A Sole Proprietor for NPI, or National Provider Identifier, is a specific type of business ownership structure in the healthcare industry. It refers to a healthcare provider who operates their practice as an individual and has their own NPI number assigned by the Centers for Medicare and Medicaid Services (CMS). This structure allows healthcare professionals to provide services and bill insurance companies or government programs directly under their individual NPI. Keywords: Sole proprietor, NPI, healthcare provider, business ownership structure, individual practice, NPI number, Centers for Medicare and Medicaid Services (CMS), healthcare professionals, insurance companies, government programs. There are various types of Sole Proprietors for NPI, which include: 1. Medical Doctors (MDs) or Physicians: These are licensed professionals who provide healthcare services directly to patients. They can operate their own individual practices, bill insurance companies, and Medicare/Medicaid programs using their NPI. 2. Dentists: Dental professionals who own and operate their own dental practices can also be classified as Sole Proprietors for NPI. They bill insurance companies and government programs for the dental services they provide. 3. Chiropractors: Chiropractors who run their own practices and deliver chiropractic care to their patients independently fall under this category. They bill insurance companies and government programs using their unique NPI. 4. Psychologists and Therapists: Mental health professionals such as psychologists, therapists, or counselors who work independently and provide therapeutic services to their clients can also be considered Sole Proprietors for NPI. 5. Optometrists: Optometrists who own and operate their own optometry clinics and provide eye care services directly to patients are another example of Sole Proprietors for NPI. 6. Alternative Medicine Practitioners: Healthcare providers in alternative medicine fields, such as naturopaths, acupuncturists, or homeopaths, who have their own practices and bill for their services using their NPI, are also considered Sole Proprietors. In summary, a Sole Proprietor for NPI is a healthcare provider who operates as an individual and has their own National Provider Identifier assigned by CMS. This ownership structure applies to various healthcare professionals like medical doctors, dentists, chiropractors, psychologists/therapists, optometrists, and alternative medicine practitioners. They handle their billing and insurance claims independently under their individual NPI numbers.

Sole Proprietor For Npi

Description sole proprietor npi meaning

How to fill out Sole Proprietor For Npi?

