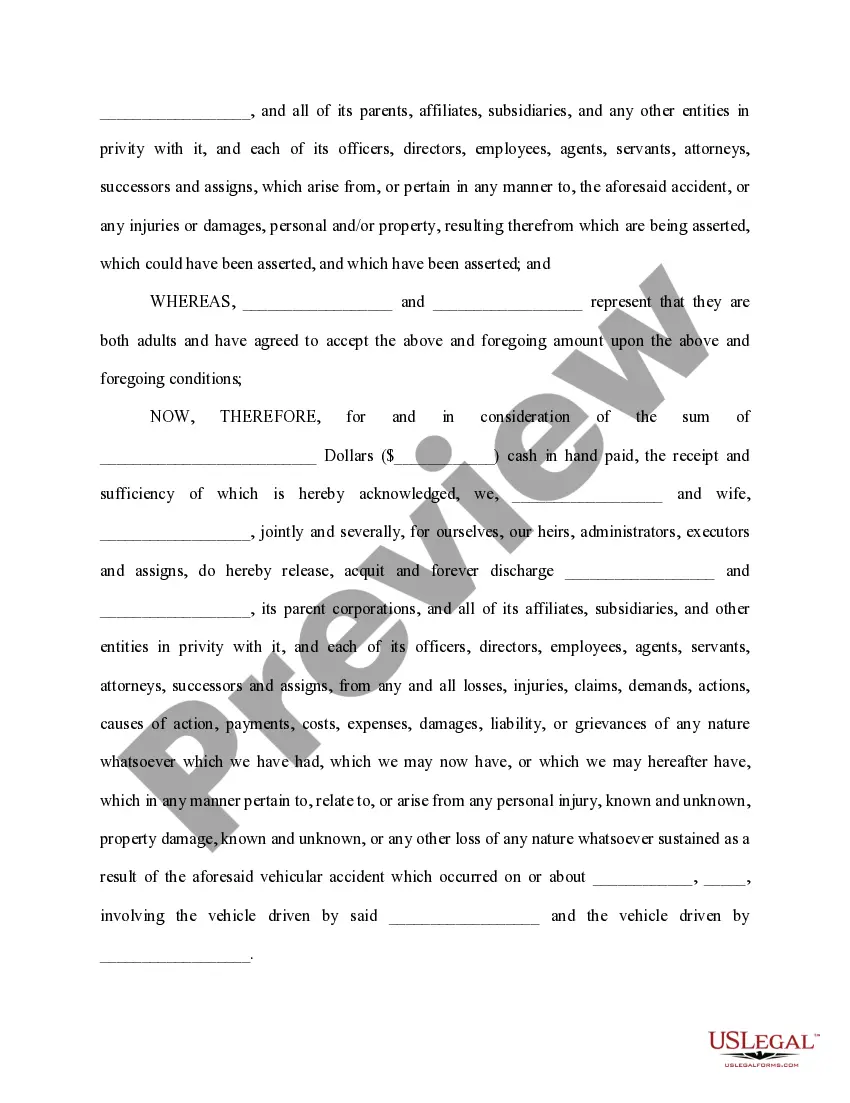

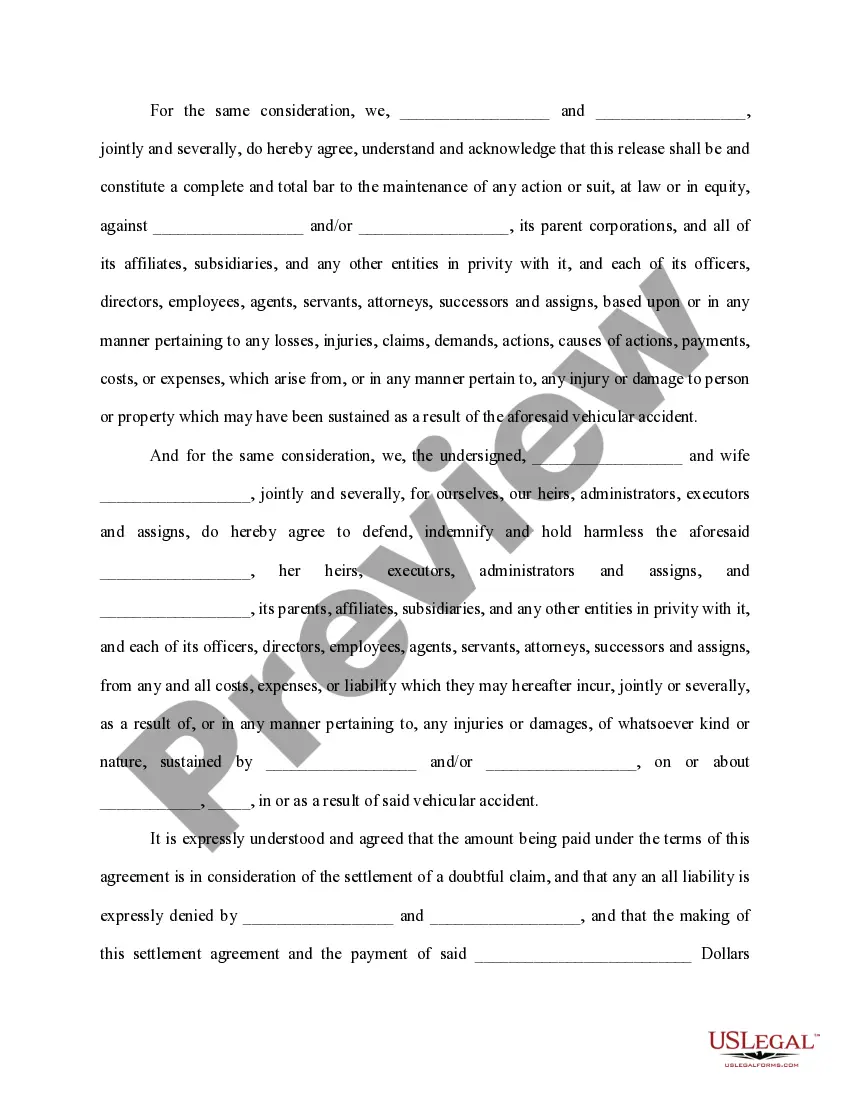

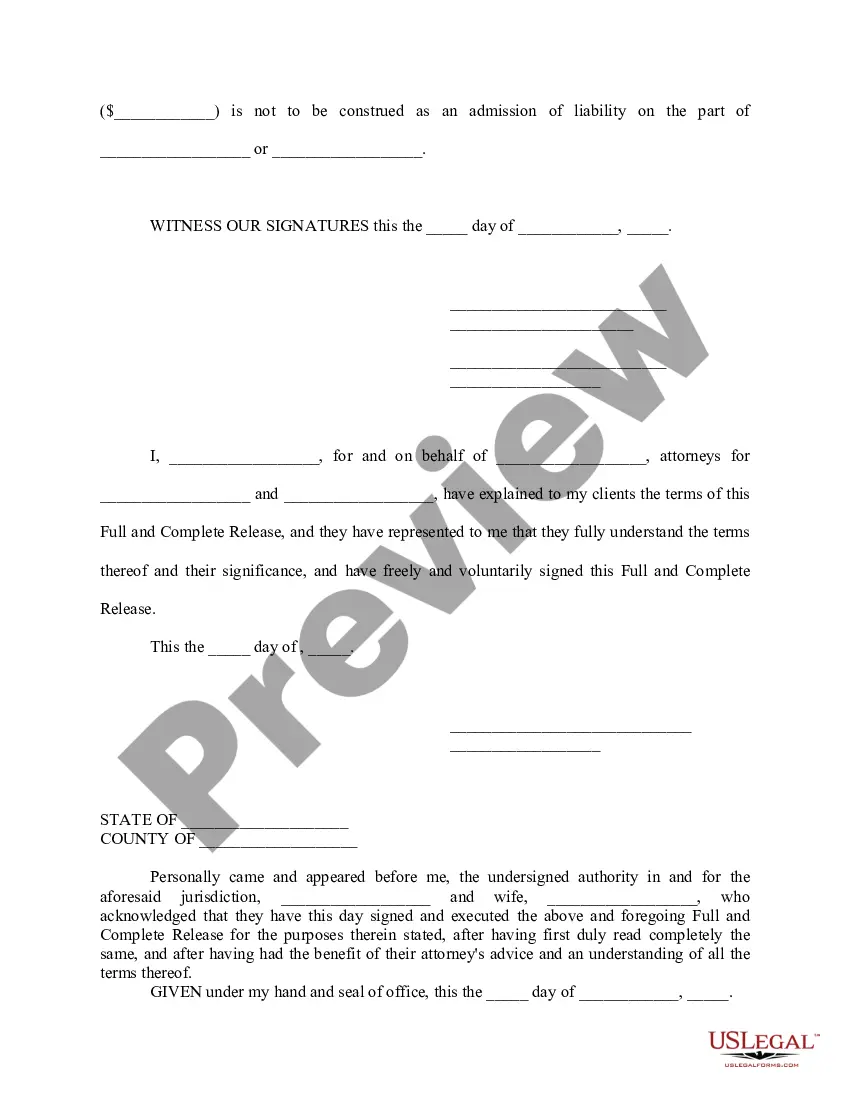

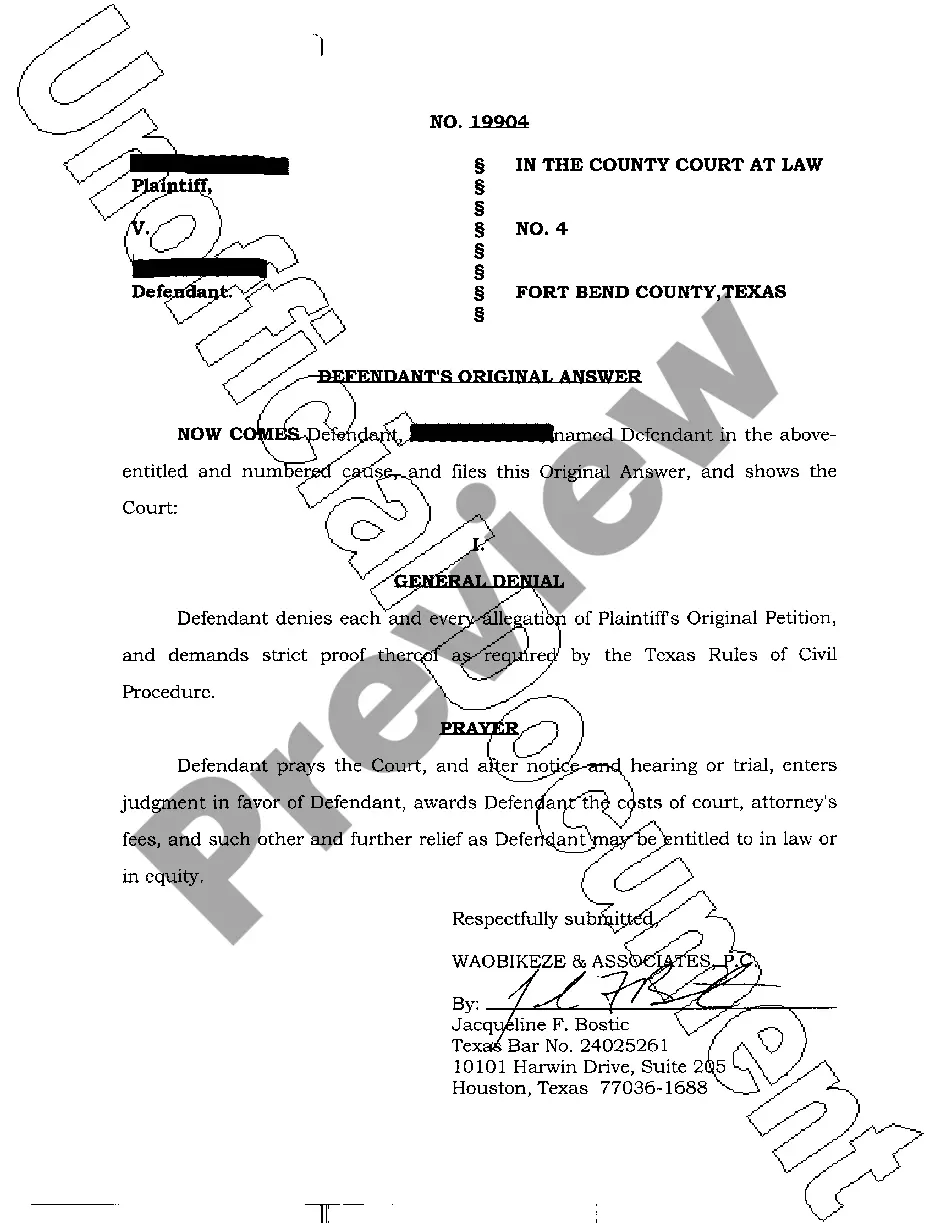

Private settlement form for car accident without insurance at fault is a legal document that facilitates the resolution of a car accident between parties involved, where the at-fault party does not have insurance coverage. This form allows the involved parties to settle the accident privately, alleviating the need for involving insurance companies or filing claims. In a situation where the at-fault party lacks insurance coverage, a private settlement form becomes an essential tool to ensure a fair resolution without resorting to legal action. This form typically includes specific information about the accident, the parties involved, and the terms of the settlement. The following are key components that should be included in a private settlement form for car accident without insurance at fault: 1. Contact Information: Names, addresses, phone numbers, and email addresses of both the at-fault party and the affected party should be included. 