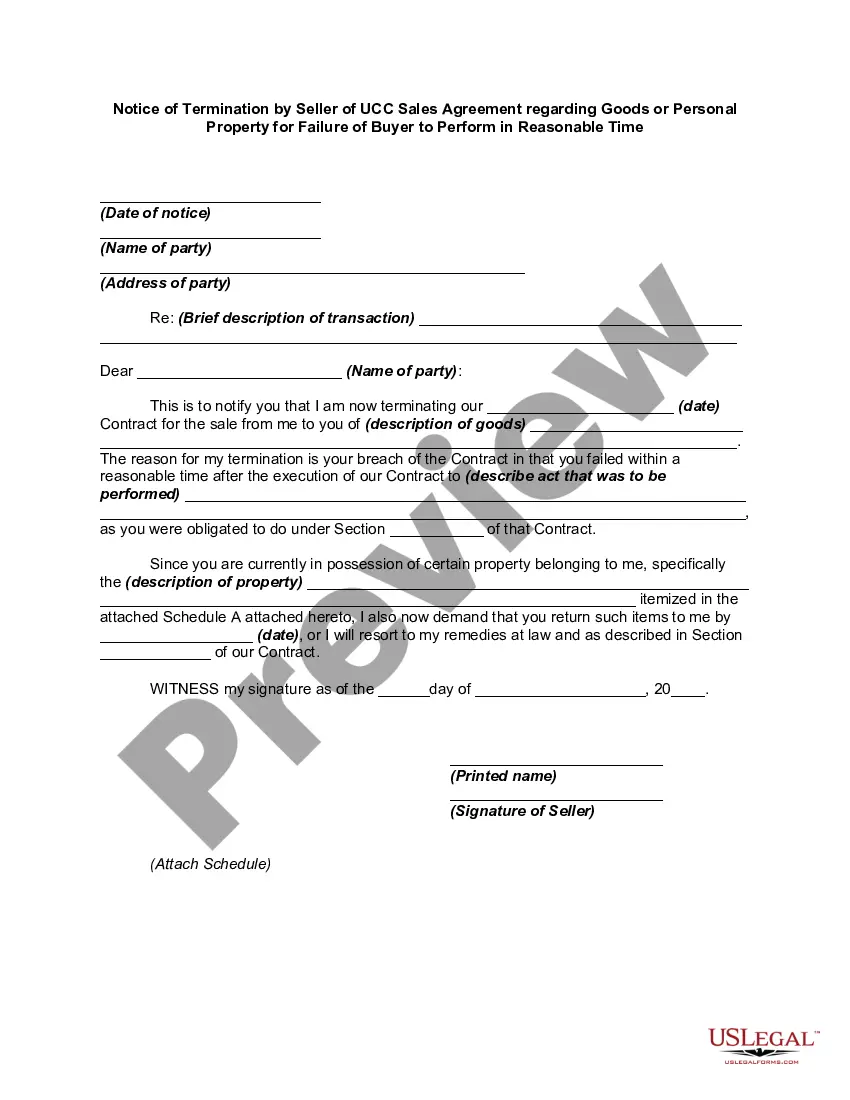

Once you confirm you meet the requirements, you may apply for S Corporation status with the IRS by filing Form 2553. The State of Texas recognizes the federal S Corp election. Your business will still be subject to franchise taxes with the State of Texas.

