Sample Certificate Of Completion For Insurance Claim

Description insurance completion certificate

How to fill out Sample Certificate Of Completion For Insurance Claim?

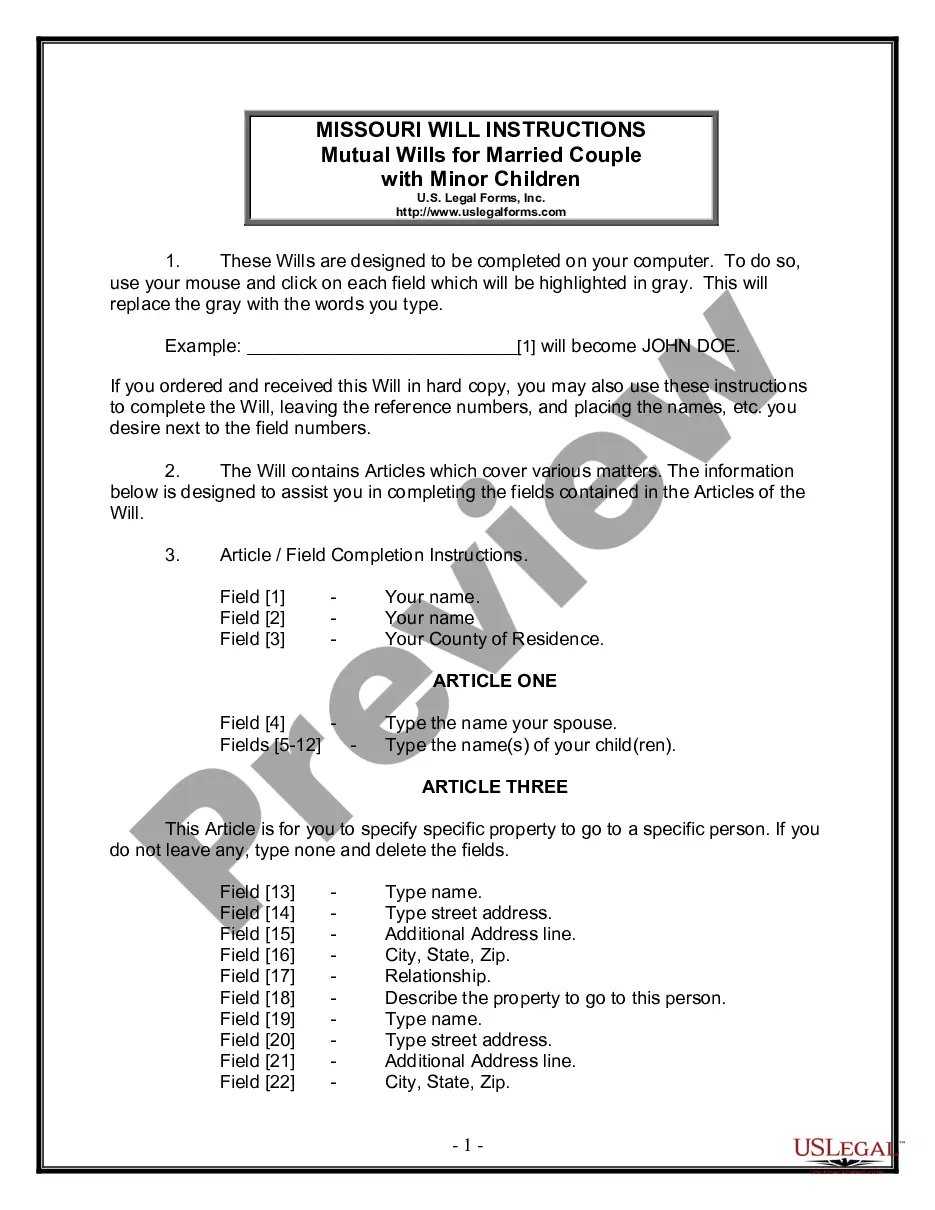

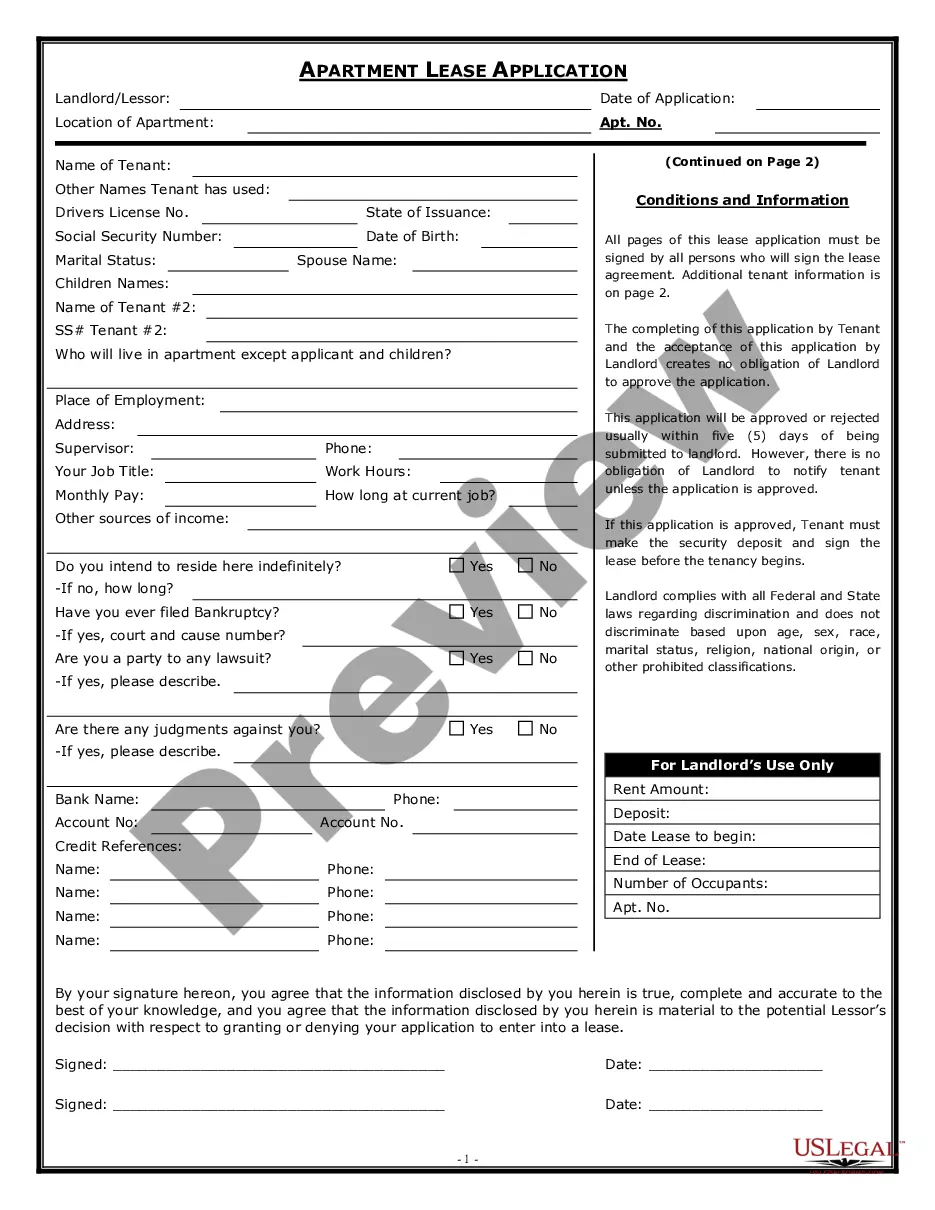

Whether for business purposes or for individual matters, everyone has to deal with legal situations at some point in their life. Completing legal paperwork needs careful attention, starting with choosing the proper form template. For instance, if you select a wrong version of the Sample Certificate Of Completion For Insurance Claim, it will be rejected once you send it. It is therefore important to have a dependable source of legal documents like US Legal Forms.

If you have to obtain a Sample Certificate Of Completion For Insurance Claim template, follow these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Check out the form’s description to ensure it matches your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to locate the Sample Certificate Of Completion For Insurance Claim sample you require.

- Download the template when it meets your needs.

- If you already have a US Legal Forms profile, simply click Log in to gain access to previously saved templates in My Forms.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Choose the document format you want and download the Sample Certificate Of Completion For Insurance Claim.

- Once it is saved, you can fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time looking for the right sample across the internet. Use the library’s easy navigation to find the right form for any occasion.

Form popularity

FAQ

Admitting fault: Using apologetic language is enough for the insurance adjuster to assume you're admitting fault and use that against you. Even if you feel you're at fault, wait for the official investigation to prove what actually happened. Don't say things like ?I'm sorry? or ?it was my fault.?

