A security agreement for aircraft is a legal document that establishes a lien on an aircraft as collateral for a loan or financial transaction. It provides a means for lenders or creditors to secure their interests in the event of default by the borrower. Key terms and provisions within the agreement typically include: 1. Definitions: The agreement begins by clearly defining key terms such as "aircraft," "debtor," "creditor," "collateral," and "lien," among others. 2. Grant of Security Interest: The agreement outlines the terms under which the debtor grants a security interest in the aircraft to the creditor. This provision ensures that the creditor has a valid claim on the aircraft. 3. Description of Collateral: The specific aircraft being used as collateral is detailed, including its make, model, serial number, registration number, and any other relevant identification details. 4. Conditions Precedent: This section describes the conditions that must be met for the security interest granted to become effective, such as the debtor providing proof of ownership or insurance coverage on the aircraft. 5. Representations and Warranties: The debtor is required to make certain representations and warranties to the creditor, ensuring that they have legal authority to grant the security interest and that there are no existing liens or encumbrances on the aircraft. 6. Security Interest Perfection: The agreement provides guidance on how the creditor will perfect their security interest, often through the filing of appropriate documents with the relevant aviation authorities or agencies. 7. Default and Remedies: This section stipulates what constitutes default by the debtor, such as non-payment or violation of the terms of the agreement. It also outlines the available remedies for the creditor in case of default, including repossession, sale, or disposal of the aircraft. 8. Governing Law: The agreement specifies the jurisdiction whose laws will govern the interpretation and enforcement of the security agreement. Different types of security agreements for aircraft may include: 1. Mortgage Agreement: A mortgage agreement provides the lender with a lien on the aircraft and allows them to foreclose on the aircraft if the debtor defaults on the loan. 2. Security Agreement with Assignment of Rights: In this type of agreement, the debtor not only grants a security interest but also assigns rights to the creditor, allowing them to take possession of the aircraft and sell it in case of default. 3. Aircraft Leasing Security Agreement: This type of agreement is specific to aircraft leasing. It ensures that the lessor retains a security interest in the aircraft throughout the leasing period, protecting their investment. 4. Conditional Sales Agreement: A conditional sales agreement allows the creditor to retain ownership of the aircraft until the debtor fulfills their obligations, such as paying off the loan in full, after which ownership is transferred to the debtor. In conclusion, a security agreement for aircraft is a crucial legal document that helps lenders secure their interests by creating a lien on the aircraft. By understanding the key provisions and different types of security agreements, parties involved can protect themselves and their investments in the aviation industry.

