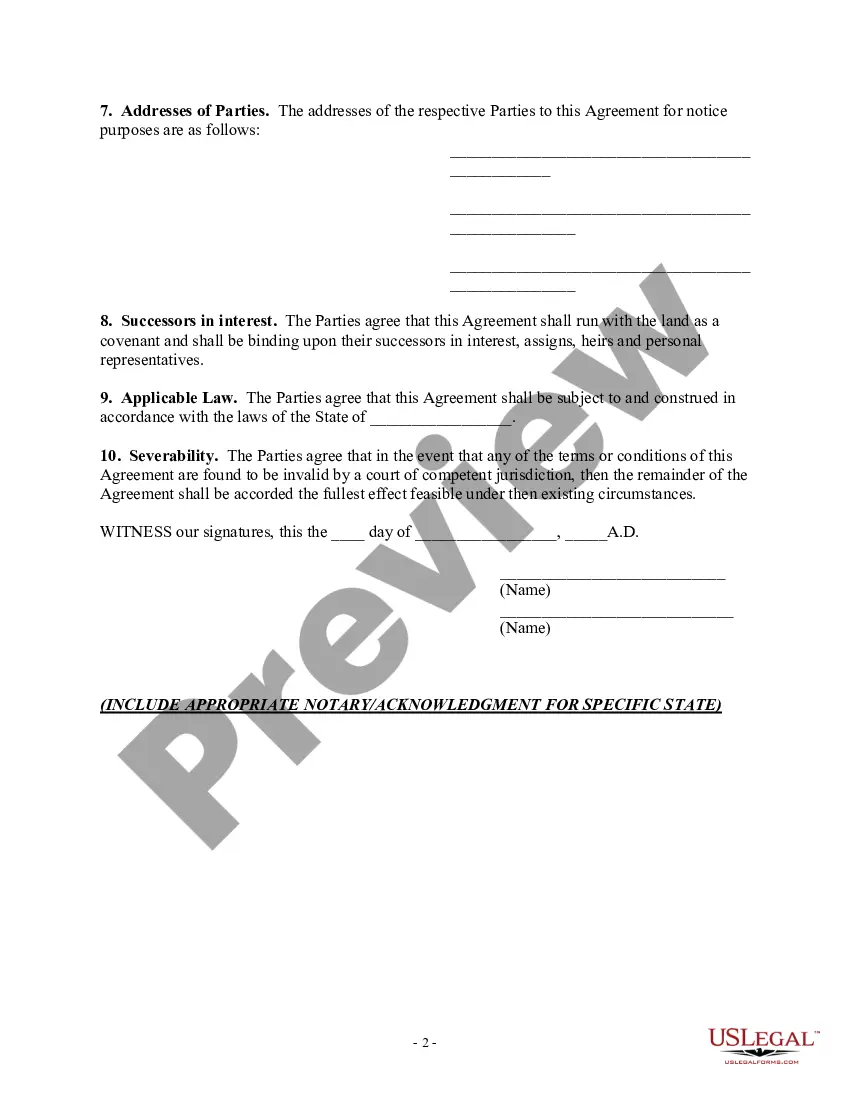

Fannie Mae guidelines for private road maintenance agreements outline the requirements and conditions that must be met for a private road to be acceptable for financing. These guidelines play a critical role in ensuring the safety, accessibility, and overall marketability of properties located on private roads. Compliance with these guidelines is crucial for borrowers, lenders, and sellers involved in transactions involving properties with private roads. Key components of Fannie Mae guidelines for private road maintenance agreements include: 1. Road Maintenance Agreement: A private road maintenance agreement is a legally binding document that outlines the responsibilities and obligations of property owners who share a private road. It defines the scope of maintenance, repair, snow removal, and liability for damages. 2. Inclusion in Deed: Fannie Mae requires that private road maintenance agreements be recorded in the land records or a governing body to be enforceable. This ensures the agreement is publicly accessible and provides notice to potential buyers and lenders. 3. Cost Sharing: The guidelines specify that the costs of maintaining and repairing private roads should be appropriately shared among the property owners. The allocation may be based on the percentage of use or some other equitable arrangement. 4. Annual Assessments: Private road maintenance agreements should include provisions for the collection and management of annual assessments from property owners. These assessments fund ongoing maintenance and repairs. 5. Liability and Insurance: Fannie Mae recommends that private road maintenance agreements address liability and insurance requirements. This includes provisions for indemnification, liability limits, and adequate insurance coverage to protect property owners and lenders. 6. Road Standards: Private roads must meet certain construction and maintenance standards outlined in the Fannie Mae guidelines. These standards aim to ensure road safety, durability, and accessibility for emergency services, including appropriate width, surface conditions, grading, drainage, signage, and lighting. 7. Documentation and Verification: Lenders and sellers must provide documentation evidencing the existence and enforceability of a private road maintenance agreement, including copies of recorded documents, proof of road maintenance obligations, and compliance with applicable local ordinances. It is worth noting that while Fannie Mae has general guidelines for private road maintenance agreements, individual lenders may have their variations or additional requirements. It is crucial for borrowers and sellers to consult with their lender and review Fannie Mae guidelines specific to their situation. Furthermore, it is important to maintain compliance with Fannie Mae guidelines for private road maintenance agreements to ensure financing eligibility and the smooth completion of property transactions. Failure to meet these guidelines may result in difficulties obtaining mortgage financing or affect the marketability of the property. Overall, Fannie Mae guidelines aim to ensure that private roads in financed properties are adequately maintained, safe, and meet industry standards, protecting the interests of both lenders and borrowers.

