Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

Engagement Letter For Accounting Services

Description

How to fill out Engagement Letter For Accounting Services?

When you are required to complete an Engagement Letter For Accounting Services following your local state's statutes and guidelines, there may be various alternatives to choose from.

There's no necessity to scrutinize each form to ensure it meets all the legal requirements if you are a US Legal Forms member.

It is a trustworthy resource that can assist you in acquiring a reusable and current template on any topic.

Utilizing the Preview mode and reviewing the form description, if available, is advisable.

- US Legal Forms is the most extensive online repository with a compilation of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to adhere to each state's laws and regulations.

- Thus, when downloading Engagement Letter For Accounting Services from our site, you can be confident that you have a legitimate and current document.

- Obtaining the necessary sample from our platform is exceptionally straightforward.

- If you already possess an account, simply Log In to the system, verify that your subscription is active, and save the selected file.

- Later, you can open the My documents tab in your profile and maintain access to the Engagement Letter For Accounting Services anytime.

- If it's your first encounter with our library, please follow the instructions below.

- Browse the suggested page and check it for conformity with your needs.

Form popularity

FAQ

An example of an engagement letter for accounting services may include sections for the client's name, the type of services provided, and the agreed-upon fees. It can also lay out the expected timelines and deliverables, along with terms regarding confidentiality and liability. By referring to a sample engagement letter, you can easily adapt it to suit your specific needs. Consider checking resources like US Legal Forms for reliable templates and examples.

To write an effective engagement letter for accounting services, start by clearly defining the services you will provide. Include details such as timelines, fees, and any relevant deadlines. Make sure to state the responsibilities of both the accountant and the client to ensure transparency. Finally, it may be helpful to use templates from platforms like US Legal Forms that guide you through the process and ensure no vital information is missed.

An engagement letter for accounting services outlines the specific terms and conditions of the services provided. It typically includes the scope of work, timeline for deliverables, and the fees involved. Additionally, it highlights the responsibilities of both the accountant and the client to ensure clarity. By using a well-structured engagement letter, both parties can avoid misunderstandings and build a strong professional relationship.

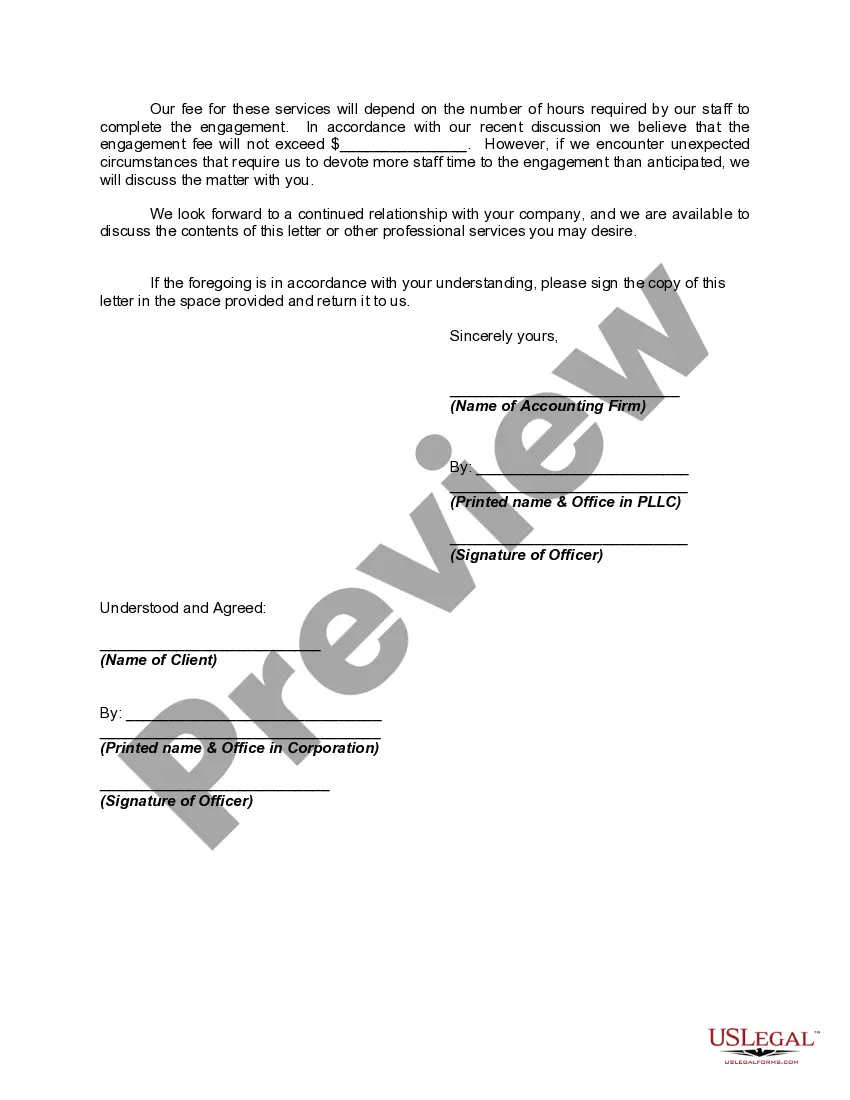

Both the accountant and the client need to sign the engagement letter for accounting services. This signature process formalizes the agreement, ensuring that both parties consent to the terms outlined. By having signed documents, you protect the interests of both sides, fostering a professional relationship built on confidence.

The client receiving the accounting services gets the engagement letter. This letter serves to inform the client about the arrangements, guiding them on what to anticipate during the working relationship. It is a critical component for establishing mutual understanding and trust.

Typically, the accounting firm provides the engagement letter to the client. This written document outlines the terms of the engagement, scope of services, and any applicable fees. By offering this letter, the firm formalizes the relationship and sets clear expectations for both parties.

Usually, the accounting firm or accountant preparing the services takes on the responsibility of drafting the engagement letter for accounting services. This is important as it ensures the letter contains all necessary details about the engagement. It also reflects the firm’s professional standards and commitment to transparency from the outset.

The engagement letter for accounting services is typically addressed to the client receiving the services. This could be an individual, a business, or an organization seeking accounting assistance. By personalizing the letter, you establish a direct connection with the client, which enhances clarity and understanding of the services being provided.

An engagement letter in accounting is a document that formalizes an agreement between an accountant and a client. It details the services to be provided, responsibilities, timelines, and fees, ensuring all parties are on the same page. By using an engagement letter for accounting services, clients benefit from clear communication and defined scopes, which can ultimately lead to a more effective professional relationship.

While an engagement letter may not be legally mandated for a review engagement, it is strongly recommended. An engagement letter for accounting services outlines the objectives and limitations of the review process, ensuring clarity between the accountant and the client. Having this letter increases professionalism and fosters trust in your accounting relationships.