Zero balance letter template for business is a standardized document used by companies to confirm that a particular business account has a zero or nil balance. It serves as an official proof that there are no outstanding dues or liabilities remaining in that account at a specific point in time. This letter is especially important when closing an account, applying for loans, or entering into financial agreements with other businesses. The Zero balance letter template for business usually includes the following key elements: 1. Business Information: The letter begins by stating the name, address, and contact details of the company issuing the letter. This information helps in identifying and verifying the legitimacy of the document. 2. Account Information: The template includes sections to fill in the account details, such as the account number, type of account, and the name of the financial institution where the account is held. This helps in accurately identifying the specific account being referred to. 3. Account Balance Confirmation: The main content of the letter confirms that the account has a zero balance. It may mention the date until which the balance is zero and is applicable. This reassures the recipient that the account is free from any obligations or dues. 4. Authentication: The template may contain a section for authorized signatures and official stamps to validate the letter's authenticity. This enhances the credibility of the document and ensures its acceptance by third parties. Different types of Zero balance letter templates for business may include: 1. Account Closure Zero Balance Letter: This type of letter is issued when a company decides to close an account. It serves as an official confirmation that there are now pending obligations, ensuring a clean break between the company and the financial institution. 2. Loan Application Zero Balance Letter: When applying for a loan, financial institutions often require proof of existing accounts with no outstanding balance. This letter template helps the applicant assure the lender that they have a good credit history and can be trusted with the loan amount. 3. Business Agreement Zero Balance Letter: In cases where one business entity enters into a financial agreement with another, a zero balance letter may be required as supporting documentation. It confirms that the account in question poses no potential risks and is suitable for carrying out the agreed-upon financial transactions. In conclusion, a Zero balance letter template for business is a standardized document used by companies to confirm that a specific account has a zero or nil balance. It plays a crucial role in various financial scenarios, including account closure, loan applications, and business agreements.

Zero Balance Letter Template For Business

Description zero demand letter

How to fill out Zero Balance Letter Template For Business?

Legal management can be frustrating, even for the most experienced professionals. When you are looking for a Zero Balance Letter Template For Business and don’t have the a chance to spend looking for the correct and updated version, the operations may be nerve-racking. A robust web form catalogue might be a gamechanger for anybody who wants to handle these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available to you whenever you want.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any demands you might have, from individual to organization papers, all in one spot.

- Make use of innovative resources to finish and handle your Zero Balance Letter Template For Business

- Access a useful resource base of articles, guides and handbooks and materials highly relevant to your situation and requirements

Save effort and time looking for the papers you need, and utilize US Legal Forms’ advanced search and Review feature to get Zero Balance Letter Template For Business and acquire it. For those who have a subscription, log in in your US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to find out the papers you previously saved as well as to handle your folders as you can see fit.

If it is the first time with US Legal Forms, register an account and obtain unlimited use of all advantages of the platform. Here are the steps for taking after accessing the form you want:

