Promissory Note Sample For Rental Payment For Tenant

Description

How to fill out Promissory Note For Past Due Rent?

Regardless of whether for corporate objectives or personal issues, everyone must confront legal matters at some stage in their existence.

Filling out legal documents requires meticulous focus, starting with selecting the correct form template. For instance, if you select an incorrect version of the Promissory Note Sample For Rental Payment For Tenant, it will be rejected upon submission.

Once it is saved, you can fill out the form using editing software or print it and complete it manually. With a vast US Legal Forms catalog available, you no longer need to waste time searching for the correct template online. Utilize the library’s easy navigation to find the suitable template for any circumstance.

- Therefore, it is crucial to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Promissory Note Sample For Rental Payment For Tenant template, follow these straightforward steps.

- Obtain the template you require by utilizing the search bar or catalog browsing.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search tool to locate the Promissory Note Sample For Rental Payment For Tenant template you need.

- Download the document if it satisfies your criteria.

- If you already possess a US Legal Forms account, click Log in to access previously saved files in My documents.

- In case you do not have an account yet, you may download the document by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the Promissory Note Sample For Rental Payment For Tenant.

Form popularity

FAQ

While promissory notes can facilitate financial agreements, they may carry risks if not properly executed. For instance, unclear terms can lead to misunderstandings or disputes. Therefore, utilizing a promissory note sample for rental payment for tenant ensures that the document is comprehensive and minimizes potential legal complications.

A promissory note is a legally binding document, provided it meets certain requirements. To be enforceable, it must include specific details such as the amount owed, repayment terms, and signatures from both parties. When you use a promissory note sample for rental payment for tenant, you create a clear record of the agreement, reducing potential disputes.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

