Consignment Note Format In Nassau

Description

Form popularity

FAQ

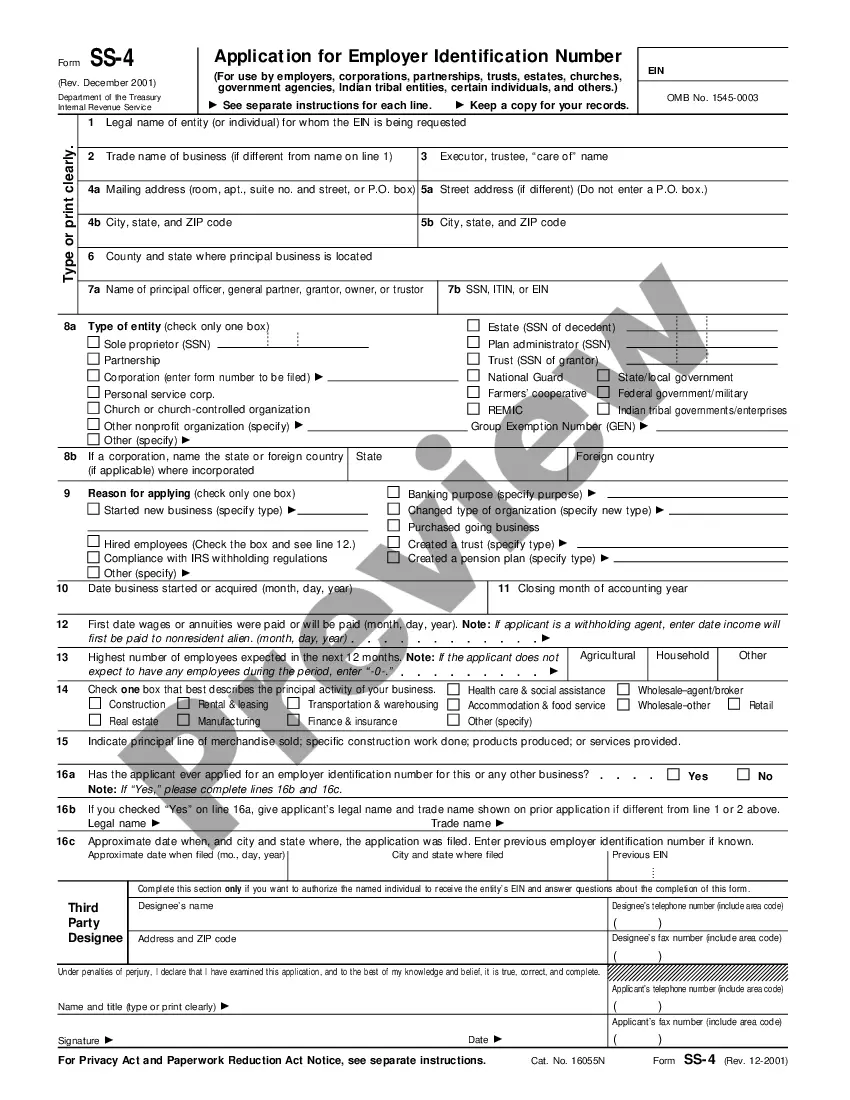

Upon delivery, the recipient signs the CMR note, providing confirmation of receipt. A CMR note includes the names and addresses of both the sender and receiver, as well as details about the goods, such as their weight. Moreover, it clarifies who is responsible for insuring the goods during transit.

The consignment note is often known as “bill of lading” (B/L) in inland carriage by road and boat, and “CMR-note” in cross-border road carriage in Europe. The waybill (WB) is the shipping company's version of the consignment note but is used mainly for the shipping company's own internal tracking.

In addition, the consignment note records the transport and freight costs, the date and place of acceptance, as well as the planned date and place of delivery. It also provides information (name, address) about the sender, recipient and carrier, as well as other agreements, notes, and conditions.

What information is required on a CMR Consignment note document? Sender's (exporter) Details. Consignee's (Receiver) Details. Place of Delivery of the goods (place, country) ... Place and date of taking over the goods (place, country, date) ... Annexed documents. 6 through to 12. Sender's Instructions.

A consignment note is another term for Air Waybill.

The sea waybill is a simple, non-negotiable transport document that can be used as an alternative to the bill of lading. Unlike the bill of lading, the sea waybill is not a document of title. But it does act as the: Evidence of a contract of carriage.

In this article, we will delve into the different types of BLs – Original BL, Surrendered BL, and Sea-Way Bill – to help you gain a comprehensive understanding of their characteristics and how they impact international trade transactions.

Document accompanying goods that is filled by the shipper. It serves as proof that a contract for carriage has been concluded and describes its content. It also serves as a receipt when goods are picked up from the shipper and delivered to the recipient.

The main exports are minerals – including salt – animal products, rum, chemicals, fruit and vegetables; the main imports are industrial equipment, manufactures, chemicals, fuels and food.

All valid receipts for declared items are required. All visitors to the Bahamas are entitled to an exemption of $100.00 on any dutiable article being brought into the Bahamas. Any value in excess of this, the necessary custom duties and taxes will be applicable.