General Partnership Agreement With Shares

Description

How to fill out General Partnership Agreement With Shares?

Bureaucracy necessitates exactness and correctness.

If you do not manage filling out documentation like the General Partnership Agreement With Shares daily, it may lead to some misunderstanding.

Choosing the correct example from the outset will guarantee that your document submission proceeds seamlessly and avert any troubles of having to resubmit a document or redo the same task from the beginning.

Finding the correct and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and enhance your form handling efficiency.

- Locate the template by utilizing the search bar.

- Verify that the General Partnership Agreement With Shares you’ve discovered is applicable for your state or area.

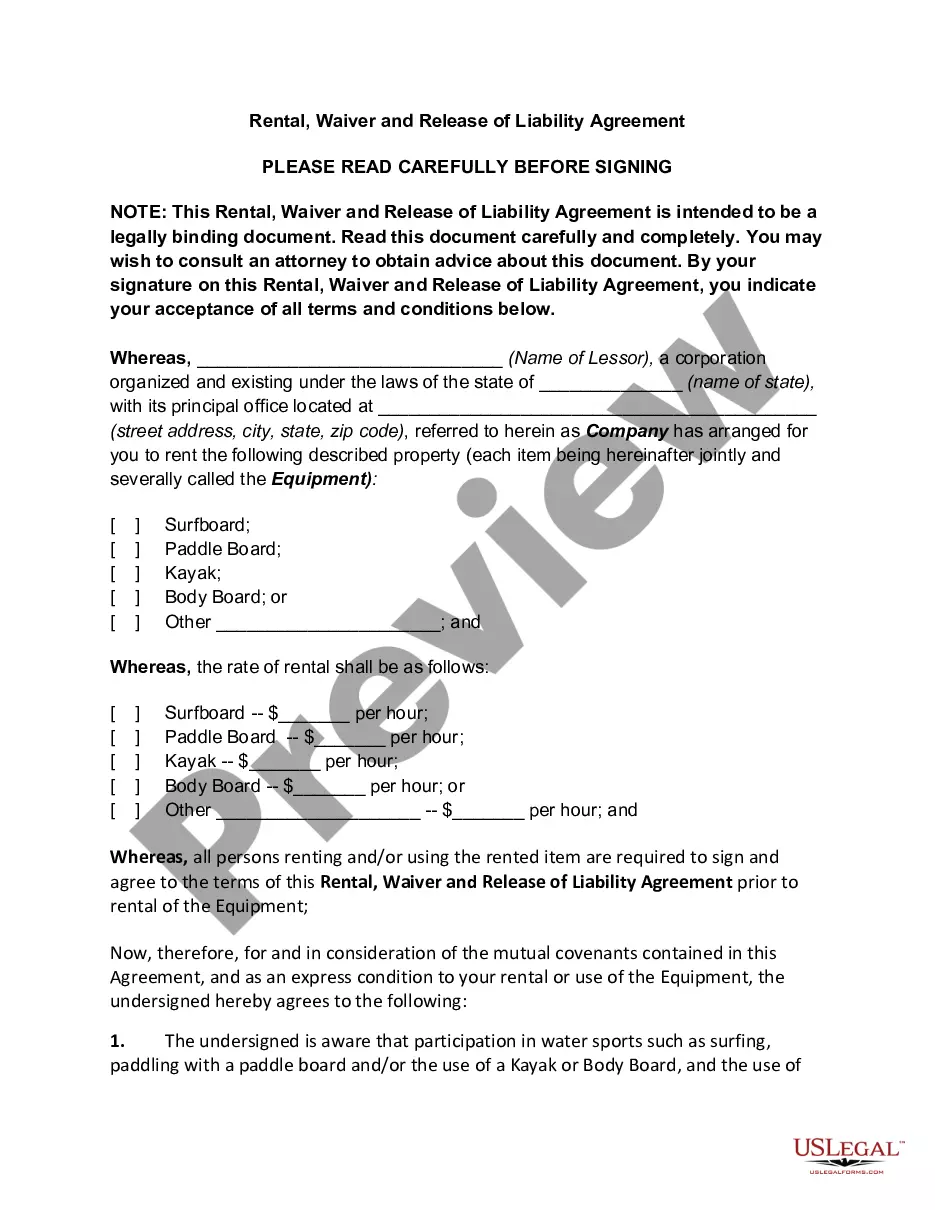

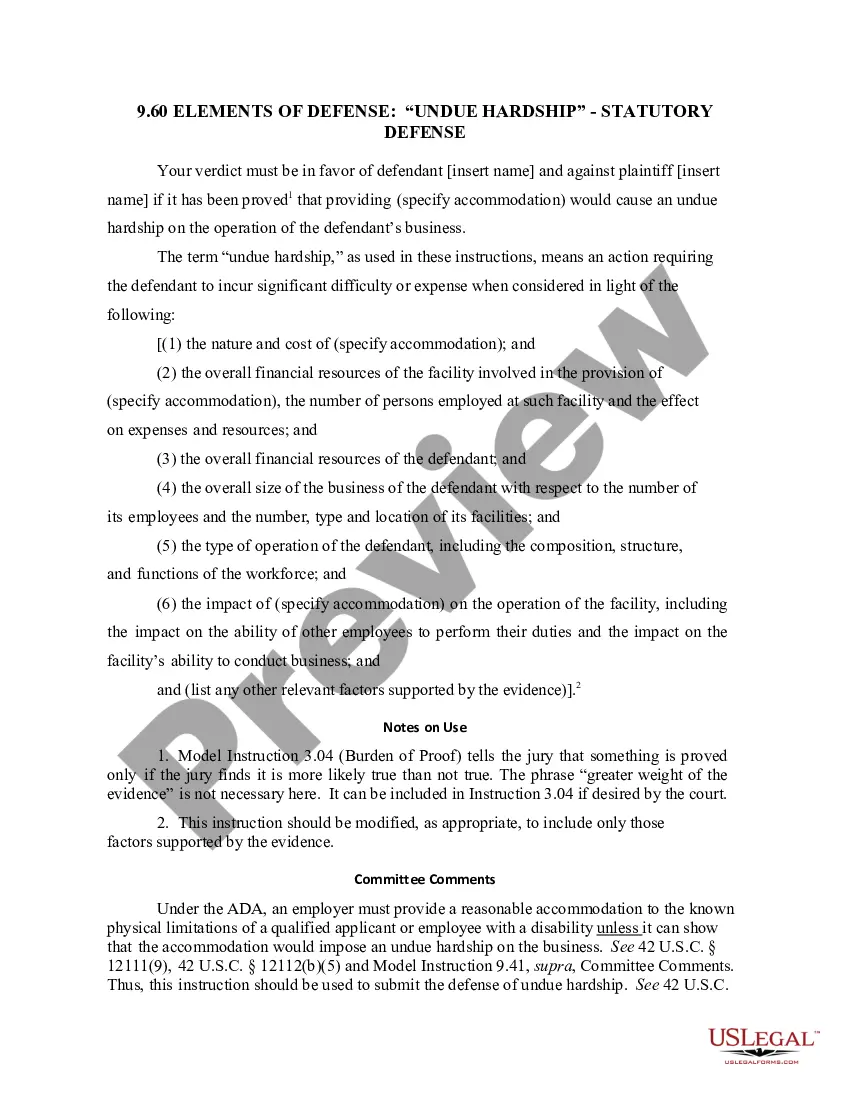

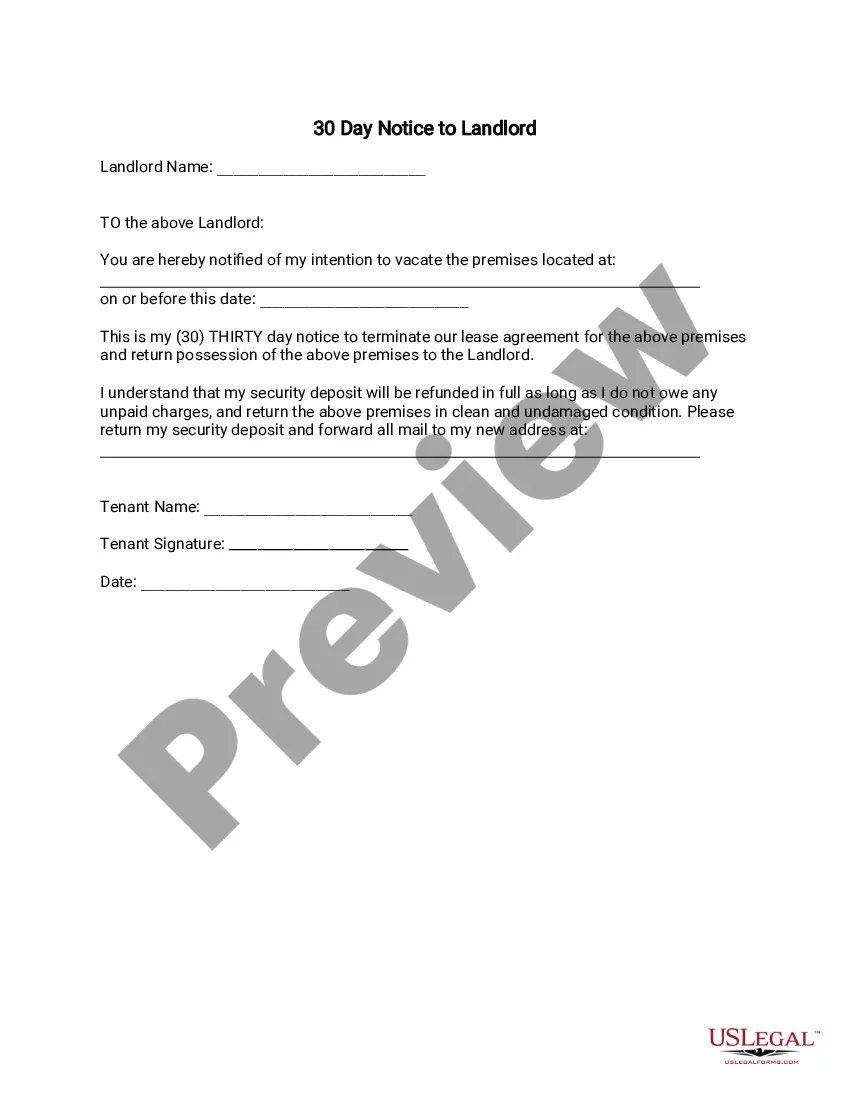

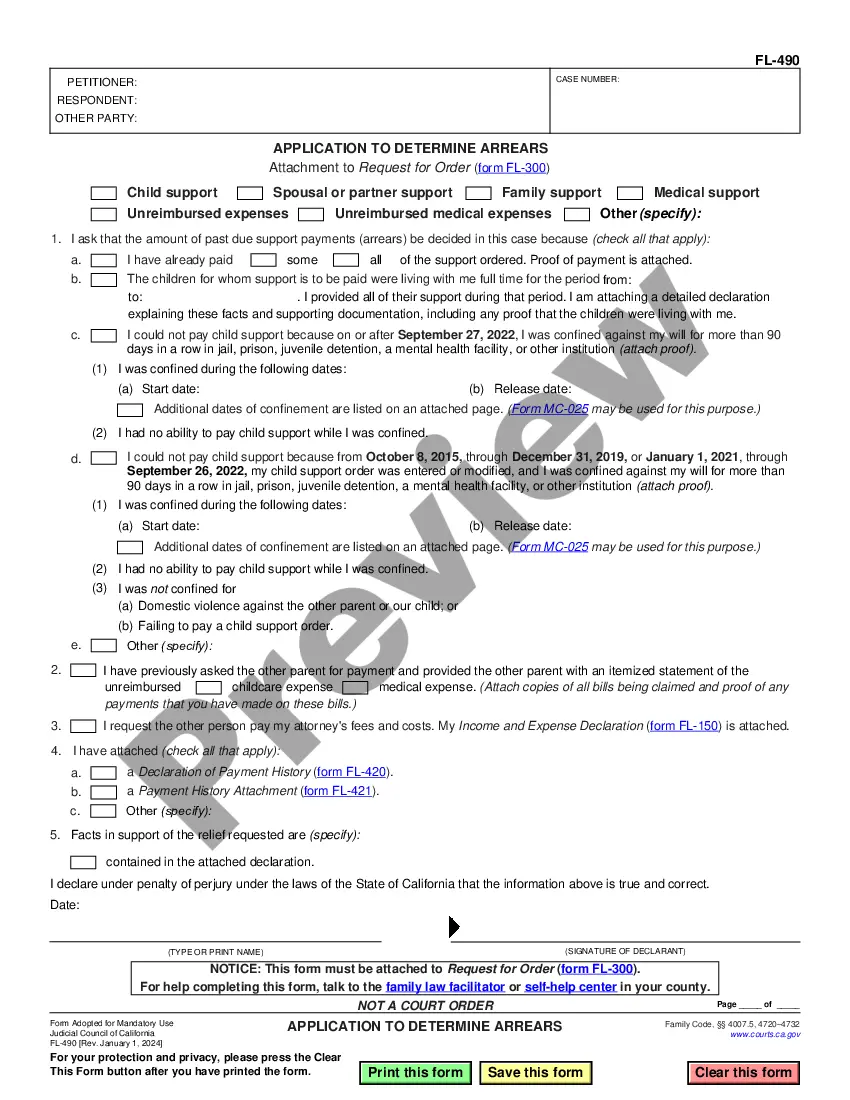

- Access the preview or review the description containing the specifics on how to use the template.

- If the outcome meets your query, click the Buy Now button.

- Select the suitable option from the offered pricing plans.

- Sign in to your account or create a new one.

- Complete the purchase using a credit card or PayPal account.

- Receive the form in the file format of your preference.

Form popularity

FAQ

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?

However, there are at least 8 key provisions that every partnership agreement should include:Your Partnership's Name.Partnership Contributions.Allocations profits and losses.Partners' Authority and Decision Making Powers.Management.Departure (withdrawal) or Death.New Partners.Dispute Resolution.

Essentially, partners share in the profits and the debts of the daily workings of the business. Because of that, when one partner wants to sell, they cannot sell the entire business. They can only sell their assets i.e., their share of the partnership.

No partner can sell or transfer his share or part or parnership of the firm to any one without the consent of the other partners.