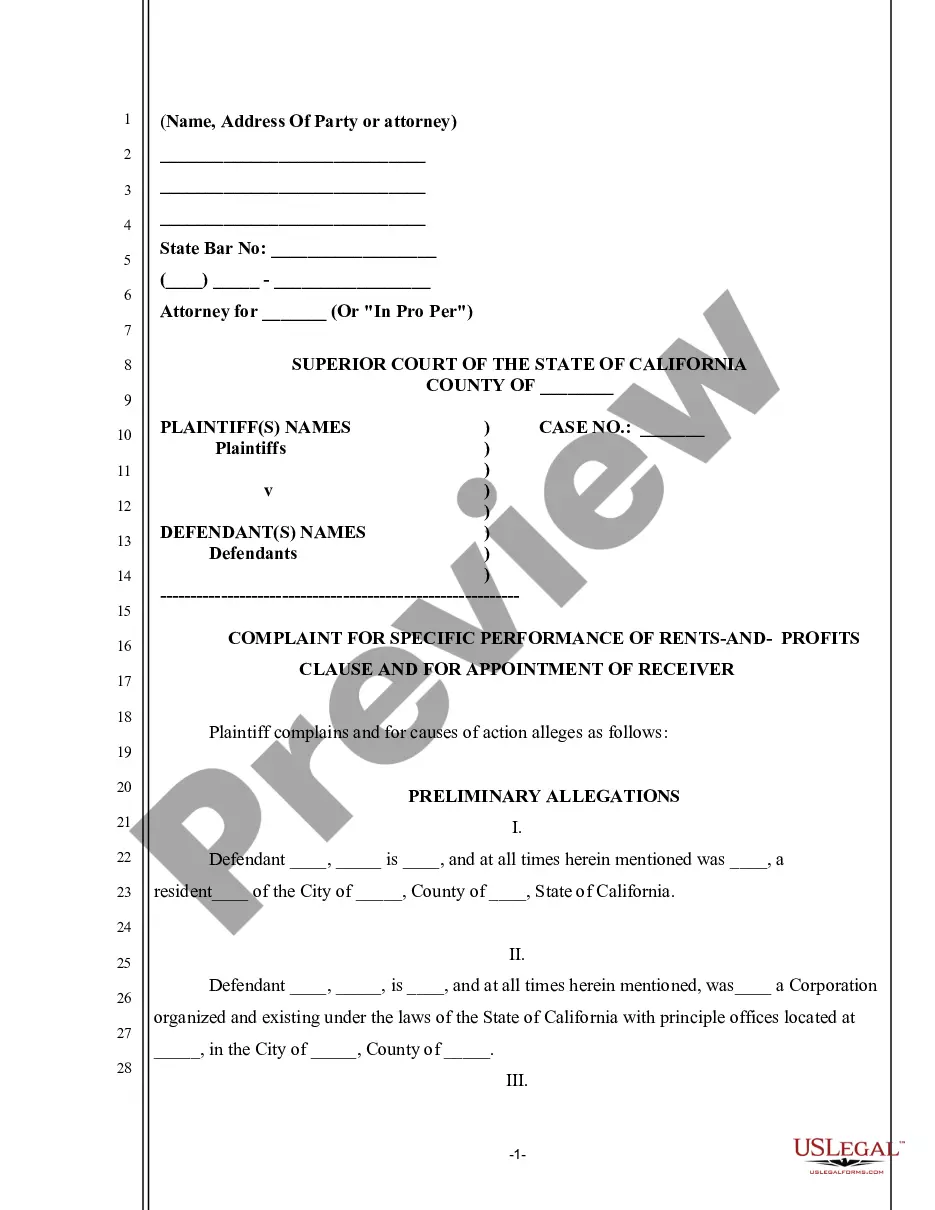

It’s no secret that you can’t become a legal professional overnight, nor can you grasp how to quickly draft Sole Proprietor For Npi without having a specialized set of skills. Putting together legal forms is a long process requiring a particular education and skills. So why not leave the preparation of the Sole Proprietor For Npi to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court papers to templates for internal corporate communication. We know how important compliance and adherence to federal and state laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s start off with our platform and obtain the document you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether Sole Proprietor For Npi is what you’re searching for.

- Begin your search again if you need a different template.

- Register for a free account and select a subscription plan to purchase the form.

- Pick Buy now. Once the transaction is complete, you can get the Sole Proprietor For Npi, fill it out, print it, and send or mail it to the necessary people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

sole proprietor meaning npi Form popularity

am i a sole proprietor npi Other Form Names

FAQ

Sole proprietor on an NPI application indicates that the individual is the sole owner and operator of the healthcare practice. This classification establishes your legal standing while applying for an NPI number. By identifying yourself as a sole proprietor for NPI, you streamline the process of delivering healthcare services and managing finances effectively.

To change your sole proprietor details on your NPI application, log into your National Plan and Provider Enumeration System (NPPES) account. You can then update your information, including business structure or name changes. Using uslegalforms can help ensure that all amendments are correctly handled, allowing you to maintain your status as a sole proprietor for NPI without issues.

To change your business structure to a sole proprietorship, you first need to register your business name with local authorities. Next, update your licenses and permits, if necessary. The uslegalforms platform can guide you through the paperwork required to officially establish yourself as a sole proprietor for NPI, making the transition smoother.

A sole proprietorship in healthcare refers to a business owned and operated by one individual. This structure allows the owner to retain full control over the business and its profits. As a sole proprietor for NPI, you can provide healthcare services while enjoying the benefits of reduced administrative burdens and simplified tax responsibilities.

Yes, you can change your NPI number under specific circumstances. For example, if your business structure changes or if you get married, you may need to update your details. Utilizing the uslegalforms platform can simplify this process, ensuring that you submit the correct modifications to maintain compliance as a sole proprietor for NPI.

As a single-member LLC, you typically do not need a type 2 NPI unless you plan to bill under that entity. A type 2 NPI is required for organizations and group practices. If you are providing services as a sole proprietor for NPI, you can function with a type 1 NPI. However, consider exploring your options to ensure full compliance with billing and insurance requirements on USLegalForms, which can guide you through the process.

If you operate as a sole proprietor for NPI purposes, you need an NPI for yourself, not your organization. The NPI is a unique identification number for health care providers, and as a sole proprietor, you are personally responsible for your services. By obtaining an NPI, you enhance your credibility and make billing easier. Overall, registering for an NPI is a vital step in ensuring you can provide services effectively.

The easiest way to obtain an NPI number is to apply through the National Plan and Provider Enumeration System (NPPES) online. This process is straightforward and allows you to fill out forms conveniently. As a sole proprietor for NPI, having access to clear instructions can simplify your application experience. Consider using platforms like US Legal Forms for additional guidance and support during your application.

The requirements for obtaining an NPI include having valid identification details and being an active healthcare provider. You must provide accurate information about your practice, including your name, address, and taxpayer identification number. As a sole proprietor for NPI, ensuring all details are precise is crucial for a smooth application process. Gather your documents and be ready to navigate the application system.

Yes, a business can obtain an NPI number if it meets the established criteria. For instance, organizations like clinics and hospitals can apply for an NPI under their business name. This helps streamline billing and healthcare operations. If your business operates under a sole proprietor for NPI, securing this number is vital for compliance.