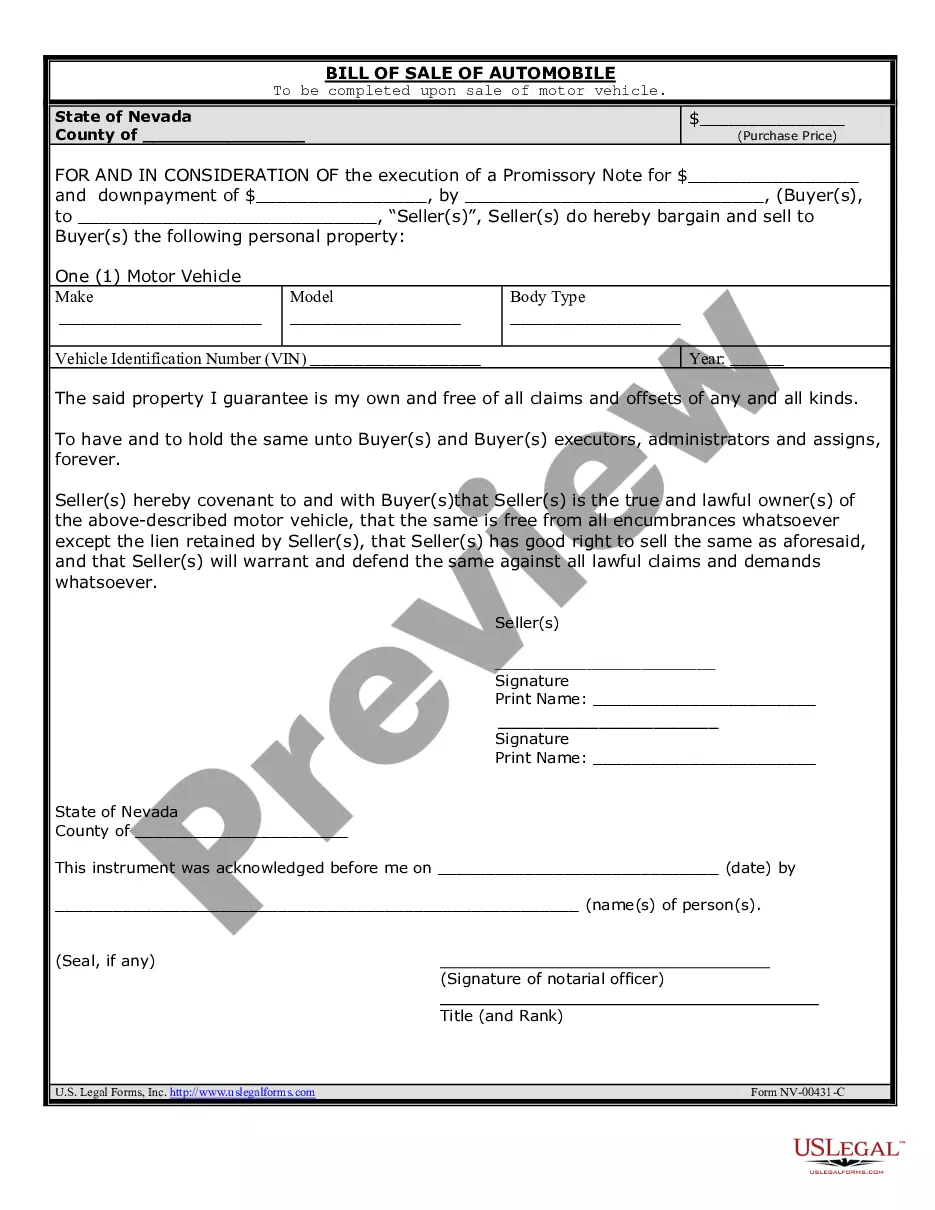

The Transfer Title Motor Vehicle Form for Texas, also known as the Application for Texas title and/or Registration (Form 130-U), is a crucial document used in the process of transferring the ownership of a motor vehicle in the state of Texas. This form is utilized when a vehicle owner wishes to sell or transfer their vehicle to another party, whether it be through a private sale, gift, inheritance, or any other means of transfer. The Transfer Title Motor Vehicle Form serves as an official application for a new Texas title and registration, and it provides the necessary information for the Texas Department of Motor Vehicles (DMV) to update their records and legally transfer the vehicle to its new owner. It is important to note that this form must be completed accurately and in its entirety to ensure a smooth transfer process. Some of the essential details that need to be provided on the Transfer Title Motor Vehicle Form include the vehicle identification number (VIN), make, model, year of the vehicle, the current owner's name, address, driver's license number or ID, and the new owner's information (name, address, driver's license number or ID) if applicable. Additionally, the form requires the current owner's signature, date of sale, and odometer reading at the time of transfer. In addition to the standard Transfer Title Motor Vehicle Form (130-U), there are several other forms that may be required in specific transfer situations. These additional forms include: 1. Vehicle Transfer Notification (Form VTR-346): This form is used to notify the Texas DMV of the vehicle transfer and relieves the seller from liability in case the new owner fails to transfer the vehicle into their name. 2. Motor Vehicle Appraisal for Tax Collector Hearing (Form 50-285): This form is used when the vehicle's value needs to be determined officially, for example, in cases where the sales price is significantly lower than market value. 3. Affidavit of Warship for a Motor Vehicle (Form VTR-262): This form is used when transferring the title of a vehicle to a surviving spouse or heir through the process of affidavit of warship. 