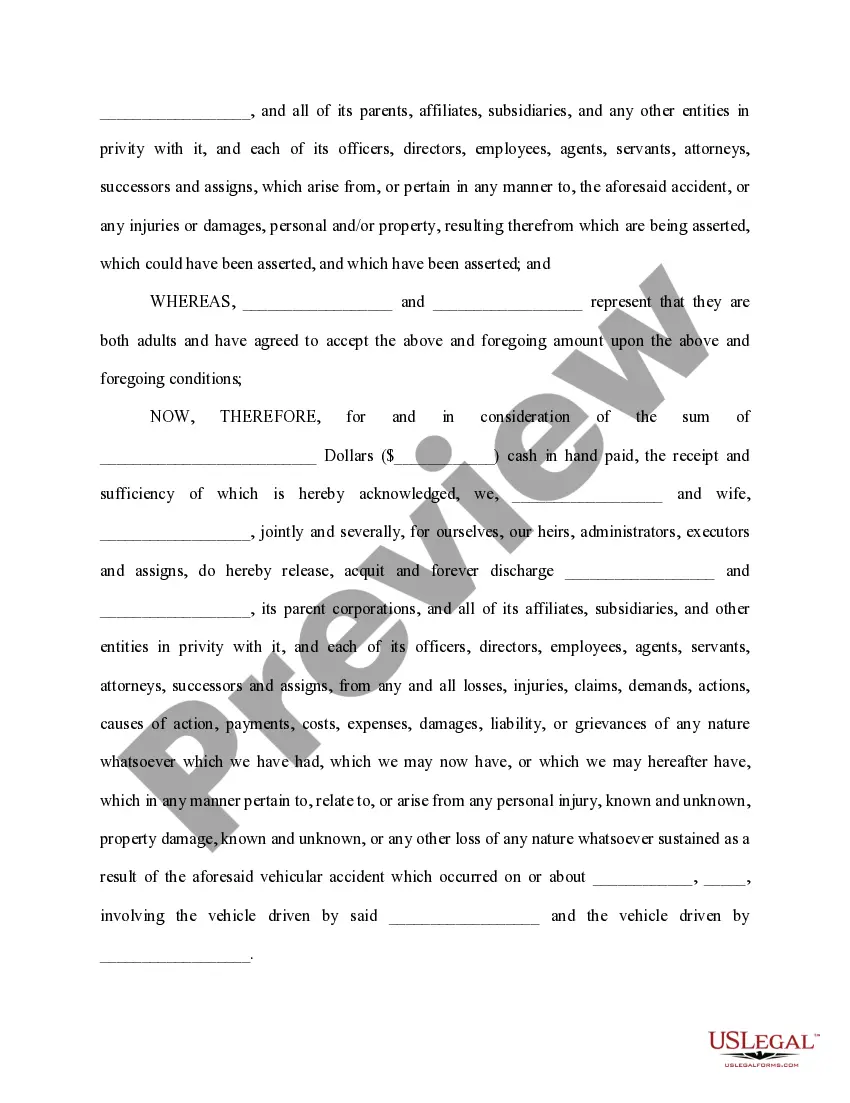

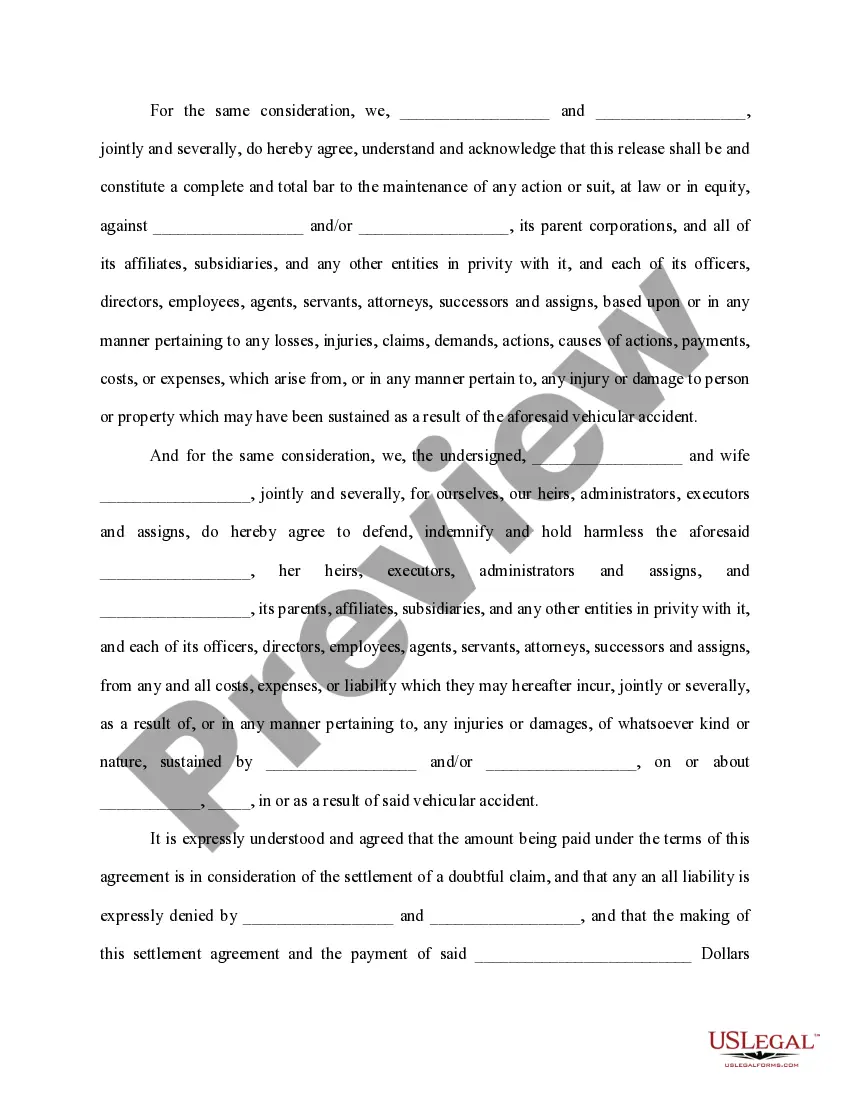

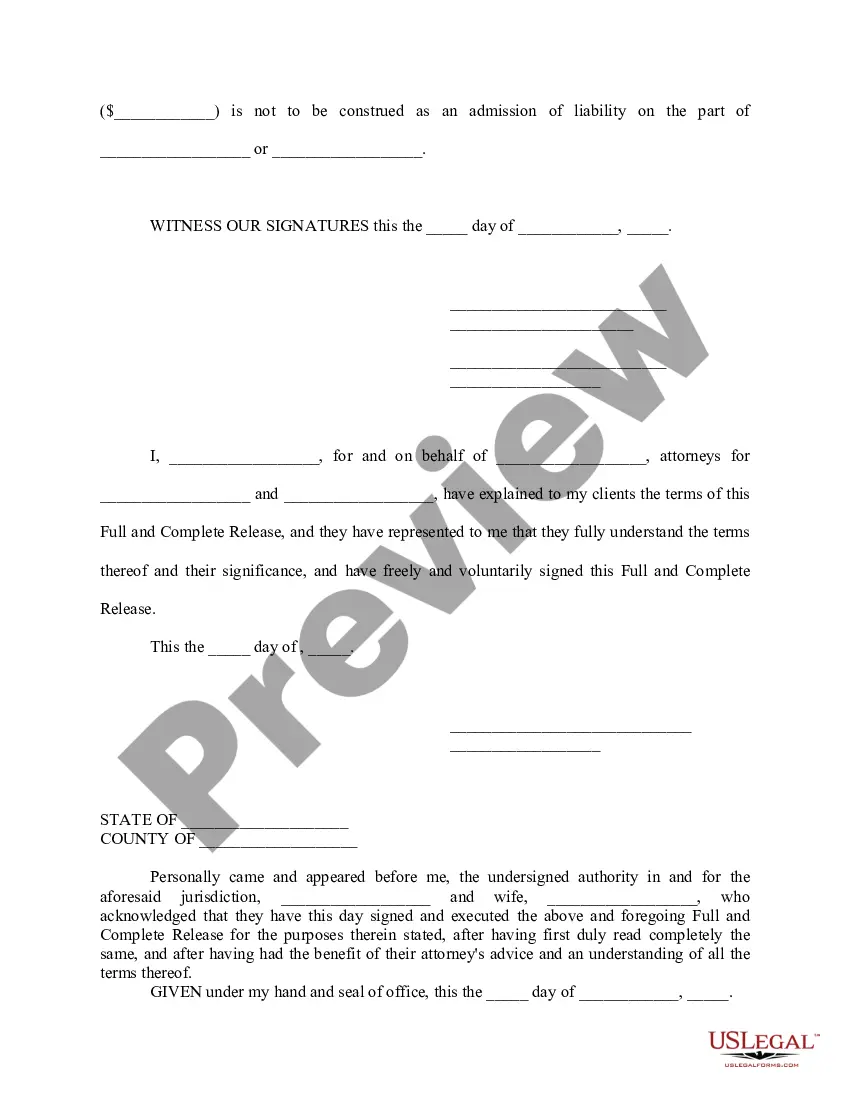

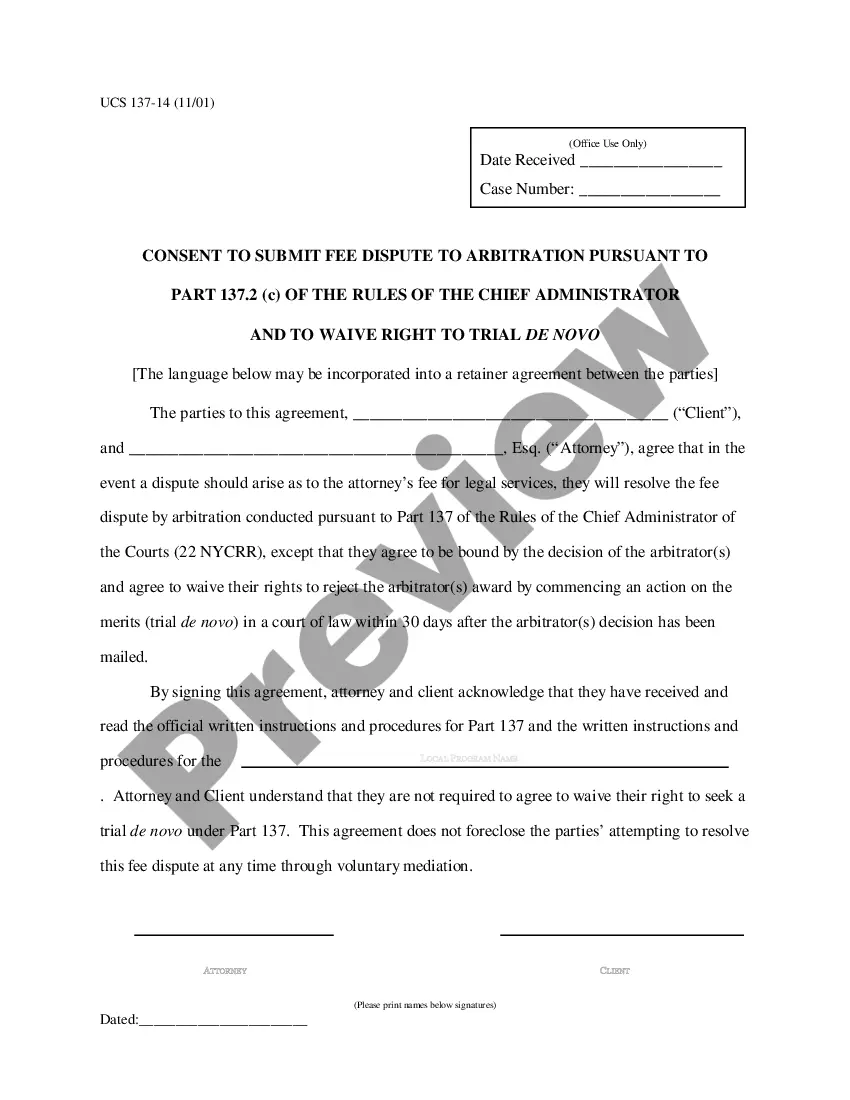

Settlement for Car Loan: A Comprehensive Overview When considering a car loan, understanding the concept of settlement is crucial to ensure a smooth and successful transaction. Settlement refers to the finalization and completion of a car loan, including the full payment or resolution of the loan amount. It involves various parties and processes, ensuring all financial obligations are met and legal requirements are fulfilled. Here, we provide a detailed description of what settlement for a car loan entails, shedding light on its importance and associated types. 1. Full Settlement: Full settlement refers to the complete repayment of the outstanding car loan amount in a lump sum. This option allows borrowers to close their loan early and enjoy several benefits, such as reduced interest costs and improved credit scores. In this case, borrowers should contact their lender to obtain an accurate settlement figure, considering any potential penalty fees or interest adjustments. 2. Partial Settlement: Partial settlement occurs when borrowers choose to make a significant payment toward their outstanding car loan amount, reducing the principal balance. It offers borrowers the advantage of reducing interest expenses and potentially shortening the loan term. However, it is essential to discuss the terms and conditions of partial settlement with the lender, as some may charge fees or impose certain limitations. 