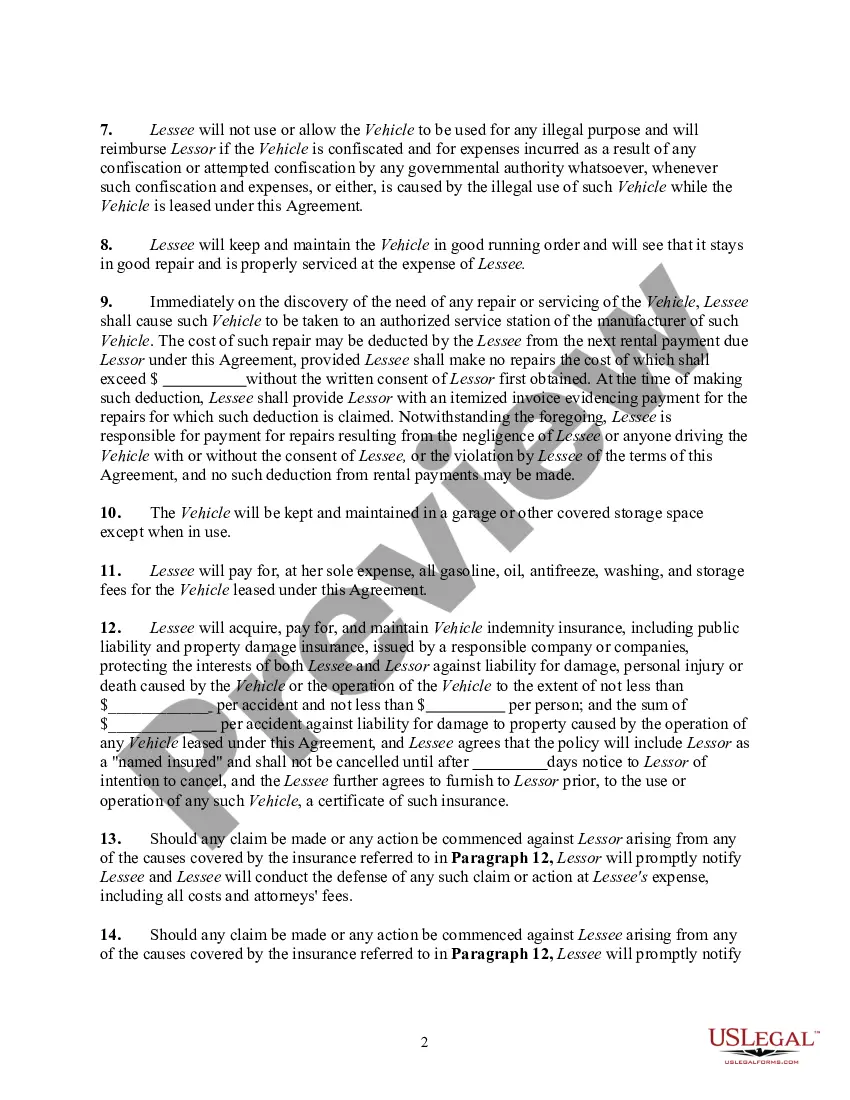

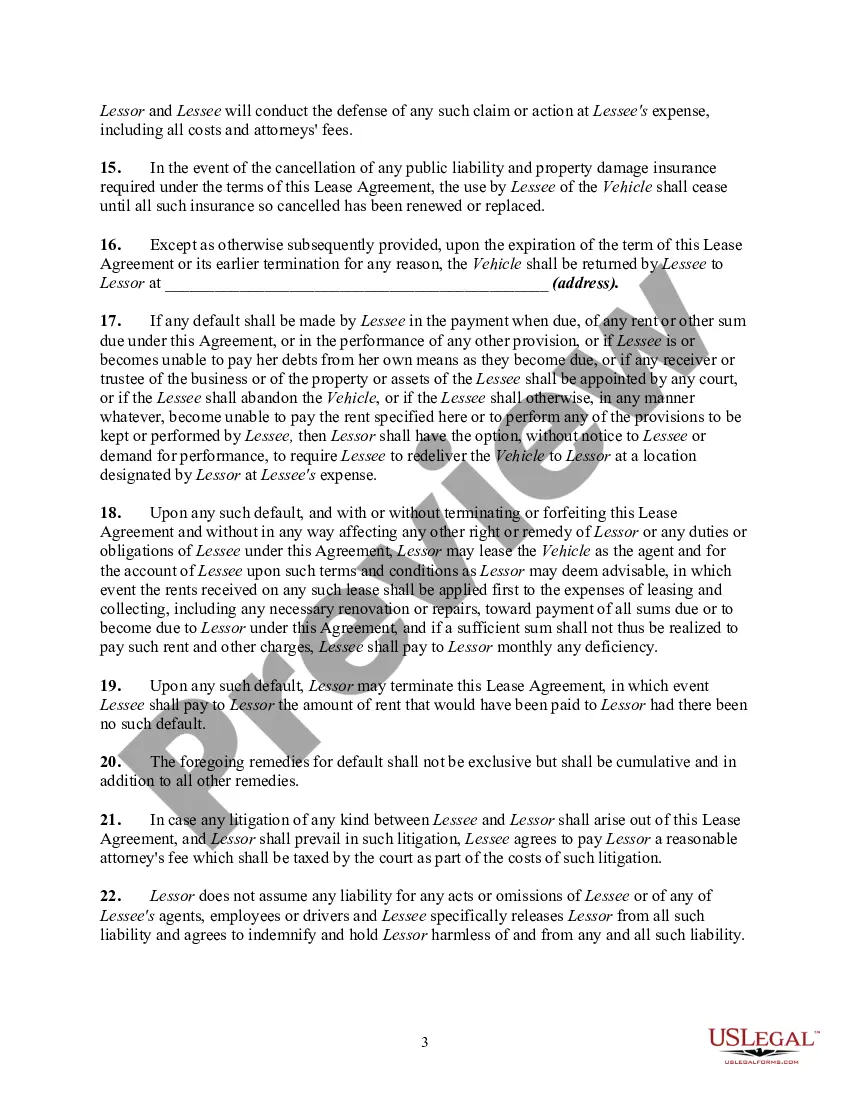

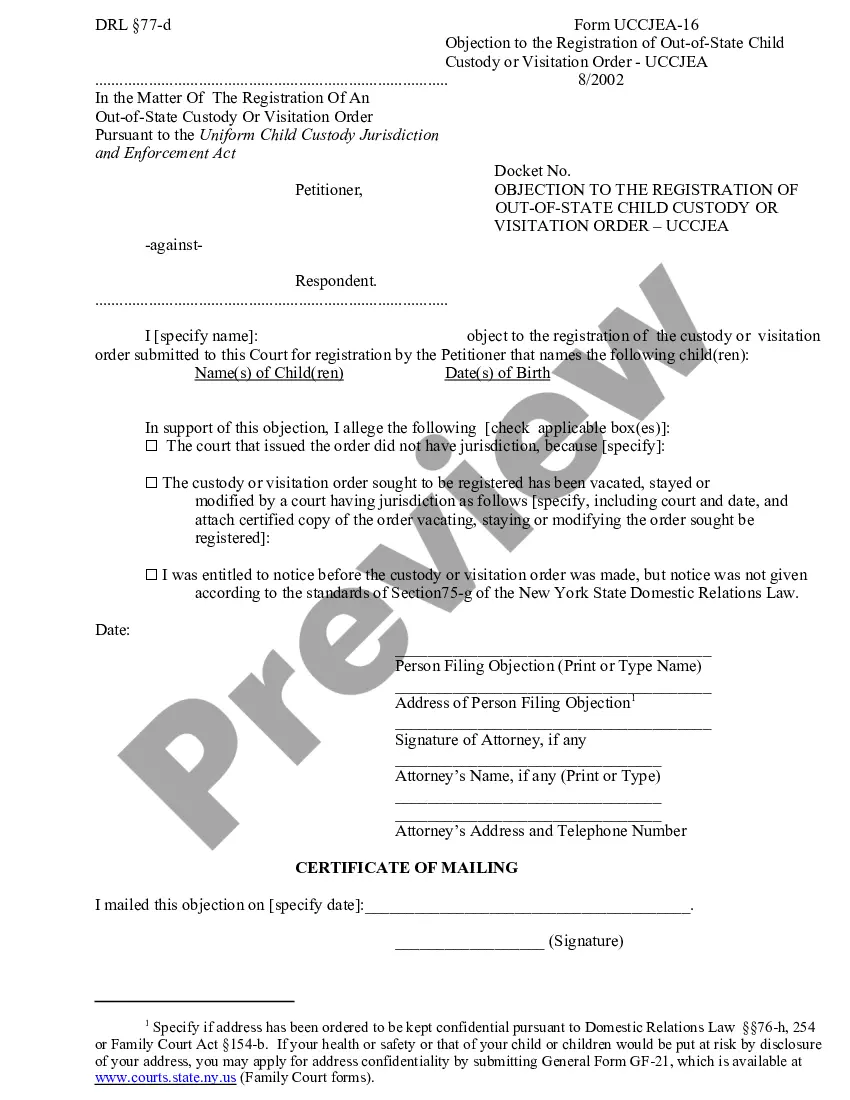

Rent-to-own RV contract with owner financing is a specialized agreement that allows individuals to acquire an RV through a combination of renting and gradual ownership. This financing option is designed to provide flexibility and ease of ownership to individuals who are unable to secure traditional loans or want to test out the RV lifestyle before committing to purchasing a recreational vehicle outright. When entering into a rent-to-own RV contract with owner financing, the prospective RV buyer typically signs an agreement with the owner or a finance company, outlining the terms and conditions of the contract. These contracts may vary in structure, terms, and requirements, depending on the parties involved. Here are some common types of rent-to-own RV contracts with owner financing: 1. Lease Option: In a lease option agreement, the prospective buyer pays an upfront deposit or an option fee to secure the right to purchase the RV at a later date. This fee is usually non-refundable and serves as a down payment towards the purchase price. The contract then includes a specific timeframe during which the buyer can exercise the option to buy the RV. 2. Lease Purchase: This type of contract combines a traditional lease agreement with a purchase agreement. The buyer becomes a tenant and agrees to lease the RV for a fixed period, typically ranging from one to five years. A portion of the monthly rental payment is usually credited towards the purchase price, reducing the final amount owed. At the end of the lease term, the buyer has the option to buy the RV. 3. Installment Sale: An installment sale agreement is similar to a lease purchase agreement, where the buyer leases the RV for a specific period and makes monthly payments. However, unlike a lease purchase, the buyer is considered the owner of the RV from the start of the agreement. Ownership is transferred once the final payment is made or at the end of the agreed-upon period. 