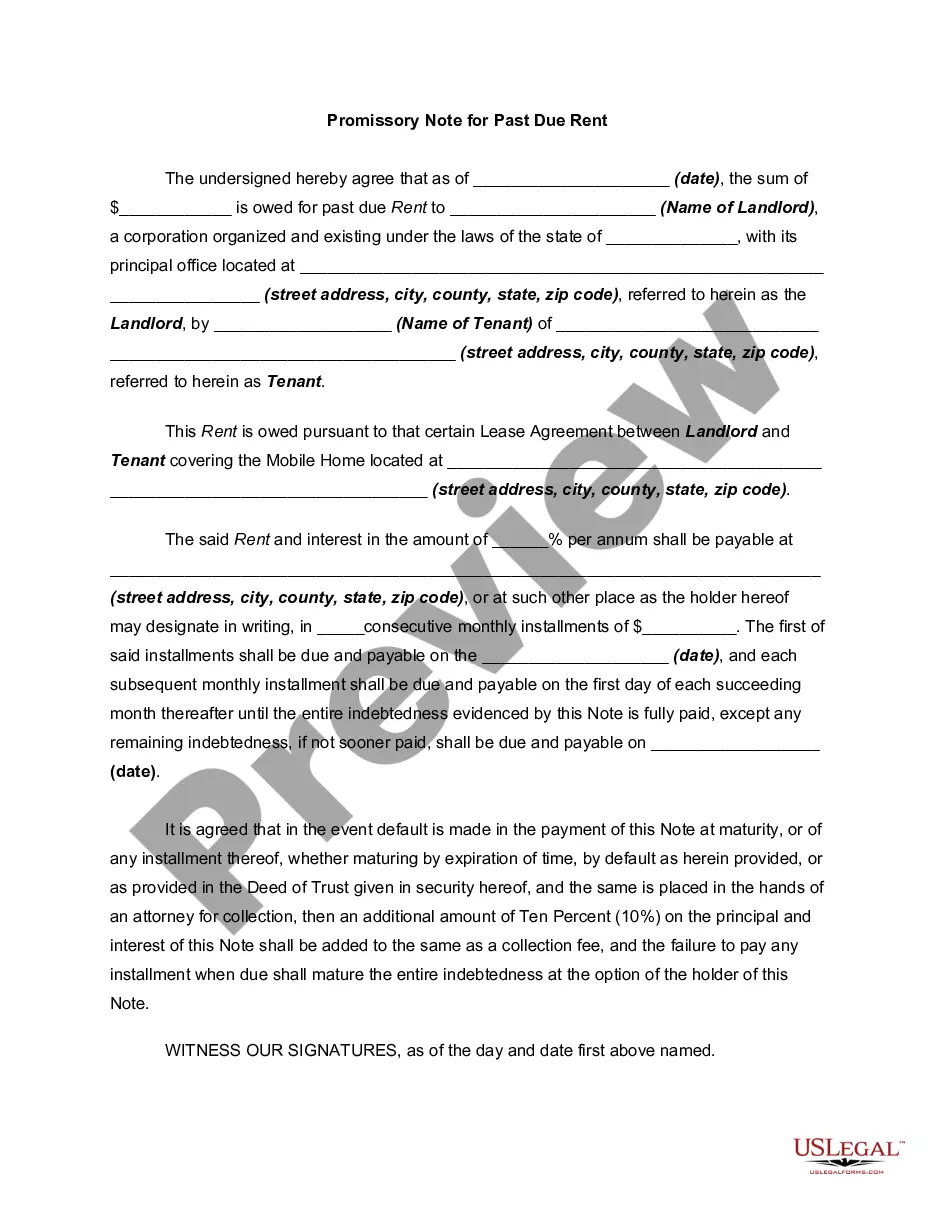

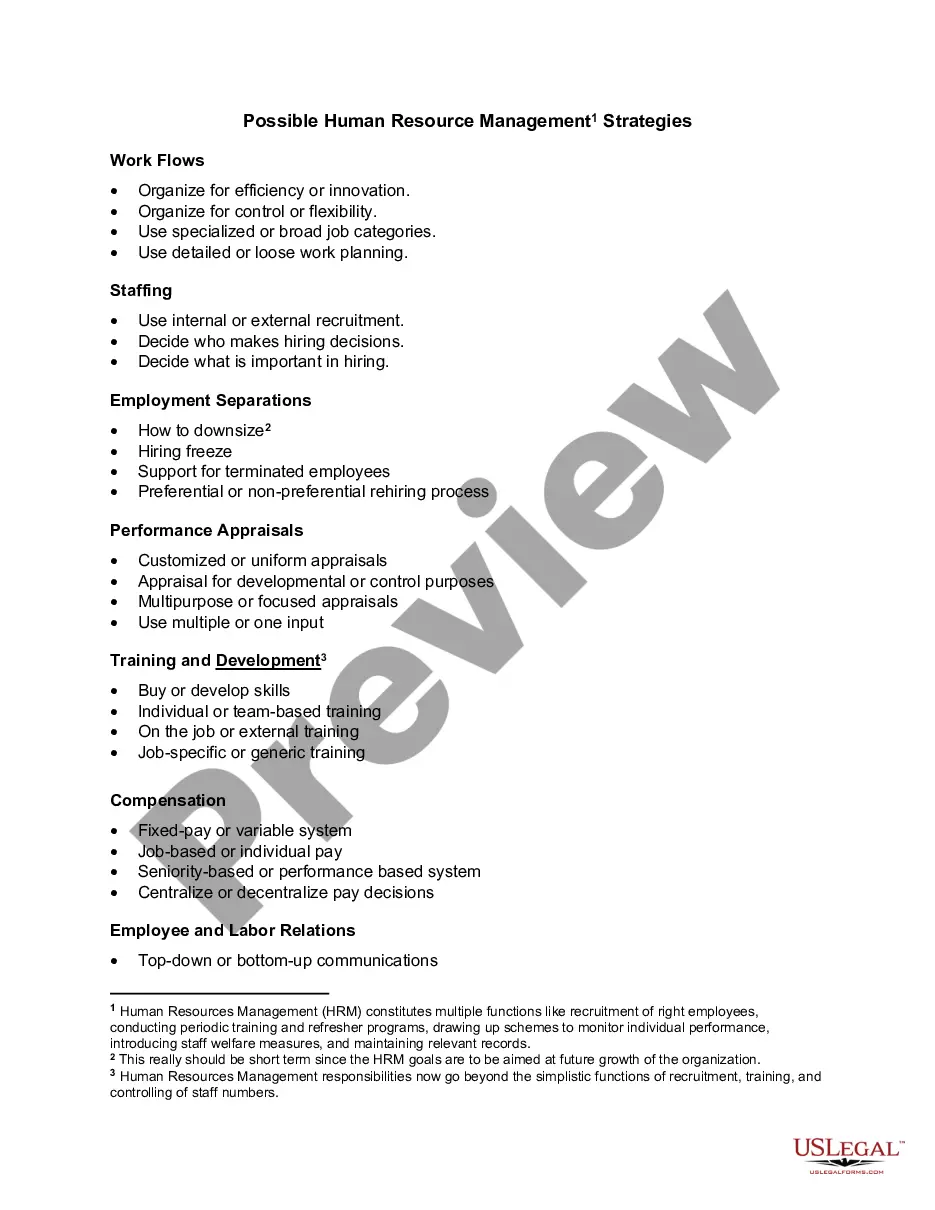

This Promissory Note provides a way for the Tenant to pay past due rent without having to also pay attorney fees or additional fees. It documents the entire amount of rent owed, provides a plan for monthly payments (including annual interest), and a maturity date by which all unpaid rent is due.

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P____________________. I promise to pay said amount on or before ______________________. Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