3. Settlement by Refinancing: Settlement by refinancing involves obtaining a new loan from another lender to replace the existing car loan. This option is particularly useful for borrowers seeking better interest rates, flexible terms, or revised repayment plans. Refinancing can help borrowers lower their monthly payments, extend the loan term, or access additional funds. However, it is crucial to compare the terms and conditions of the new loan with the existing loan to ensure it is a beneficial financial decision. 4. Trade-In Settlement: Trade-In settlement is an arrangement where borrowers trade in their current vehicle to cover the outstanding balance of their car loan. In this case, the dealership or lender appraises the vehicle and offers a trade-in value that is deducted from the loan balance. Any remaining amount can be settled through various payment methods, such as cash or financing options. Trade-in settlement provides convenience, allowing borrowers to upgrade their vehicle without having to pay off the full loan amount separately. In any settlement for a car loan, borrowers must consider several factors. These include reading and understanding the loan agreement, reviewing any penalty fees or charges for settling early, and ensuring all necessary paperwork is completed accurately. Seeking professional advice, especially from financial experts or car loan specialists, can also help borrowers make informed decisions and navigate the settlement process more effectively. To conclude, settlement for a car loan refers to the finalization and satisfaction of the outstanding loan amount through various methods such as full settlement, partial settlement, settlement by refinancing, and trade-in settlement. Understanding these types of settlement helps borrowers make financially sound decisions, allowing them to manage their car loan effectively and secure their financial well-being.