Fannie Mae Guidelines For Private Road Maintenance Agreement

Description fnma private road requirements

How to fill out Fannie Mae Guidelines For Private Road Maintenance Agreement?

Handling legal paperwork and procedures could be a time-consuming addition to your entire day. Fannie Mae Guidelines For Private Road Maintenance Agreement and forms like it often require you to search for them and understand the best way to complete them effectively. Therefore, if you are taking care of economic, legal, or individual matters, using a extensive and convenient web catalogue of forms at your fingertips will go a long way.

US Legal Forms is the number one web platform of legal templates, boasting more than 85,000 state-specific forms and a variety of tools to help you complete your paperwork easily. Check out the catalogue of pertinent papers accessible to you with just one click.

US Legal Forms gives you state- and county-specific forms offered at any moment for downloading. Shield your document managing procedures with a top-notch support that lets you prepare any form within a few minutes with no extra or hidden fees. Just log in in your account, find Fannie Mae Guidelines For Private Road Maintenance Agreement and download it immediately within the My Forms tab. You may also gain access to previously saved forms.

Could it be the first time utilizing US Legal Forms? Sign up and set up up an account in a few minutes and you’ll have access to the form catalogue and Fannie Mae Guidelines For Private Road Maintenance Agreement. Then, adhere to the steps listed below to complete your form:

- Be sure you have discovered the right form by using the Preview option and reading the form description.

- Pick Buy Now once all set, and select the monthly subscription plan that suits you.

- Choose Download then complete, sign, and print the form.

US Legal Forms has twenty five years of expertise supporting users handle their legal paperwork. Obtain the form you require today and improve any process without breaking a sweat.

Form popularity

FAQ

On average, parties to mediation can expect fees anywhere from $300.00 to $1,000.00, divided 50/50 between the parties. Because the parties divide the fees equally between them, mediation is generally less expensive than going to court.

Answer. There is no set age in the law that confirms exactly when a child can decide they don't want to see a parent. However, a child can legally decide who they want to live with at the age of 16.

Absent parent: If a parent has been absent for 6 months or more, the law allows the other, more responsible parent, to petition to terminate parental rights.

Subject to the court's right to award custody of the child to either parent, considering the best interest of the child as to its temporal, mental, and moral welfare the father and mother of any minor child born in wedlock are equally entitled to the child's custody, service, and earnings.

To be eligible as a court-appointed family court mediator in South Dakota under this statute, a mediator must have a minimum of 40 hours of mediation training (or five years' experience in mediating custody and visitation issues with a minimum of 20 mediations during that period).

South Dakota child custody laws don't prescribe a certain age when a child's preference may be considered. Judges have broad discretion when deciding how much weight to give the child's preference. In some South Dakota custody cases, judges have considered the well-reasoned preferences of children as young as 10.

The ?best interests of the child" are the primary concern. South Dakota law encourages joint custody between parents. Courts determining custody arrangements are also able to modify or vacate their decisions at any time, allowing for continued supervision of a child and their parents.

It's common for a divorced parent to relocate, but this can create problems for the other parent, including decreased parenting time and increased visitation costs. In South Dakota, when custodial parents want to move with their minor children, they must give specific notice to the noncustodial parent.