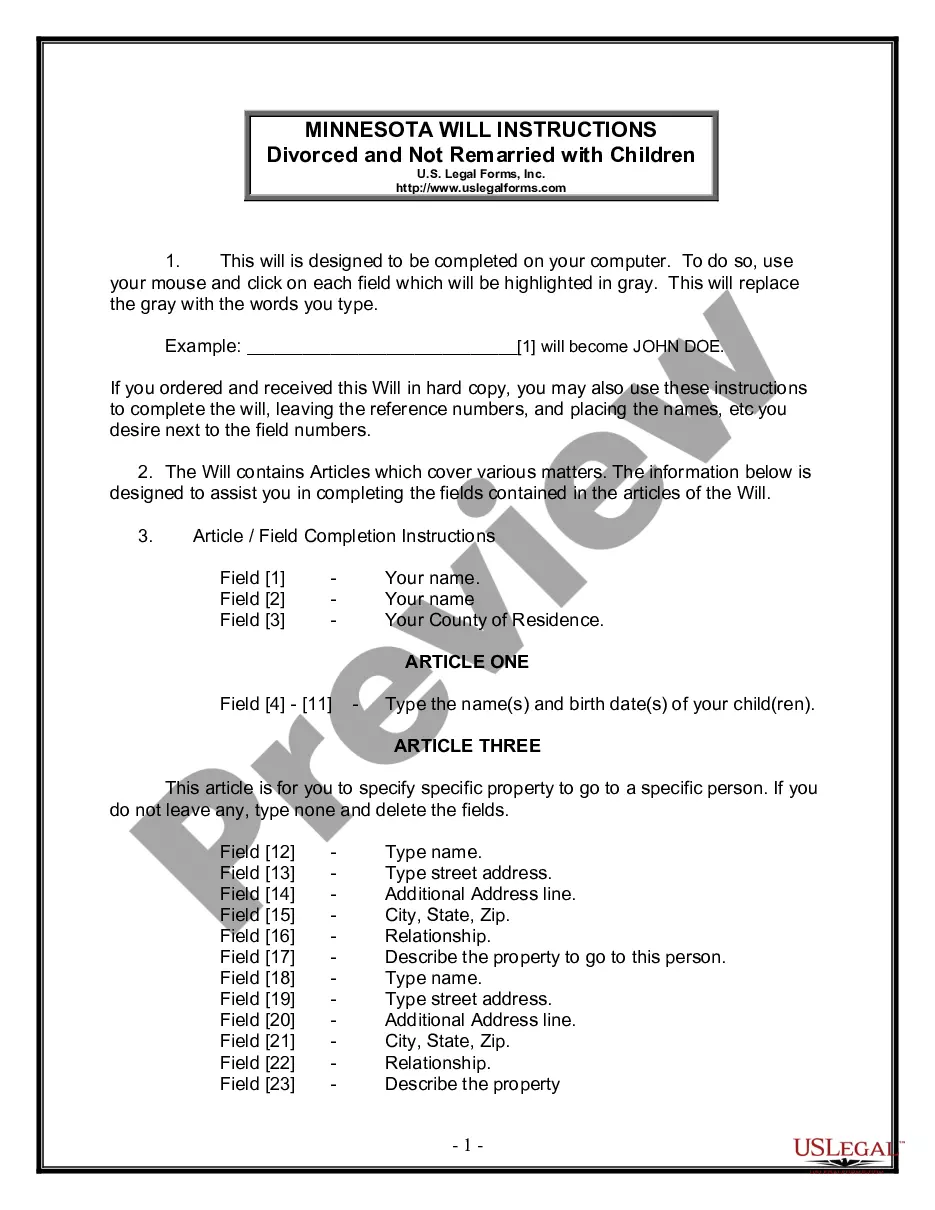

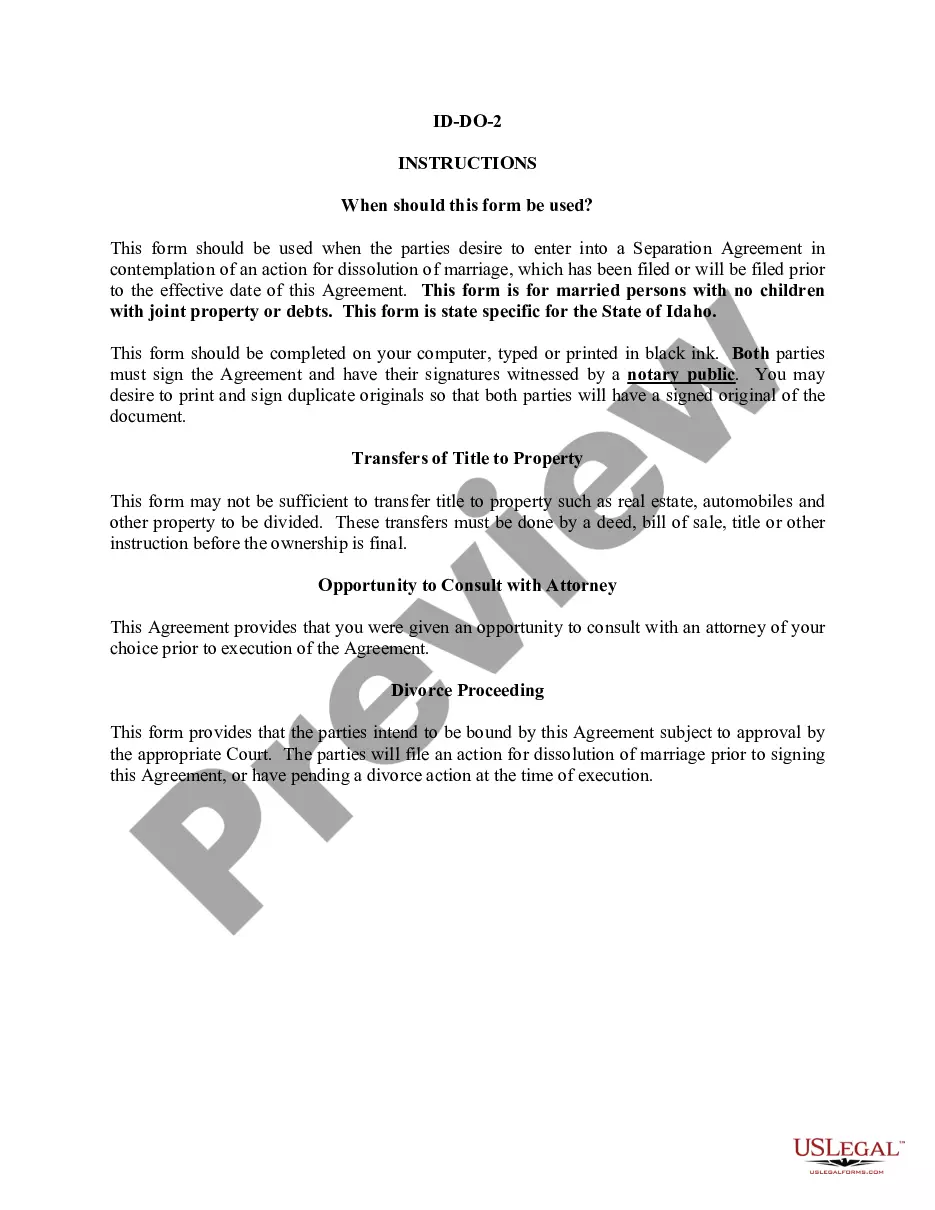

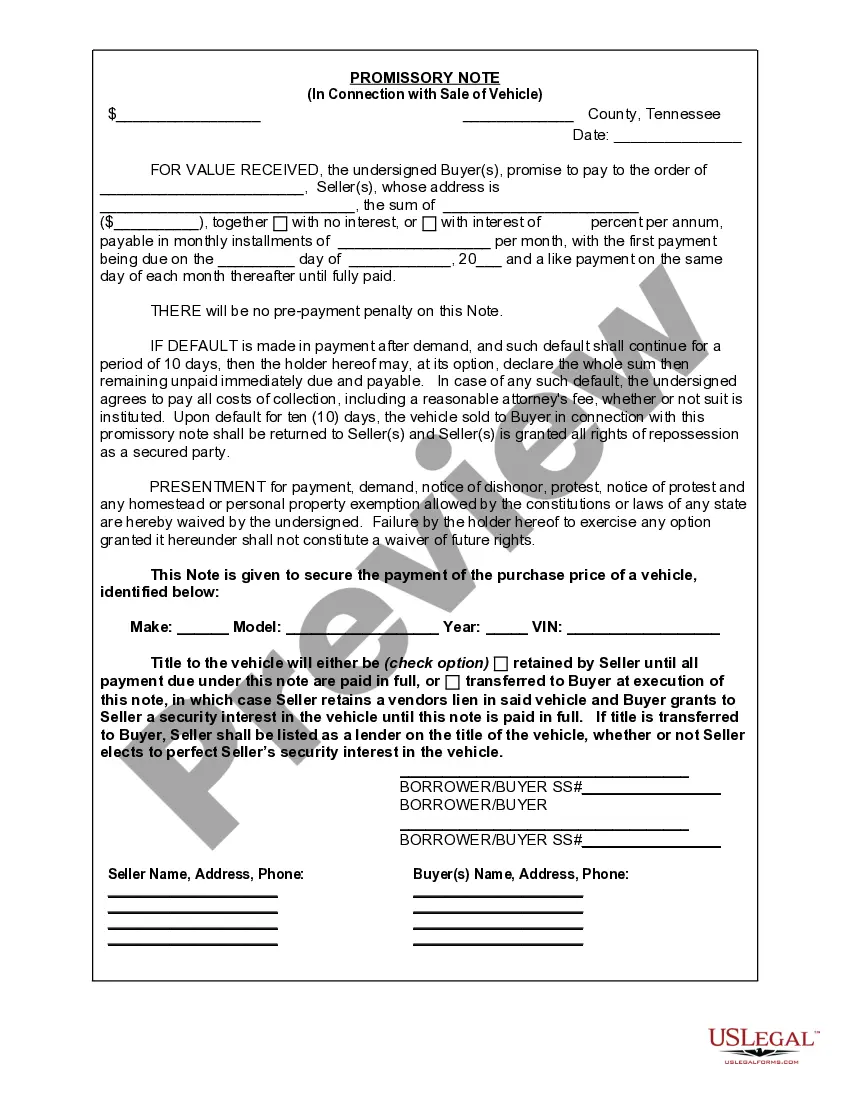

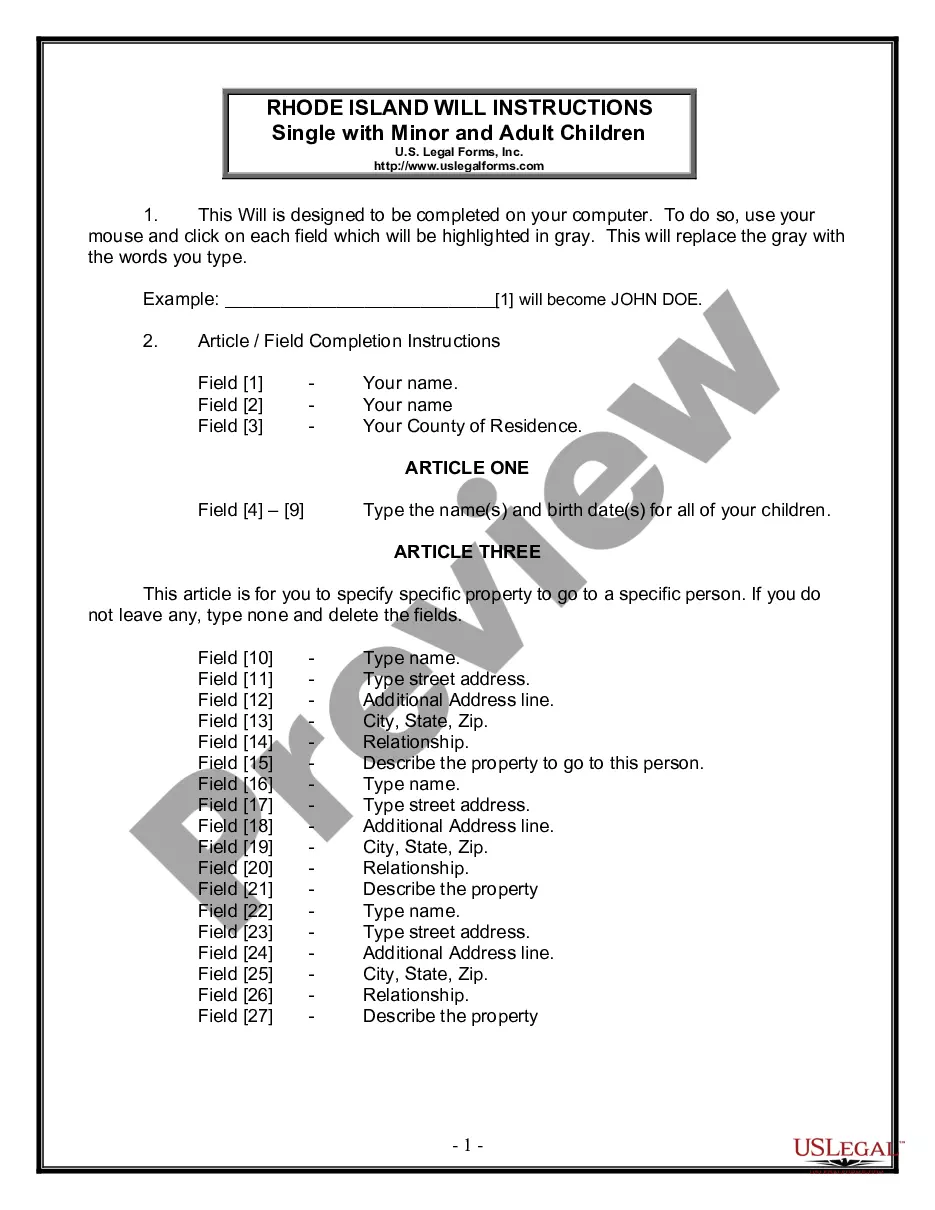

A repossession letter template for a vehicle is a pre-designed document used by lenders or financial institutions to inform borrowers about the repossession process of their vehicle due to defaulting on loan payments. This formal letter provides important details and instructions regarding the repossession, as well as the borrower's rights and responsibilities. Keywords: Repossession letter template, vehicle, lender, financial institution, inform, repossession process, defaulting on loan payments, formal letter, details, instructions, borrower's rights, borrower's responsibilities. Different types of repossession letter templates for vehicles may include: 1. Initial Repossession Notice: This type of letter is sent to the borrower as soon as they miss a payment or demonstrate a consistent pattern of non-payment. It serves as a warning that the vehicle is at risk of being repossessed if the outstanding payment is not made promptly. 