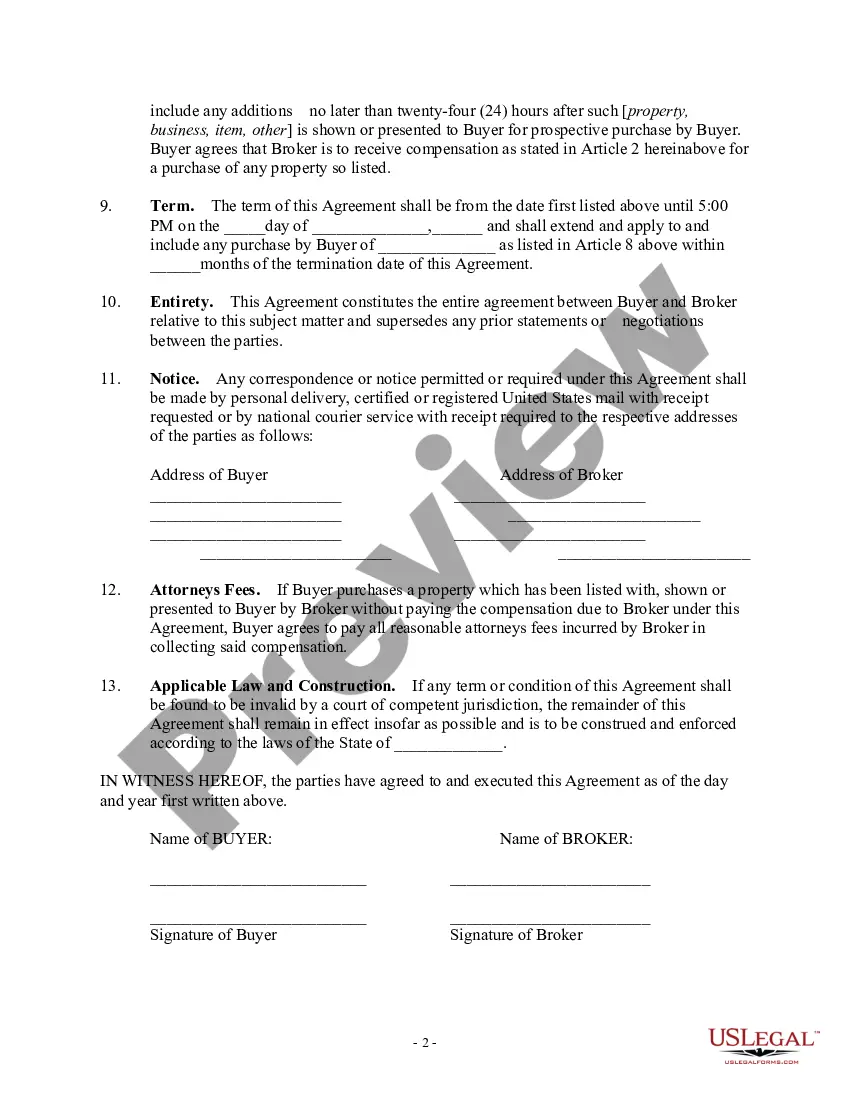

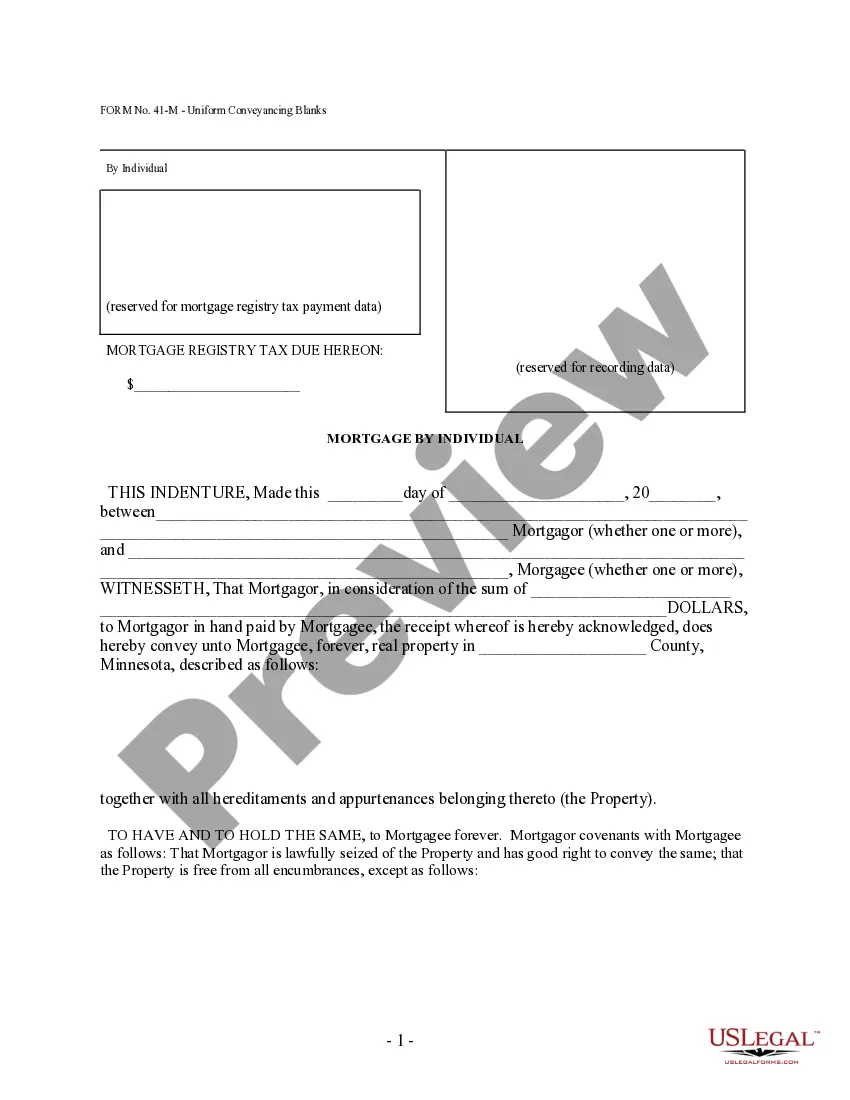

Insurance Broker Agreement With Client

Description

How to fill out Insurance Broker Agreement With Client?