4. Gift Affidavit (Form 14-317): This form is utilized when a vehicle is being given as a gift, and both the donor and the recipient need to prove their relationship or eligibility for the gift tax exemption. It is important to be aware of these various forms and their specific requirements to ensure a successful transfer of motor vehicle ownership in Texas. Failure to submit the correct forms or provide accurate information may result in delays or complications during the transfer process. Therefore, carefully reviewing the Texas DMV website or consulting with a local DMV office can provide further guidance on the specific requirements and processes involved in transferring the title of a motor vehicle.

Transfer Title Motor Vehicle Form For Texas

Description dmv form for title transfer

How to fill out Dmv Car Transfer Form?

Handling legal paperwork and procedures might be a time-consuming addition to your day. Transfer Title Motor Vehicle Form For Texas and forms like it often require you to look for them and navigate the way to complete them effectively. Consequently, if you are taking care of financial, legal, or individual matters, using a extensive and hassle-free online library of forms at your fingertips will greatly assist.

US Legal Forms is the top online platform of legal templates, featuring more than 85,000 state-specific forms and numerous resources to assist you complete your paperwork effortlessly. Explore the library of relevant papers available to you with just one click.

US Legal Forms provides you with state- and county-specific forms offered at any moment for downloading. Safeguard your document administration operations using a top-notch support that allows you to put together any form within a few minutes without any additional or hidden cost. Just log in to the account, find Transfer Title Motor Vehicle Form For Texas and acquire it immediately from the My Forms tab. You may also gain access to previously saved forms.

Could it be the first time using US Legal Forms? Sign up and set up an account in a few minutes and you’ll gain access to the form library and Transfer Title Motor Vehicle Form For Texas. Then, follow the steps below to complete your form:

- Make sure you have discovered the right form using the Review feature and reading the form information.

- Pick Buy Now when ready, and select the monthly subscription plan that fits your needs.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of expertise assisting users manage their legal paperwork. Obtain the form you want today and enhance any process without breaking a sweat.