2. Final Repossession Notice: This letter is typically sent after the borrower has failed to respond to the initial notice or has not rectified the situation. It notifies the borrower that their vehicle is scheduled for repossession within a specified timeframe, usually within days or weeks. 3. Post-Repossession Letter: This letter is sent after the repossession has taken place and provides information regarding the next steps. It may include details about the sale of the repossessed vehicle, any outstanding debts the borrower may still owe, and the lender's intention to pursue legal actions if necessary. 4. Redemption Letter: This type of letter is sent to the borrower if they wish to redeem their repossessed vehicle. It includes information about the redemption process, including the amount needed to reclaim the vehicle, any associated fees, and the timeframe within which the redemption must occur. 5. Auction Letter: If the lender plans to sell the repossessed vehicle at an auction, they may send an auction letter to the borrower. This letter provides details about the auction, including the date, time, and location, as well as instructions for the borrower to participate or make arrangements before the auction takes place. It is essential to customize the content of these repossession letter templates with specific details pertaining to the borrower, loan agreement, and applicable laws, ensuring clarity and effectiveness in conveying the necessary information.

Repossession Letter Template For Vehicle

Description vehicle repossession letter

How to fill out Repossession Letter Template For Vehicle?

It’s no secret that you can’t become a law expert immediately, nor can you grasp how to quickly draft Repossession Letter Template For Vehicle without having a specialized background. Putting together legal documents is a long venture requiring a particular education and skills. So why not leave the preparation of the Repossession Letter Template For Vehicle to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court paperwork to templates for in-office communication. We understand how important compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our website and get the form you require in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Repossession Letter Template For Vehicle is what you’re looking for.

- Begin your search over if you need a different form.

- Set up a free account and select a subscription option to buy the form.

- Pick Buy now. As soon as the payment is complete, you can get the Repossession Letter Template For Vehicle, fill it out, print it, and send or send it by post to the necessary people or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your paperwork-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!