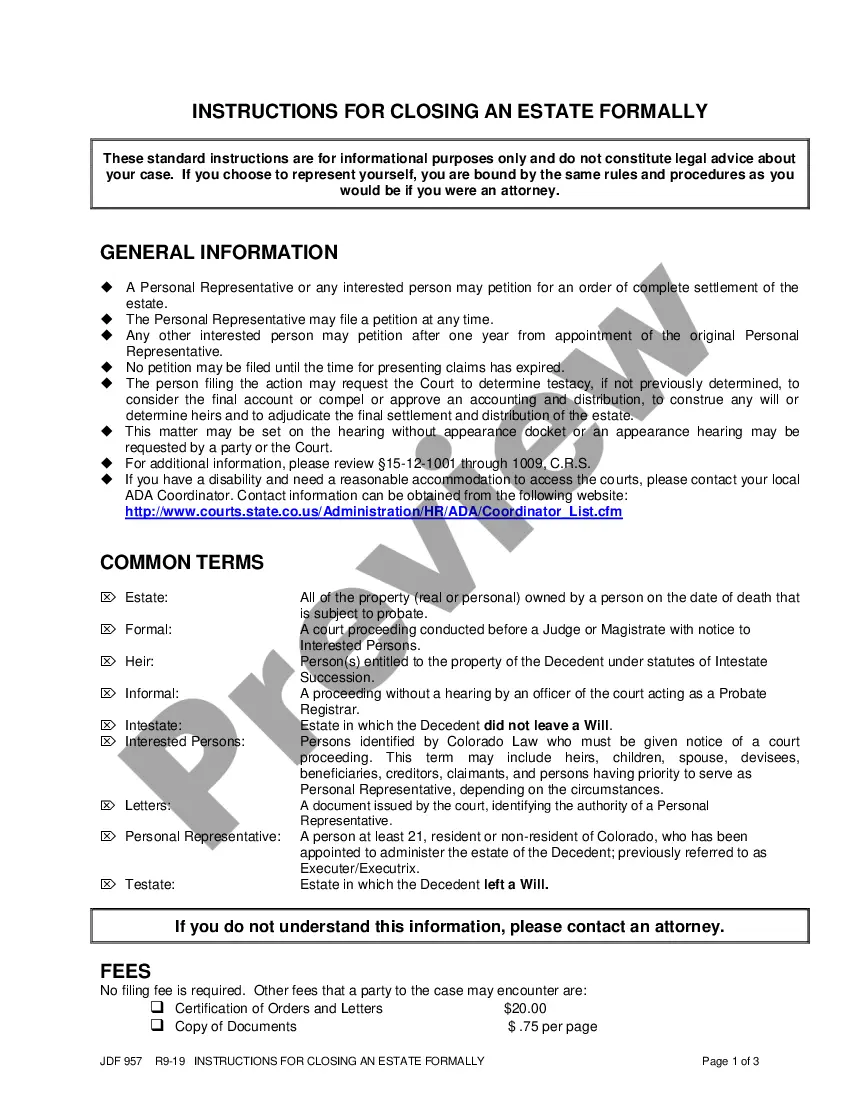

Individuals often connect legal documentation with something intricate that only an expert can manage.