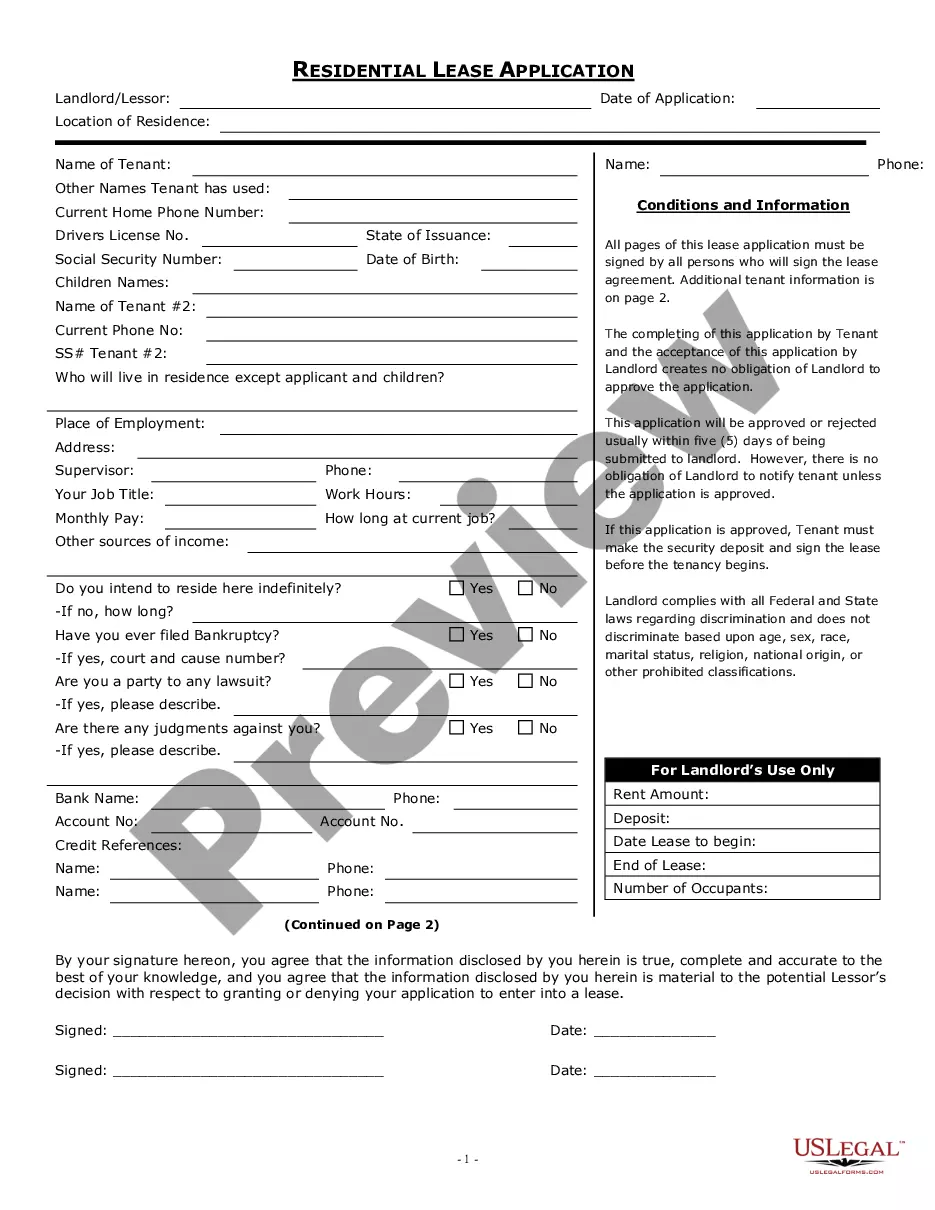

Passive income consists of amounts derived from royalties, rents, dividends, interest and annuities. Although conventional rental income is passive in nature, rents derived from an activity where the S corporation/lessor renders significant services or incurs substantial costs will not be treated as passive income.

