Sample Letter for Loan Cancellation: A Comprehensive Guide with Relevant Keywords Introduction: A sample letter for loan cancellation is a formal document that borrowers can use to request the cancellation of their loan agreement with a financial institution or lender. This letter serves as a written request to terminate the loan, alleviate the borrower's financial burden, and dissolve the contractual obligations associated with the loan agreement. It is essential to include certain keywords and phrases while drafting this letter to ensure its effectiveness and compliance with legal requirements. Relevant Keywords: 1. Loan cancellation request: In the opening paragraph, clearly state the purpose of the letter by mentioning that it is a loan cancellation request. This keyword helps the recipient instantly understand the intention behind the letter. 2. Loan agreement number: Include the loan agreement number in your letter to provide a reference point for the lender to locate your file and take necessary action. 3. Borrower's information: Begin the letter by stating your name, address, contact information, and any other relevant identification details to ensure prompt identification and easy processing of your request. 4. Reason for cancellation: Clearly state the reason for canceling the loan. Mention valid justifications, such as unexpected financial hardships, changing circumstances, or any other grounds that render the continuance of the loan unfavorable or impossible. 5. Timely repayments: If you have been consistently making loan repayments on time, emphasize this fact to strengthen your request. Keywords such as "diligent payment history" or "timely repayments" can highlight your responsible behavior as a borrower. 6. Loan cancellation terms and conditions: Dealing with loan cancellations might involve adhering to specific terms and conditions set by the lender. Ensure to review the loan agreement or any cancellation policies provided by the lender to include any relevant keywords that will help ensure compliance. 7. Repayment obligations: If you have any outstanding balance, state your intention to clear that amount before or after the loan cancellation. Use keywords like "settle remaining balance" or "arrange repayment plan" to indicate your willingness to fulfill your obligations. 8. Legal rights: Familiarize yourself with your legal rights as a borrower and incorporate keywords such as "consumer protection laws" or "right to cancel" to assert your position and reinforce your request for loan cancellation. 9. Request for written confirmation: Ask for written confirmation of the loan cancellation for your records and to ensure that there is a formal acknowledgment of your request. Specify this request using keywords like "written confirmation" or "acknowledgment letter." 10. Contact information: Provide your contact information again at the end of the letter, including phone number and email address, so that the lender can swiftly respond or seek additional details if required. Types of Sample Letters for Loan Cancellation: 1. Personal Loan Cancellation Letter: This sample letter is tailored specifically for individuals seeking to cancel a personal loan due to unforeseen circumstances or financial hardships. 2. Mortgage Loan Cancellation Letter: This type of sample letter is designed for homeowners looking to cancel their mortgage loan agreement either by refinancing or due to reasons like selling the property. 3. Student Loan Cancellation Letter: Borrowers burdened by student loans can make use of this sample letter to request the cancellation of their education loan, often due to financial difficulties or other valid reasons. Conclusion: Writing a sample letter for loan cancellation requires a careful selection of keywords and relevant details to effectively convey your request. By utilizing the suggested keywords and including pertinent information, borrowers can increase the chances of their loan cancellation request being granted. However, it is crucial to remember that this content is intended for general informational purposes only and should not be considered legal or financial advice.

