Securities Agreement Collateral Without

Description

How to fill out Securities Agreement Collateral Without?

When you need to complete a Securities Agreement Collateral Without that adheres to your local state's regulations, there can be numerous choices available.

There's no necessity to inspect every document to confirm it meets all the legal requirements if you are a subscriber to US Legal Forms.

It is a reliable resource that can aid you in acquiring a reusable and current template on any subject.

Utilizing expertly crafted official documents is easy with US Legal Forms. Furthermore, Premium users can also benefit from the powerful integrated tools for online PDF editing and signing. Try it out today!

- US Legal Forms is the largest online repository with a compilation of over 85,000 ready-to-use documents for business and personal legal needs.

- All templates are verified to comply with each state's laws and regulations.

- Hence, when you download a Securities Agreement Collateral Without from our platform, you can be assured that you possess a valid and current document.

- Retrieving the necessary template from our site is exceedingly straightforward.

- If you already have an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile to have access to the Securities Agreement Collateral Without at any time.

- If this is your initial experience with our library, please follow the instructions below.

- Browse the suggested page and verify it against your criteria.

Form popularity

FAQ

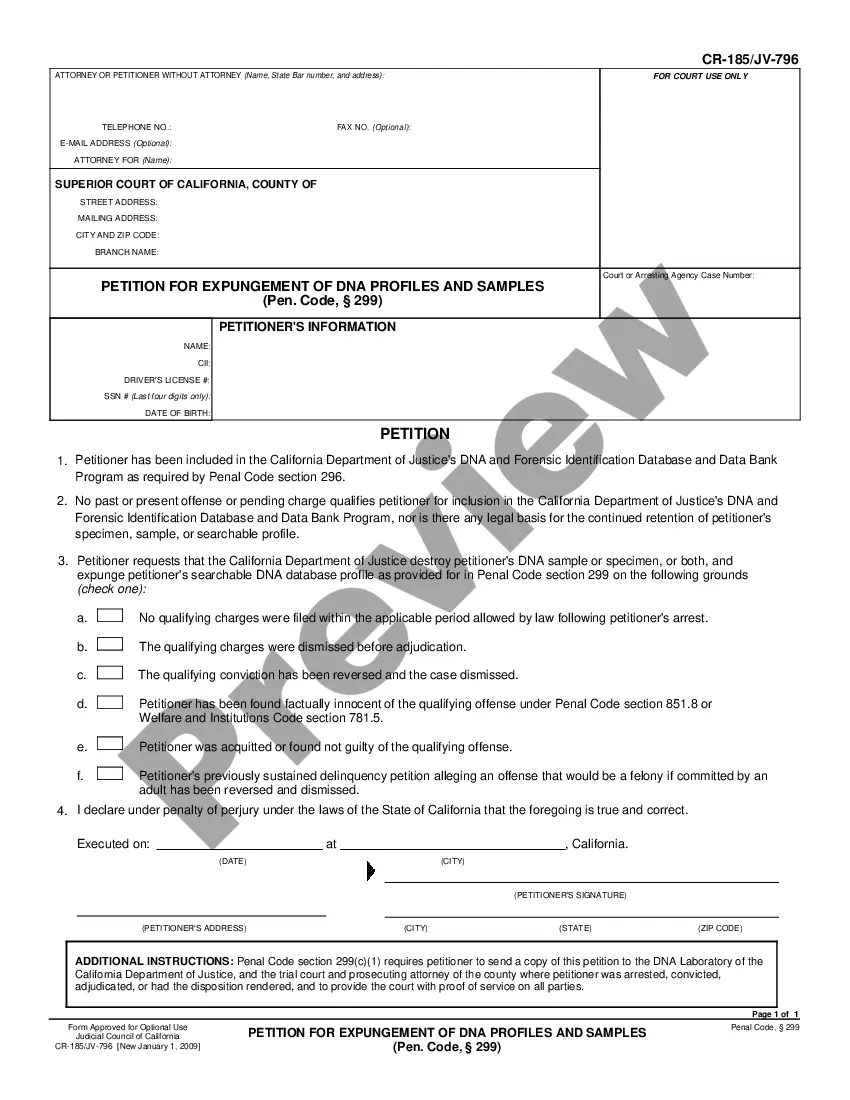

Summary: Thus, when the collateral is not in the possession of the secured party, a security agreement must be in writing to be enforceable. The agreement must be signed by the debtor, contain a description of the property, and the description must reasonably identify the property involved (the collateral).

Collateral descriptions often include an after-acquired property clause to include within the scope of the collateral certain property that was not in the debtor's possession when the security agreement was executed but which may come into the debtor's possession afterward.

For purposes of attachment, the debtor must "authenticate" a security agreement. In other words, the debtor must sign the agreement....The UCC specifies what must be contained in a financing statement:the name of the debtor.the name of the secured party; and.an indication of the collateral.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved.

According to UCC Section 9-504, a financ- ing statement sufficiently indicates the collateral that it covers if the financing statement provides (1) a description of the collateral pursuant to UCC Section 9-108, or (2) a generic description of all assets or all personal property of the debtor if the description of