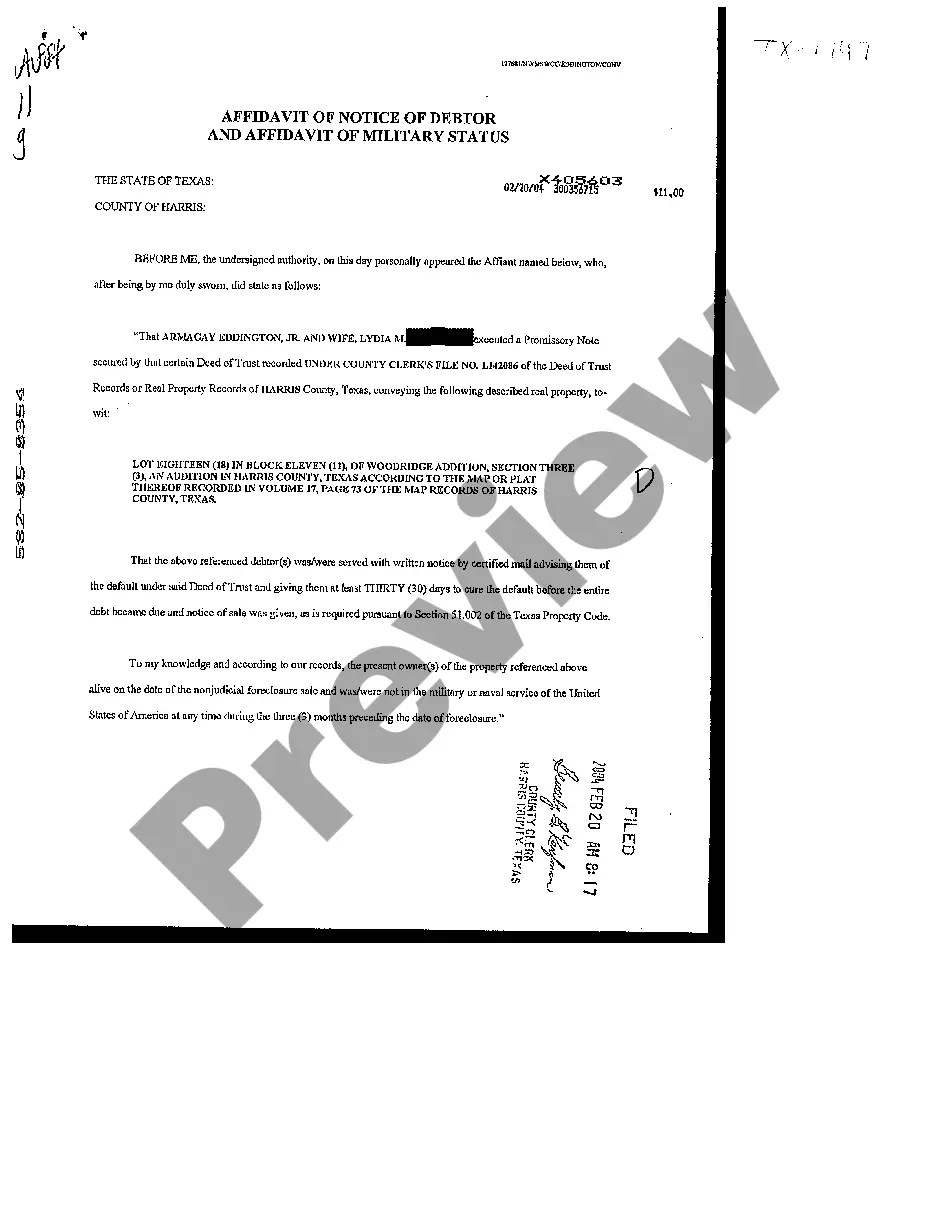

Lien release is an essential process in the financial industry that involves the removal of a legal claim, known as a lien, on a property or asset. In the case of Santander, a renowned financial institution, a lien release refers to the cancellation or satisfaction of a lien issued by Santander on a borrower's property or vehicle. Santander offers two different types of lien releases, which cater to distinct financial situations: 1. Mortgage Lien Release: This type of lien release is applicable to borrowers who have obtained a mortgage loan from Santander Bank to finance their property. Once the mortgage loan is fully repaid, Santander issues a mortgage lien release document to the borrower, releasing the lien on the property. This document is crucial for homeowners as it signifies the removal of the lien, allowing them to gain clear title to their property. 2. Auto Loan Lien Release: Santander also provides auto loans to individuals purchasing vehicles. These loans are secured by placing a lien on the vehicle, which acts as collateral in case of default. Once an auto loan is successfully paid off, Santander issues an auto loan lien release, also known as a vehicle title release, to the borrower. This release document declares that the lien has been lifted, enabling the borrower to obtain an unencumbered title to their vehicle. Obtaining a lien release from Santander is vital for individuals seeking to sell, refinance, or transfer ownership of a property or vehicle. A lien-free title grants peace of mind and allows borrowers to proceed with their desired financial transactions seamlessly. It is important to note that the specific requirements and procedures for obtaining a lien release from Santander may vary based on the relevant jurisdiction and the individual's unique circumstances. In conclusion, Santander provides two primary types of lien releases — mortgage lien releases for borrowers who have paid off their mortgage loans, and auto loan lien releases for those who have successfully repaid their vehicle loans. These releases serve to eliminate the legal claim Santander holds on the property or vehicle, enabling borrowers to regain full ownership and financial flexibility.

Lien Release For Santander

Description santander lien release form

How to fill out Lien Release For Santander?

Whether for business purposes or for individual affairs, everybody has to manage legal situations sooner or later in their life. Completing legal documents requires careful attention, beginning from selecting the correct form template. For example, if you choose a wrong version of the Lien Release For Santander, it will be rejected once you submit it. It is therefore crucial to have a trustworthy source of legal documents like US Legal Forms.