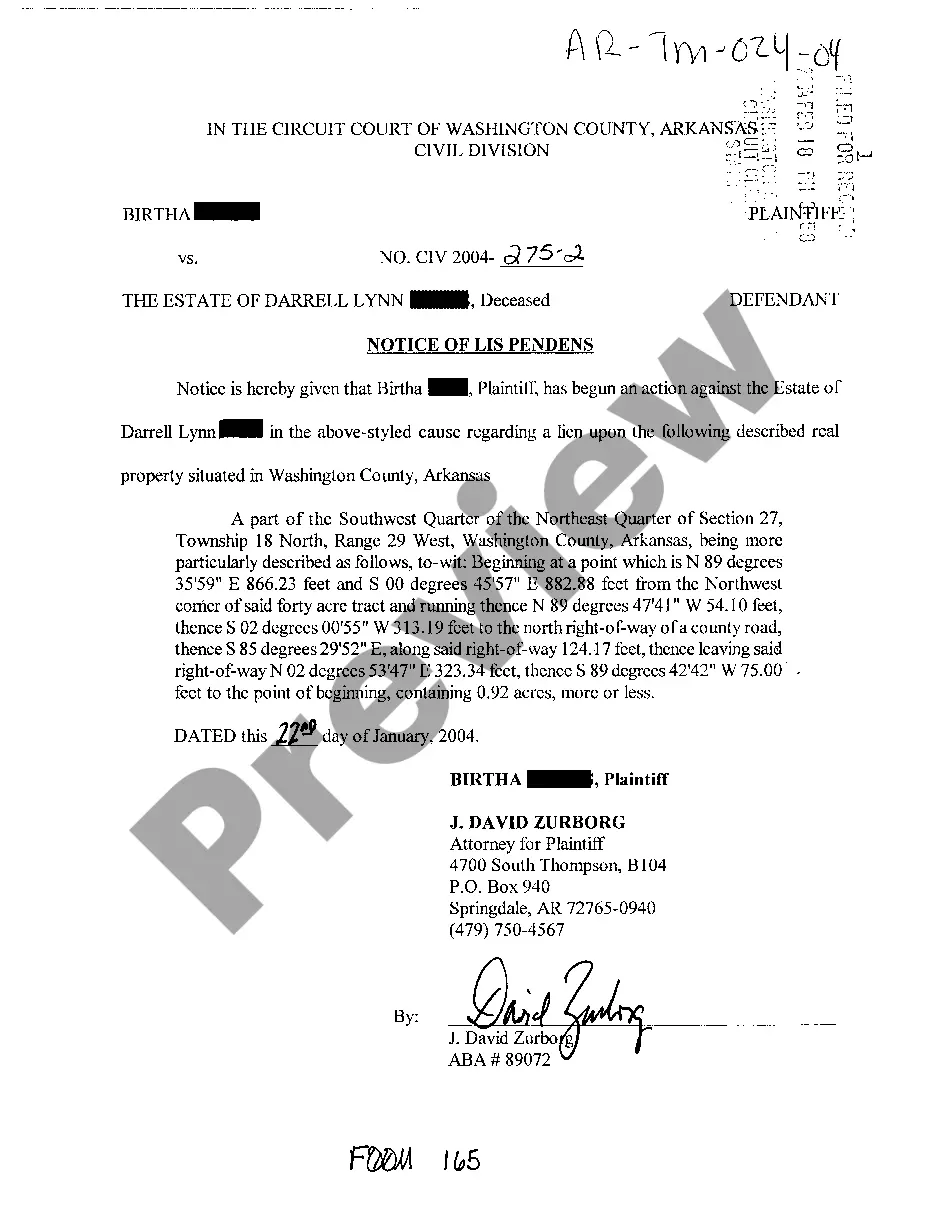

Sample Letter For Loan Cancellation

Description bank loan cancellation letter sample

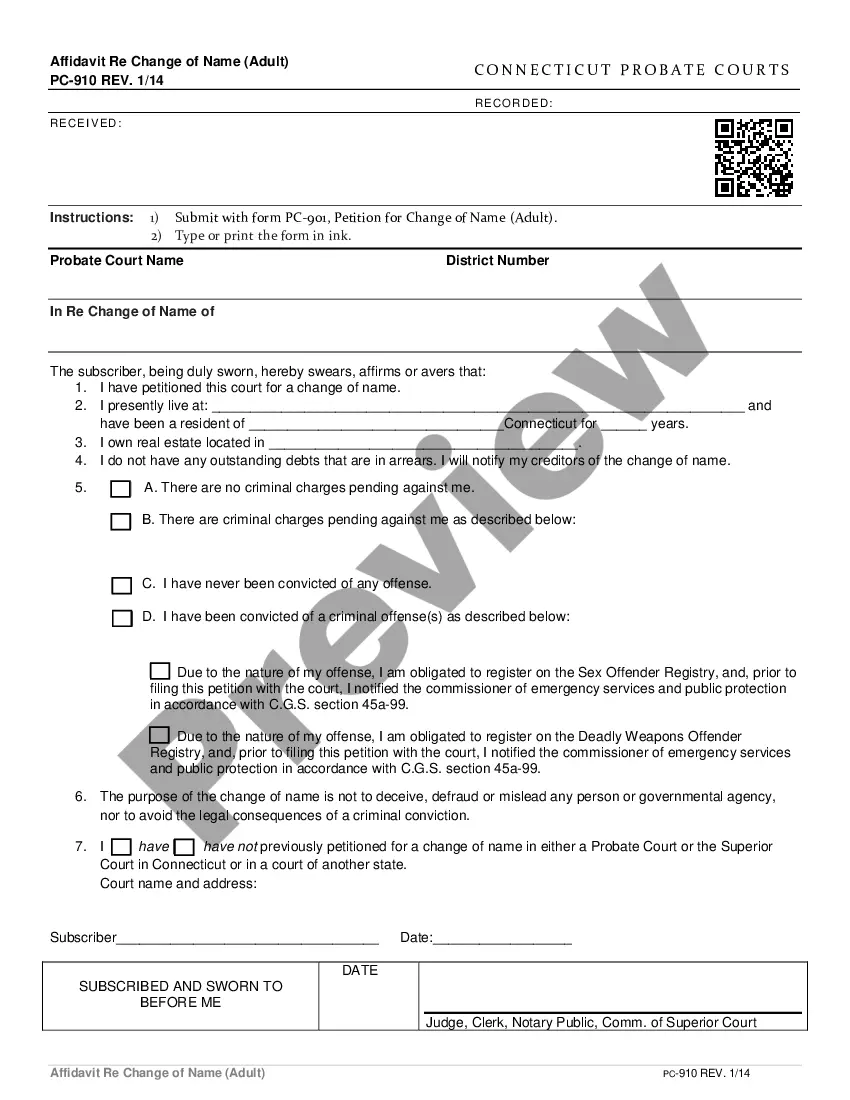

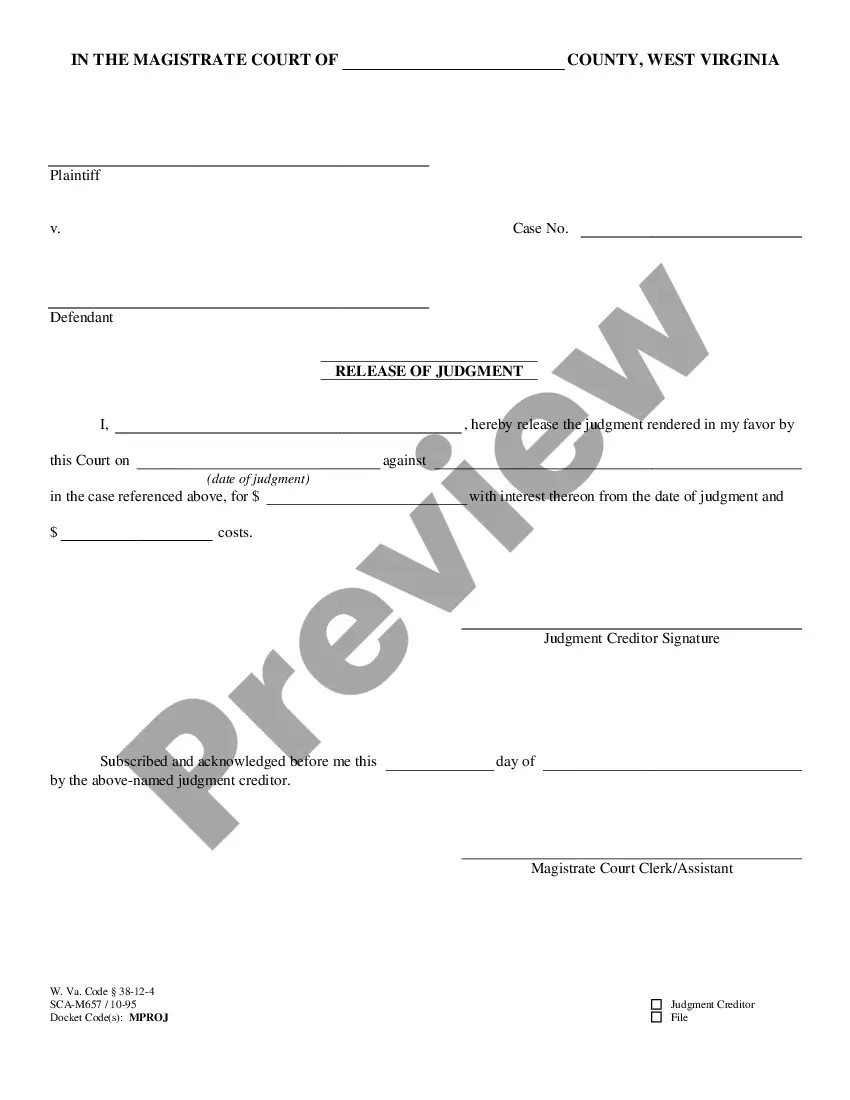

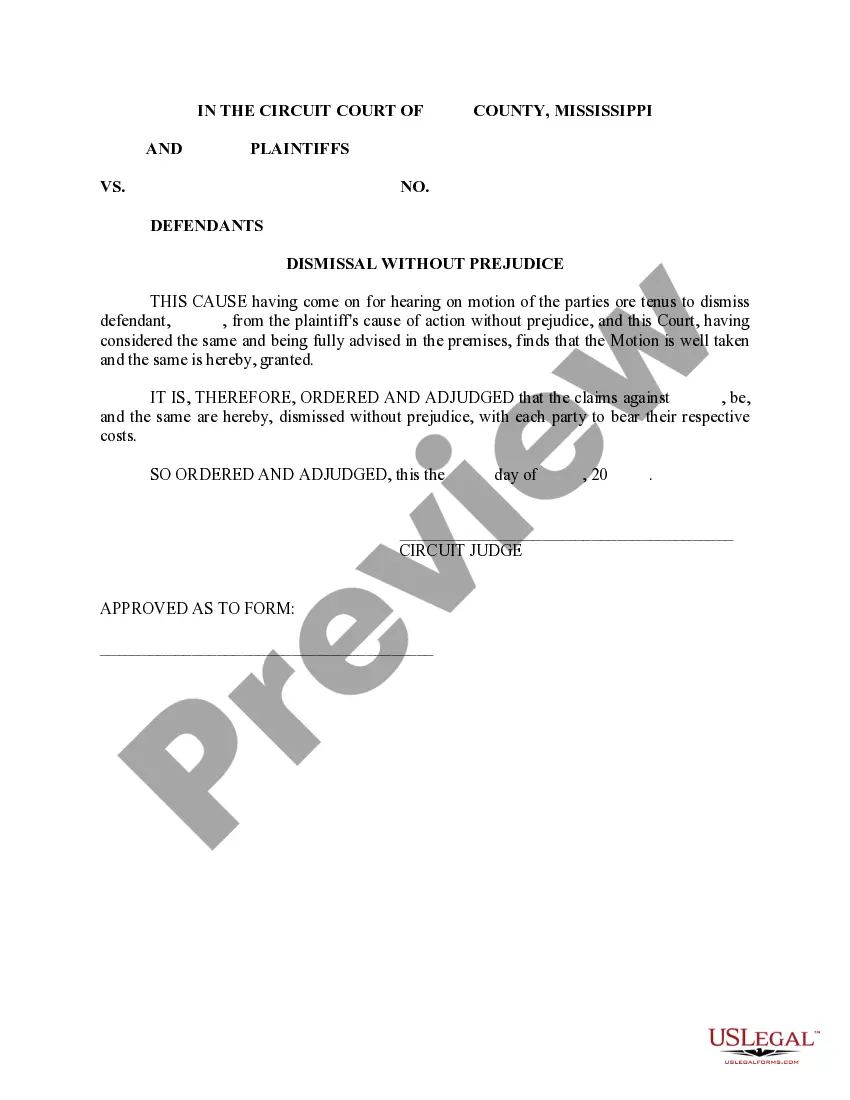

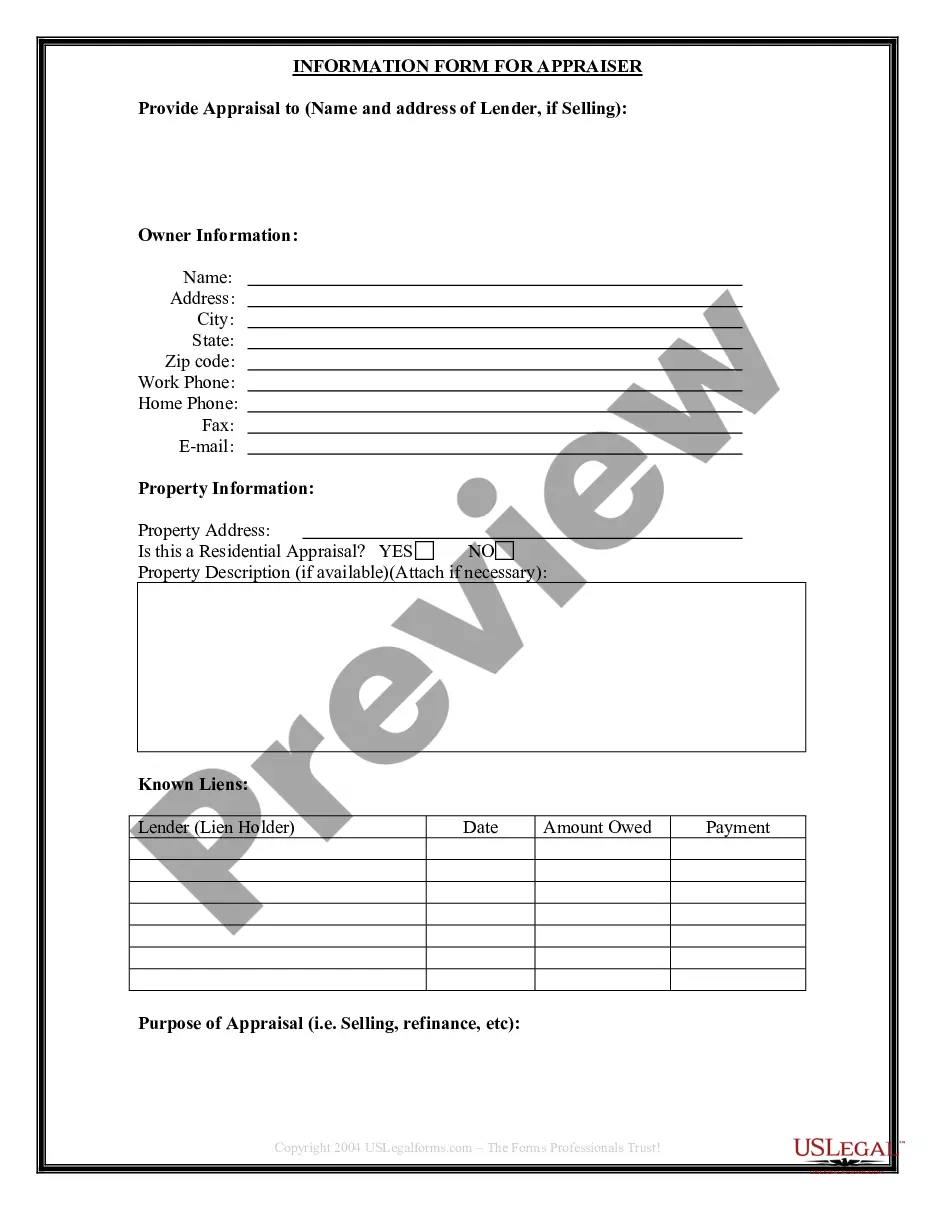

How to fill out Sample Letter For Refinancing Of Loan?

Working with legal paperwork and operations can be a time-consuming addition to your day. Sample Letter For Loan Cancellation and forms like it often require that you search for them and understand the best way to complete them appropriately. Consequently, if you are taking care of economic, legal, or individual matters, having a thorough and convenient web library of forms on hand will significantly help.

