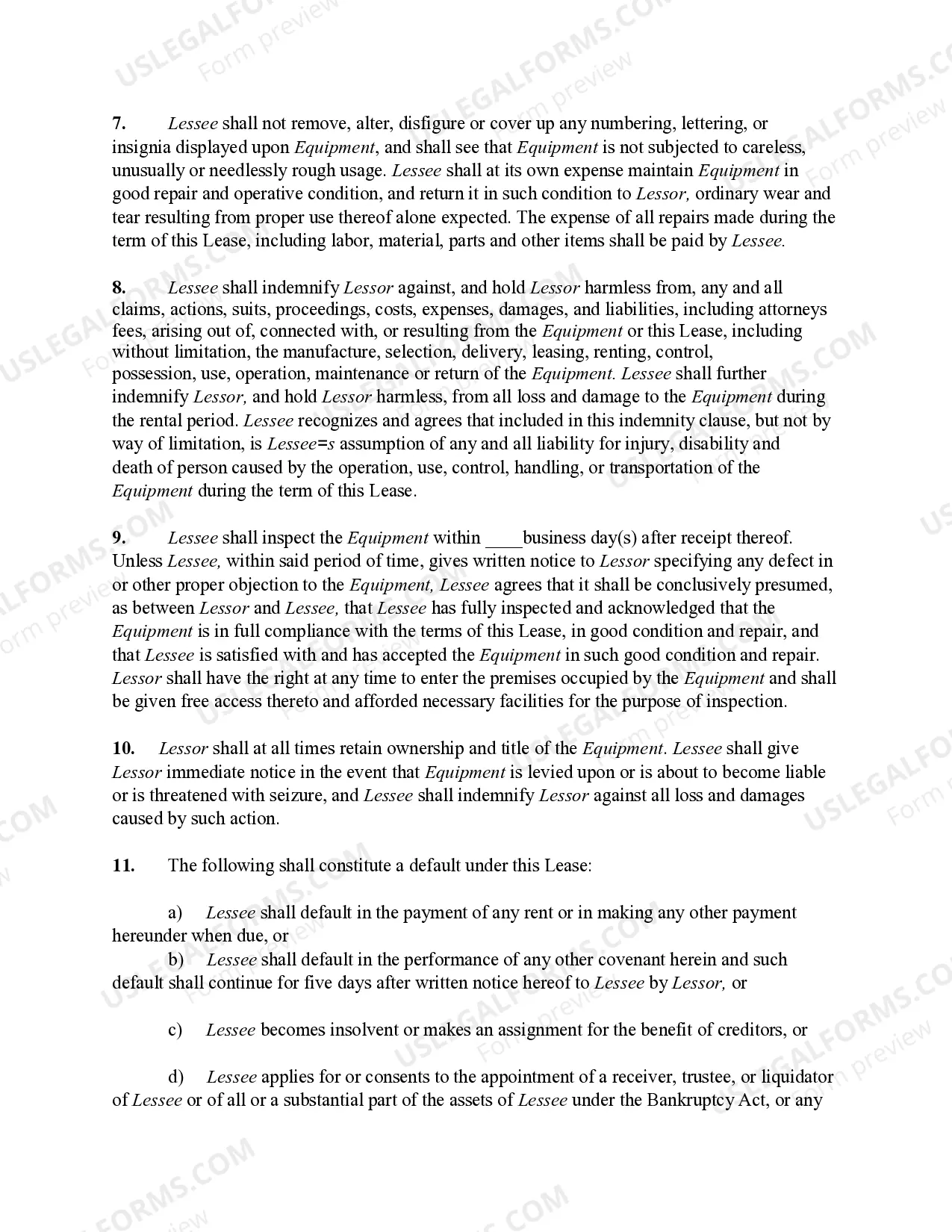

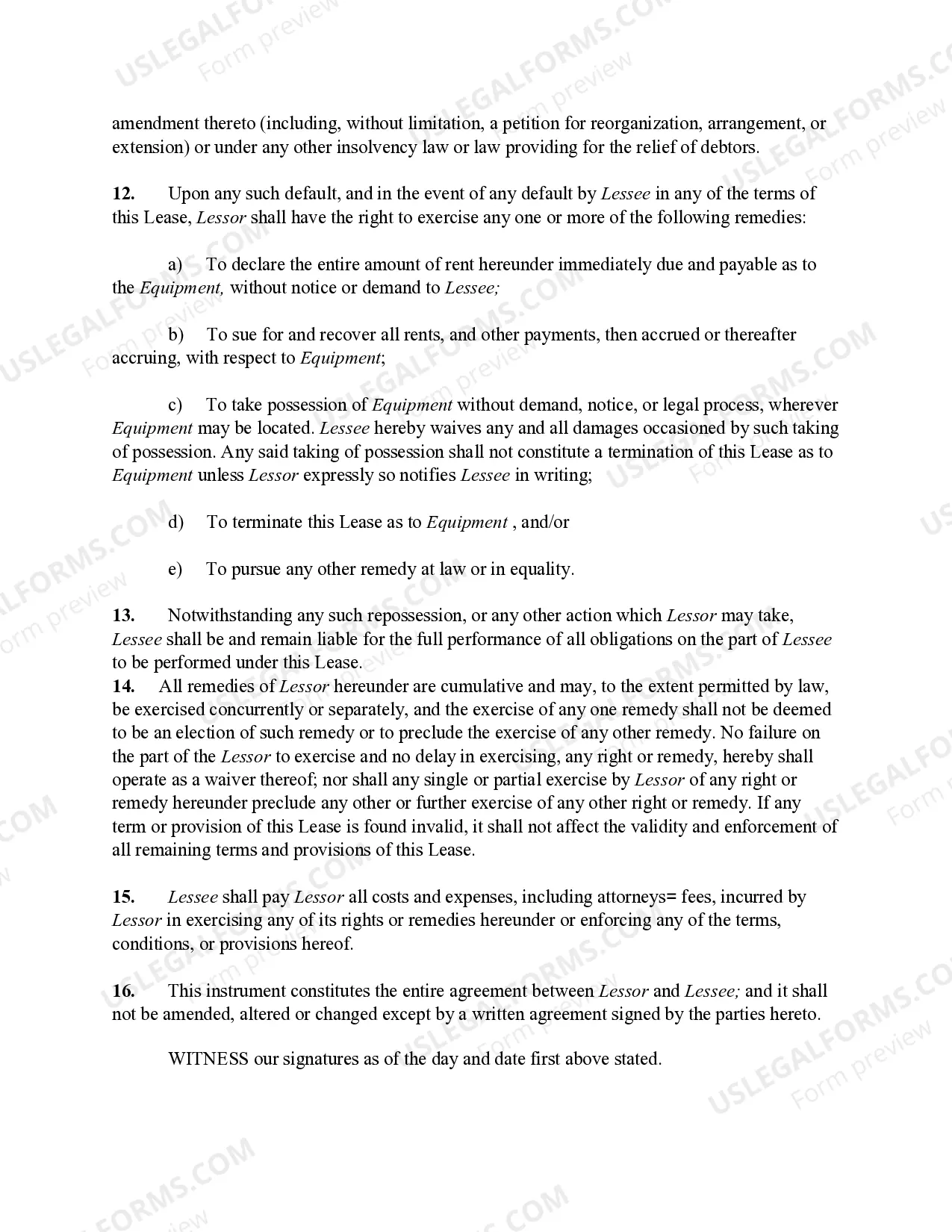

Equipment Lease Formula

Description

How to fill out Equipment Lease Formula?

How to obtain professional legal documents that comply with your state regulations and draft the Equipment Lease Template without consulting a lawyer.

Numerous online services offer templates to address various legal matters and formal requirements. However, it may take a while to identify which of the provided samples fulfill both your usage needs and legal criteria.

US Legal Forms is a credible platform that assists you in finding official documents created in accordance with the latest state law revisions, helping you save on legal fees.

If you lack an account with US Legal Forms, follow the instructions below: Examine the webpage you have opened and verify if the form meets your requirements.

- US Legal Forms is not just an ordinary web directory.

- It features over 85,000 validated templates for diverse business and personal scenarios.

- All documents are categorized by field and state to enhance the efficiency and convenience of your search.

- Additionally, it integrates with powerful tools for PDF editing and electronic signing, enabling users with a Premium subscription to easily finalize their paperwork online.

- It requires minimal effort and time to get the necessary documents.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Equipment Lease Template using the corresponding button beside the file name.

