Property Buyout Agreement Form With Mortgage

Description

How to fill out Buy Sell Agreement Between Co-Owners Of Real Property?

Legal managing might be overwhelming, even for the most skilled professionals. When you are searching for a Property Buyout Agreement Form With Mortgage and do not get the a chance to commit searching for the right and up-to-date version, the operations may be stressful. A robust online form library could be a gamechanger for anybody who wants to take care of these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any needs you could have, from individual to business papers, in one location.

- Utilize innovative tools to accomplish and deal with your Property Buyout Agreement Form With Mortgage

- Gain access to a resource base of articles, tutorials and handbooks and resources relevant to your situation and needs

Save time and effort searching for the papers you need, and use US Legal Forms’ advanced search and Preview feature to get Property Buyout Agreement Form With Mortgage and get it. In case you have a membership, log in for your US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the papers you previously downloaded as well as to deal with your folders as you see fit.

Should it be the first time with US Legal Forms, make an account and have unrestricted access to all benefits of the library. Listed below are the steps for taking after getting the form you want:

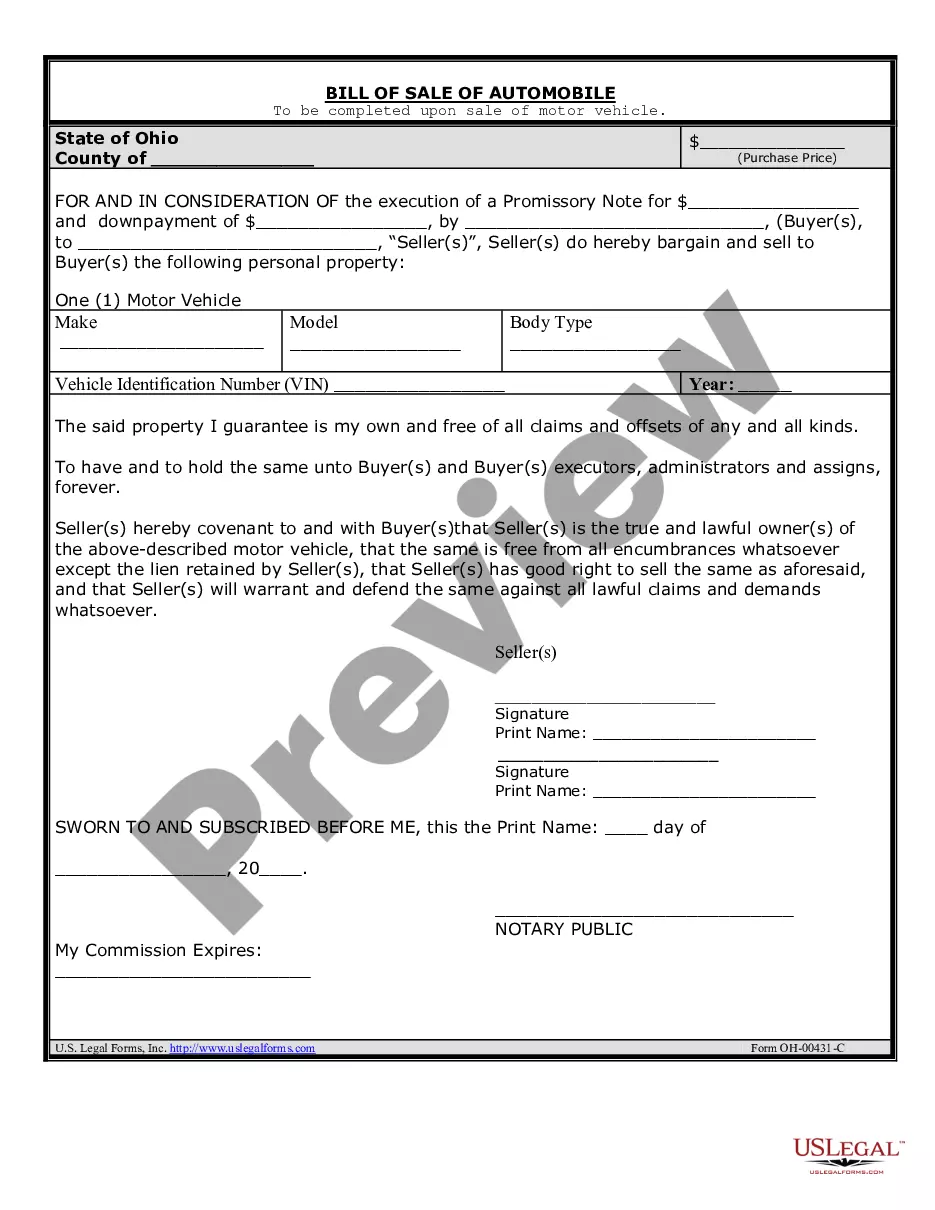

- Validate this is the proper form by previewing it and looking at its information.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now once you are ready.

- Choose a monthly subscription plan.

- Pick the file format you want, and Download, complete, eSign, print out and deliver your papers.

Take advantage of the US Legal Forms online library, backed with 25 years of experience and stability. Change your everyday papers management in to a smooth and intuitive process today.

Form popularity

FAQ

Discussing and compromising on the different points of negotiation Agree on the purchase price and payment structure. Outline the responsibilities of each party. Decide on the timeline for the buyout. Address any existing contracts and agreements. Establish the method of transfer of ownership.

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

Signing a PSA does not complete the sale of the home. Signing a purchase agreement, however, does complete the home sale. Where the PSA lays out the details of the transaction leading up to the closing date, the purchase agreement is what you sign to finalize the transaction.

In real estate, a purchase agreement is a binding contract between a buyer and seller that outlines the details of a home sale transaction. The buyer will propose the conditions of the contract, including their offer price, which the seller will then agree to, reject or negotiate.