Agreement Spouse Form Withdrawal

Description

How to fill out Agreement To Continue Payment Of Monthly Spousal Support?

There's no longer a requirement to allocate time searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location, making their accessibility easier.

Our website features over 85k templates for any business and personal legal situations categorized by state and area of application.

Using the Seach bar above can help locate another template if the previous one wasn’t suitable. Click Buy Now next to the template name upon finding the correct one. Select the desired subscription plan and create an account or Log In. Process your subscription payment with a credit card or through PayPal to proceed. Choose the file format for your Agreement Spouse Form Withdrawal and download it to your device. Print your form to fill it out manually or upload the sample if you choose to edit it in an online editor. Creating legal paperwork under federal and state regulations is quick and easy with our platform. Explore US Legal Forms today to maintain your documentation organized!

- All forms are properly drafted and validated for authenticity, ensuring you receive an up-to-date Agreement Spouse Form Withdrawal.

- If you are acquainted with our platform and already possess an account, confirm your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can return to all obtained documents anytime by navigating to the My documents tab in your profile.

- If this is your first experience with our platform, the process will involve a few additional steps.

- Here's how new users can find the Agreement Spouse Form Withdrawal in our library.

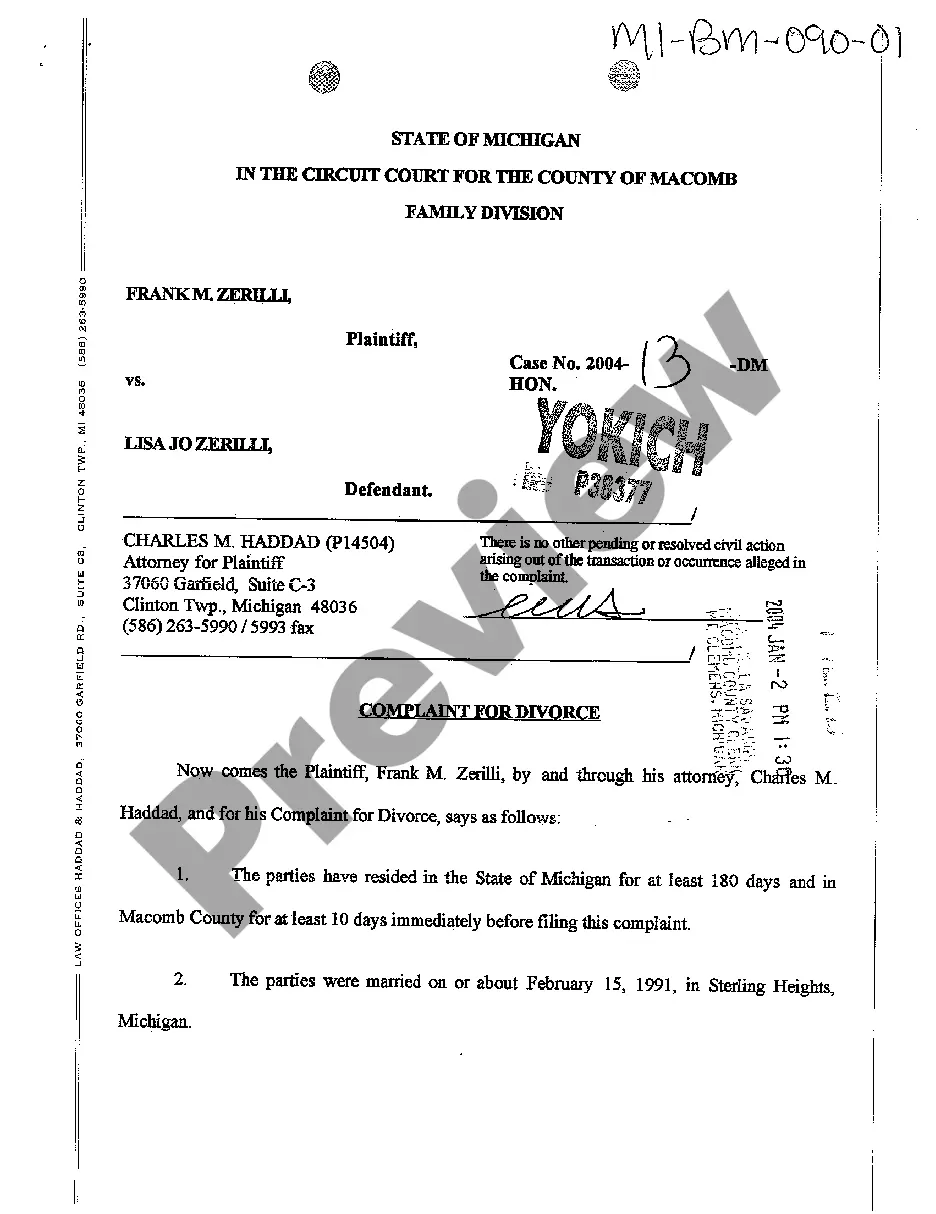

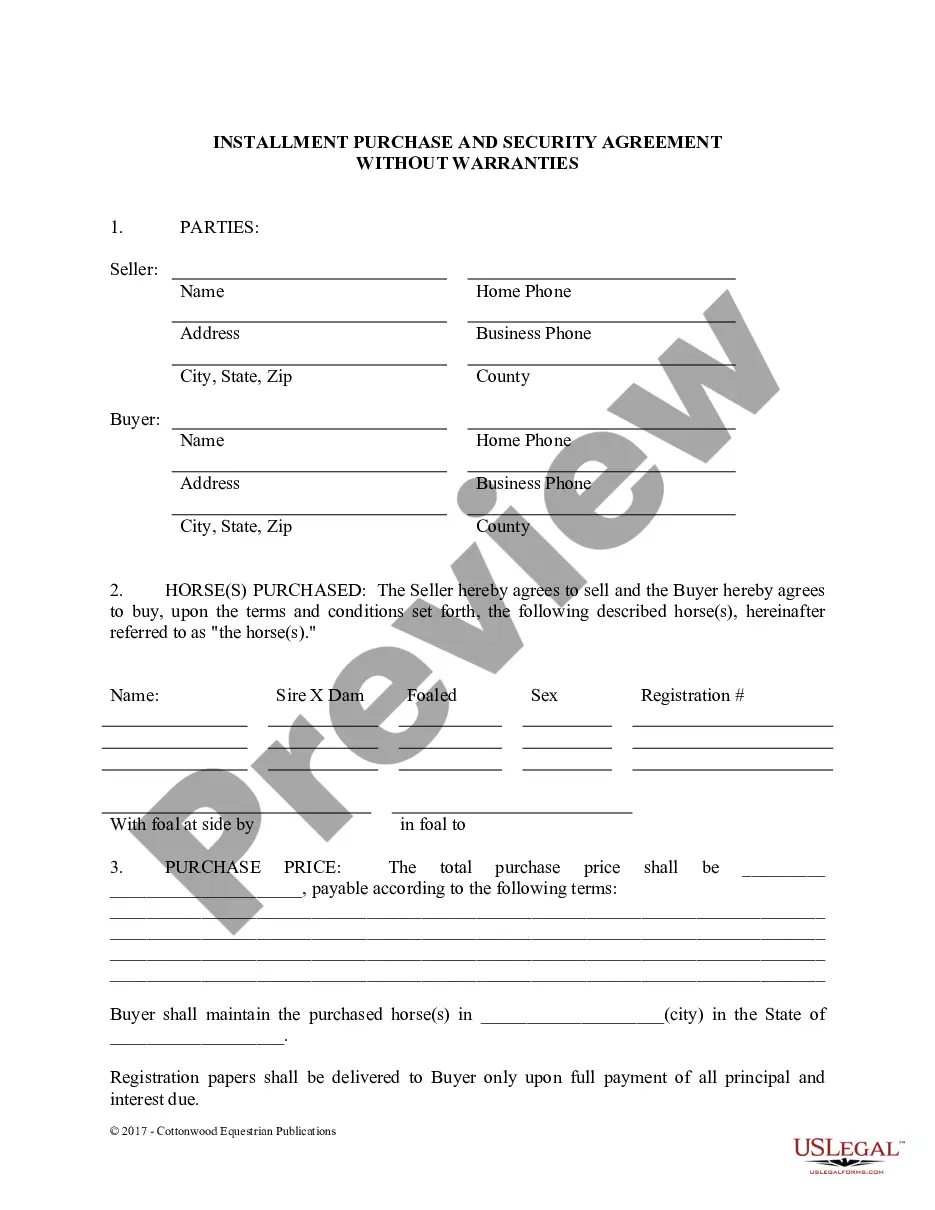

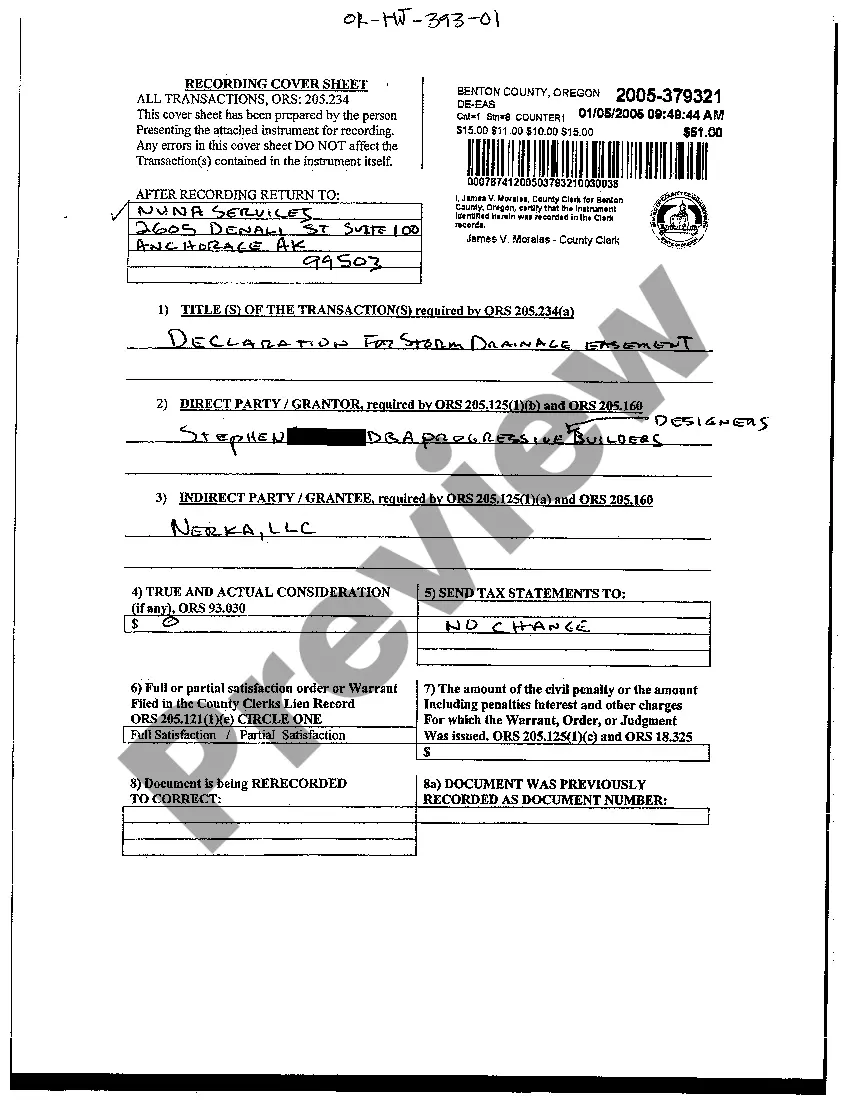

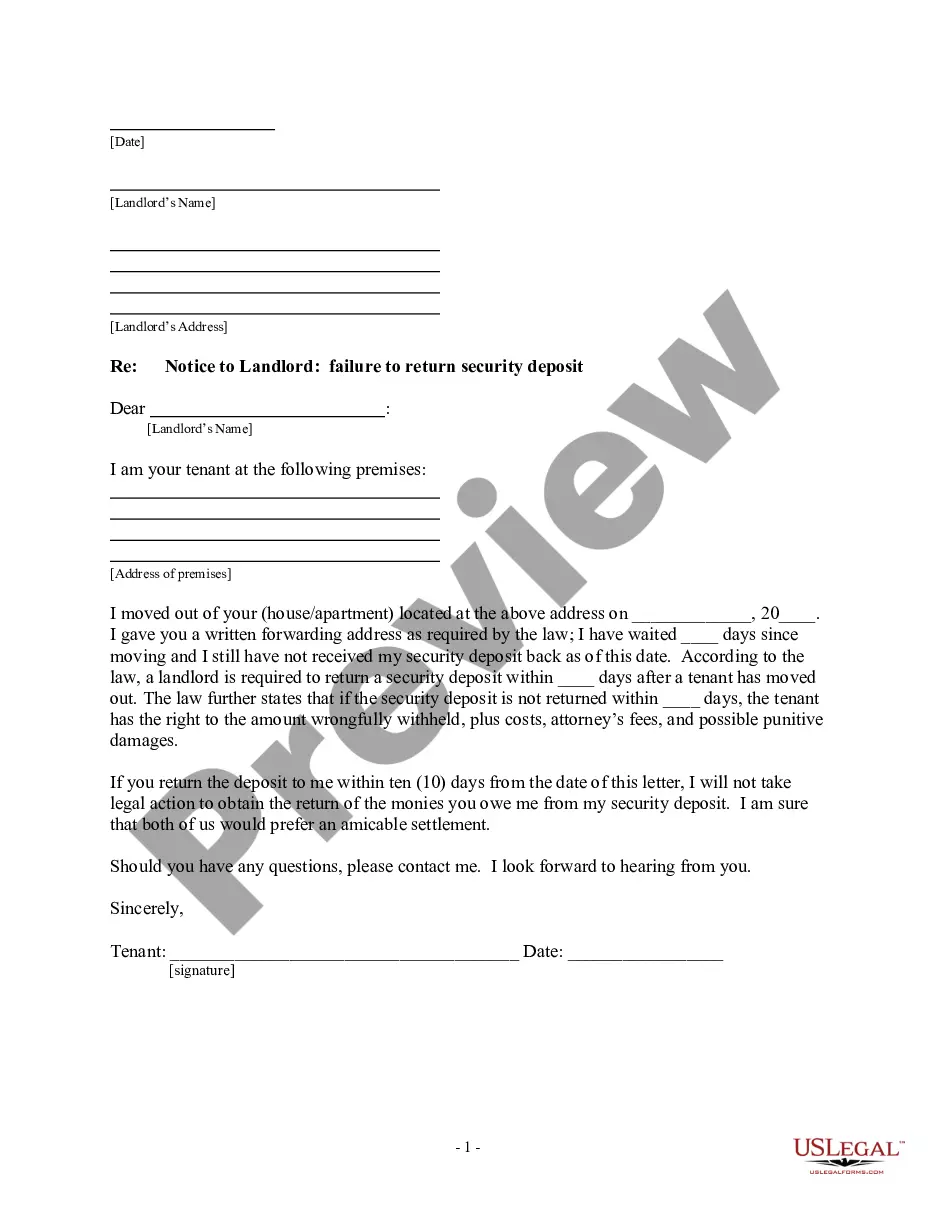

- Examine the page content closely to ensure it contains the sample you need.

- To do so, utilize the form description and preview options if available.

Form popularity

FAQ

Form 5329 is required for individuals with retirement plans or education savings accounts who owe an early distribution or another penalty. Taxpayers who do not file the form could end up owing more in penalties and taxes.

Use Form 5329 to report additional taxes on IRAs, other qualified retirement plans, modified endowment contracts, Coverdell ESAs, QTPs, Archer MSAs, or HSAs.

Form 433-F is used to obtain current financial information necessary for determining how a wage earner or self-employed individual can satisfy an outstanding tax liability. Note: You may be able to establish an Online Payment Agreement on the IRS web site.

You are required to fill out Form 5329 if you exceed the eligible contributions allowed for an IRA. Traditional and Roth IRA contributions cannot exceed $5,500 annually for individuals under the age of 50. Or, for people age 50 or older, they can contribute up to $6,500 to a traditional or Roth IRA each year.

77 form is known as a Request for Partial Withdrawal When Separated. This form will be used by a participant who has been separated from federal service to request a onetime withdrawal of at least $1,000 or more from their TSP.