Lien Child Support Withholding Calculator

Description

How to fill out Lien Child Support Withholding Calculator?

There's no longer any reason to squander time searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our platform offers over 85k templates for various business and personal legal matters compiled by state and area of use. All forms are properly drafted and authenticated for legitimacy, so you can feel confident in acquiring an updated Lien Child Support Withholding Calculator.

Select the most suitable pricing plan and either create an account or Log In.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all obtained documentation whenever necessary by accessing the My documents tab in your profile.

- If you haven't utilized our service previously, the process will require a few additional steps to complete.

- Here's how new users can acquire the Lien Child Support Withholding Calculator from our collection.

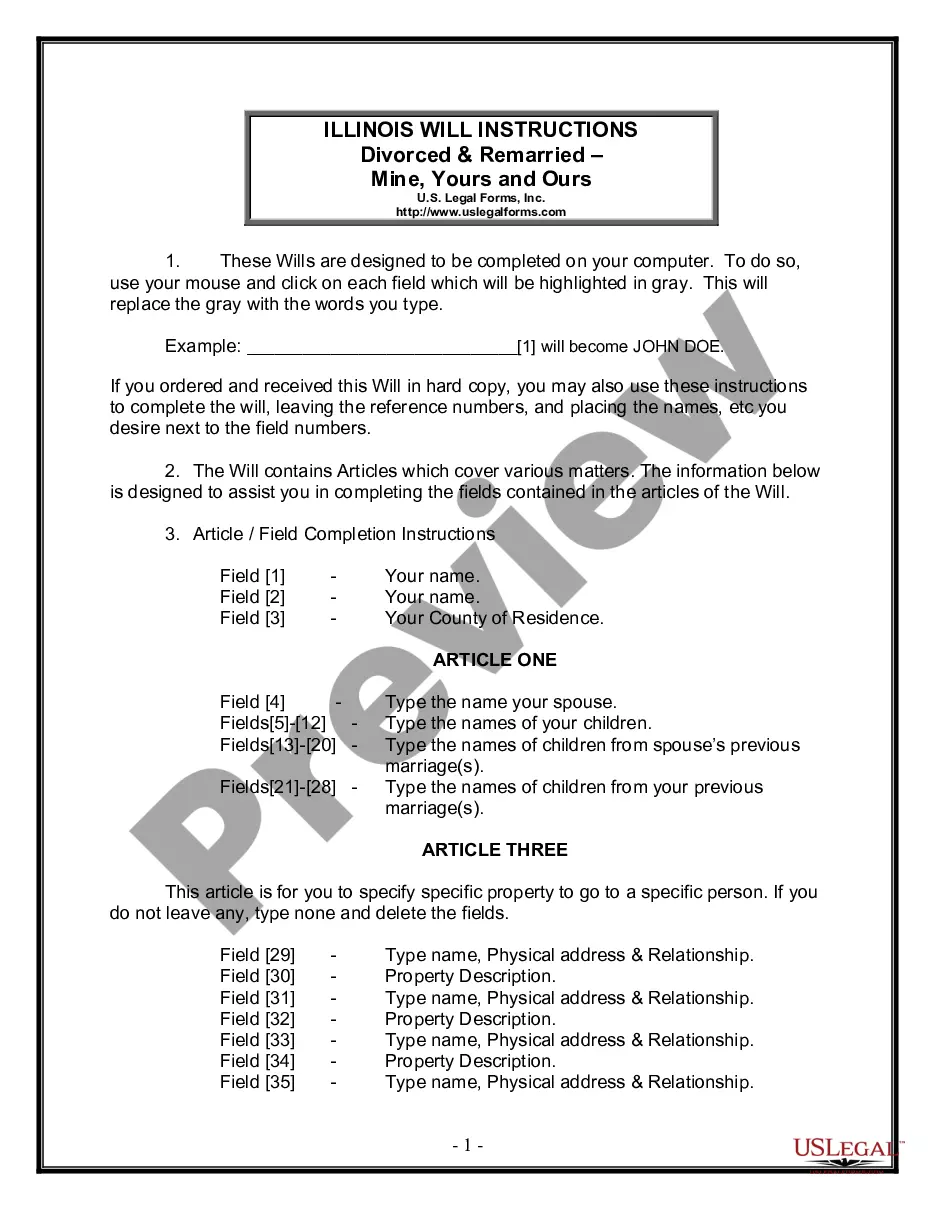

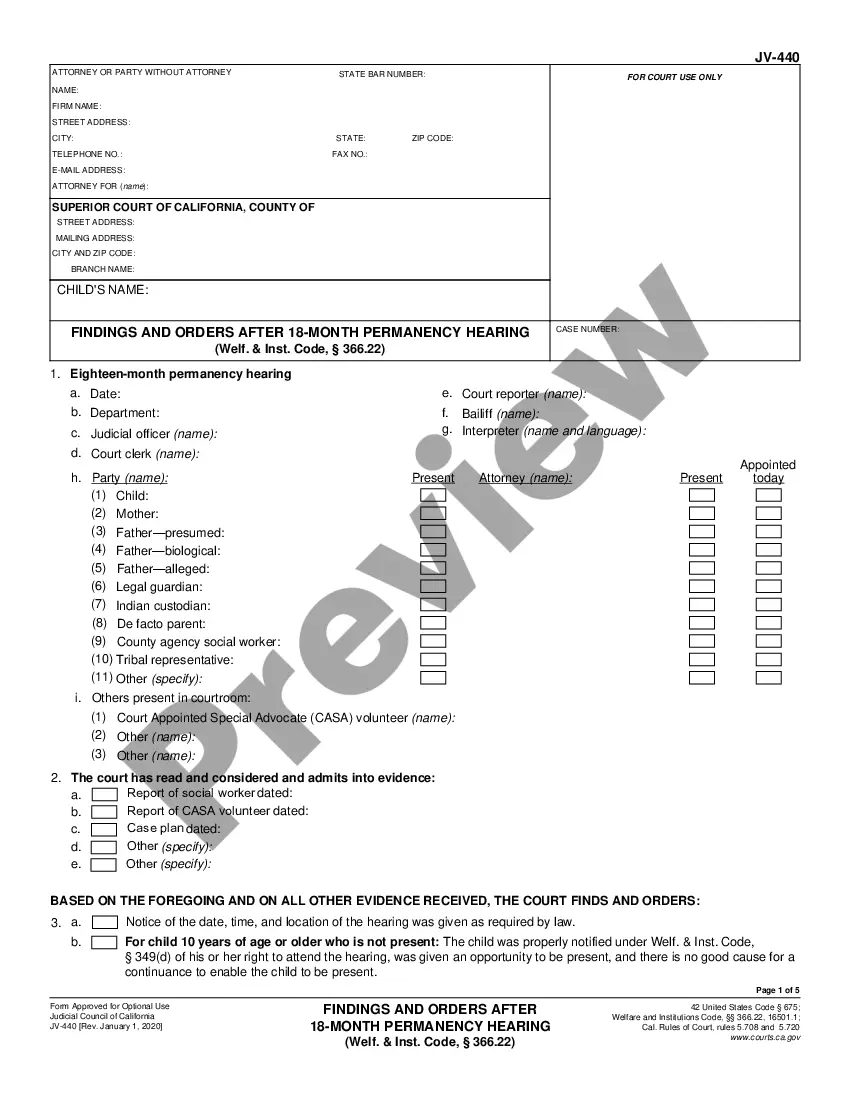

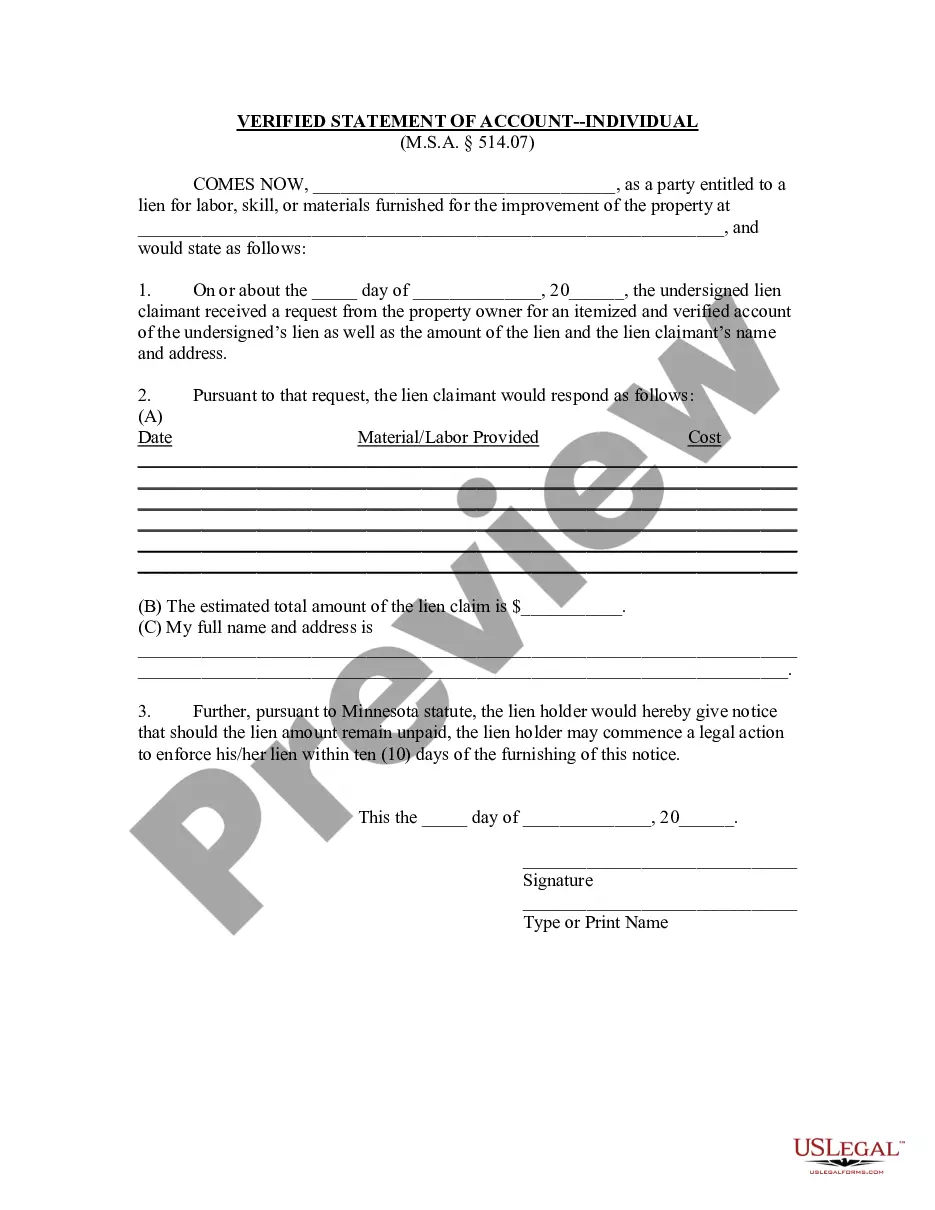

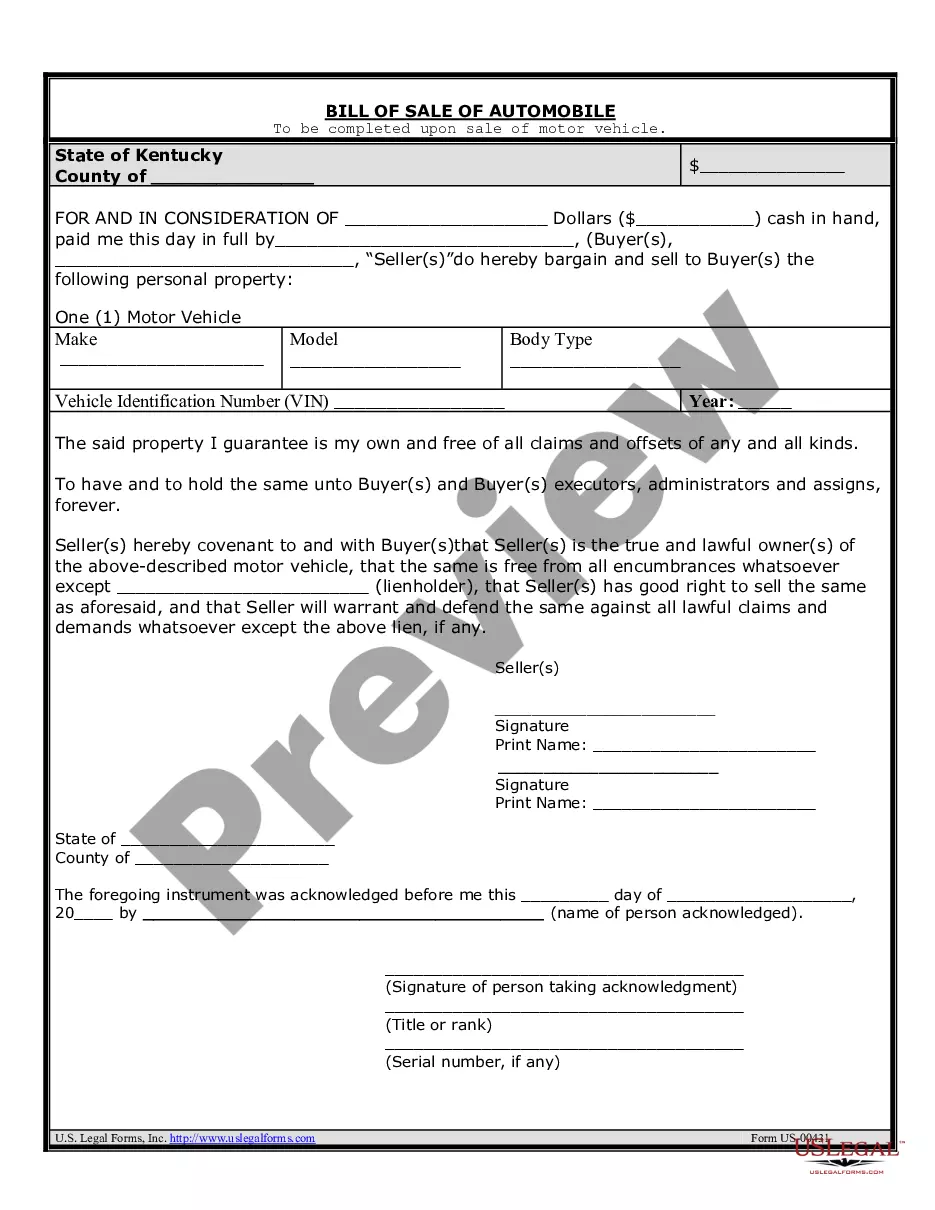

- Carefully review the page content to ensure it includes the sample you require.

- To do so, utilize the form description and preview options if available.

- Use the Search bar above to find another template if the previous one was unsatisfactory.

- Click Buy Now next to the template title once you identify the appropriate one.

Form popularity

FAQ

How Much Is Child Support in NY?Calculate the combined income and each parent's pro-rata share of the same.Use the correct percentage of total income CSSA says should be devoted to child support: 17% for one child. 25% for two children. 29% for three children. 31% for four children.Calculate each parent's share thereof.

Use the following formula to calculate this amount:Disposable Income = Gross Pay Mandatory Deductions.Gross pay includes not only salary, but also other forms of income such as bonuses, commissions, or severance pay.More items...

Indiana Code 35-46-1-5 allows for the classification of a class D felony when there is intentional failure to financially support a dependent or overdue amounts is in excess of $15,000.

The maximum amount that may be withheld is 50 percent of the lump sum after taxes or the total amount of arrears, whichever is less.

Federal law sets limits on the percentage of your pay you can lose to creditors or child support. The percentage applies to your aggregate disposable weekly earnings. This is the amount you have left in your weekly paycheck after taking out mandatory expenses such as income tax.