An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Loan Maturity Notice Letter For Not Paying

Description maturity letter

How to fill out Loan Maturity Notice Letter For Not Paying?

There’s no further cause to squander time searching for legal documents to comply with your local state requirements. US Legal Forms has compiled all of them in one location and made them easier to access.

Our website offers over 85k templates for any business and personal legal matters categorized by state and area of application. All forms are properly drafted and verified for legitimacy, ensuring you receive an up-to-date Loan Maturity Notice Letter For Not Paying.

If you are acquainted with our service and already possess an account, ensure your subscription is current before obtaining any templates. Log In/">Log In to your account, select the document, and click Download. You can also access all saved documents whenever needed by navigating to the My documents section in your profile.

Print your form for manual completion or upload the template if you prefer to use an online editor. Producing official documents under federal and state laws and regulations is quick and simple with our library. Experience US Legal Forms now to keep your documentation organized!

- If you have never used our service before, the process will involve a few more steps to finalize.

- Here’s how new users can find the Loan Maturity Notice Letter For Not Paying in our repository.

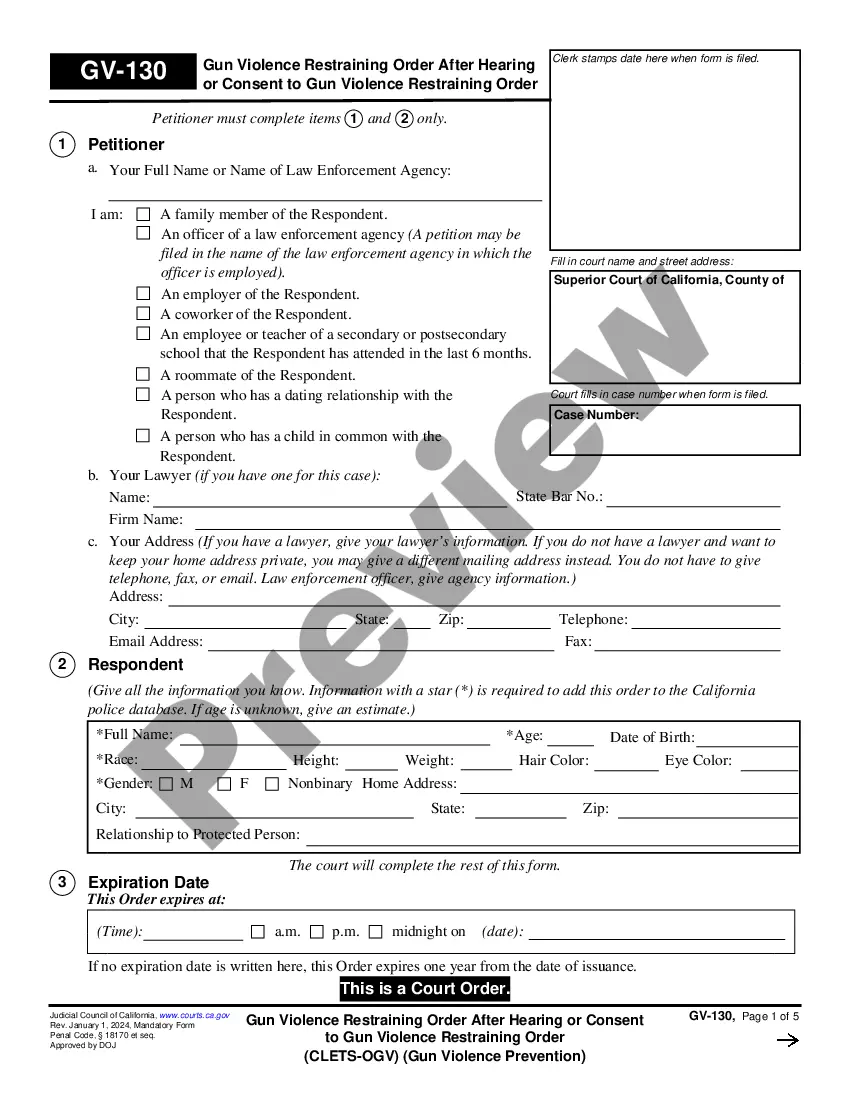

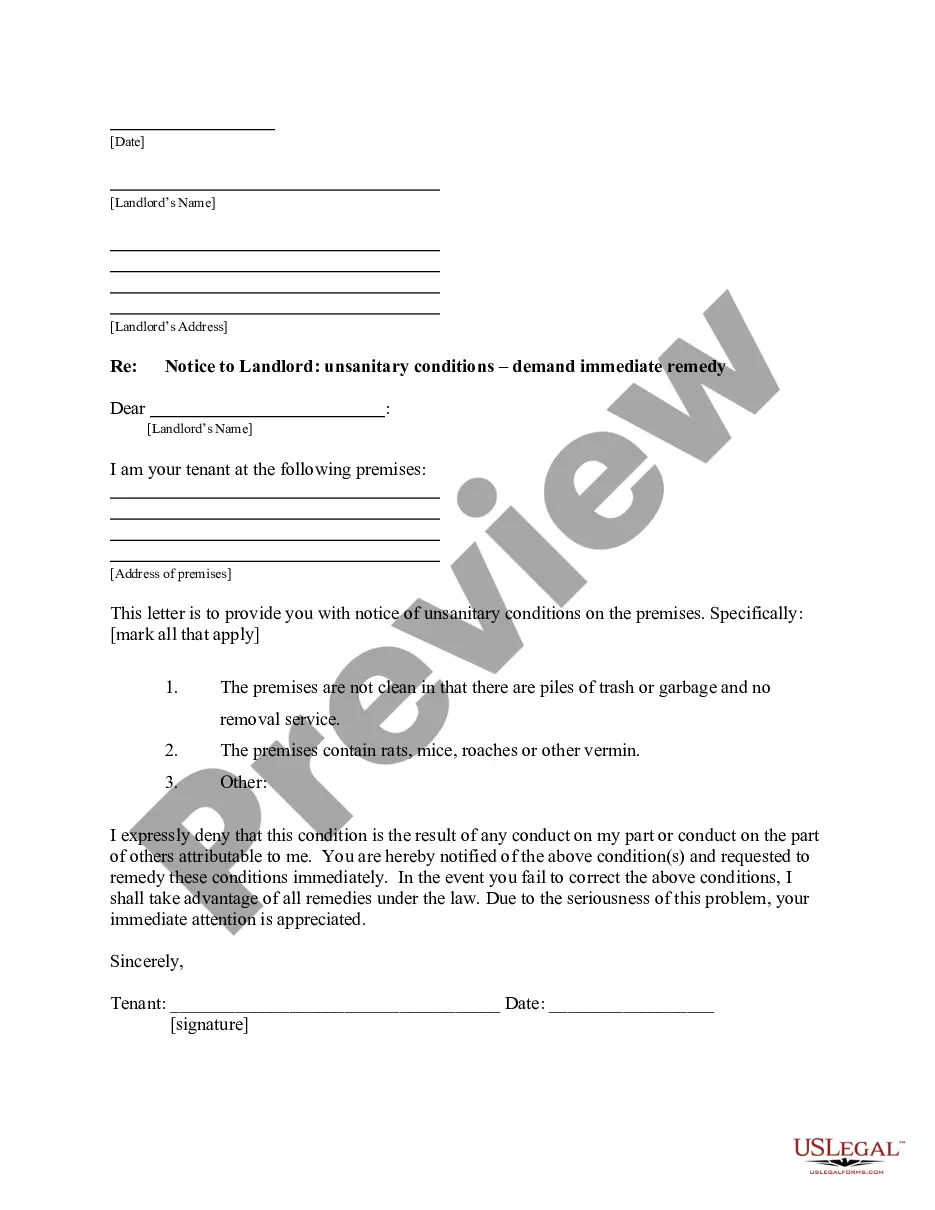

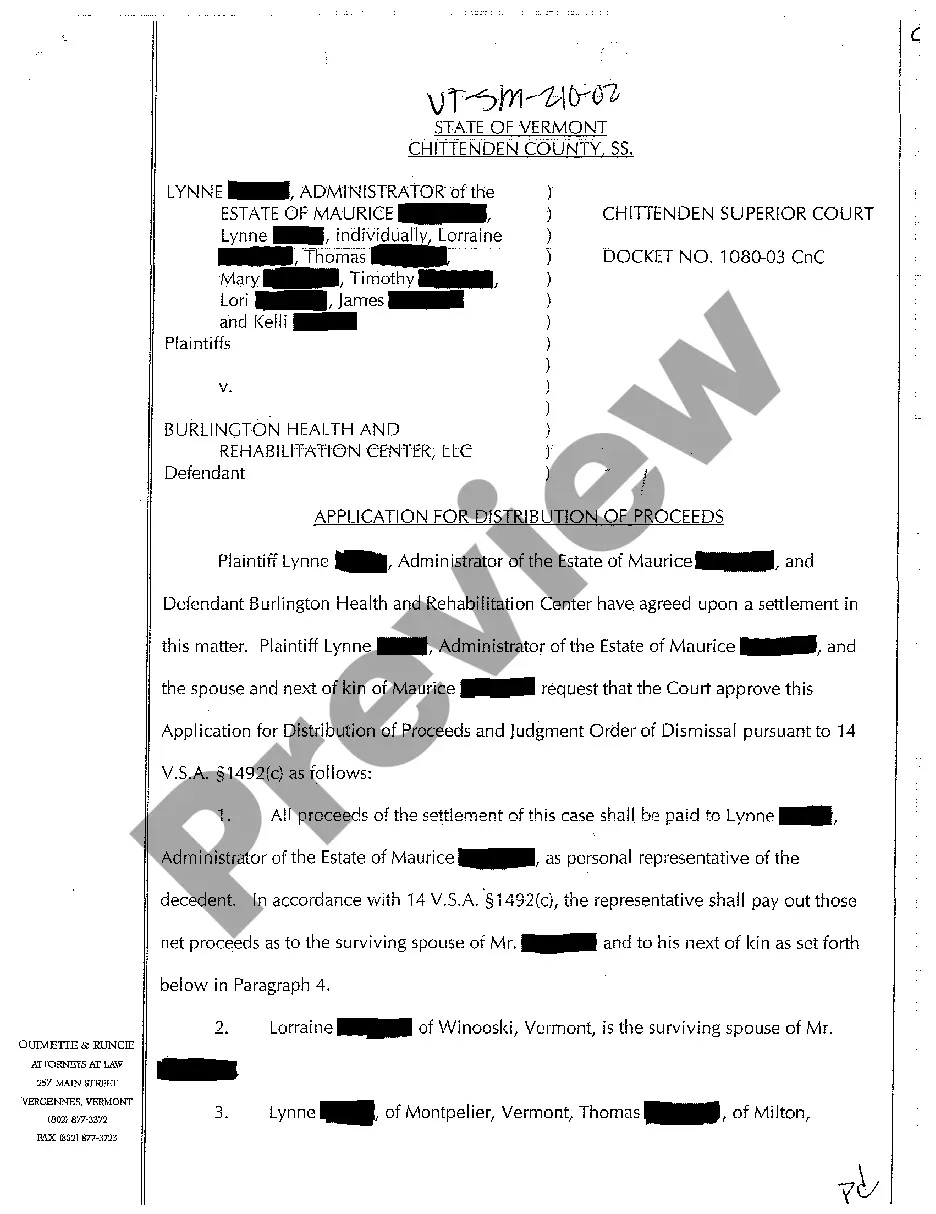

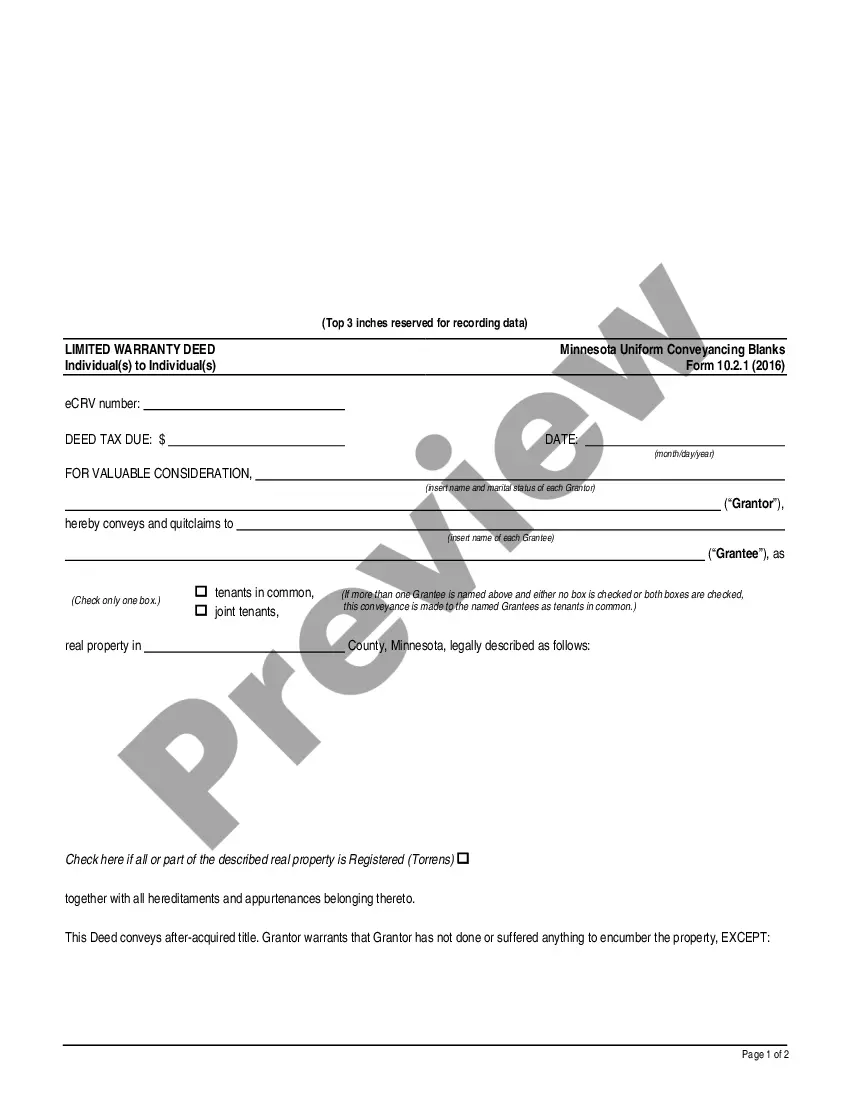

- Read the page content thoroughly to ensure it includes the sample you require.

- To do this, make use of the form description and preview options if available.

- Utilize the Search field above to look for another template if the current one doesn't suit your needs.

