Guaranty Promissory Note With Payment Schedule

Description promissory note payment schedule

How to fill out Guaranty Promissory Note With Payment Schedule?

There’s no longer a need to invest hours hunting for legal documents to adhere to your local state guidelines.

US Legal Forms has compiled all of them in one location and made them easier to access.

Our platform offers over 85k templates for any corporate and personal legal situations organized by state and area of application.

Utilize the search bar above to locate another template if the current one does not meet your requirements.

- All forms are expertly crafted and confirmed for accuracy, so you can be assured of acquiring a current Guaranty Promissory Note With Payment Schedule.

- If you’re acquainted with our service and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click on Download.

- You can also revisit all saved records whenever necessary by accessing the My documents tab in your profile.

- If you haven’t interacted with our service before, the process will involve more steps to finalize.

- Here’s how new users can secure the Guaranty Promissory Note With Payment Schedule in our catalog.

- Examine the page content closely to confirm it includes the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

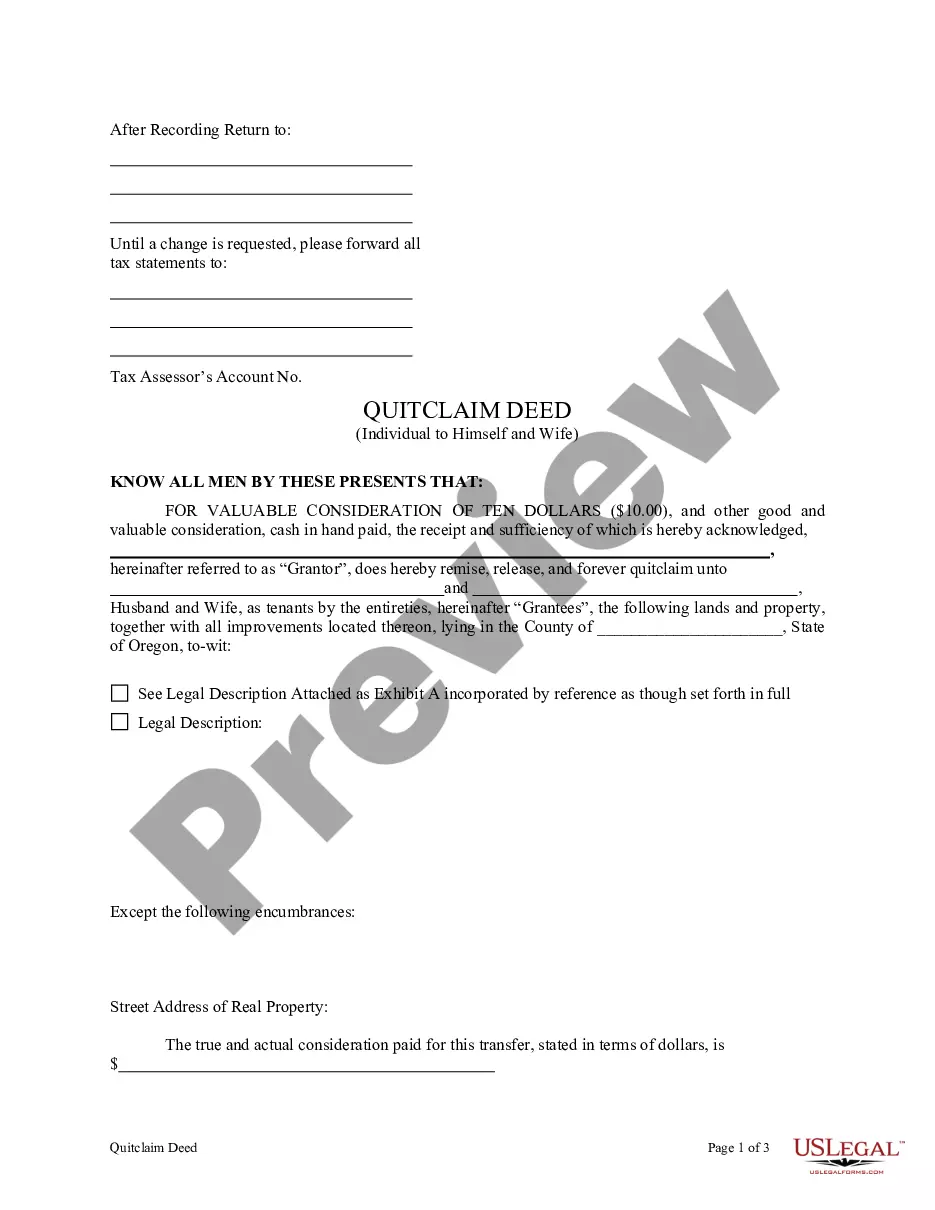

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

Guaranteed promissory note means a written contract obligating a recipient to repay the funds received if the recipient does not fulfill the service obligation, which was a condition of the recipient's scholarship, or grant award.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.