Security Agreement For Aircraft

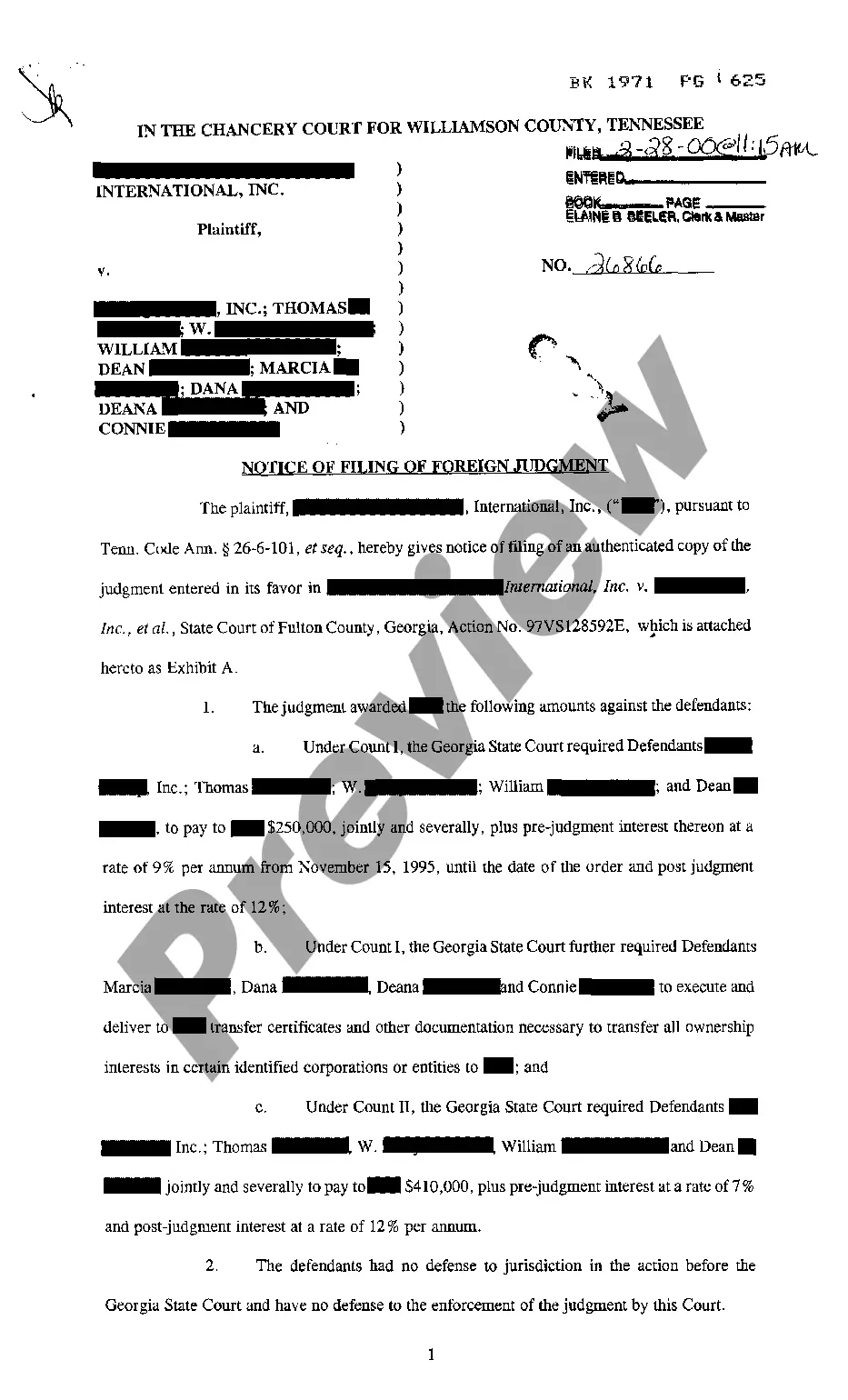

Description ac8050 98

How to fill out Security Agreement For Aircraft?

Whether for business purposes or for individual matters, everyone has to manage legal situations at some point in their life. Completing legal documents requires careful attention, starting with selecting the right form sample. For example, if you choose a wrong version of the Security Agreement For Aircraft, it will be turned down when you send it. It is therefore essential to have a reliable source of legal files like US Legal Forms.

If you need to get a Security Agreement For Aircraft sample, follow these easy steps:

- Get the template you need by utilizing the search field or catalog navigation.

- Check out the form’s information to make sure it matches your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect form, go back to the search function to find the Security Agreement For Aircraft sample you require.

- Get the file if it meets your needs.

- If you have a US Legal Forms profile, simply click Log in to access previously saved documents in My Forms.

- In the event you don’t have an account yet, you may obtain the form by clicking Buy now.

- Select the proper pricing option.

- Complete the profile registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Select the document format you want and download the Security Agreement For Aircraft.

- Once it is saved, you are able to fill out the form with the help of editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time looking for the right template across the internet. Make use of the library’s simple navigation to find the proper template for any situation.

Form popularity

FAQ

Record an Aircraft Claim of Lien the amount of the claim. a description of the aircraft by N-Number, manufacturer name, model designation, and serial number. dates on which labor, materials, or services were last furnished. the ink signature of the claimant showing signer's title as appropriate.

Common Ways to Perfect a Security Interest in Aircraft and Associated Aviation Assets Recording the Security Agreement with the FAA. ... Recording the Security Agreement Through Cape Town Convention Treaty. ... Recording/Filing a UCC-1 Financing Statement.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or.

To Release a Recorded Lien A new Conveyance Recordation Notice form may be requested. Contact the Aircraft Registration Branch at 1 (866) 762-9434. You will need to describe the aircraft and the lien document sufficiently to identify the specific document needing release.

A prospective buyer may search the FAA Aircraft Registry or the International Registry to find out who owns the aircraft and who may have security interests in it. The FAA Registration, which is the US registry, assigns an N-number to every US aircraft.