4. Rent-to-own with Financing: In this type of agreement, the buyer pays a monthly rental fee that includes financing costs. Similar to a traditional loan, the buyer makes fixed payments over a specific period, and once the final payment is cleared, ownership is transferred. Rent-to-own RV contracts with owner financing provide several advantages for both buyers and sellers. Buyers have the opportunity to test the RV's suitability, build equity through rental payments, and potentially secure ownership without a sizeable upfront investment. Sellers benefit from consistent rental income, a larger pool of potential buyers, and the ability to sell an RV that may otherwise be challenging to move through conventional sales channels. It is essential to carefully review the terms and conditions of any rent-to-own RV contract with owner financing before signing. Both parties must clearly understand their responsibilities, including maintenance, insurance, repairs, and any penalties for defaulting on payments. Seeking legal advice or consulting a financial professional can help ensure a smooth and transparent transaction while protecting the interests of all parties involved.

Rent To Own Rv Contract With Owner Financing

Description

How to fill out Rent To Own Rv Contract With Owner Financing?

Whether for business purposes or for personal affairs, everyone has to manage legal situations at some point in their life. Completing legal documents requires careful attention, starting with selecting the proper form sample. For example, when you select a wrong version of a Rent To Own Rv Contract With Owner Financing, it will be rejected once you submit it. It is therefore essential to have a reliable source of legal papers like US Legal Forms.

If you need to obtain a Rent To Own Rv Contract With Owner Financing sample, follow these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Check out the form’s description to make sure it fits your situation, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search function to find the Rent To Own Rv Contract With Owner Financing sample you require.

