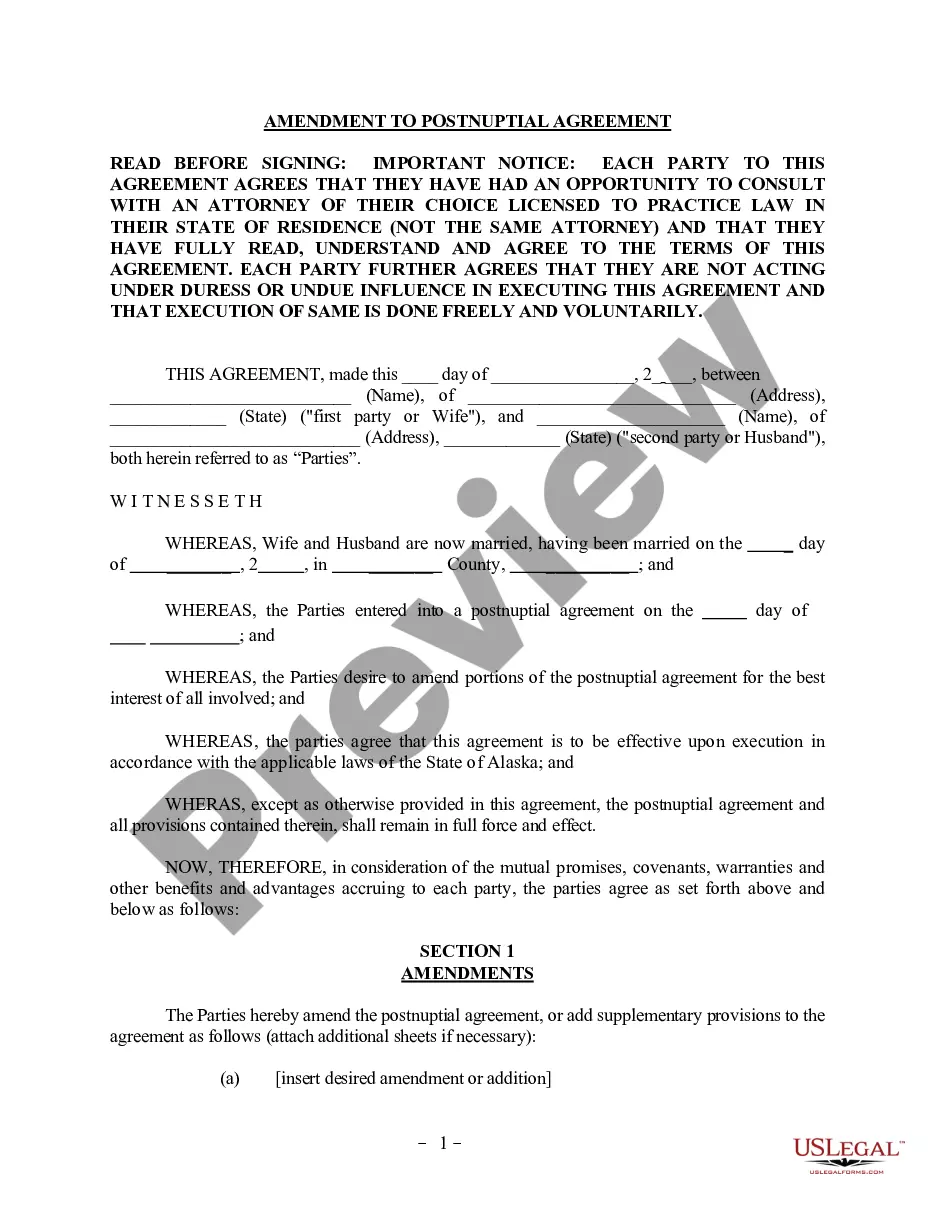

A repossession letter template for a car is a professionally crafted document that is used by a lender or financial institution to notify a borrower of their intent to repossess their vehicle. This letter serves as an official notification to the borrower, outlining the reasons for repossession and providing them with an opportunity to address the issue. The content of a repossession letter template for a car typically includes several important elements. It starts with a clear and concise introductory paragraph stating the purpose of the letter. Keywords such as "repossession letter template," "car repossession notice," and "vehicle repossession notification" can be used in this paragraph to enhance its relevance. The body of the letter should contain specific details related to the repossession, such as the borrower's name, vehicle make and model, identification number, and outstanding balance. The lender should also mention the reason for the repossession, which can vary from failure to make timely payments, breach of loan agreement terms, or insurance coverage lapses. Including keywords like "defaulted loan," "unpaid installments," and "repossession due to non-payment" can make the content more targeted. Additionally, the letter should inform the borrower of the actions they can take to prevent repossession, such as bringing the loan current, providing proof of insurance coverage, or negotiating a repayment plan. Relevant keywords like "payment options," "insurance documentation," and "probationary period to reinstate the loan" can be used in this section to add context. Different types of repossession letter templates for cars are available, each addressing specific scenarios. Some common variations include: 1. Prepossession letter template: Sent prior to the repossession process, this type of letter serves as a warning to the borrower, notifying them of the impending repossession if they fail to rectify the issue promptly. 2. Post-repossession letter template: Used after the car has been repossessed, this letter confirms the repossession and provides the borrower with information regarding the next steps, such as auction details and potential deficiency balance. 3. Acceleration letter template: This type of letter is sent when the lender accelerates the loan due to the borrower's failure to meet the loan obligations. It notifies the borrower that the entire loan amount is now due immediately, making repossession a possible consequence. In conclusion, a repossession letter template for a car is a crucial document used to inform borrowers about their impending repossession. By utilizing relevant keywords, such as "repossession letter template," "car repossession notice," and "vehicle repossession notification," the content can be optimized for its intended purpose. Various types of repossession letters may be used, including prepossession, post-repossession, and acceleration letters, each catering to different stages and circumstances of the repossession process.