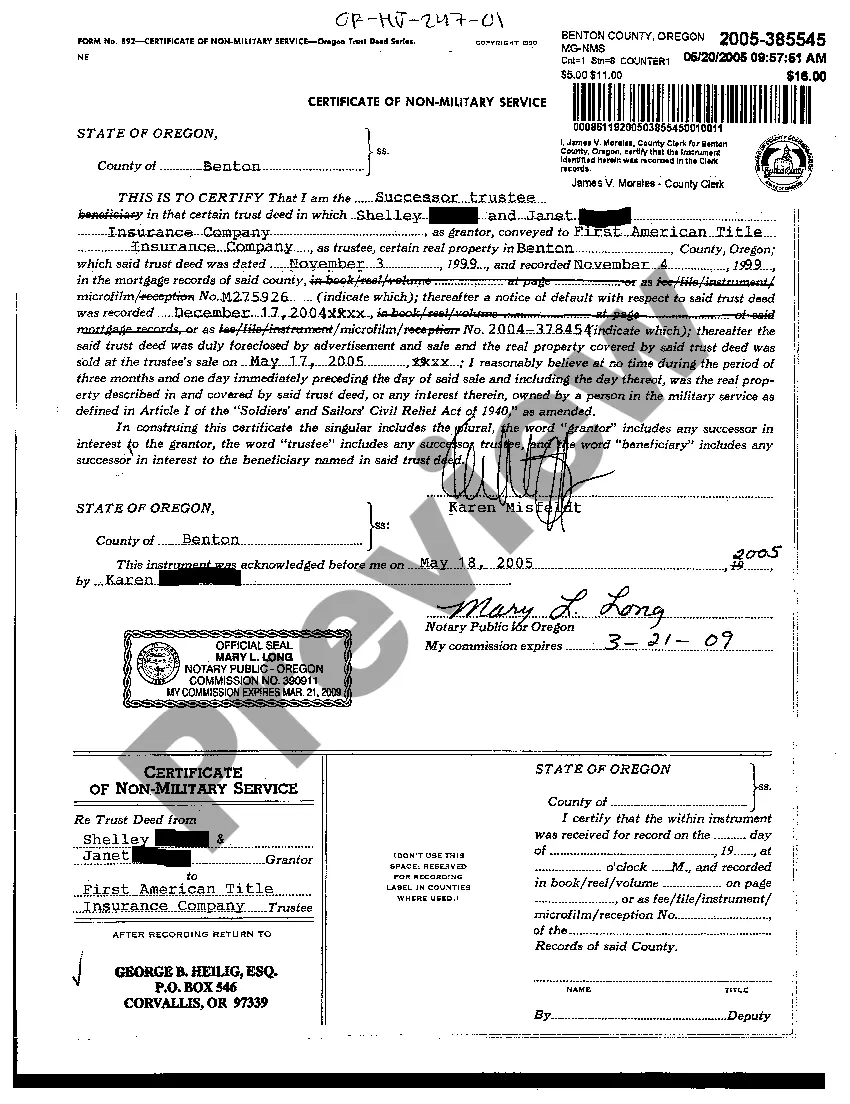

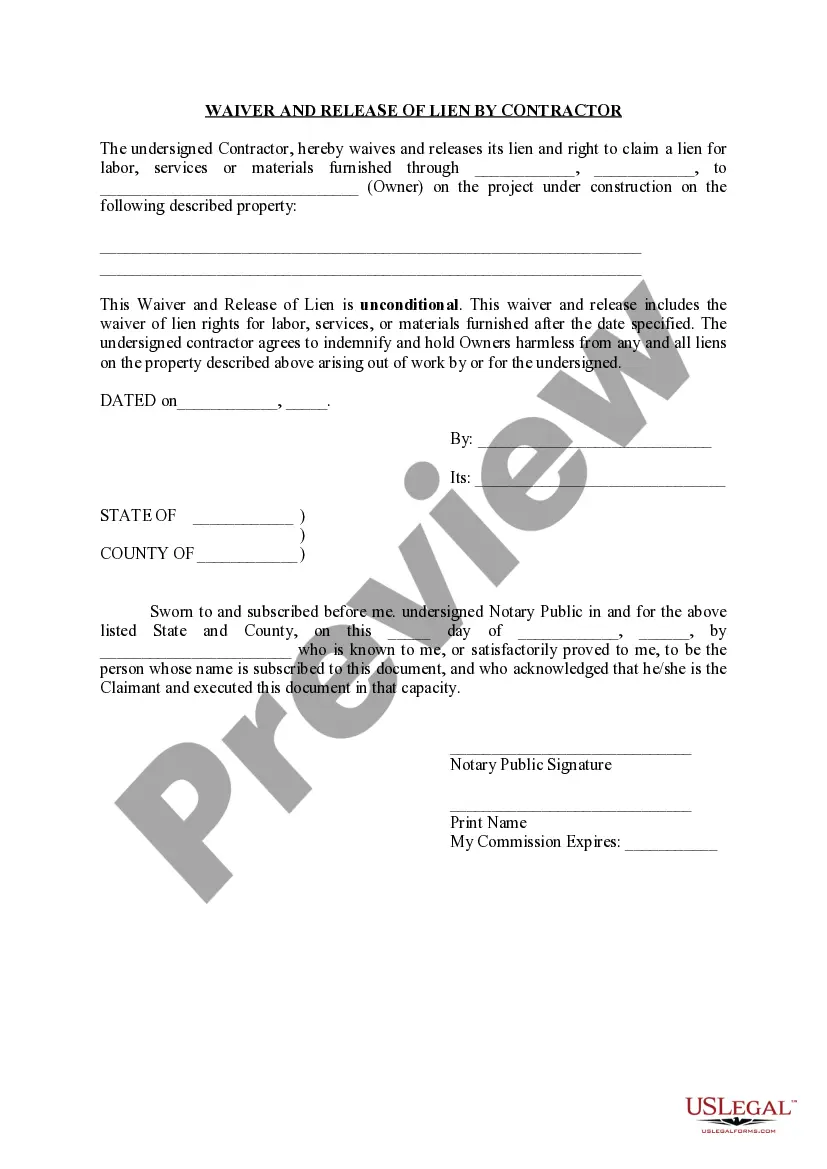

- Verify this is the proper form by previewing it and looking at its information.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now once you are all set.

- Choose a monthly subscription plan.

- Pick the formatting you want, and Download, complete, sign, print out and deliver your papers.

Take advantage of the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Change your everyday papers administration into a smooth and user-friendly process today.

0 balance letter Form popularity

request letter for zero balance account Other Form Names

FAQ

Responding to a Summons In most civil law suits, a person has 21 days in which to answer the complaint or petition. If the person is served outside of Utah, they have 30 days in which to answer.

You must also send an application to the Utah Bureau of Criminal Information for certification of your ability to change your name. Finally, you must attend a short court hearing. The court filing fee is $360. Utah has adopted the common law that says people should be able to choose about any name they want.

Most Defendants file an Answer to the Complaint. If the Plaintiff did not follow the rules when serving you with the Complaint, the Complaint is missing certain information, or the Complaint shows that the Plaintiff cannot win, it may be possible to file a Motion to Dismiss the Complaint instead.

In general, the defendant has 30 days to answer. If the defendant doesn't answer in time, the Court can enter a default judgment.

Rule 12(b) (6) permits the dismissal of a case "for failure of the pleading to state a claim upon which relief can be granted." Rule 8(a) sets out what a complaint must contain in order to state a claim for relief: "A pleading which sets forth a claim for relief * * * shall contain (1) a short and plain statement of ...

Time to Respond The summons will say how many days the defendant has to respond. In most cases, if the defendant is served in Utah, they must file their answer within 21 calendar days after the date of service. If the defendant is served outside Utah, they must file an answer within 30 calendar days after service.