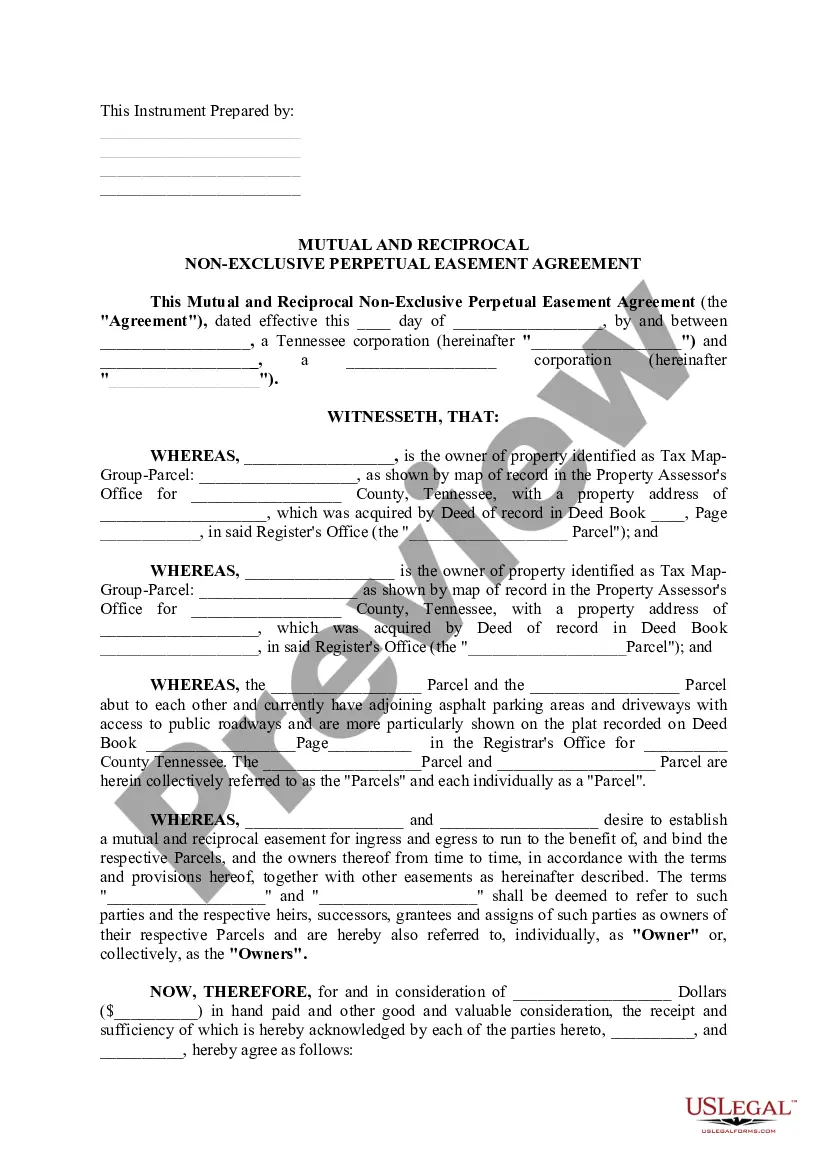

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A mortgage agreement clause for Chase Bank is a legally binding provision included in the mortgage contract between the borrower and Chase Bank. This clause outlines the terms and conditions under which the mortgage loan is granted and sets forth the obligations and responsibilities of both parties involved. The mortgage agreement clause is crucial in providing clarity and protection for both the borrower and the lender. One of the common types of mortgage agreement clauses offered by Chase Bank is the Interest Rate Clause. This clause specifies the interest rate that will be charged on the mortgage loan and the terms for any adjustments or modifications to the rate during the loan term. It ensures that the borrower understands the applicable interest rate and how it may change over time, reducing any ambiguity or misunderstanding. Another crucial type of mortgage agreement clause is the Repayment Clause. This clause outlines the agreed-upon repayment terms, including the monthly mortgage payment amount, payment schedule, and any penalties or fees for late or missed payments. It provides transparency for the borrower, ensuring that they understand their obligations and responsibilities for making timely payments. Moreover, it serves as a guideline for Chase Bank to monitor loan repayment and address any defaults or issues that may arise. Furthermore, Chase Bank offers a Mortgage Insurance Clause as a part of their mortgage agreement. This clause details the requirements and terms for mortgage insurance, which is typically necessary for borrowers making a down payment below a certain threshold or having a higher loan-to-value ratio. The clause clarifies the borrower's obligations concerning mortgage insurance premiums and the circumstances under which they may be canceled or modified. Additionally, Chase Bank may include a Prepayment Clause in their mortgage agreement. This clause outlines the borrower's rights, if any, to make additional payments towards the principal balance or pay off the mortgage loan in full before the scheduled maturity date. It explains any penalties or fees that may be associated with prepayment and helps the borrower make informed decisions regarding early loan repayment. Overall, the mortgage agreement clauses provided by Chase Bank play a crucial role in establishing the terms and conditions of the mortgage loan. By clearly defining the interest rate, repayment terms, mortgage insurance requirements, and prepayment options, these clauses protect both the borrower and the lender, ensuring transparency, mutual understanding, and accountability throughout the loan term.