US Legal Forms is the number one web platform of legal templates, boasting over 85,000 state-specific forms and a variety of tools to assist you to complete your paperwork easily. Explore the library of appropriate papers available with just a single click.

US Legal Forms offers you state- and county-specific forms offered at any moment for downloading. Protect your papers management operations with a high quality support that allows you to prepare any form within minutes without extra or hidden charges. Simply log in in your profile, locate Sample Letter For Loan Cancellation and download it immediately in the My Forms tab. You may also gain access to previously saved forms.

Is it your first time utilizing US Legal Forms? Register and set up your account in a few minutes and you will gain access to the form library and Sample Letter For Loan Cancellation. Then, adhere to the steps listed below to complete your form:

- Ensure you have discovered the right form by using the Review feature and looking at the form information.

- Pick Buy Now as soon as ready, and choose the monthly subscription plan that fits your needs.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise assisting users manage their legal paperwork. Discover the form you want today and streamline any operation without breaking a sweat.

how to write loan cancellation letter Form popularity

cancellation of loan application letter Other Form Names

sample letter of cancellation FAQ

South Dakota CPA Exam Cost Breakdown The South Dakota CPA exam cost consists of three main fees: the $268.15 per CPA exam section totaling $1072.60 for all four sections, the CPA certificate application fee which depends on the day that you'll apply, and lastly the renewal fee of $50.