In a sense, this is accurate, as composing an Insurance Broker Agreement With Client demands considerable understanding of subject matter, including state and local regulations.

Nonetheless, with US Legal Forms, everything has turned more user-friendly: pre-prepared legal documents for any personal and commercial situation related to state laws are gathered in a singular online collection and are now accessible to all.

Choose the pricing plan that best suits your needs and budget. Set up an account or Log In/">Log In to move on to the payment step. Complete the payment for your subscription using PayPal or a credit card. Choose the file format you desire and click Download. You can print your document or transfer it to an online editor for quicker completion. All templates in our library are reusable: once acquired, they remain stored in your profile. You can access them anytime through the My documents section. Experience all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms sorted by state and usage area, making it easy to find an Insurance Broker Agreement With Client or any specific template in just a few minutes.

- Previously registered individuals with a valid subscription must Log In/">Log In to their account and click Download to obtain the document.

- New users on the platform will need to create an account and subscribe first before they can access and download any documentation.

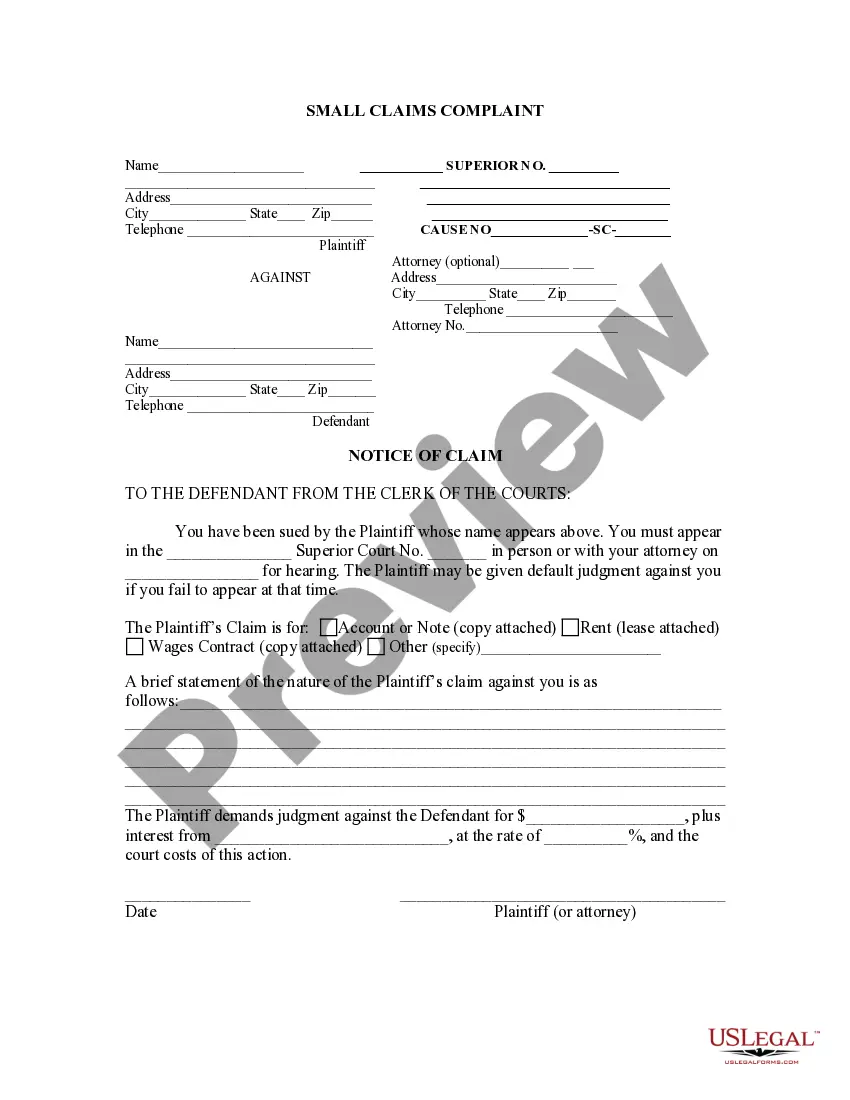

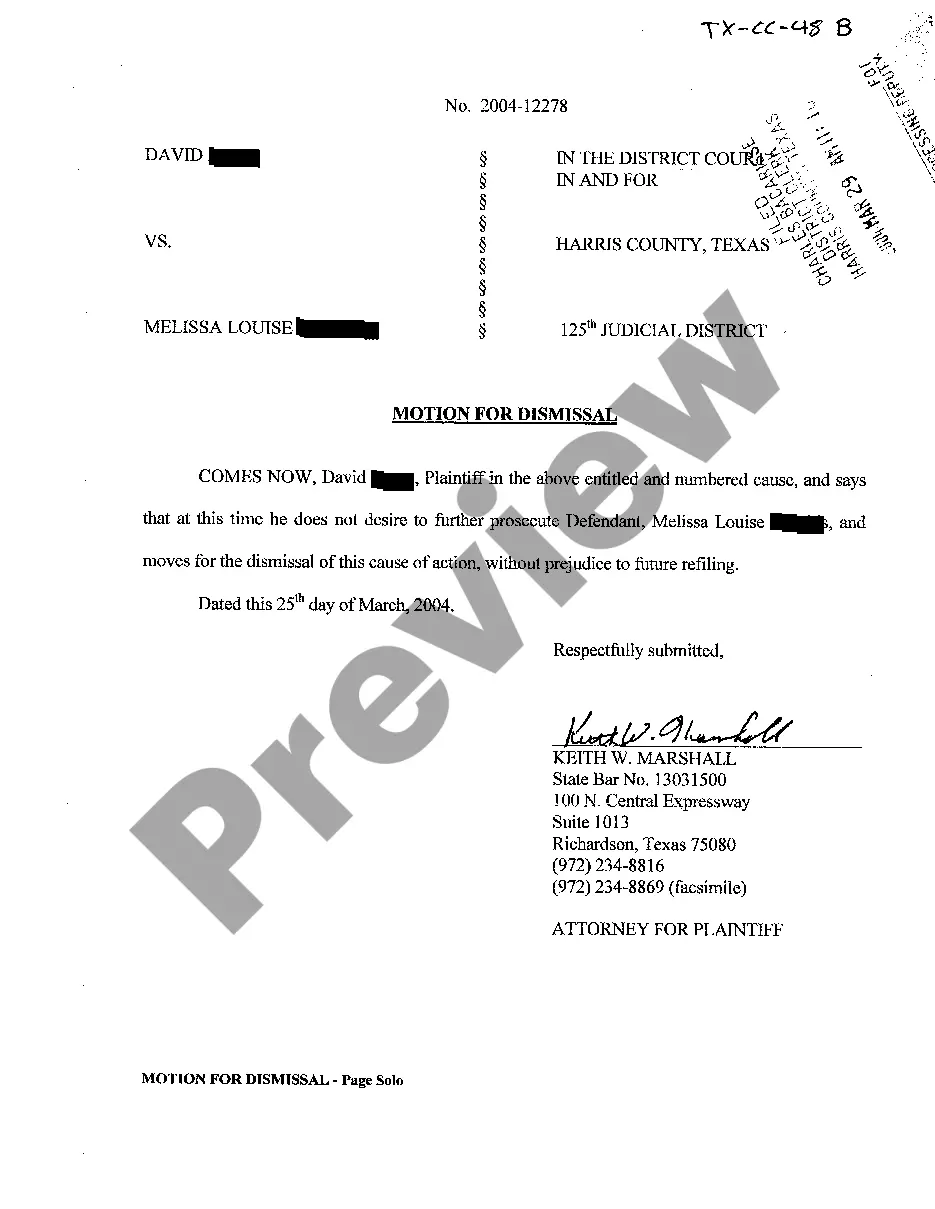

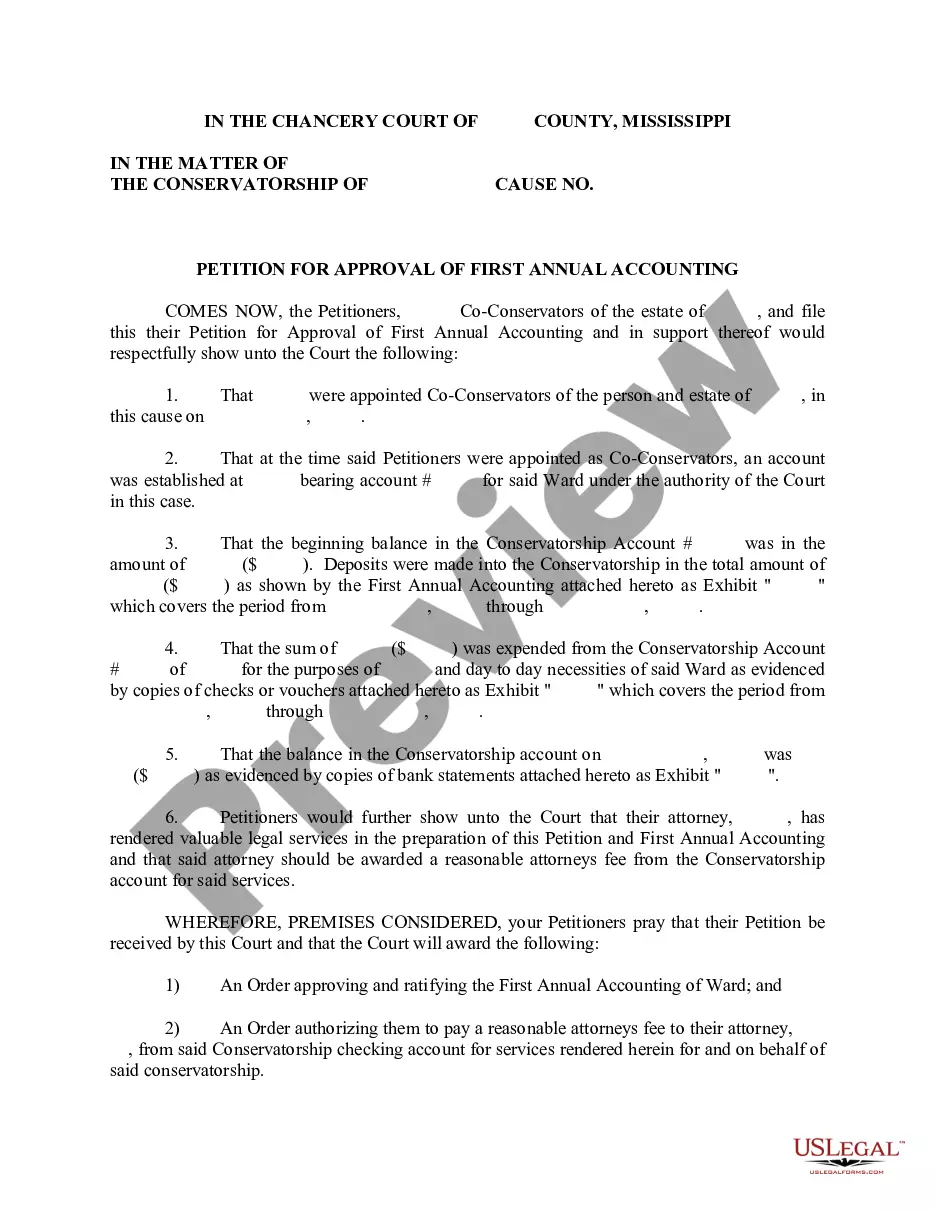

- Here is a detailed guide on how to obtain the Insurance Broker Agreement With Client.

- Carefully examine the page content to make sure it meets your requirements.

- Review the form description or check it via the Preview feature.

- If the initial document isn’t suitable, search for another example using the Search bar at the top.

- Once you find the appropriate Insurance Broker Agreement With Client, click Buy Now.

Form popularity

FAQ

An insurance broker is a professional who represents consumers in their search for the best policy for their needs. Brokers work closely with their clients to research the client's needs.

Insurance brokers acting on behalf of an insured can be paid for their services in a variety of ways. The most straightforward method is a simple fee arrangement between broker and client. More commonly, the broker earns a commission, which is agreed with the insurer but taken out of the premium paid by the insured.

Most commissions are between 2% and 8% of premiums, depending on state regulations. Brokers sell all insurance types, including health insurance, homeowner insurance, accident insurance, life insurance, and annuities.

E.g. by adding language along the lines A Broker Insurance Document is provided by (name broker) as evidence of cover for this insurance contract solely in their capacity as agent of the insured and it is not an insurer approved document.

All insurance brokers must disclose the Nature (type of remuneration i.e. commission) and Basis (source of the remuneration i.e. insurer) of the remuneration, but it stops short of having to disclose the actual earning figure in cash terms.