- Click Buy Now next to the template title once you find the right one.

- Choose the suitable pricing plan and create an account or Log In/">Log In.

- Pay for your subscription with a credit card or through PayPal to proceed.

- Select the file format for your Loan Maturity Notice Letter For Not Paying and download it to your gadget.

sample letter to bank requesting extension of time for loan payment due to covid 19 Form popularity

extension of loan repayment period letter Other Form Names

FAQ

If you fail to repay your mortgage, the real estate you purchased with the mortgage loan can be repossessed by the lender as repayment. Another common type of secured loan is auto loans, which work the same way. An unsecured loan is a loan that is not secured by other funds or property.

If you owe a loan balance at maturity and become delinquent on payments, the bank can send your account to collections. The bank will charge late fees on the missed payments. The interest will continue to accrue on the balance you owe. To avoid additional fees and finance charges, you should stay current on payments.

A loan is classified as a non-performing asset (NPA) if the repayment is 90 days overdue. In such cases, the lender has to first issue a 60-day notice to the defaulter. If the borrower fails to repay within the notice period, the bank can go ahead with sale of assets.

Loan maturity date refers to the date on which a borrower's final loan payment is due. Once that payment is made and all repayment terms have been met, the promissory note that is a record of the original debt is retired. In the case of a secured loan, the lender no longer has a claim to any of the borrower's assets.

When you fail to pay off the borrowed amount even after a certain period of time, the lender will report your loan account as a non-performing asset (NPA) to the credit bureaus. This will severely affect your credit history and bring down your credit score as well.