A settlement offer letter to a creditor is a formal correspondence sent by a debtor to propose a mutually beneficial resolution to an outstanding debt. It outlines the debtor's willingness to settle the debt for an amount lesser than the original owed sum, typically due to financial hardship or other circumstances. This letter serves as a negotiation tool and opens a line of communication between the debtor and the creditor with the aim of reaching a settlement agreement that suits both parties involved. Keywords: settlement offer letter, creditor, debtor, formal correspondence, outstanding debt, mutually beneficial resolution, negotiate, financial hardship, circumstances, negotiation tool, communication, settlement agreement. There are different types of settlement offer letters to a creditor, including: 1. Lump-Sum Settlement Offer Letter: This type of letter proposes a one-time payment to settle the debt entirely. It often implies a reduced amount from the original outstanding balance, which may vary based on the debtor's financial situation and negotiation abilities. 2. Installment Settlement Offer Letter: In this letter, the debtor suggests paying the debt in multiple installments over an agreed-upon period. The letter details the proposed installment amounts, frequencies, and dates of payment, aiming to make the debt manageable for the debtor while still providing compensation to the creditor. 3. Hardship Settlement Offer Letter: This letter is specifically tailored to highlight the debtor's current financial hardship, explaining the reasons why they are unable to repay the debt in full. It emphasizes the need for a settlement agreement that considers the debtor's circumstances while still satisfying the creditor's desire for some repayment. 4. Dispute Settlement Offer Letter: Sometimes, a debtor may dispute the validity or accuracy of a debt. In such cases, a dispute settlement offer letter seeks to resolve the disagreement while simultaneously proposing a settlement amount that the debtor is willing to pay to resolve the matter. 5. Professional Debt Settlement Offer Letter: This letter is typically drafted by a professional debt settlement company or debt relief agency on behalf of the debtor. It acts as a formal representation of the debtor and includes expert insight, negotiation strategies, and industry-specific language to maximize the chances of reaching a favorable settlement for the debtor. In conclusion, a settlement offer letter to a creditor initiates the process of resolving an outstanding debt by proposing a mutually acceptable solution. By employing strategic negotiation techniques and considering the debtor's financial circumstances, a well-crafted settlement offer letter can pave the way for a successful agreement between the debtor and the creditor.

Settlement Offer Letter To Creditor

Description sample letter to creditor requesting settlement

How to fill out Settlement Offer Letter To Creditor?

It’s obvious that you can’t become a legal professional immediately, nor can you learn how to quickly draft Settlement Offer Letter To Creditor without the need of a specialized set of skills. Creating legal forms is a long venture requiring a certain training and skills. So why not leave the preparation of the Settlement Offer Letter To Creditor to the pros?

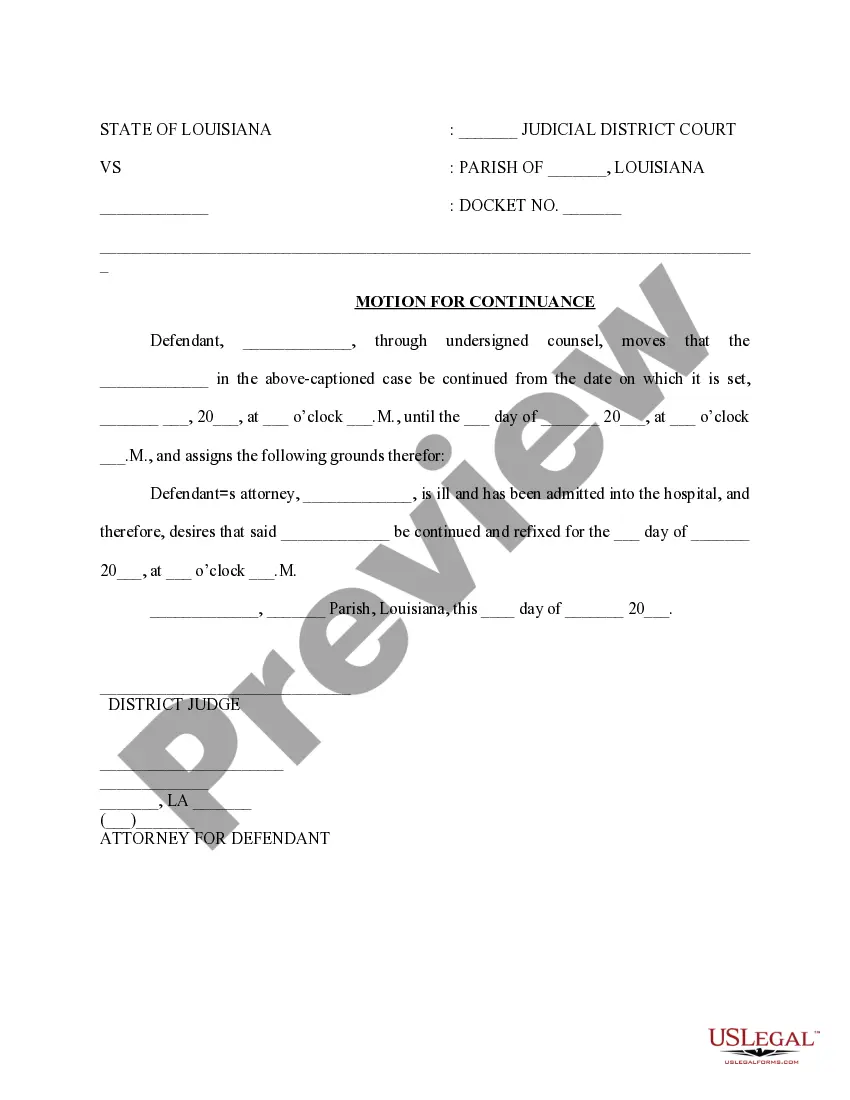

With US Legal Forms, one of the most comprehensive legal document libraries, you can access anything from court documents to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and get the document you need in mere minutes:

- Find the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Settlement Offer Letter To Creditor is what you’re looking for.

