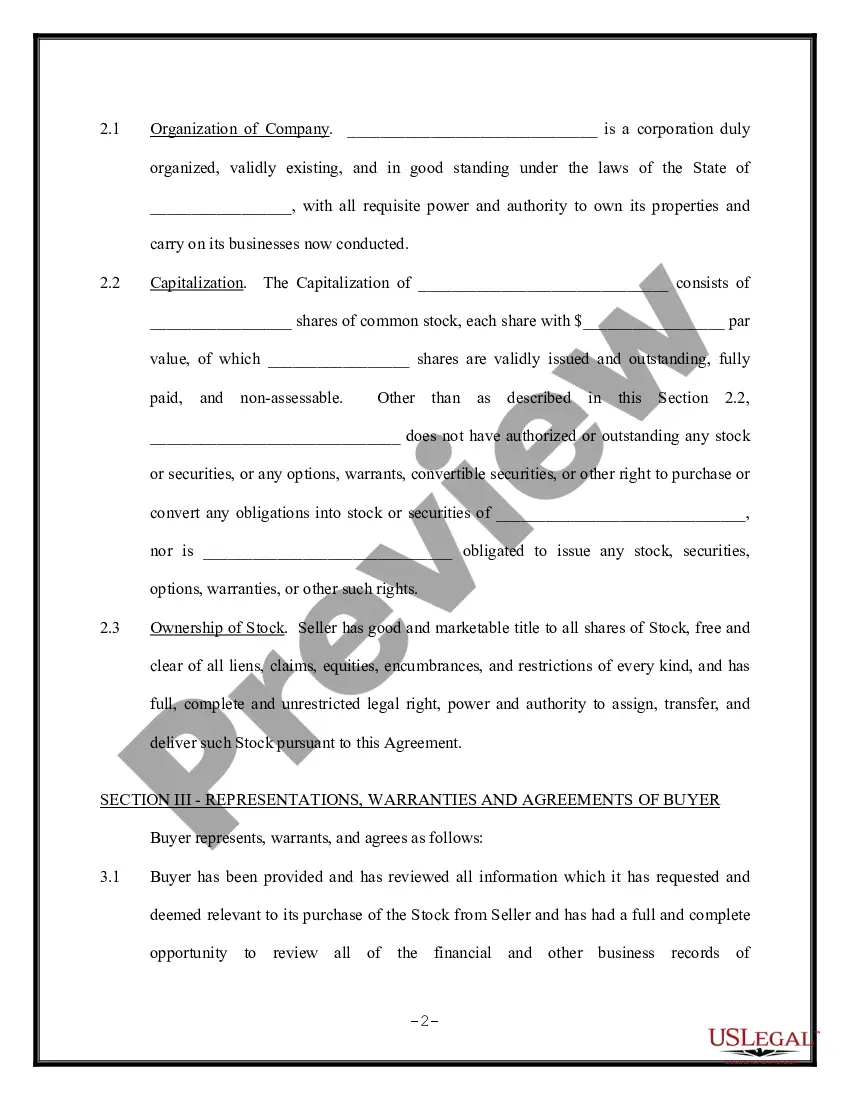

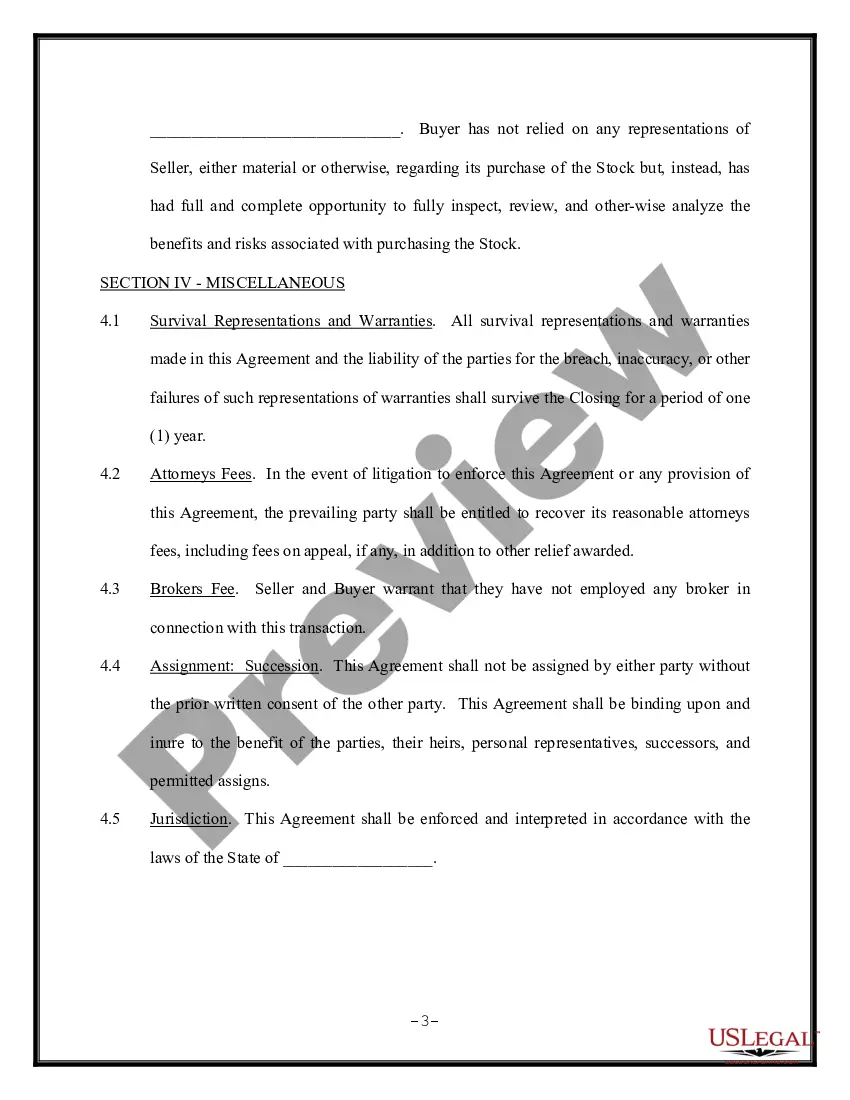

A share transfer agreement is a legally binding document that outlines the process and terms of transferring shares from one party to another. It is an essential agreement used in corporate transactions, M&A deals, corporate restructurings, and other similar scenarios where the ownership of shares needs to be transferred. The agreement typically includes details such as the names of the parties involved, the number and types of shares being transferred, the purchase price or consideration involved, any conditions or restrictions attached to the shares, and the timeline for the transfer. It also covers clauses related to representations and warranties, indemnification, non-compete provisions, dispute resolution, and governing law. There are different types of share transfer agreements based on the context or purpose of the transfer. Some common types include: 1. Stock Purchase Agreement: This type of agreement is used when a company or individual wants to purchase shares of another company. It outlines the terms and conditions of the purchase, including the number of shares, purchase price, payment terms, and any representations or warranties made by the seller. 2. Share Subscription Agreement: This agreement is used when a company wants to issue new shares to investors. It specifies the number and type of shares to be issued, the subscription price, payment terms, and any rights or conditions attached to the shares. 3. Share Transfer Agreement (between shareholders): Shareholders of a company may use this agreement when they want to transfer their shares to another existing shareholder. It ensures a smooth transfer of ownership by laying out the terms, including the number of shares, consideration, and any transfer restrictions or obligations. 4. Share Pledge Agreement: This agreement is used when a shareholder pledges their shares as collateral for a loan or debt. It outlines the terms of the pledge, including the number of shares pledged, the value, obligations of the pledge, and rights of the pledge in case of default. In conclusion, a share transfer agreement is a crucial legal document used in various scenarios when shares need to be transferred. It encompasses the terms and conditions of the transfer, protects the rights of both parties, and helps ensure a smooth and transparent transaction process.

Share Transfer Agreement Of

Description stock transfer agreement

How to fill out Share Transfer Agreement Of?

