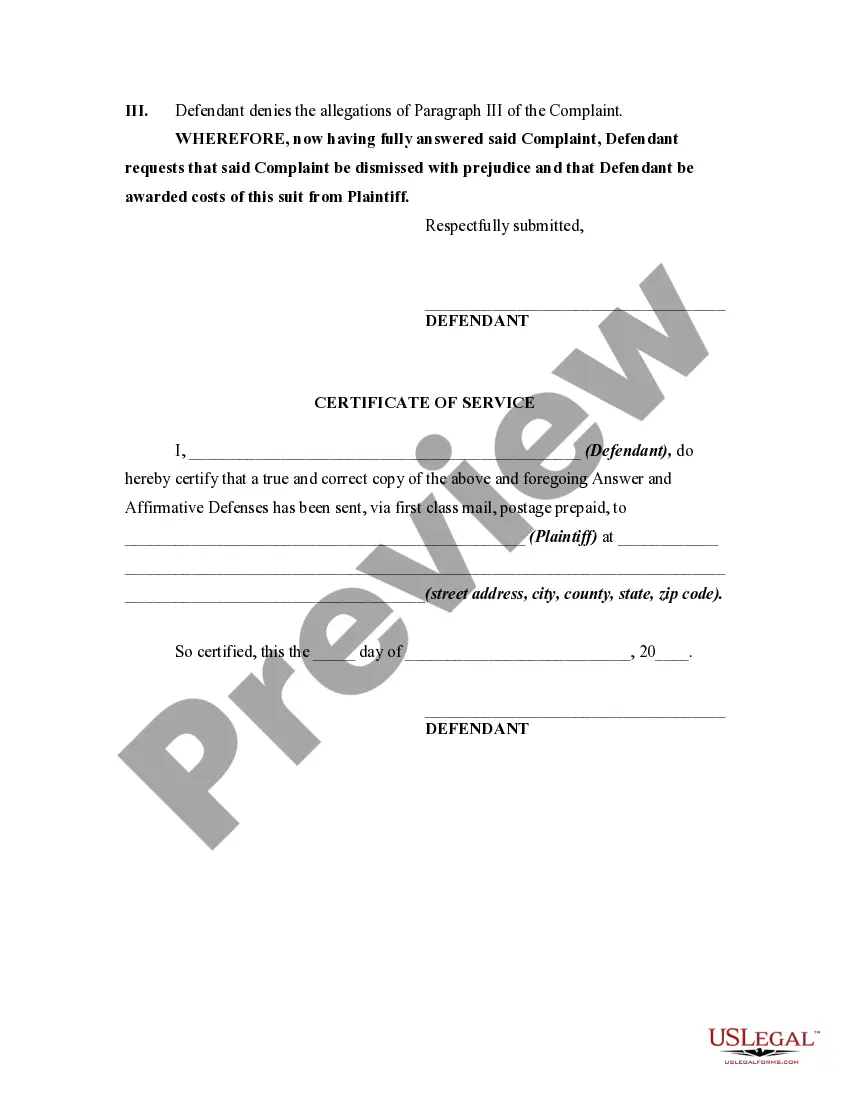

This is an answer to a civil lawsuit which includes affirmative defenses.

Title: Answer to Debt Collection Lawsuit Examples with Answers: Explained in Detail Introduction: When facing a debt collection lawsuit, it is crucial to respond appropriately to protect your rights and navigate the legal process effectively. This article provides a comprehensive overview of the answer to a debt collection lawsuit, including relevant examples and answers for different scenarios. 1. What is an Answer to a Debt Collection Lawsuit? In a debt collection lawsuit, the debtor is typically served with a Complaint, which outlines the details of the debt owed. The Answer is the debtor's formal response to the Complaint, addressing each allegation made by the plaintiff (creditor or debt collector). 2. Key Elements of an Answer: a) Admit, Deny, or Claim Insufficient Knowledge: The defendant must specifically admit, deny, or claim insufficient knowledge regarding each allegation stated in the Complaint. b) Affirmative Defenses: The defendant may assert affirmative defenses challenging the validity of the debt, such as the statute of limitations, lack of written contract, illegible documentation, or illegal collection practices. c) Counterclaims: In some cases, the defendant may counter-sue the plaintiff for violations under federal or state consumer protection laws. d) Affirmative Relief: The defendant may seek affirmative relief, such as requesting the court to dismiss the lawsuit, awarding attorney's fees, or recovering damages. 3. Example: Answer to Debt Collection Lawsuit — Denying the Debt Defendant Answer: "Defendant denies the allegations made in paragraph 1of the Complaint as they are inaccurate, erroneous, and fail to provide specific details regarding the alleged debt. Defendant demands strict proof of the existence, validity, and enforceability of said debt." 4. Example: Answer to Debt Collection Lawsuit — Statute of Limitations Defense Defendant Answer: "Defendant asserts the statute of limitations as an affirmative defense, claiming that the alleged debt falls outside the specified timeframe allowed by [state law or contract]. All claims are thus barred, and the court should dismiss this lawsuit accordingly." 5. Example: Answer to Debt Collection Lawsuit — Illegal Collection Practices Defendant Answer: "Defendant alleges that the plaintiff engaged in illegal collection practices by making false representations, using unfair or deceptive methods, and violating the Fair Debt Collection Practices Act (FD CPA). Defendant seeks counterclaims and affirmative relief to hold the plaintiff accountable for such violations." 6. Types of Answers to Debt Collection Lawsuits: a) General Denial: The defendant denies most or all allegations made in the Complaint. b) Specific Admission and Denial: The defendant admits or denies each alleged fact individually. c) Affirmative Defense Only: The defendant solely focuses on asserting affirmative defenses. d) Counterclaim Included: The defendant includes a counterclaim against the plaintiff within the answer. Conclusion: Answering a debt collection lawsuit is a critical step in protecting your rights as a defendant. By understanding the different elements involved in an Answer and utilizing relevant strategies, such as denying the debt, utilizing affirmative defenses, or asserting counterclaims, individuals can effectively address lawsuits brought against them. Always consult with an attorney experienced in debt collection lawsuits for personalized legal advice.