Repossession Letter Template For Car

Description car repossession letter template

How to fill out Repossession Notice Template?

Using legal templates that comply with federal and local regulations is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the appropriate Repossession Letter Template For Car sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are easy to browse with all documents organized by state and purpose of use. Our experts keep up with legislative updates, so you can always be sure your form is up to date and compliant when obtaining a Repossession Letter Template For Car from our website.

Getting a Repossession Letter Template For Car is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, follow the guidelines below:

- Take a look at the template using the Preview feature or via the text description to ensure it meets your requirements.

- Locate a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and choose a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Select the best format for your Repossession Letter Template For Car and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

letter of repossession Form popularity

repo letter example Other Form Names

intent to repossess letter FAQ

How to Rebuild Scores After a Voluntary Surrender Bring any past-due accounts current. ... Pay off any outstanding debt. ... Reduce balances on your credit cards. ... Order your free Experian credit score. ... Add your utility and streaming service payments to your report.

A repossession stays on your credit report for seven years, starting from the first missed debt payment that led to the repossession. In the credit world, a repo is considered a derogatory mark. After a repo, it's not unusual to see a person's credit score take a substantial drop.

How To Hide Your Car From Repossession? Change the License Plate. ... Disguise the Vehicle's Appearance. ... Store the Car at a Relative's House. ... Transfer the Title to Someone Else. ... Don't Use Your Car Much and Don't Keep Track of it. ... Store the Car at a Relative's House. ... Don't Use Your Car Much and Don't Keep Track of it.

Start the letter by identifying yourself and the property. The lender will need to identify your loan, so include an account number. Give them your name, address and contact information. Tell the lender that you are voluntarily giving the item back because you can no longer make the payments.

Negotiate with the creditor. Immediately after repossession, you should contact your lender to see if they may be willing to work with you. Whether or not you will be shown any lenience is entirely up to the particular bank that you're dealing with, but you won't know unless you try.