Living Trust Printable Forms For Illinois

Description

How to fill out Living Trust - Irrevocable?

Whether for commercial intentions or for individual issues, everyone eventually must confront legal circumstances in their lifetime.

Filling out legal documents necessitates meticulous care, starting from choosing the appropriate form model.

Once it is downloaded, you can fill out the form with the aid of editing software or print it and complete it manually. With an extensive US Legal Forms catalog available, you never have to waste time searching for the correct sample online. Utilize the library’s straightforward navigation to obtain the appropriate template for any scenario.

- For example, if you choose the incorrect version of a Living Trust Printable Forms For Illinois, it will be rejected upon submission.

- Hence, it is essential to secure a trustworthy source of legal documentation like US Legal Forms.

- If you seek to acquire a Living Trust Printable Forms For Illinois template, adhere to these straightforward steps.

- Utilize the search bar or catalog navigation to locate the sample you require.

- Review the details of the form to ensure it aligns with your circumstance, state, and area.

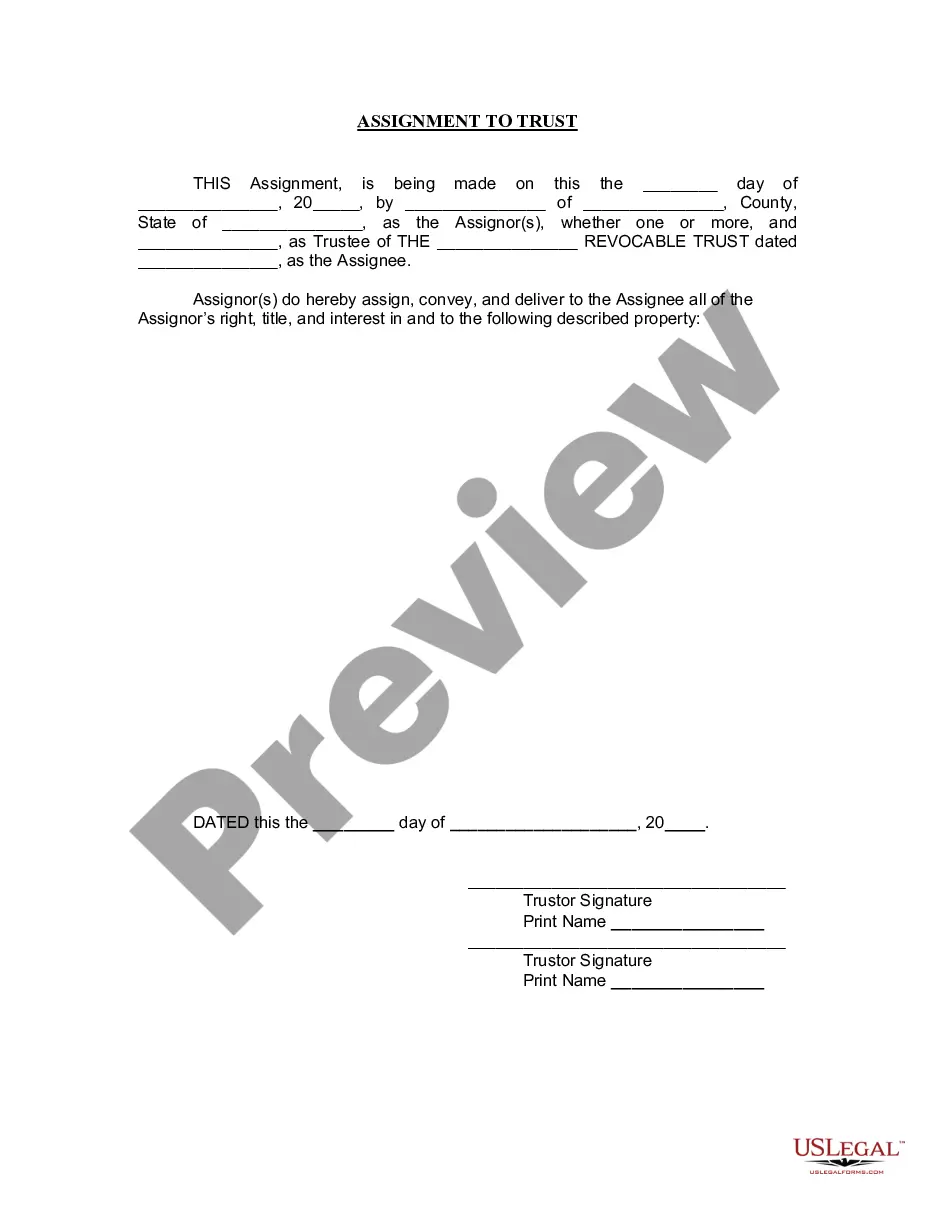

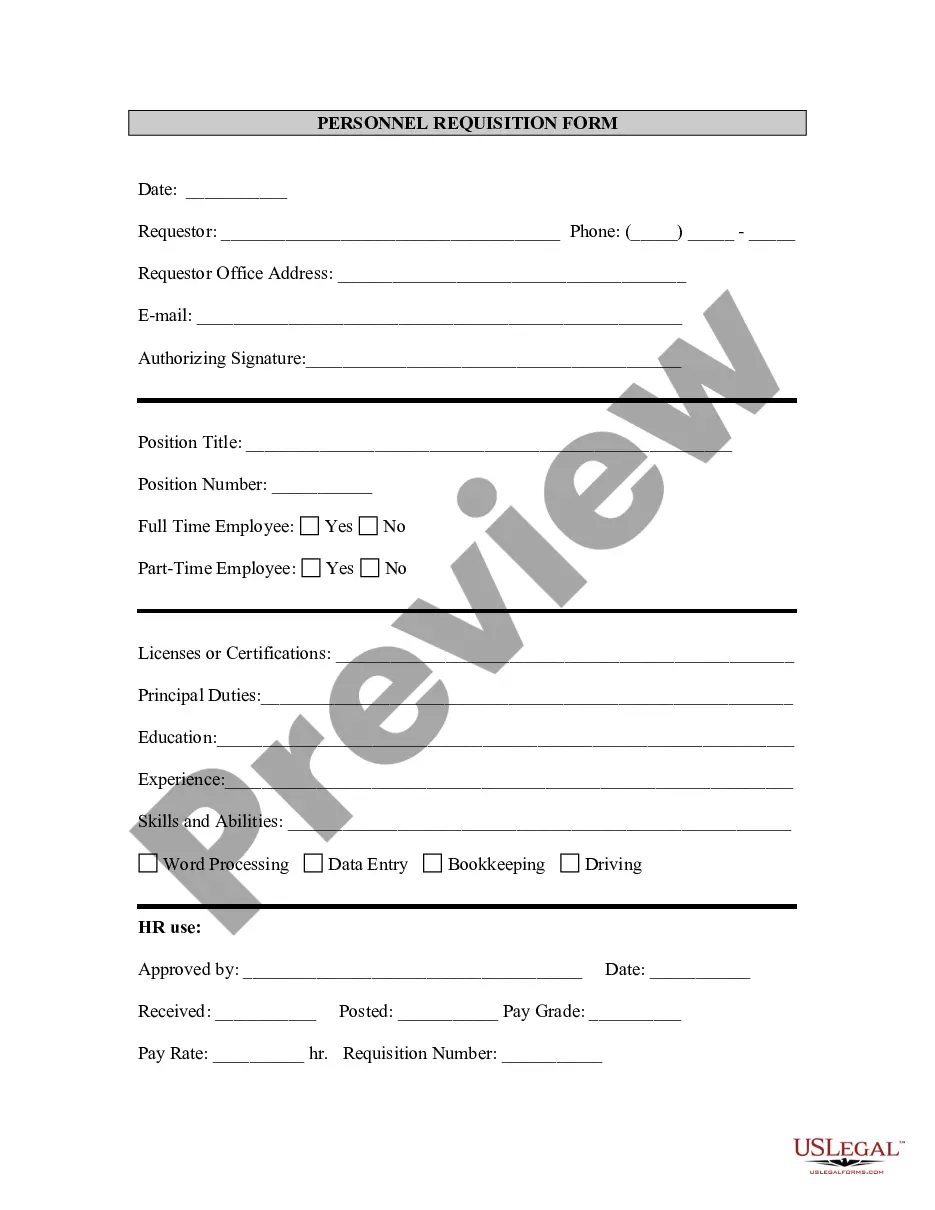

- Click on the form’s preview to examine it.

- If it is not the correct form, return to the search feature to find the Living Trust Printable Forms For Illinois sample you need.

- Download the template if it meets your criteria.

- If you already possess a US Legal Forms account, click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you prefer and download the Living Trust Printable Forms For Illinois.

Form popularity

FAQ

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

It's generally easier for first-party creditors to prove you owe a debt. They simply produce the original credit agreement that shows your name and identifying information, like your address and Social Security number.

Debt Collection Laws in Missouri Residents of Missouri fall under the Federal Debt Collections Protection Act, which prohibits collection agencies from harassing borrowers or using unfair or misleading tactics to collect debts.

To take legal action to collect a debt, the creditor (the person or company owed money) files a lawsuit against the debtor (the person who owes the money). Once a debt collection lawsuit is filed with the court, the creditor must give the debtor notice of the lawsuit (service).

Under this Act (Title VIII of the Consumer Credit Protection Act), third-party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes.

Evidence of debt means a writing that evidences a promise to pay or a right to the payment of a monetary obligation, such as a promissory note, bond, negotiable instrument, a loan, credit, or similar agreement, or a monetary judgment entered by a court of competent jurisdiction.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment.

If you choose not to verify your identity by providing information, like your Social Security number, the debt collector will generally ask you for another form of identification, including: Account number for the debt in question, if you know it. Other contact information, such as your current or previous address.