If you have to get a Lien Release For Santander template, follow these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Examine the form’s information to make sure it fits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the wrong form, go back to the search function to find the Lien Release For Santander sample you need.

- Get the template if it matches your requirements.

- If you already have a US Legal Forms profile, simply click Log in to access previously saved documents in My Forms.

- In the event you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you can use a bank card or PayPal account.

- Select the file format you want and download the Lien Release For Santander.

- Once it is downloaded, you can complete the form with the help of editing software or print it and finish it manually.

With a large US Legal Forms catalog at hand, you never need to spend time seeking for the right sample across the web. Make use of the library’s simple navigation to get the proper template for any occasion.

santander auto payoff Form popularity

santander lien address Other Form Names

FAQ

Whether you need to create a form for school, work, business, or personal needs, Canva's free form builder got you covered! Our easy-to-use tool lets you make printable survey forms, quizzes, sign-up forms, order forms, and many more.

Create from template Click the Add New icon displayed at the top of the Design page: Select Form, as shown below. ... Select From a template?. Hover the mouse on the required template and click Use Template: You will be redirected to the newly created form's builder.

A Form Builder enables web designers to create customized forms for their sites. Web creation platforms offer Form Builders that are increasingly easy, simple, and fast to use.

A form is the component of your Zoho Creator application that enables you to collect and store data.

Online form builders make it easy to gather information from visitors to your site. Learn more about website form builders and why they're important here. An online form is an important tool to gather the required information from your customers, website audience, or users.

Using Zoho Forms, you can easily create forms ranging from registration forms to payment order forms. HR managers, market researchers, sales representatives, event planners, NGOs, and educators use Zoho Forms to design beautiful forms from scratch.

Form Builder in Creator. The form builder is the interface for building and modifying forms in Zoho Creator. All the different types of fields that can be inserted into your form will be listed in the form builder. You can effortlessly drag and drop them into a building space.