- Start your search again if you need a different template.

- Register for a free account and choose a subscription plan to buy the template.

- Pick Buy now. Once the payment is through, you can get the Settlement Offer Letter To Creditor, complete it, print it, and send or send it by post to the necessary individuals or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

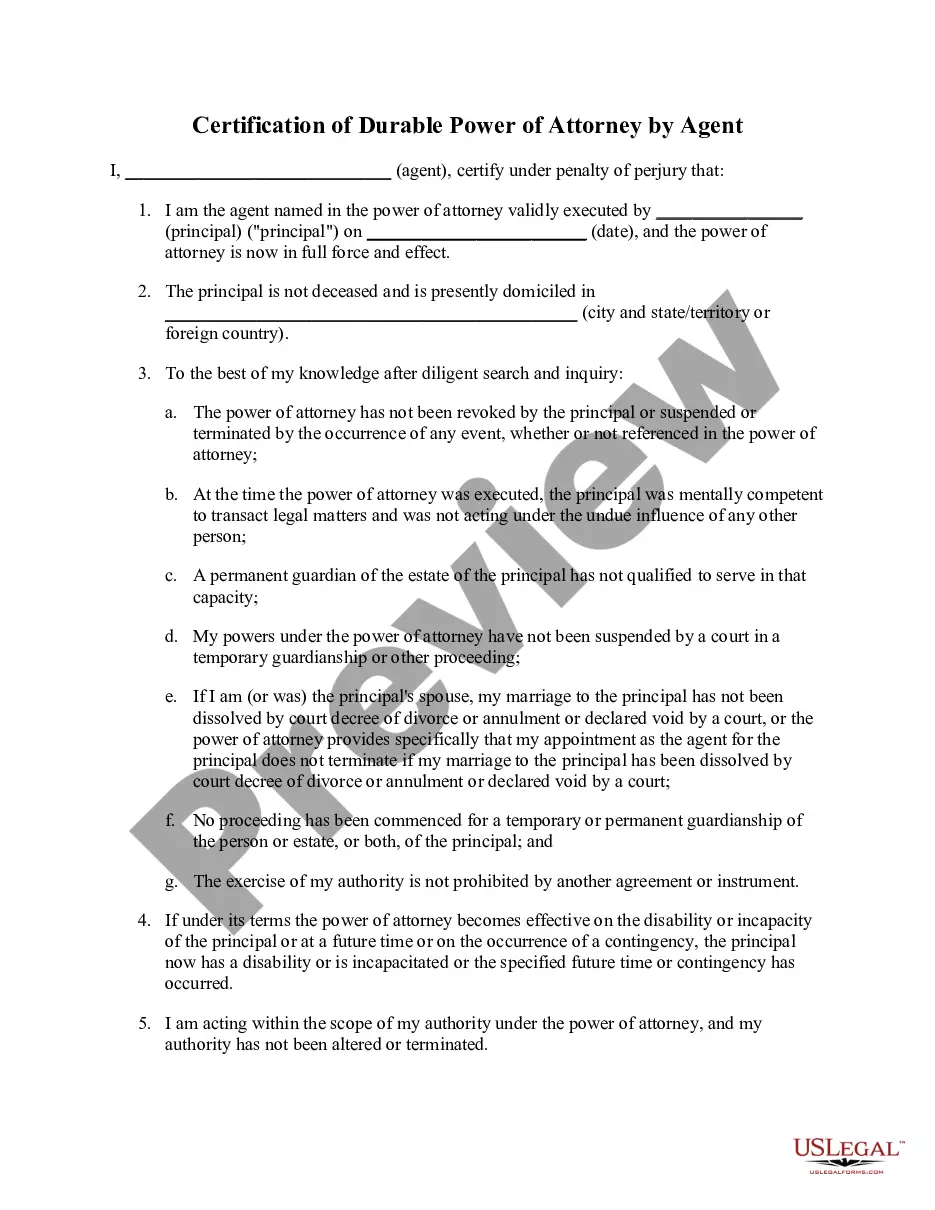

Tell the Truth and Keep a Consistent Story Make a list of the reasons you've fallen behind in payments. Debt often results from hardships such as job loss, divorce, medical bills. Put them down on paper to use as a reference when you're negotiating a debt settlement with a creditor.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay upfront. Also, provide them with a clear description of what you expect in return, such as the removal of missed payments or the account shown as paid in full on your report.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

I would like to offer an amount of to settle the outstanding debt amount of $ with you. I also like to request you to include the following conditions as a part of my settlement offer: My account will be showing as 'paid in full' with no future liability or involvement.