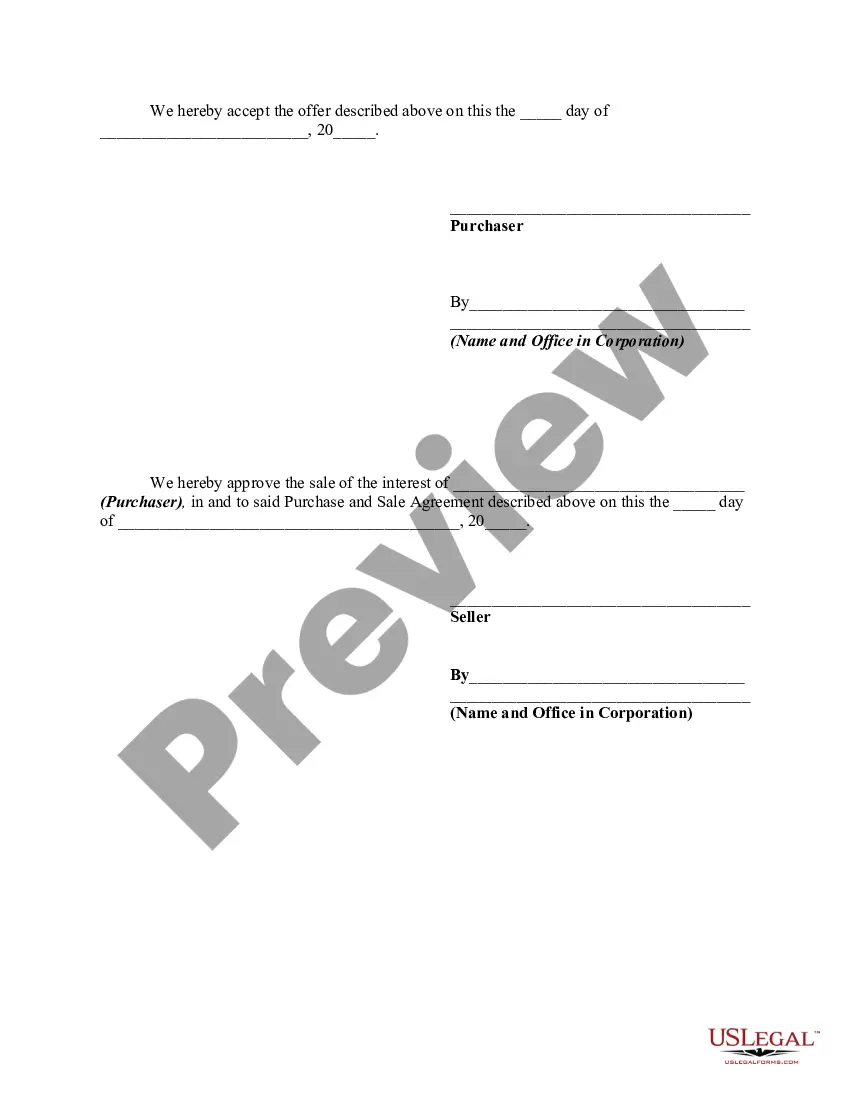

An assignment is the transfer of rights that one party has under a contract to another. The assigning party is called the assignor. The person receiving the assignment is called the assignee. This form is an offer to the purchaser under a real estate purchase and sale agreement to purchase said purchaser's rights under said agreement. The purchaser would be the assignor and the assignee would be the person making the offer to said purchaser.

Sales Contract For Real Estate With Gift Of Equity

Description gift letter template pdf

How to fill out Sales Contract For Real Estate With Gift Of Equity?

What is the most reliable service to obtain the Sales Agreement For Real Estate With Gift Of Equity and other up-to-date versions of legal documents.