Get them to sign a promissory note. When they do that, the rent is paid. You have accepted a note in place of a check (which, incidentally, is also a note). That means if they don't pay the promissory note, you can't evict for nonpayment of rent. You'd have to sue.

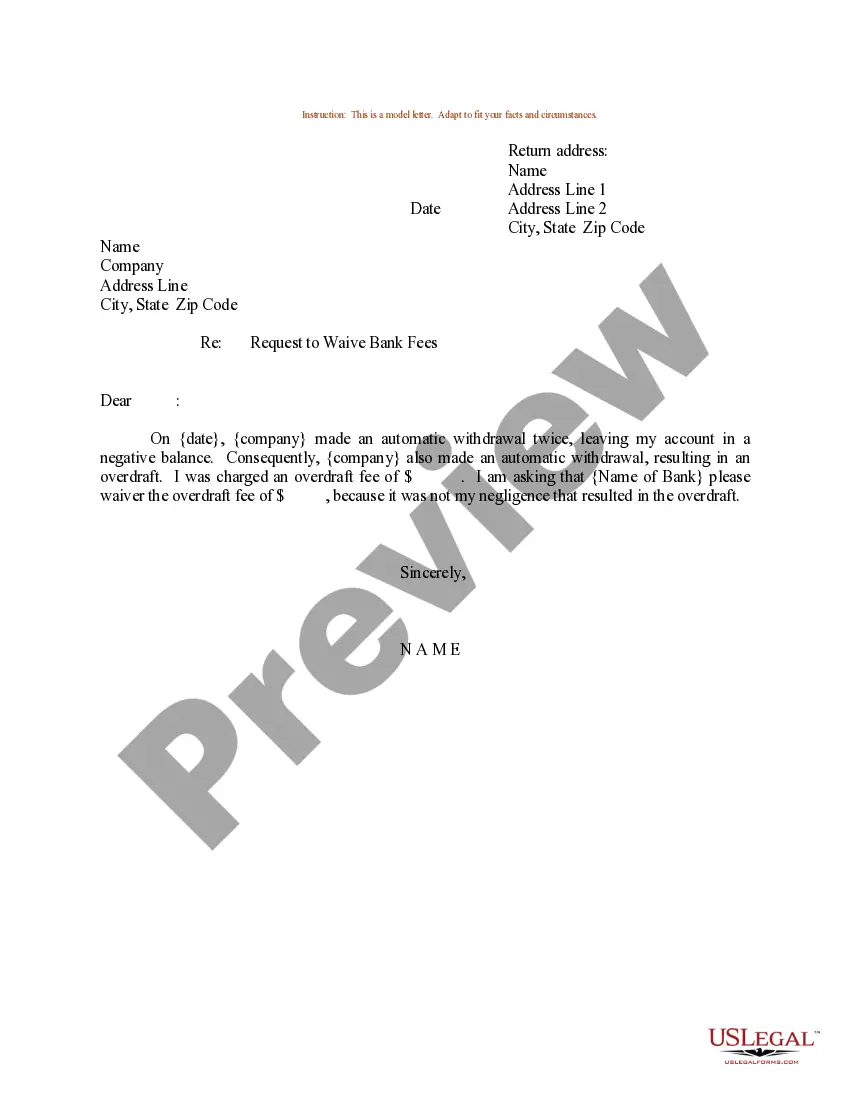

Any time you write a letter or email to your landlord, keep your language clear and concise to eliminate any potential for confusion. Include relevant details such as the date of writing, the dates of any instances referenced within the letter, and your contact information and unit number.