- Download the file if it meets your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved files in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Choose your transaction method: use a bank card or PayPal account.

- Select the document format you want and download the Rent To Own Rv Contract With Owner Financing.

- When it is saved, you can complete the form by using editing software or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time searching for the appropriate template across the web. Take advantage of the library’s simple navigation to find the correct form for any occasion.

Form popularity

FAQ

Yes, South Dakota requires all business entities to list a Registered Agent on their LLC formation paperwork. And they must keep a Registered Agent on file with the state for the life of the LLC.

A limited liability company (LLC) offers liability protection and tax advantages, among other benefits for small businesses. LLC formation in South Dakota is easy.

It costs $150 to form an LLC in South Dakota. This is a fee paid for the Articles of Organization. You'll file this form with the South Dakota Secretary of State. And once approved, your LLC will go into existence.

Can I Be My Own Registered Agent In South Dakota? Yes, you can be your own registered agent in South Dakota. However, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

Business Entity Registration Both non-profit and for-profit businesses must be registered with the Secretary of State's office. Out-of-state businesses must be registered before doing business in this state.

Can I Be My Own Registered Agent In South Dakota? Yes, you can be your own registered agent in South Dakota. However, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.

It costs $150 to form an LLC in South Dakota. This is a fee paid for the Articles of Organization. You'll file this form with the South Dakota Secretary of State. And once approved, your LLC will go into existence.

To change your registered agent in South Dakota, you must complete and file a Statement of Change of Registered Agent form with the South Dakota Secretary of State. The South Dakota Statement of Change of Registered Agent must be submitted by mail or in person and costs $10 to file.