assignment of title texas Form popularity

dmv forms for title transfer Other Form Names

certificate of title transfer form FAQ

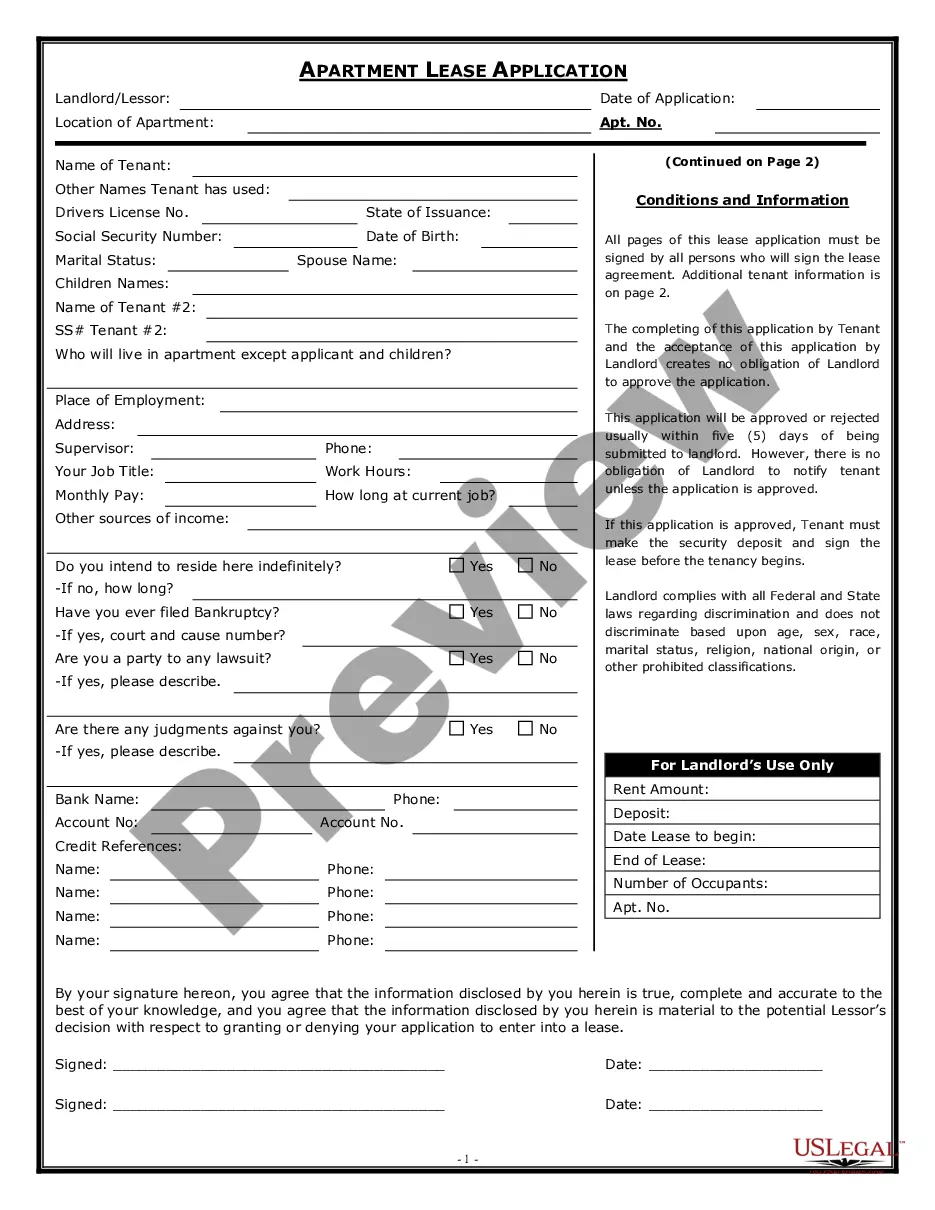

On the back of the title you will fill out completely the upper block of information that says ASSIGNMENT OF TITLE in the left margin. Print the buyer(s) name and complete address on the first line. Fill in the odometer reading in the space provided. Enter your mileage EXACTLY AS IT APPEARS ON YOUR ODOMETER.

Fees one can expect to pay when buying a car in Texas are as follows: Sales Tax: 6.25% of the total vehicle purchase price. Title Transfer Fee: $28 to $33 (varies by county)

The signed negotiable title and completed Application for Texas Title and/or Registration (Form 130-U), must be provided to the county tax office to title the vehicle. The title application must be accompanied by Affidavit of Motor Vehicle Gift Transfer (Texas Comptroller of Public Accounts Form 14-317).

To transfer a Texas titled vehicle, bring in or mail the following to our offices: Texas title, signed and dated by the seller(s) and buyer(s). ... VTR-130U (Application for Texas title), signed and dated by the seller(s) and buyer(s). ... Proof of insurance in the buyer's name. Acceptable form of ID. Proof of inspection. Fees.

For buyers, you must submit Form 130U along with a vehicle inspection prior to transferring the title. A seller must submit a vehicle transfer notification and form VTR-275. The transfer has to be completed within 30 days of the buy-sell transaction completion.