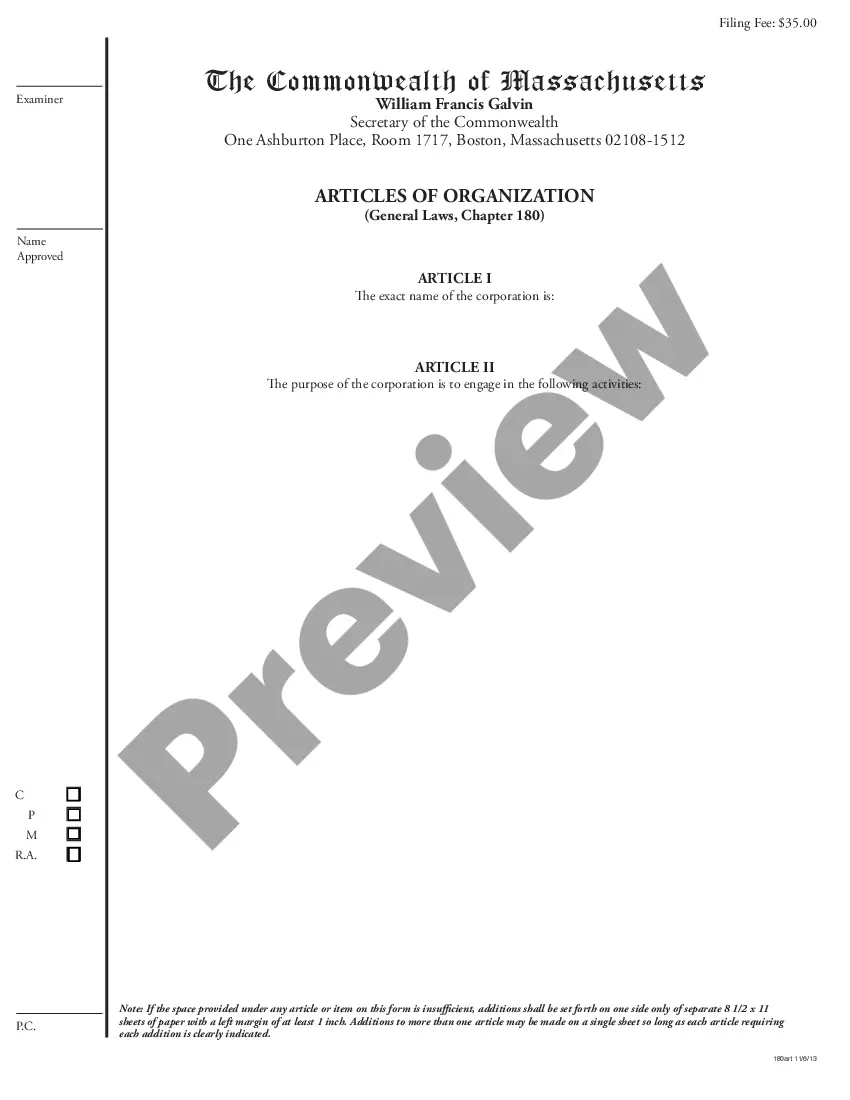

US Legal Forms is the solution! It's the largest repository of legal forms for any situation. Each sample is expertly crafted and verified for adherence to federal and local laws.

Form compliance assessment. Prior to accessing any template, ensure it aligns with your specific use case and complies with your state's or county's regulations. Review the form description and utilize the Preview if available.

- They are organized by region and state, making it easy to find what you need.

- Experienced users just need to Log In to the platform, confirm their subscription is active, and click the Download button next to the Sales Agreement For Real Estate With Gift Of Equity to obtain it.

- Once downloaded, the template will remain accessible for future use in the My documents section of your account.

- If you don't yet have an account with our library, follow these steps to create one.

Form popularity

FAQ

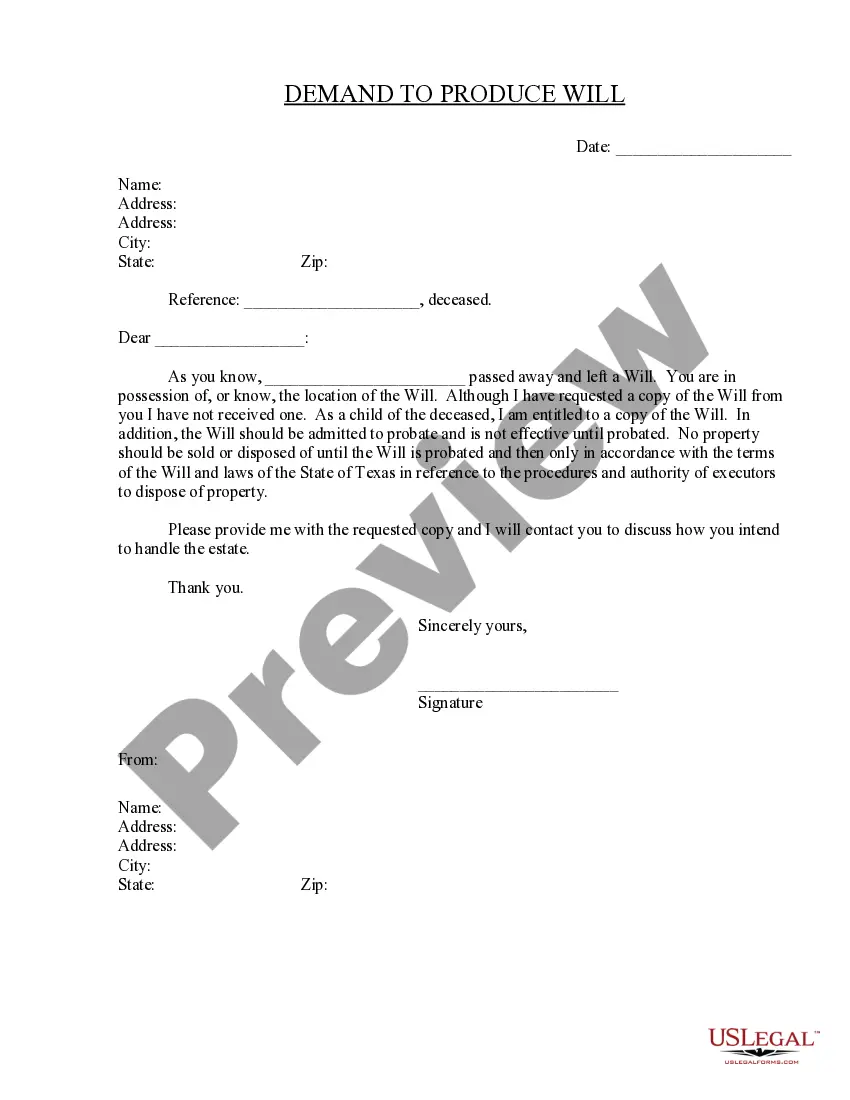

A gift of equity letter must be included in the loan file, and it should clearly state the monies are not a loan so there is no repayment involved (hence the phrase gifted money). The letter should be signed by the buyer and the seller. Funds must also be properly documented through financial records.

The following documents must be retained in the loan file for a gift of equity:a signed gift letter (see B3-4.3-04, Personal Gifts , and.the settlement statement listing the gift of equity.

In the case of a family gift, the amount is disclosed as an other credit in the cost to close section of the Loan Estimate (LE) and the Closing Disclosure (CD).

A gift of equity is not allowed when the seller is an estate. This is even true when the buyer is family of the deceased. This will not take the place of a transfer on death deed or a life estate. The only way a gift of equity works is if there is actual equity that already exists.