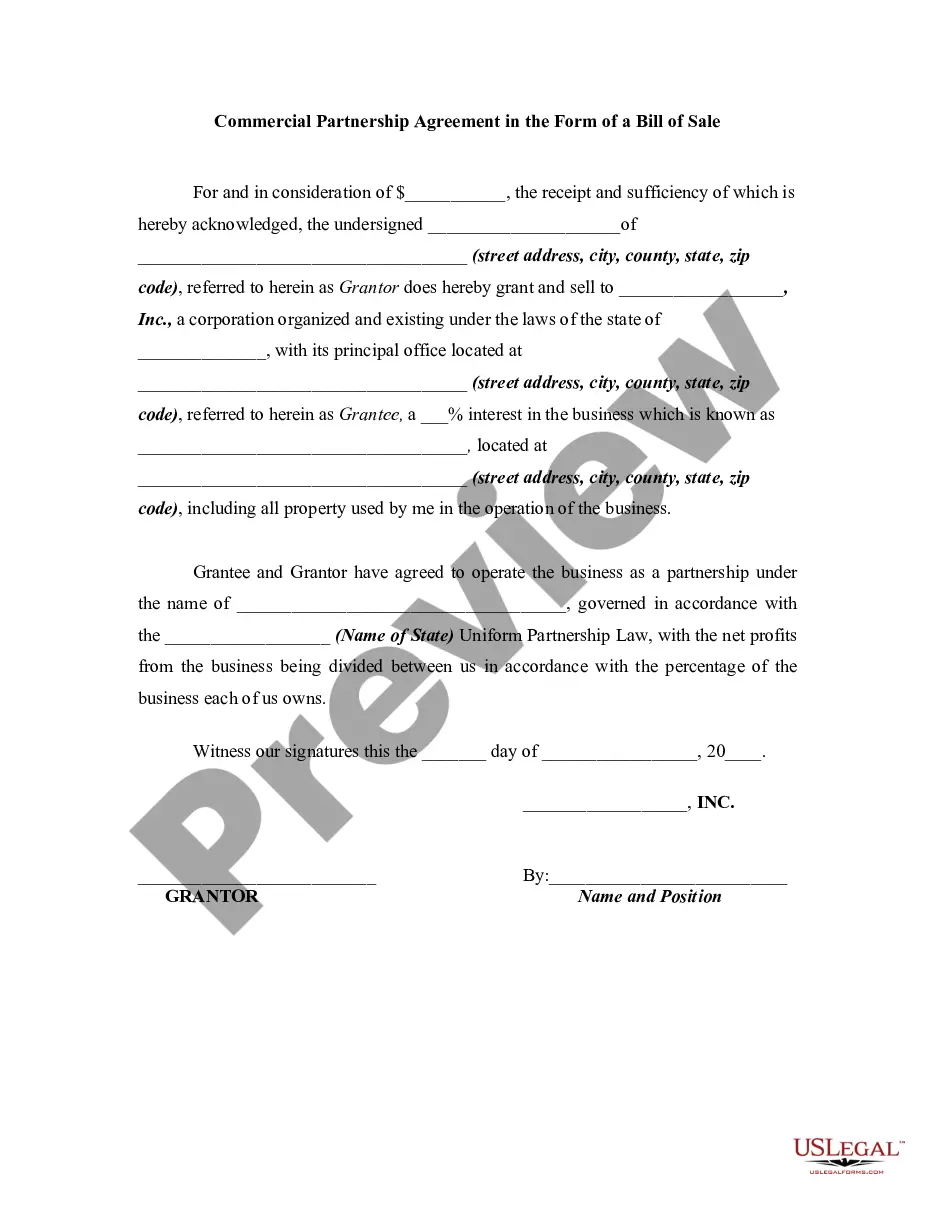

Because of the one-class-of-stock restriction, an S corporation cannot allocate losses or income to specific shareholders. Allocation of income and loss is governed by stock ownership, unlike partnerships or LLCs taxed as partnerships where the allocation can be set in the partnership agreement or operating agreement.

To qualify as a passive entity, the entity must be a partnership or trust, other than a business trust, for the entire accounting period on which the tax is based. The entity may not qualify as passive for the accounting period during which the conversion occurs even if it meets the 90 percent income test.

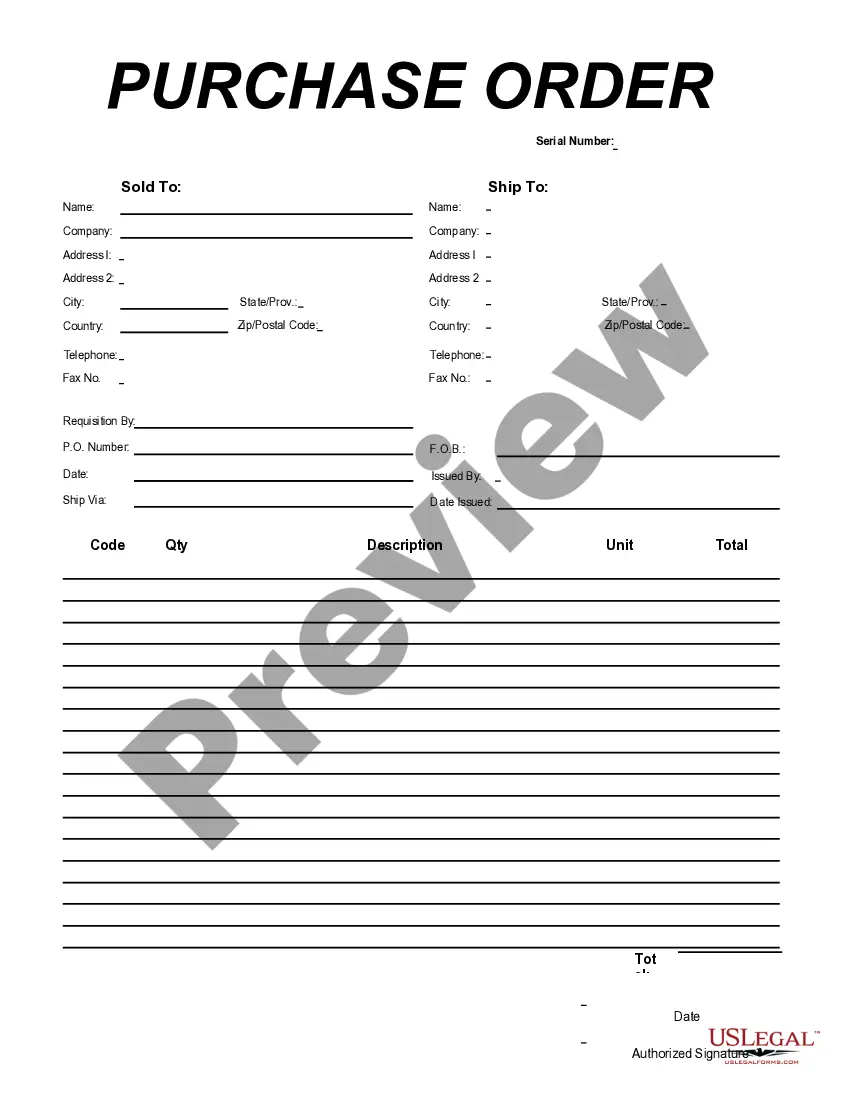

South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts tax. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding. .

Texas S Corp Formation Generally, business owners will first form an LLC (Limited Liability Company) by following the process for forming an LLC in Texas. Then they make an S Corp election. Owners may also choose another entity type with the State of Texas and then make the S election.