Form popularity

FAQ

Use the equation associated with calculating equipment lease payments. Payment = Present Value - (Future Value / ( ( 1 + i ) ^n) / 1- (1 / (1 +i ) ^ n ) / i. In this equation, "i" represent the interest rate as a monthly decimal. Convert the interest rate to a monthly decimal.

To determine the lease term, first, start with the non-cancelable period of the lease. Then, add any renewal option periods for renewals the lessee is reasonably certain of exercising. Third, add any periods covered by a termination option if the lessee is reasonably certain it will NOT exercise that option.

How to calculate lease payments using Excel in 5 stepsStep 1: Create your table with headers.Step 2: Enter amounts in the Period and Cash columns.Step 3: Insert the PV function.Step 4: Enter the Rate, Nper Pmt and Fv.Step 5: Sum the Present Value column.

This is calculated as:+ Total up Front Costs (down payment + other fees)+ Lost interest.+ Outstanding loan balance at time lease expires.- Market value of equipment at time lease expires.= Net cost of buying.

Fundamentals of Lease PaymentsResidual Value = (MSRP) x (Residual Percentage)Monthly Depreciation = (Adjusted Capitalized Cost - Residual Value) / Term.Monthly Rent Charge = (Adjusted Capitalized Cost + Residual Value) x (Money Factor)Monthly Tax = (Monthly Depreciation + Monthly Rent Charge) x (Tax Rate)More items...