Settlement For Car Loan

Description

How to fill out Settlement For Car Loan?

The Settlement For Car Loan you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and state regulations. For more than 25 years, US Legal Forms has provided people, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Settlement For Car Loan will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or review the form description to ensure it satisfies your requirements. If it does not, utilize the search bar to get the correct one. Click Buy Now when you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Select the format you want for your Settlement For Car Loan (PDF, DOCX, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork again. Utilize the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

You can use either asterisks or visual indicators to mark the required fields. As a UX Designer, I always recommend marking all required form fields as required, unless there is a specific reason not to.

Best Practice Required fields should be indicated with either a symbol or text, not just color. When providing an indicator for a required field, it should be placed right before the form field. This allows a screen reader to read the indicator to a screen reader user right before the user activates the field.

Best Practice Required fields should be indicated with either a symbol or text, not just color. When providing an indicator for a required field, it should be placed right before the form field. This allows a screen reader to read the indicator to a screen reader user right before the user activates the field.

6.4. Clearly indicate mandatory fields A distinctive sign (?*? symbol, ?mandatory? mention, etc.) must be provided in the label of each mandatory field. If a symbol is used to declare mandatory fields, a statement placed at the beginning of the form must indicate that the symbol stands for a mandatory field.

Required attribute: If you want to make an input mandatory to be entered by the user, you can use the required attribute. This attribute can be used with any input type such as email, URL, text, file, password, checkbox, radio, etc. This can help to make any input field mandatory.

What are required form fields? To put it simply, a required form field must contain an answer before the respondent can submit the form. These are fields that absolutely must be answered in order for the form to be useful. It's possible for a form to be useful without having any required fields.

Fields marked with * are mandatory Using an asterisk (*) symbol content authors notify mandatory field. This is said to be one of the accessible modes of identifying a mandatory field, however this method also will be a problem with screen readers in certain times.

Fields marked with * are mandatory Using an asterisk (*) symbol content authors notify mandatory field. This is said to be one of the accessible modes of identifying a mandatory field, however this method also will be a problem with screen readers in certain times.