Acknowledgement Of Paternity Form In Texas

Description acknowledgment of paternity form texas

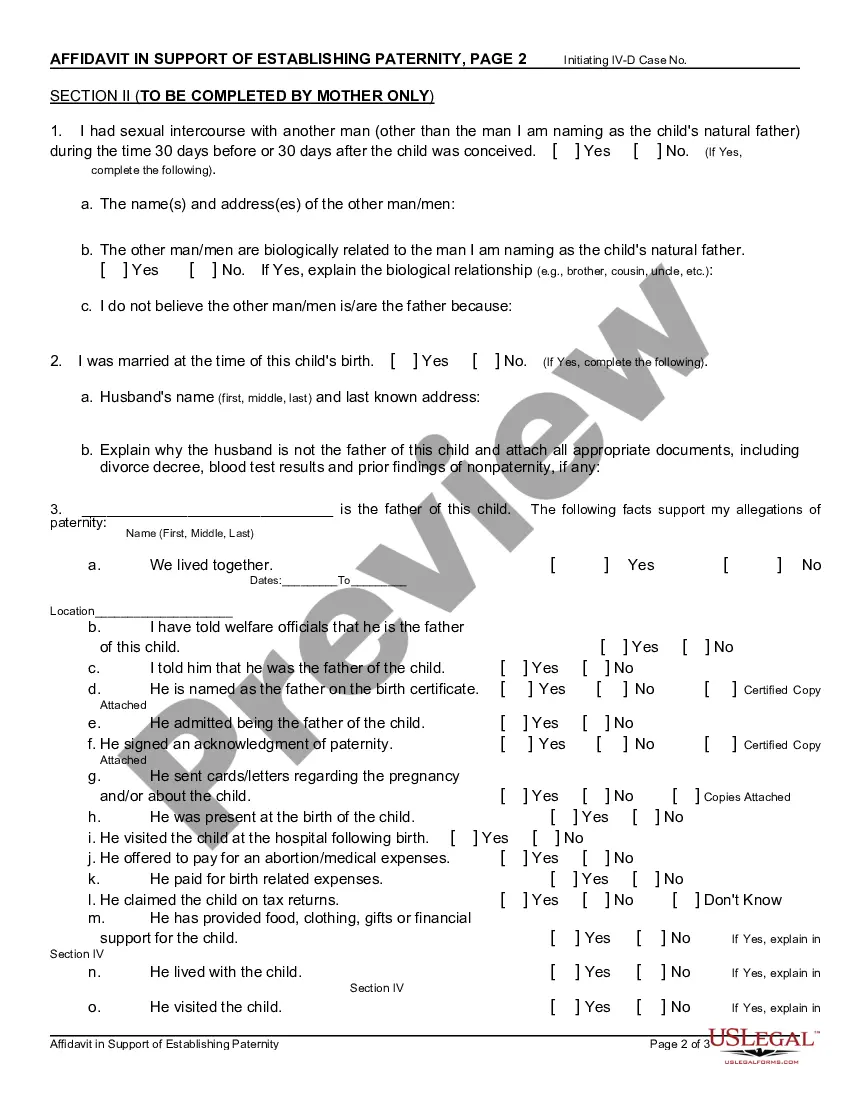

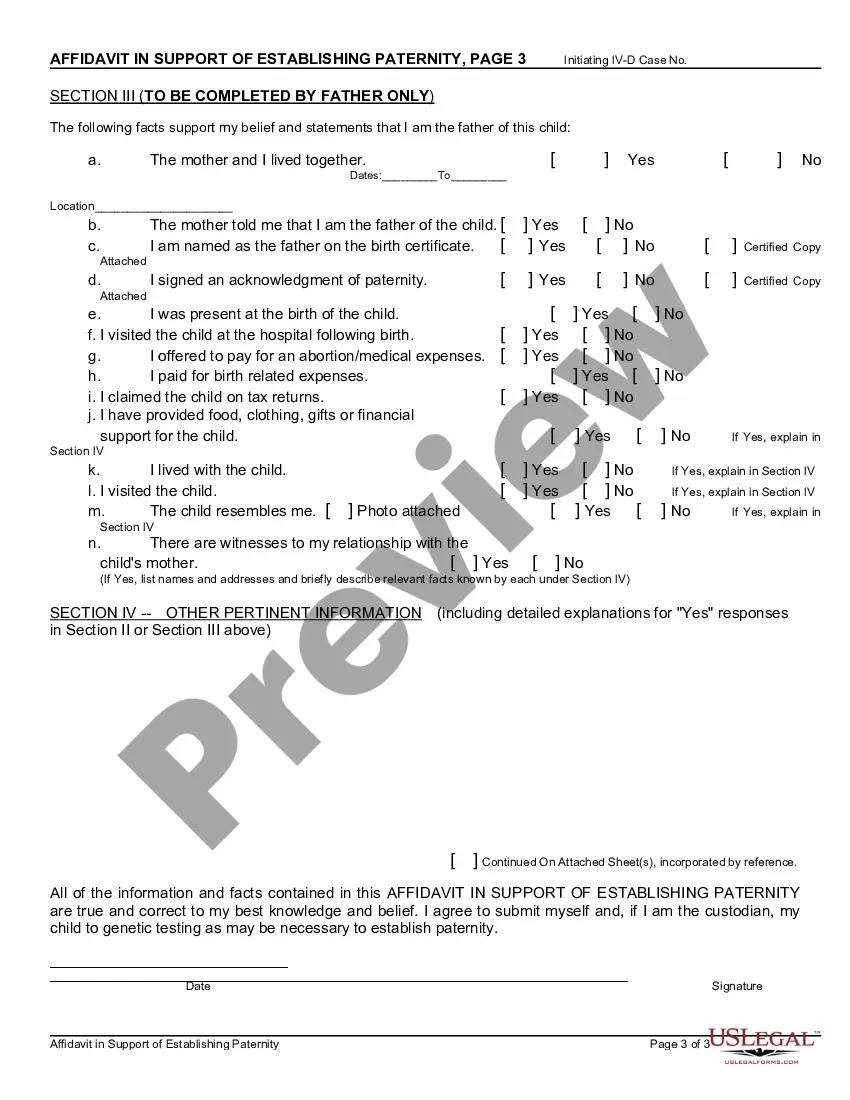

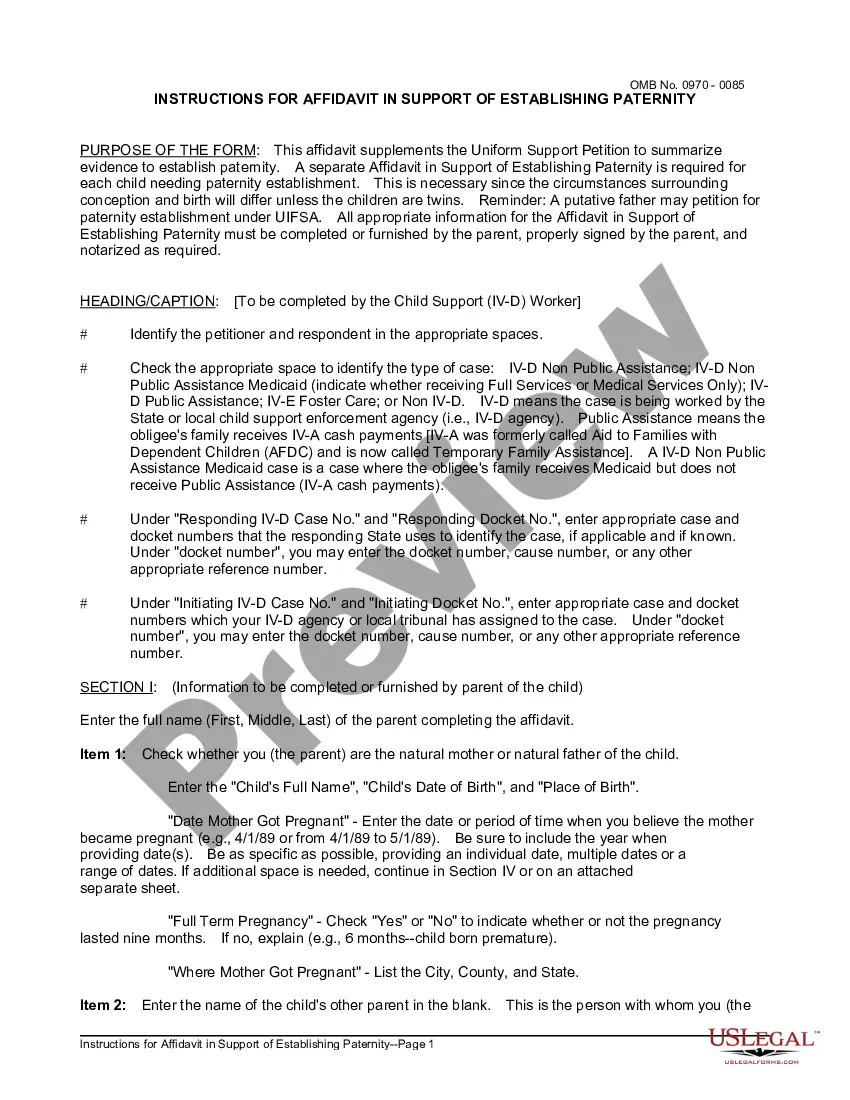

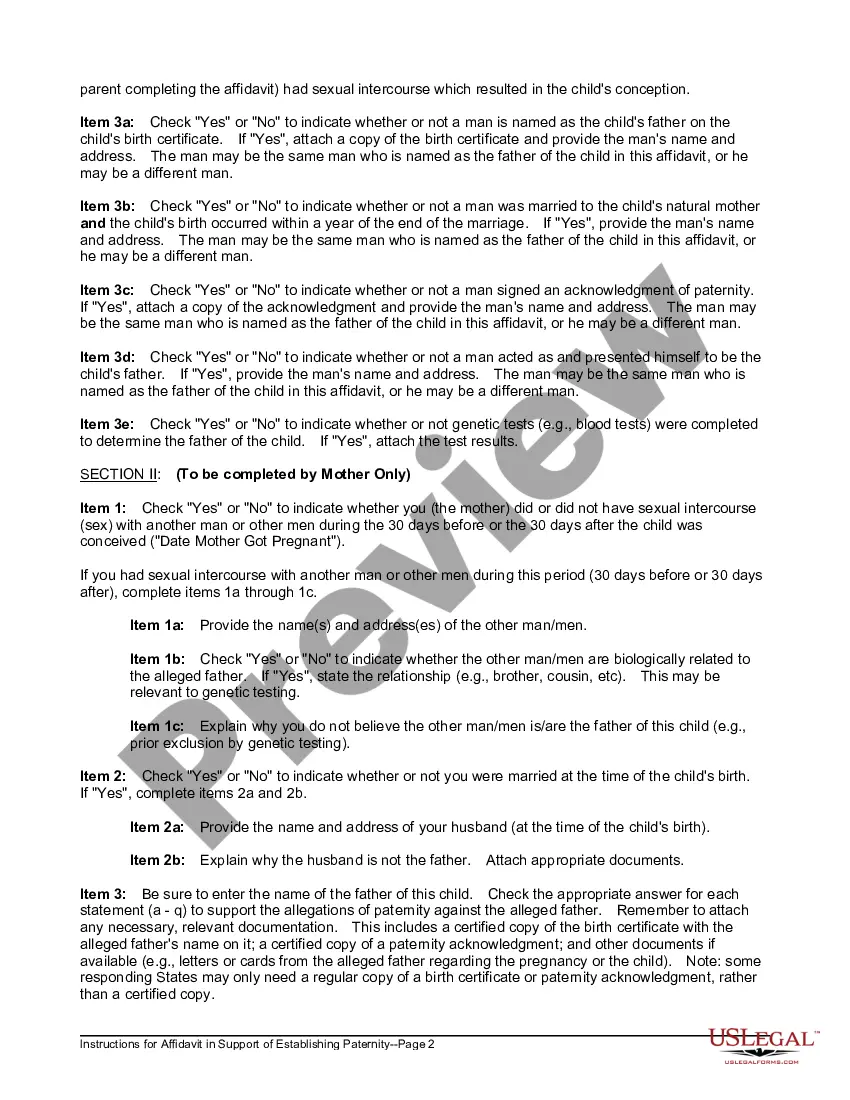

How to fill out Affidavit Of Admission Of Paternity?

The Acknowledgement Of Paternity Form In Texas you see on this page is a multi-usable legal template drafted by professional lawyers in line with federal and regional laws. For more than 25 years, US Legal Forms has provided individuals, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Acknowledgement Of Paternity Form In Texas will take you only a few simple steps:

- Search for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it satisfies your needs. If it does not, utilize the search bar to get the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Pick the format you want for your Acknowledgement Of Paternity Form In Texas (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a eSignature.