South Dakota, like nearly every other state, has four main areas for applicants to satisfy: education, CPA exam scores, an ethics test and experience. The state neither requires in-state residency for licensure, nor does it ask that you be a U.S. citizen, it even makes the Social Security number optional.

Our iconic attractions include Mount Rushmore National Memorial, Badlands National Park, the Black Hills and the Missouri River. On top of that, we have abundant state parks, lakes and trails. Beyond that, we have some of the nation's best hunting and fishing. It's the complete package.

To meet the South Dakota CPA education requirements, candidates need to acquire a bachelor's or graduate degree in accounting or a course of study that is the equivalent of an accounting degree with 150-semester credits that includes 24 semester hours in accounting including elementary principles of accounting and at ...

South Dakota CPE requirements Continuing professional education (CPE) hours must be completed in the three calendar years prior to the year during which a license is to be renewed. All CPAs must complete no less than 120 hours of CPE credits during the three-year renewal period.

With no requirement to be a US Citizen, a resident of CO, or a certain age, it makes Colorado one of the easiest states to sit for the CPA exam and become licensed. Be sure to follow each caption below to ensure that you are qualified to sit for the exam.

North Dakota CPA Exam Cost Breakdown Initial Exam Application Fee$120.00Total for all 4 CPA Exam Sections$899.96CPA License Application Fee$185.00CPA License Renewal Fee (April 15 to June 30)$85.00CPA License Renewal Fee (July 31 to August 31)$185.005 more rows