Hardship Letter Sample For Mortgage

Description

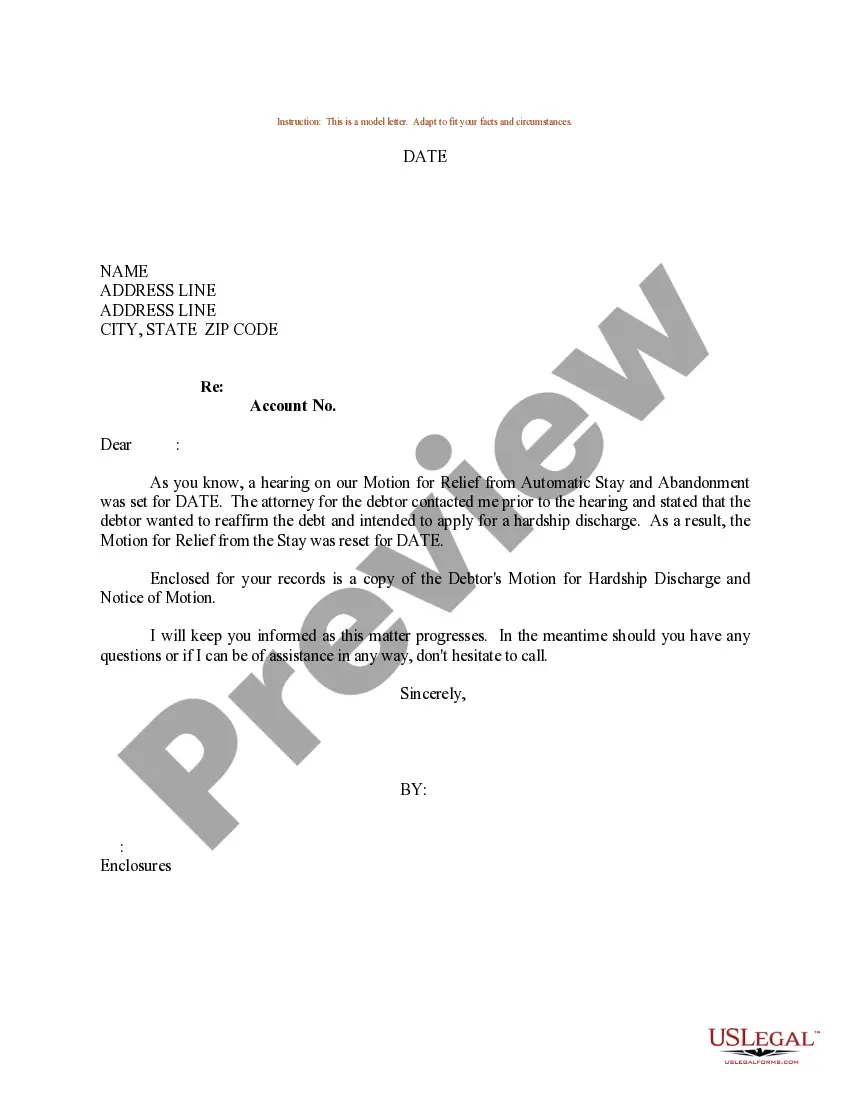

How to fill out Hardship Letter Sample For Mortgage?

What is the most trustworthy service to obtain the Hardship Letter Sample for Mortgage and other up-to-date forms of legal documentation? US Legal Forms is the solution! It's the largest compilation of legal papers for any situation.

Each template is professionally crafted and validated for conformity with federal and local statutes and regulations. They are gathered by category and state of application, making it easy to find the one you require.

US Legal Forms is an excellent resource for anyone who needs to manage legal documentation. Premium members can gain even more benefits as they can complete and electronically sign previously saved documents at any time using the integrated PDF editing feature. Try it out today!

- Experienced users of the site simply need to Log In to the platform, verify if their subscription is active, and hit the Download button next to the Hardship Letter Sample for Mortgage to obtain it.

- Once saved, the template is accessible for future reference within the My documents section of your account.

- If you haven't created an account with us, here are the steps you should follow to establish one.

- Form compliance check. Before you acquire any template, you must ensure it meets your usage criteria and complies with your state or county's regulations. Review the form description and use the Preview if it's available.

Form popularity

FAQ

You can start a hardship letter by addressing it to your lender and stating your account details clearly. Next, briefly explain your current situation and the reason you are seeking assistance. Referencing a hardship letter sample for mortgage can be beneficial for structure. Lastly, express gratitude for their consideration and your hope for a positive resolution.

A proof of hardship letter is a document that verifies your financial struggles and serves as a request for assistance from your lender. This letter often provides evidence such as job loss, medical bills, or other significant financial burdens. You can find a hardship letter sample for mortgage which can help illustrate how to effectively present your case. clarity and documentation are key elements to include.

To write a good mortgage hardship letter, be direct and clear about the difficulties you face. Start by stating your intention to keep your home and your desire to continue working with the lender. Utilize a hardship letter sample for mortgage for additional guidance. Make sure to personalize the letter by sharing your story and explaining how the lender can help.

To write a successful hardship letter, start by clearly explaining your financial situation. Include specific details such as loss of income or unexpected expenses. Furthermore, refer to a hardship letter sample for mortgage to guide your structure and tone. Make sure to express your willingness to work with your lender to find a solution.

To write an effective hardship letter for a mortgage, start by clearly explaining your financial situation. Include specific details about your hardships, such as job loss or medical expenses, that led to your current predicament. You can also refer to a hardship letter sample for mortgage to help structure your letter. Remember to express your commitment to resolving the situation and include any proposed solutions, as this demonstrates your willingness to cooperate with your lender.

An effective hardship letter for a mortgage typically starts with a statement of your situation, followed by a request for consideration or assistance. For example, you could write, 'I am facing financial difficulties due to medical expenses and am unable to maintain my regular mortgage payments. I kindly request a review of my case and welcome any possible repayment options.' Using a hardship letter sample for mortgage can help you draft a persuasive letter.

A financial hardship statement should succinctly explain your circumstances. For instance, you might say, 'Due to an unexpected layoff, my income has significantly decreased, making it difficult to afford my mortgage payments.' This direct approach illustrates your situation clearly, helping the lender understand your need for assistance. Consider using a hardship letter sample for mortgage for guidance on structure and content.

When writing a hardship letter sample for mortgage, avoid including emotional language or irrelevant personal details. Stay focused on the specific financial challenges you face, such as job loss or medical expenses. It is also important not to exaggerate your situation, as honesty builds trust. Instead, provide clear, factual information to support your request.