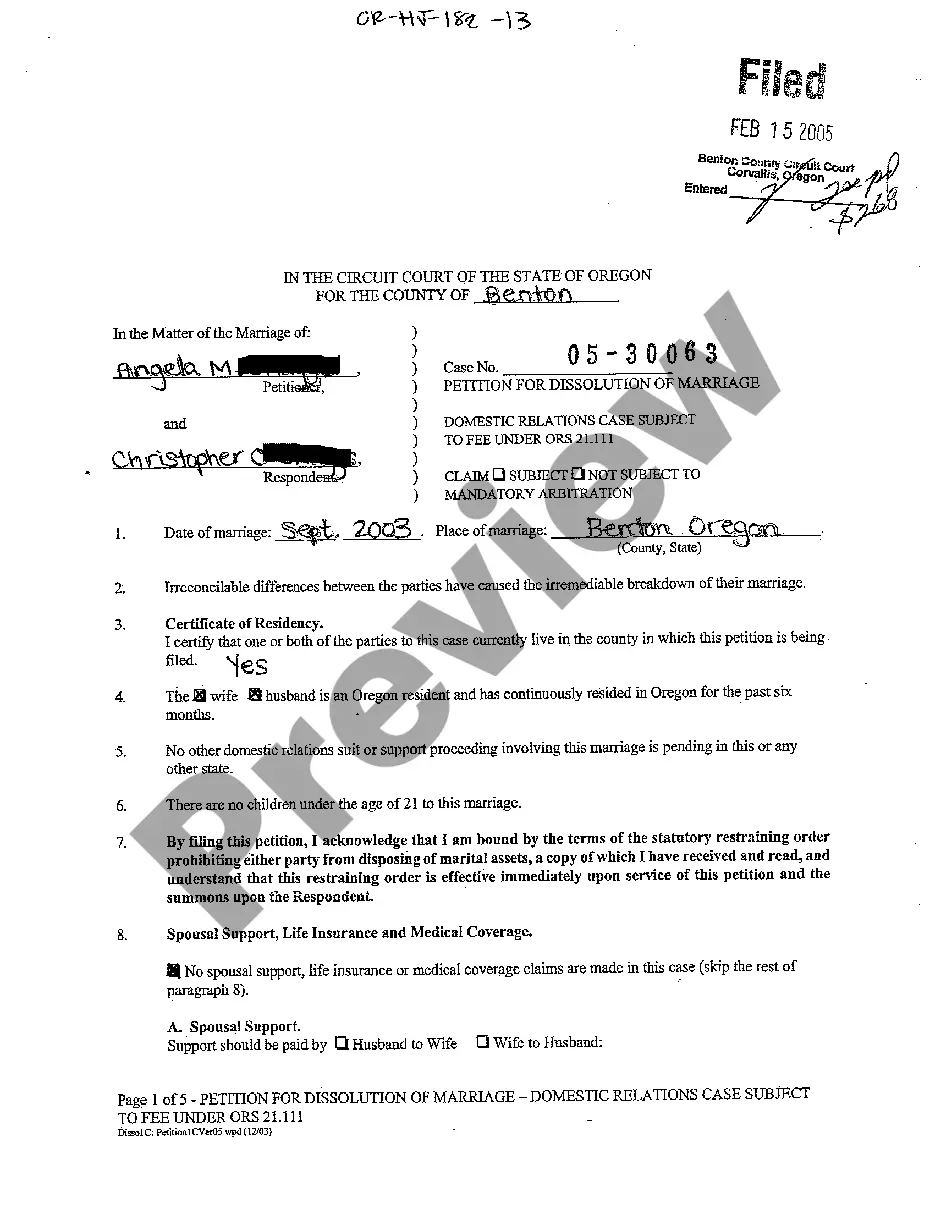

Step-by-step procedure to file a claim Contact your insurer. The first step of claim process is to contact your insurer and intimate about the claim. Fill your claim form and attach the relevant documents. A surveyor conducts damage evaluation. Acceptance of your claim. Get the claim amount.

An insurance claim letter is an important part of any insurance claim process. It helps the accredited insurance adjuster understand how much money you are requesting to cover the damage. At minimum the letter should include information about the accident, the policy number, the date of loss, and the amount claimed.

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred. Cause of the loss. Identity of party claiming the loss.

You can induce fear by countering with the amount you will accept. To show that you mean business, a lawyer might write a letter that: States clearly that the settlement offer you received is unacceptable. Responds to any inaccurate statements in the insurance adjuster's correspondence to you.