At one time all ?ˆ?clergy?ˆ were considered self-employed; however, in the mid 1980?ˆ™s the IRS decided to declare such ministers ?ˆ?employees?ˆ of the church . Most pastors should be considered employees. They typically have a governing council they work with or for to determine to work to be performed (which is one of the criteria the IRS uses to determine the status of a person). Exceptions to this would be supply pastors or missionaries who travel from church to church filling in or working for short periods Misclassification of workers is a big issue with churches and the IRS, so be very certain you have properly classified your clergy and other workers such as musicians, nursery workers, and, custodians. A member of the clergy is considered an employee for federal income tax purposes and self-employed for Social Security and Medicare purposes. See Topic 417 - Earnings for Clergy at https://www.irs.gov/taxtopics/tc417.html

Engagement Agreement For Accounting Services

Description Rabbi Agreement

How to fill out Rabbi Agreement Form?

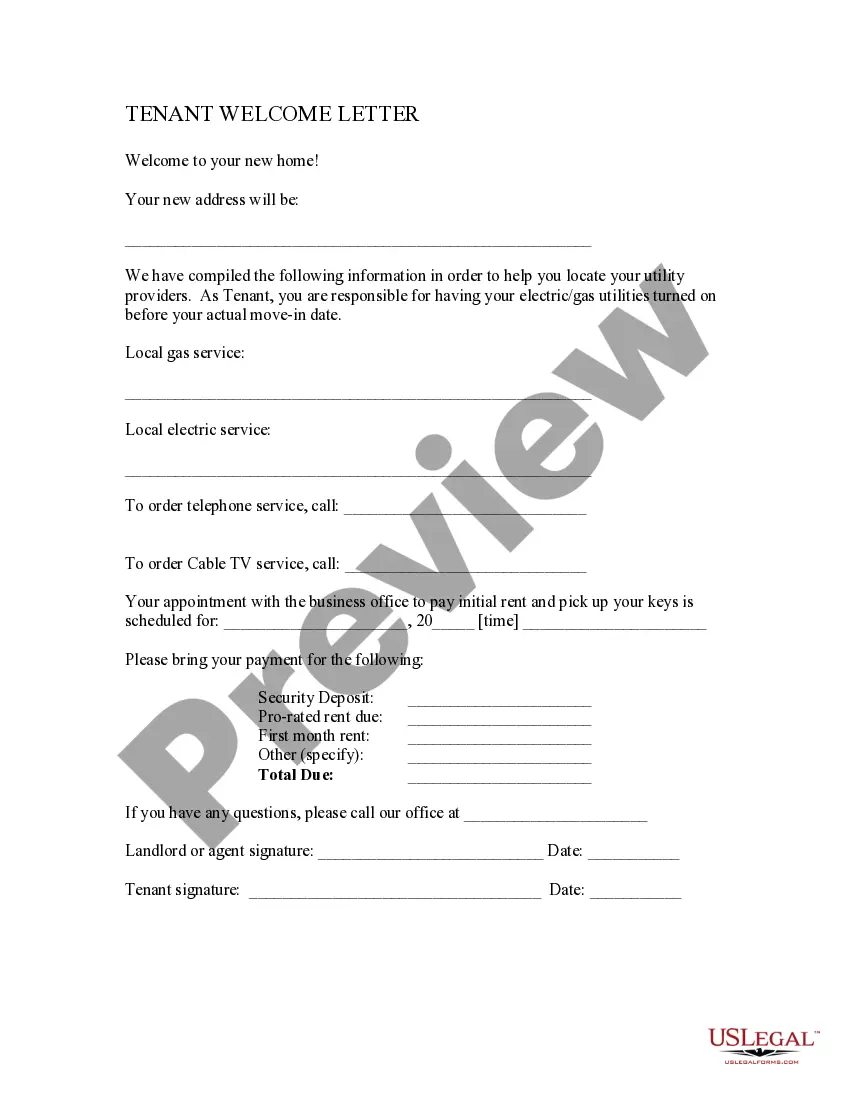

People tend to associate legal paperwork with something complex that only a professional can deal with. In some way, it's true, as drafting Engagement Agreement For Accounting Services demands extensive knowledge of subject criteria, including state and county regulations. But with the US Legal Forms, everything has become more accessible: ready-made legal templates for any life and business situation specific to state laws are accumulated in a single online catalog and are now available for everyone.

US Legal Forms offers more than 85k up-to-date documents organized by state and area of use, so browsing for Engagement Agreement For Accounting Services or any other particular sample only takes minutes. Previously registered users with an active subscription need to log in to their account and click Download to get the form. Users that are new to the service will first need to create an account and subscribe before they can download any files.

Here is the step-by-step guideline on how to get the Engagement Agreement For Accounting Services:

- Check the page content attentively to make sure it satisfies your needs.

- Read the form description or verify it through the Preview option.

- Find another sample via the Search bar above if the previous one doesn't suit you.

- Click Buy Now once you find the correct Engagement Agreement For Accounting Services.

- Decide on the subscription plan that suits your requirements and budget.

- Register for an account or sign in to proceed to the payment page.

- Pay for your subscription via PayPal or with your credit card.

- Opt for the format for your sample and click Download.

- Print your document or upload it to an online editor for a faster fill-out.

All templates in our catalog are reusable: once purchased, they keep stored in your profile. You can retain access to them whenever needed via the My Forms tab. Check all positive aspects of using the US Legal Forms platform. Subscribe now!