Finding a go-to place to take the most recent and relevant legal templates is half the struggle of working with bureaucracy. Choosing the right legal documents requirements accuracy and attention to detail, which is the reason it is very important to take samples of Share Transfer Agreement Of only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You can access and see all the details regarding the document’s use and relevance for the situation and in your state or county.

Consider the following steps to complete your Share Transfer Agreement Of:

- Utilize the catalog navigation or search field to locate your template.

- View the form’s description to see if it fits the requirements of your state and county.

- View the form preview, if available, to ensure the form is the one you are looking for.

- Resume the search and look for the appropriate document if the Share Transfer Agreement Of does not match your needs.

- If you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Pick the pricing plan that suits your preferences.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Pick the document format for downloading Share Transfer Agreement Of.

- When you have the form on your gadget, you may alter it with the editor or print it and finish it manually.

Eliminate the inconvenience that accompanies your legal paperwork. Explore the comprehensive US Legal Forms catalog to find legal templates, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

The following are the core elements of a share transfer agreement : Definition of transfer of shares. Definition of consideration of shares. Date of transfer. Purchase price. Payment. Liability. Creditors. Representations and warranties.

Even if a share purchase agreement or sale agreement is used to set out the terms of the share transfer, you will always need a separate share transfer form to legally transfer the shares.

The share transfer form should be signed by the person transferring the shares. Usually, is the seller or sellers, as all joint holders should sign to transfer a joint shareholding. There are a few situations where someone else may sign Stock Transfer Forms: The legal personal representatives.

SH-4 should be Duly stamped. Dated. Specifying the Name, Fatehr Name, Address and Occupation, if any, of the transferee & Transferor. Folio No. ... Distinctive No, Certificate No. ... of Share Transfer. Nominal Value of Shares, Consideration Received. Executed by or on behalf of the transferor and the transferee and '

The share transfer form should be signed by the person transferring the shares. Usually, is the seller or sellers, as all joint holders should sign to transfer a joint shareholding. There are a few situations where someone else may sign Stock Transfer Forms: The legal personal representatives.