- Download your papers again. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

aop texas Form popularity

acknowledgement of paternity texas Other Form Names

paternity form FAQ

Mortgage Promissory Notes: 12-Year Statute of Limitations When you get a mortgage loan to buy a house in Maryland, you give the lender a Deed of Trust, which gives them the right to foreclose if you default. You also give the lender a separate promissory note that obligates you to repay all the money they lent.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

A deed of trust is an agreement where the borrower is using the property to secure a loan. A deed of trust is very similar to a mortgage, but there are key differences between a deed of trust and a mortgage. For example, mortgages generally have two parties: the borrower and the lender.

In Maryland a deed must include the name of the grantor and the grantee, the consideration paid for the property. In addition, there must be a preparer's certification and an acknowledgment by a notary public or authorized court officer.

The Maryland deed of trust is broken down into sections A- Q, and then1 -25. The deed of trust is a rather lengthy document usually 15 pages with additional rider pages when applicable. Section A ?G is the basic information of the borrower(s), lender and trustee.

A "Short Form Deed of Trust" is a document that is used to secure a promissory note by using real estate as collateral. When filing a Deed of Trust, it places a lien against the property.

Deeds of trust and mortgages are both acceptable under Maryland law, however, deeds of trust are used in almost every residential transaction. Under Maryland Real Property §7-105 and Maryland Rule 14-214(b)(2), corporate trustees may not exercise the power of sale.