Sale Of Home Worksheet With Answers

Description

How to fill out Sale Of Home Worksheet With Answers?

Individuals generally connect legal documentation with something intricate that only an expert can handle.

In a certain sense, this is accurate, as creating a Sale Of Home Worksheet With Answers requires considerable knowledge in subject criteria, including local and regional regulations.

However, with US Legal Forms, matters have become simpler: ready-to-use legal templates for any personal and business situation tailored to state laws are gathered in a single online collection and are now accessible to all.

Sign up for an account or Log In to continue to the payment page. Complete your subscription payment via PayPal or using your credit card. Select the format for your document and click Download. Print your document or import it into an online editor for quicker completion. All templates in our library are reusable: once purchased, they are stored in your profile. You can access them anytime needed through the My documents tab. Discover all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85,000 current forms organized by state and application area, making it quick to search for Sale Of Home Worksheet With Answers or any other specific document.

- Registered users with an active membership must Log In to their account and click Download to get the form.

- New users need to register for an account and subscribe before they can download any documents.

- Here is a step-by-step guide on how to obtain the Sale Of Home Worksheet With Answers.

- Carefully review the page content to ensure it aligns with your requirements.

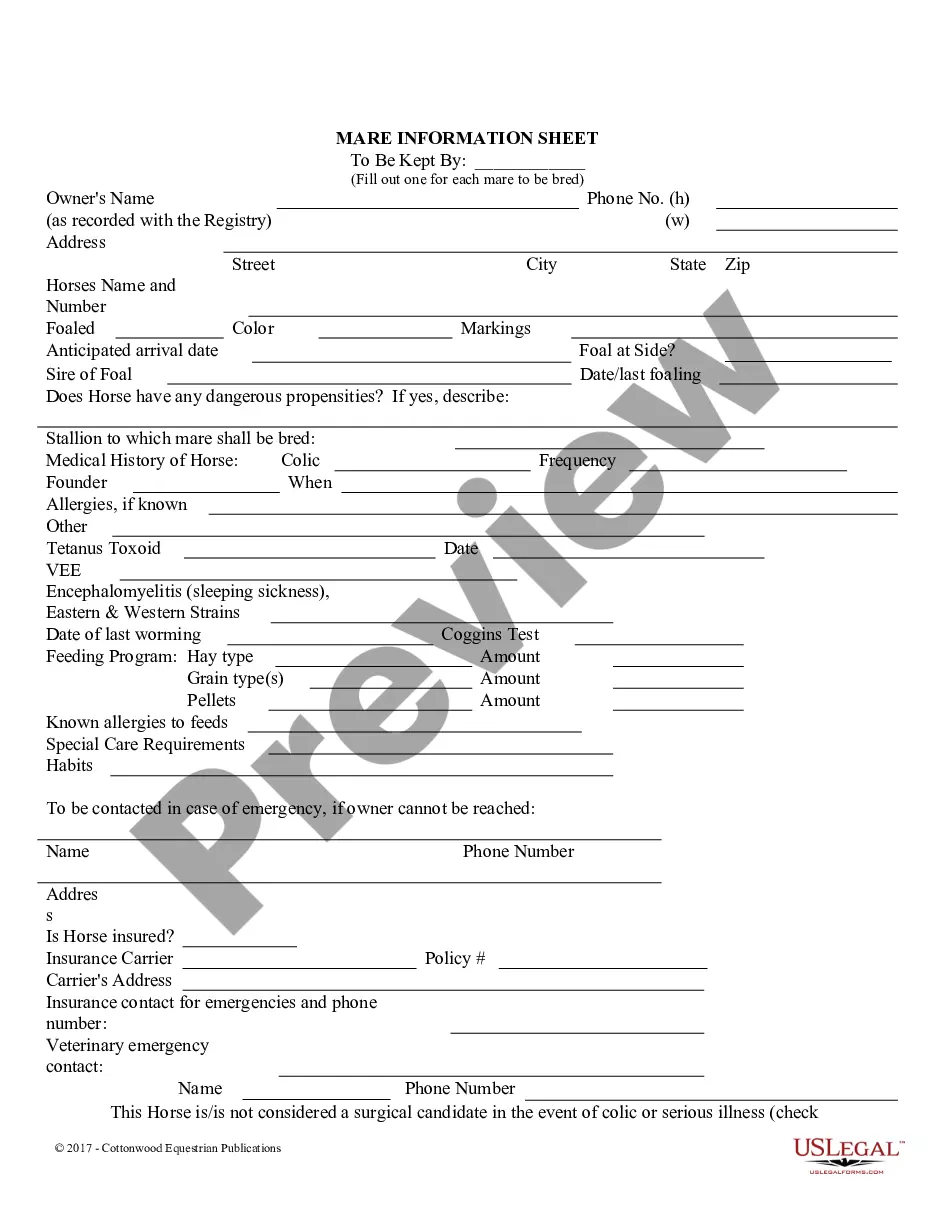

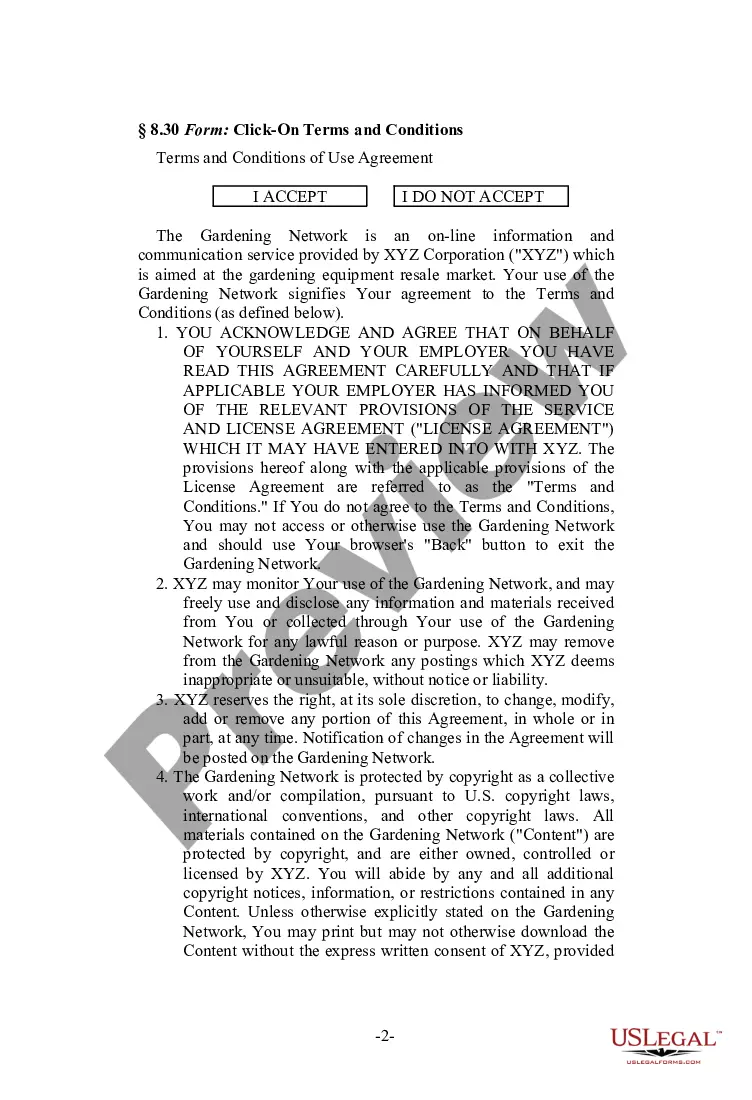

- Read the form description or review it using the Preview option.

- If the prior one doesn't meet your needs, find another template using the Search bar above.

- When you locate the appropriate Sale Of Home Worksheet With Answers, click Buy Now.

- Choose a pricing plan that suits your needs and financial situation.

Form popularity

FAQ

Receiving a 1099 form when selling a house is common but not guaranteed. A 1099-S is issued if the sale meets specific reporting thresholds. Utilizing the sale of home worksheet with answers can help track your transaction details and ensure you understand any documentation you may receive. This can provide clarity on your tax obligations following the sale.

