Irrevocable Trusts Explained For Dummies

Description irrevocable trust for dummies

How to fill out Irrevocable Trusts Explained For Dummies?

Getting a go-to place to take the most recent and appropriate legal samples is half the struggle of dealing with bureaucracy. Finding the right legal files requirements accuracy and attention to detail, which explains why it is vital to take samples of Irrevocable Trusts Explained For Dummies only from trustworthy sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You can access and view all the information regarding the document’s use and relevance for your circumstances and in your state or county.

Take the following steps to complete your Irrevocable Trusts Explained For Dummies:

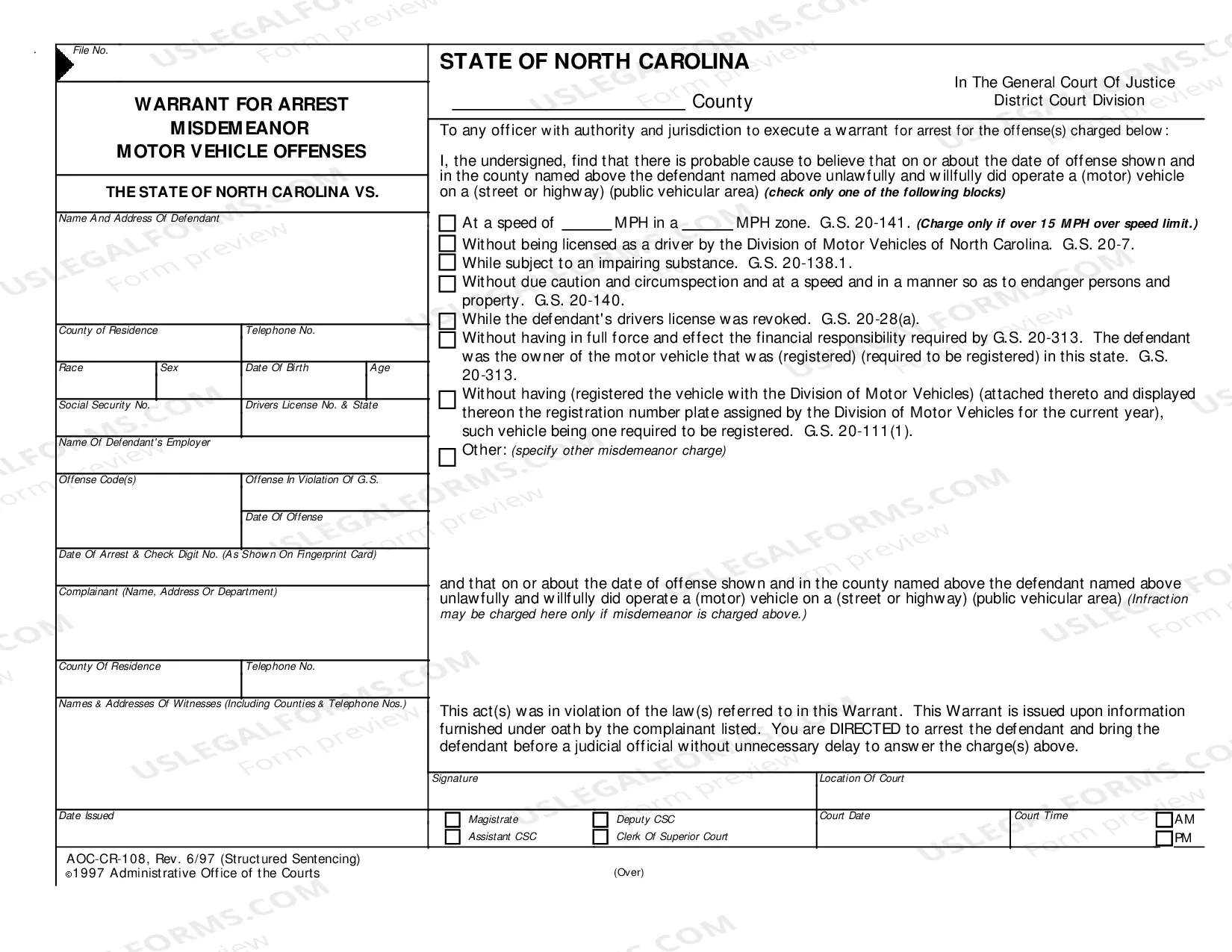

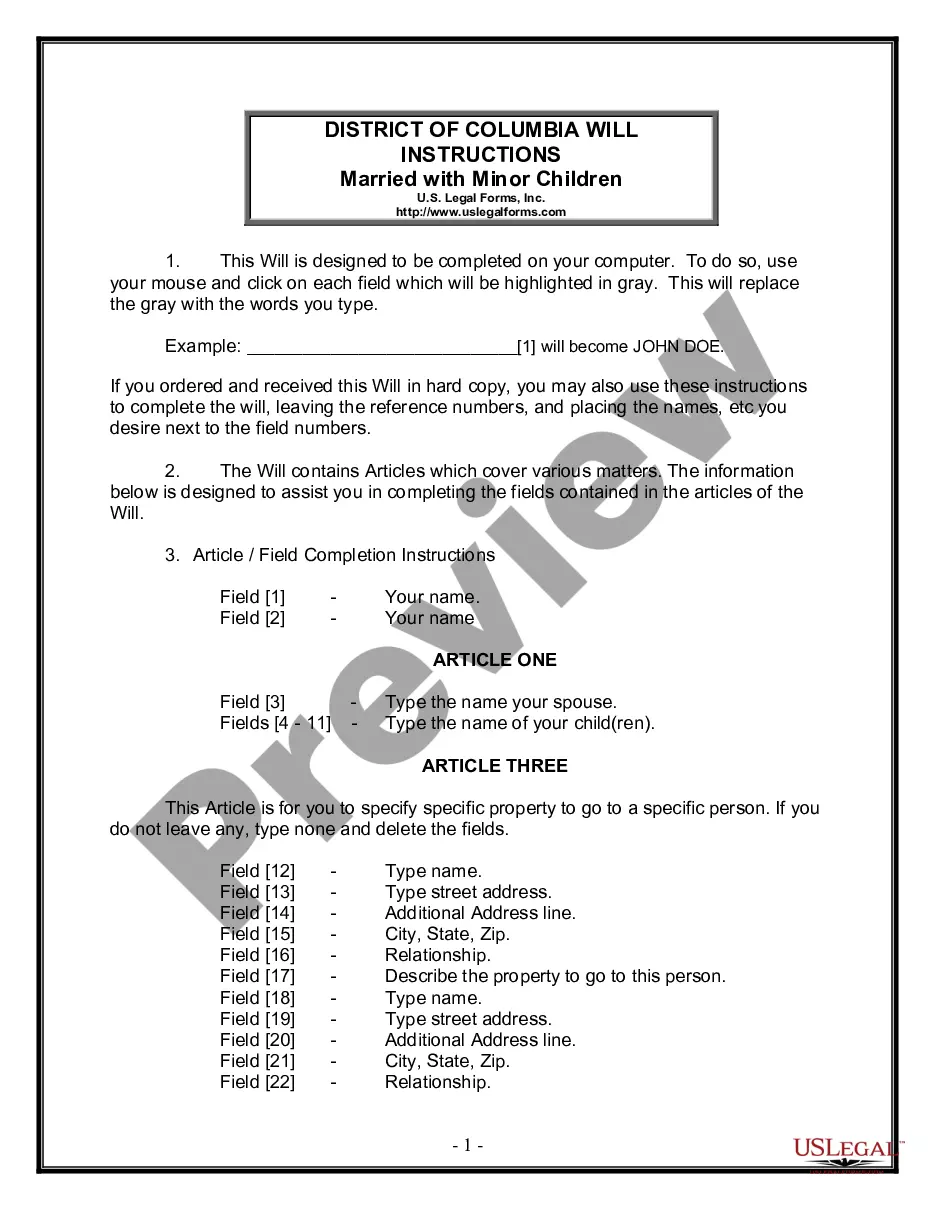

- Use the catalog navigation or search field to find your sample.

- View the form’s description to check if it matches the requirements of your state and county.

- View the form preview, if there is one, to make sure the template is definitely the one you are looking for.

- Get back to the search and find the right document if the Irrevocable Trusts Explained For Dummies does not suit your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that fits your needs.

- Proceed to the registration to complete your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Pick the file format for downloading Irrevocable Trusts Explained For Dummies.

- When you have the form on your device, you can modify it with the editor or print it and complete it manually.

Eliminate the hassle that accompanies your legal documentation. Explore the comprehensive US Legal Forms collection to find legal samples, examine their relevance to your circumstances, and download them on the spot.

trusts explained Form popularity

what are irrevocable trusts Other Form Names

FAQ

How long does a UCC filing last? A UCC-1 filing is good for five years. After five years, it is considered lapsed and no longer valid.

The filing fee is $25. make checks payable to the Georgia Superior Court Clerks' Cooperative Authority.

Uniform Commercial Code (UCC)Filings.

?UCC? stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

A Uniform Commercial Code filing, also known as a UCC filing, is a document that lenders use to establish their legal right to assets that a borrower uses to secure a loan. This notice allows the lender to seize the borrower's collateral in the case of default.

UCC forms may only be completed online or submitted by mail to the following address: PO Box 5616, Montgomery, AL 36103. The Uniform Commercial Code Division operates a filing and retrieval center for UCC financing statements at the state level.

Ask the lender to terminate the lien upon payoff. When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. ... Visit your secretary of state's office. ... Dispute inaccurate information on your business credit reports.