2. Accident Details: Provide a detailed account of the accident, including the date, time, and location. Describe the sequence of events leading up to the accident and include any eyewitness testimonies if available. 3. Vehicle Information: Include the make, model, year, and license plate of both vehicles involved in the accident. It's important to note the extent of damages sustained by each vehicle. 4. Insurance Information: Despite the at-fault party not having insurance, it's essential to document their lack of coverage. Include any relevant information about their absence of insurance, such as the reason for not having coverage. 5. Liability Statement: The at-fault party should acknowledge their responsibility for the accident and take full liability for the resulting damages. This statement acts as a legally binding admission of fault. 6. Terms of Settlement: Specify the agreed-upon terms of settlement, including the compensation or reimbursement for damages, medical expenses, property repair costs, and any other related expenses. This section should also clarify the agreed-upon timeline for payment. Different types of private settlement forms may exist depending on jurisdiction and specific circumstances. Some additional variations include: 1. Private Property Accident Settlement Form: Designed specifically for accidents that occur on private property, this form is necessary when insurance coverage is not available. 2. Pedestrian Accident Private Settlement Form: This form is used when a pedestrian is involved in a car accident, and the at-fault driver lacks insurance coverage. 3. Minor Car Accident Private Settlement Form: Used for minor accidents with limited damages, this form streamlines the settlement process without involving insurance companies or legal action. In any case, it is vital to consult with a legal professional to ensure that the private settlement form complies with local laws and adequately protects the rights of both parties involved.

Private Settlement Form For Car Accident Without Insurance At Fault

Description Settlement Accident

How to fill out Settlement Accident Sample?

The Private Settlement Form For Car Accident Without Insurance At Fault you see on this page is a reusable legal template drafted by professional lawyers in line with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the quickest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Private Settlement Form For Car Accident Without Insurance At Fault will take you just a few simple steps:

- Search for the document you need and check it. Look through the file you searched and preview it or review the form description to confirm it satisfies your requirements. If it does not, utilize the search bar to get the appropriate one. Click Buy Now when you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Select the format you want for your Private Settlement Form For Car Accident Without Insurance At Fault (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.