Often, the profit from selling your house can be taxable income, especially if it exceeds certain thresholds. The IRS allows an exclusion for profits from the sale of your primary residence, which may reduce or eliminate your taxable amount. Using the sale of home worksheet with answers aids in determining whether your gain is subject to taxes. Always consider your unique situation, as tax rules can vary.

To report the sale of your house, you typically need to fill out Schedule D and Form 8949 on your tax return. These forms allow you to calculate capital gains and losses. The sale of home worksheet with answers simplifies this process by providing a clear format to gather your financial information. By keeping accurate records, you will be better prepared for tax season.

Yes, reporting the sale of your house to the IRS is necessary in many circumstances. If you make a profit beyond the exemption limit, you must disclose it on your tax return. The sale of home worksheet with answers can guide you on what to report based on your specific situation. Always consult a tax professional for personalized advice.

To avoid paying capital gains on a house sale, familiarize yourself with available exemptions, such as the primary residence exclusion. Additionally, consider strategies like 1031 exchanges for investment properties or reinvesting gains into a new primary residence. Using a sale of home worksheet with answers can guide you in documenting these details to maximize your tax benefits.

The 90% rule refers to the stipulation that to qualify for the primary residence exclusion, you must occupy the property as your primary residence for at least 90% of the time you own it. This means that if you sell before meeting this requirement, you may face capital gains tax. Utilize a sale of home worksheet with answers to monitor how long you’ve lived in the home to ensure you comply with this rule.

One effective method to avoid capital gains tax involves utilizing the primary residence exclusion. If you have lived in your home for at least two of the past five years, you may be exempt from capital gains taxes on profits up to $250,000 for single filers and $500,000 for married couples. Consider using a sale of home worksheet with answers to help you track your residency status and calculate potential gains or losses.

Closing costs can be included in the adjusted basis of your home. This means that when filling out a sale of home worksheet with answers, it’s important to consider these costs. They can significantly impact your overall tax situation. Including closing costs helps you establish a more accurate financial picture when calculating gains.